Is Deduction u/s 54 & 54F can be claimed simultaneously

Page Contents

Is deduction u/s 54 & 54F of the Income Tax Act be claimed simultaneously?

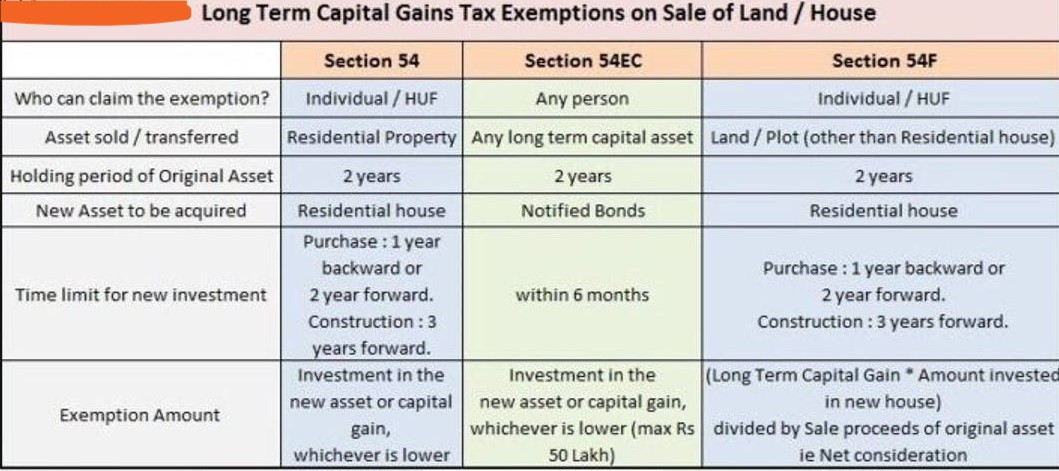

- under Section 54 & Section 54F investment in residential house has to be made within a period of 2 years from the date of sale of respective capital assets. A longer period of 3 years is available if you go for self-construction or booking an under-construction residential house.

- In the matter of Venkata Ramana Umareddy Vs Dy. CIT (ITAT Hyderabad) decision made by the Income Tax Appellate Tribunal : There is no specific bar in simultaneously claiming the exemption under both sections.

- We can conclude that a Taxpayer can claim income tax deduction u/s 54 & Section 54F simultaneously subject to that above has been acquired in conditions fulfilment of stipulated under the said respective sections.

What will be nature of Capital Gain where Depreciable Asset is sold after a period of 36 months ?

- Unser Section 50 of Income Tax Act being a Deeming provision, its Operation is restricted, not to allow indexation advantage When taxpayer sold the depreciable Assets, Even if Holding period is more than thirty Six months.

- Once Depreciable Asset was hold for more than thirty Six months, Nature of Capital Gain is Long Term ( No Indexation benefit), and Tax to be deposited under section 112 @ 20%.

- Taxpayer can entitled to claim advantage of Section 54EC, Section 54 & Section 54F , from that LTCG.

Popular blog:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

For query or help, contact: singh@carajput.com or call at 9555555480