Deemed approval of GST Registration amendment

Page Contents

Deemed approval of Goods and Services Tax registration amendment

Deemed Goods and Services Tax Registration.

Goods and Services Tax Registration application will get Goods and Services Tax deemed approved after Thirty calendar days, if Goods and Services Tax Official doesn’t take any action. If Goods and Services Tax Official raises Show Cause Notice within Thirty calendar days, then you will have Seven working days to reply to it GST Tax Official can take further action on that reply within Seven working days.

Authentication of Aadhaar No under the Goods and Services Tax Act

- Aadhar authentication not opted & GST registration not granted within thirty days

- The Aadhar authentication not completed within fifteen days and thirty days has expired from such period of fifteen days and registration not granted.

- Aadhar authentication completed but neither GST Form REG 03 nor REG 06 granted within Seven working days from aadhar authentication.

- The Aadhar authentication completed, reply sent in GST Form REG 04 but neither GST Form REG 05/ GST Form REG 06 granted with Seven working days from reply.

- Aadhar authentication completed & based on risk parameters actual GST registration site verification is needed & GST registration not granted within thirty days of GST application

Compulsory cases of GST Aadhaar Authentication applicability

According to the Sec 25(6C) of the Central Goods and Services Tax Act, 2017, the Aadhaar authentication is compulsory for following class of individuals as per Rule 8 of the Central Goods and Services Tax Act, 2017 in order to become eligible for the Goods and services Tax registration:

- authorized partners or Managing of a firm

- Authorised signatory of all kind of taxpayer

- Karta of a HUF

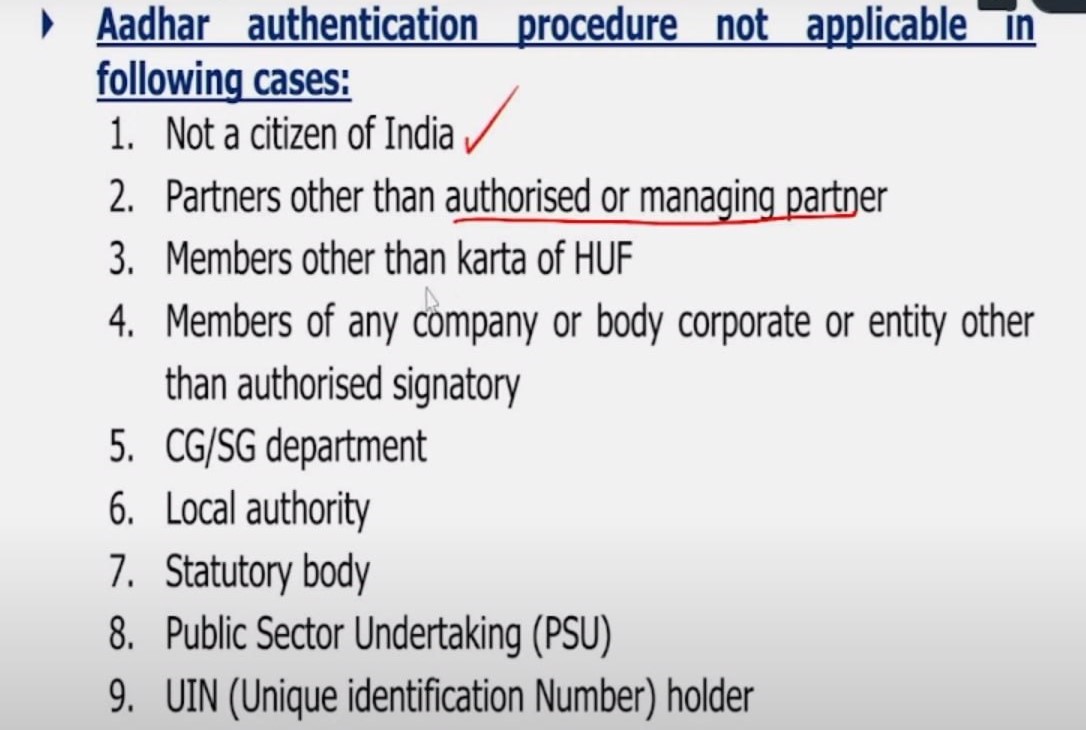

Exceptions- Case where GST for Adhar authentication not applicable

- For these cases, after submission of REG 01. physical verification is done for them to get the certificate for registration