Overview on partition of a Hindu Undivided Family

Page Contents

Overview on partition of a Hindu Undivided Family:

-

Income tax Section 171:

Above Section deal with the definition of the partition of HUF & deals with the Income tax applicable provisions of assessment related law after Hindu Undivided Family partition. So a transaction may be treated as severance of status under Hindu Law, However not a partition under Income tax Act 1961 as physical division of property is compulsory & necessary under Income tax Act 1961.

Ancestral Property: The property that a man gets from any of his three direct male ancestors—his father, grandfather, and great grandfather—is referred to as ancestral property. Property inherited from any other relationship is therefore not considered ancestral property. The following families’ ancestral property income is subject to Hindu Undivided Family taxation:

-

- Family of husband and wife, having no child;

- The Family of two widows of deceased brothers;

- Family of two or more brothers;

- The Family of mother, son and son’s wife;

- A family of widow mother and sons (may be minor or major);

- Family of uncle and nephew;

- The Family of a male and his late brother’s wife.

-

-

Distinguished from Hindu Law:

-

The Partition of Hindu Undivided Family should be considered as per IT Act & not as per the Hindu Law. Section 6 of the Hindu Succession Act would govern the rights of the each parties However insofar as IT law is concerned, the matter has to be undertaken u/s 171(1) of the IT Law.

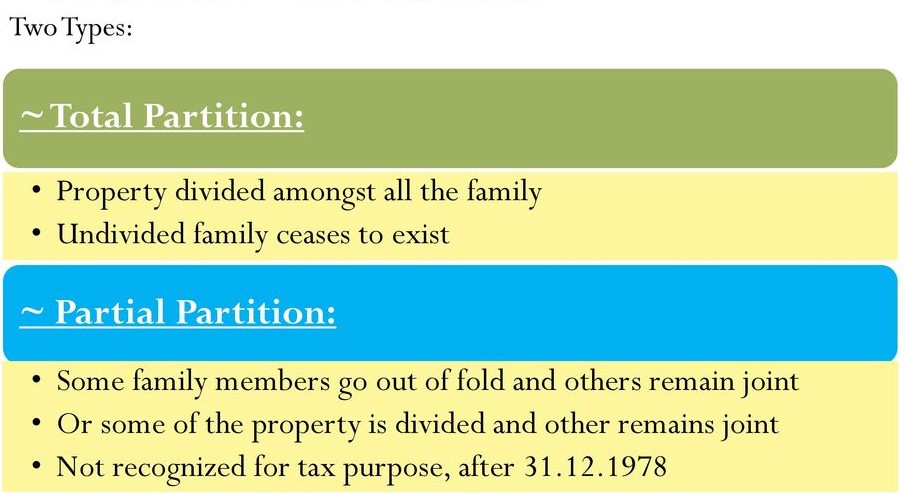

The Partition of Hindu Undivided Family can be classified as under: –

-

- Complete or Total Partition – As per explanation to section 171 of the Income Tax Act. Hindu Undivided Family Assets are physically divided.

- Partial Partition – Hindu Undivided Family Partial partition means a partition which is partial as regards the persons constituting the Hindu Undivided Family, or the properties belonging to the Hindu Undivided Family, or both.

Who can claim a share in the Hindu Undivided Family partition?

-

- All coparceners;

- Mother;

- A son in the womb of his mother at the time of partition;

-

Partial partition:

Income Tax Act do not consider Hindu Undivided Family property or/and persons partial partition after 30.03.1978 on insertion of section 171(9). Above restriction was come to avoid making multiple Hindu Undivided Family’s which was a misuse of Income Tax law.

- Law related to the assets Distribution at time of partition of Hindu Undivided Family on a complete partition of HUF Assets, all coparceners of Hindu Undivided Family get their respective shares in the HUF property.

According to the Hindu Succession Act, 1956, Daughters are also made coparceners & their rights are equal to those of sons & therefore sons & daughters get same share in the Hindu Undivided Family property on partition. (Section 6 of Hindu Succession Act, 1956)

-

HUF Physical division by metes & bounds is complete,

According to the Hindu Succession Act, 1956 & other related Hindu Law does not need division of joint family property physically or by metes and bounds. But, HUF partition as defined under Explanation to Section 171 of the Act means—

-

- where the HUF property does not physical division admit, then such kind of division as the HUF property admits of But a mere only severance of status shall not be deemed to be a partition; or

- In case property admits of a physical division, a physical division of the property, but a physical division of the income without a physical division of the property producing income shall not be deemed to be a HUF partition.

-

Partition of Hindu Undivided Family property can be done either via a Hindu Undivided Family partition deed or via family settlement.

-

- Partition of Hindu Undivided Family property can be done either via a partition deed or via family settlement.

- In the case of a Family settlement does not attract stamp not need to be registered as per law,

- However HIF partition deed attracts stamp duty & it must be required to be registered.

-

Basic Procedures for Hindu Undivided Family partition recognition.

Procedure by which the Hindu Undivided Family partition gets its complete recognition are as mentioned here under : —

(a) Hindu Undivided Family, which has been hitherto assessed, must make a claim to A.O. that Hindu Undivided Family properties have been basically subjected to complete Partition.

(b) thereafter, respective A.O. will make an basic inquiry into claim after giving notice to all members of the Hindu Undivided Family; &

(c) In case A.O. is feel & satisfied that above claim is accurate & correctly claimed, then, A.O. will record his finding that there was a complete partition of Hindu Undivided Family, & A.O. will also mention date on which it has taken place.

-

A.O. Under Section 171 of Income Tax not applicable where an Hindu Undivided Family has not been assessed to income tax.

-

- In the matter of CIT v. Hari Krishnan Gupta (2001) decision taken wordings of Income tax section 171 that Section has no application to an Hindu Undivided Family, which has not been hitherto assessed.

- Under the matter Smt. Sudha V. Iyer v. Income tax officer (ITAT-Mum.) – Amount received by a HUF member as & towards his share as coparcener of Hindu Undivided Family, on its partition cannot be brought to tax as income

-

Hindu Undivided Family Partition is not a transfer

Assets distribution of a Hindu Undivided Family during course of HUF partition, will not attract any income tax capital gains tax liability as it does not involve any kind of transfer. So, it would be no clubbing of incomes u/s 64 of Income Tax law as it will not involve any kind of capital Assets transfer.

9. All the Hindu Undivided Family Deductions available under the Chapter VIA

| S.No. | Section | Deduction |

| 1 | Under Section 80D | Deduction for payment on a/c of preventive health check-ups not available. Mediclaim Policy on health of any member of the family. |

| 2 | Under Section 80DDB | Medical treatment for any dependent member of the Hindu Undivided Family |

| 3 | Under Sections 80ID / 80IE / 80JJA / 80IA / 80IAB / 80IB / 80IC / | New Industrial undertakings |

| 4 | Under Section 80C | Hindu Undivided Family Deduction available |

| 5 | Under Section 80G | Donation to charitable institutions, certain funds etc. |

| 6 | Under Section 80DD | For maintenance including medical treatment of a dependent member of the family. |