Re-Availment of Input Tax Credit Reversed

Page Contents

Re-Availment of Input Tax Credit Reversed

What does a credit mismatch represent in context of scrutiny notices?

A number of taxpayers are concerned about the lack of credit available. Mismatched credit is defined as follows:

- Discrepancies between GSTR-3B and GSTR-2A or/and Discrepancies between GSTR-3B and GSTR-1 or/and Discrepancies between GSTR-3B and GSTR-2A or/and Discrepancies between GSTR-3B and GSTR-1 or/and Discrepancies between GSTR-3B and GSTR-2A or/

- Differences between the claimed provisional credit and the real credit available. This is a common occurrence during transitional periods.

Any discrepancy between these returns will result in the taxpayers receiving scrutiny notices.

Modes of communicating differences noticed in the returns by officers

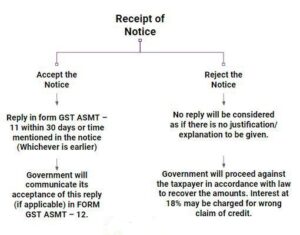

Any discrepancy found by the authorised official must be reported to the appropriate person in Form GST ASMT-10. The form’s content

- The officer’s observations

- The taxpayer has a certain amount of time to respond to this notice with an explanation.

- This form may or may not include the tax amount that is different and is the cause of the disparity.

What kind of responses actions available to GST taxpayers who receive GST Notice :

Rectification of discrepancies

If there is a discrepancy, it can be resolved in the following manner:

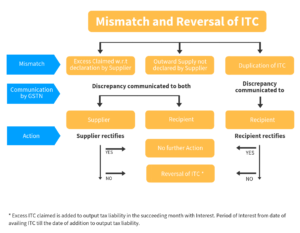

Excess ITC claimed based on a supplier’s declaration or outward supply is not declared by the supplier:

- If there is a disparity between the claim and the declaration made by the supplier in his valid return, the discrepancy must be disclosed to both the supplier and the recipient. The supplier will be required to correct the discrepancy in his legitimate return for the month in which the discrepancy is disclosed upon receipt of such a communication.

- If the supplier does not correct the error, the excess ITC claimed earlier will be applied to the recipient’s output tax liability the following month.

- For example, if a discrepancy is reported in July and not corrected by the supplier, the ITC claimed earlier will be applied to the recipient’s output tax liability for August.

Duplication of the input Tax credit claim by Recipient:

- In the event that a duplicated claim, the beneficiary will be notified. If no rectification is made, the ITC previously claimed will be applied to the recipient’s output tax due for the month in which the duplicate was communicated.

- For example, if the notification regarding the duplicate claim was sent in July, the ITC claimed earlier will be applied to the recipient’s output tax liability in July itself if the rectification is not completed in time.

- If additions are made, the receiver must pay an interest rate of not more than 18 percent on the amount added to the output tax due from the time the ITC is claimed until the additions are made in returns.

Re-claim of Input Tax Credit

- It refers to reclaiming an ITC that was earlier reversed due to a discrepancy in the amount disclosed by the supplier in his legal return or a duplication of the ITC claim. Only if the supplier reports the details of the invoice and/or debit notes in his valid return for the period in which the omission or inaccurate particulars were noticed by the supplier, or the notification about the same was received, can the supplier make such reclaims.

- Any interest paid on an excess ITC claim will be reimbursed to the beneficiary by crediting the amount to their Electronic Cash Ledger.

- No refund would be given if an ITC claim is duplicated, as this is a violation of the GST regulations.

ITC reversal reporting in GSTR-9

The GSTR-9 (annual return) will also need to be filled out with information about ITC reversals for the entire year. The details will be auto-filled where possible based on the data submitted in the monthly form GSTR 3B, although the taxpayer can make modifications as needed. For the financial year, Table 7 shows the specifics of ITC reversed and ineligible ITC. The necessary information for the entire year must be provided.

How can RJA Assist you?

Using the RJA expert calculations when filing GSTR-9 can make the process of calculating the reverse ITC and reporting it in the appropriate GST returns much easier.

Do you know which suppliers have not filed or improperly filed their GST Returns?

In case your supplier’s mismanaged GST returns will disallow your company to get the maximum eligible Input Tax credit.