Overview on AIS & Statement Form No. 26AS

Page Contents

Overview on AIS (Annual Information Statement) (earlier Form No. 26AS)

- Tax Dept has issue a new statement which call Annual Information Statement(AIS)

- It is earlier known as Form No. 26AS.

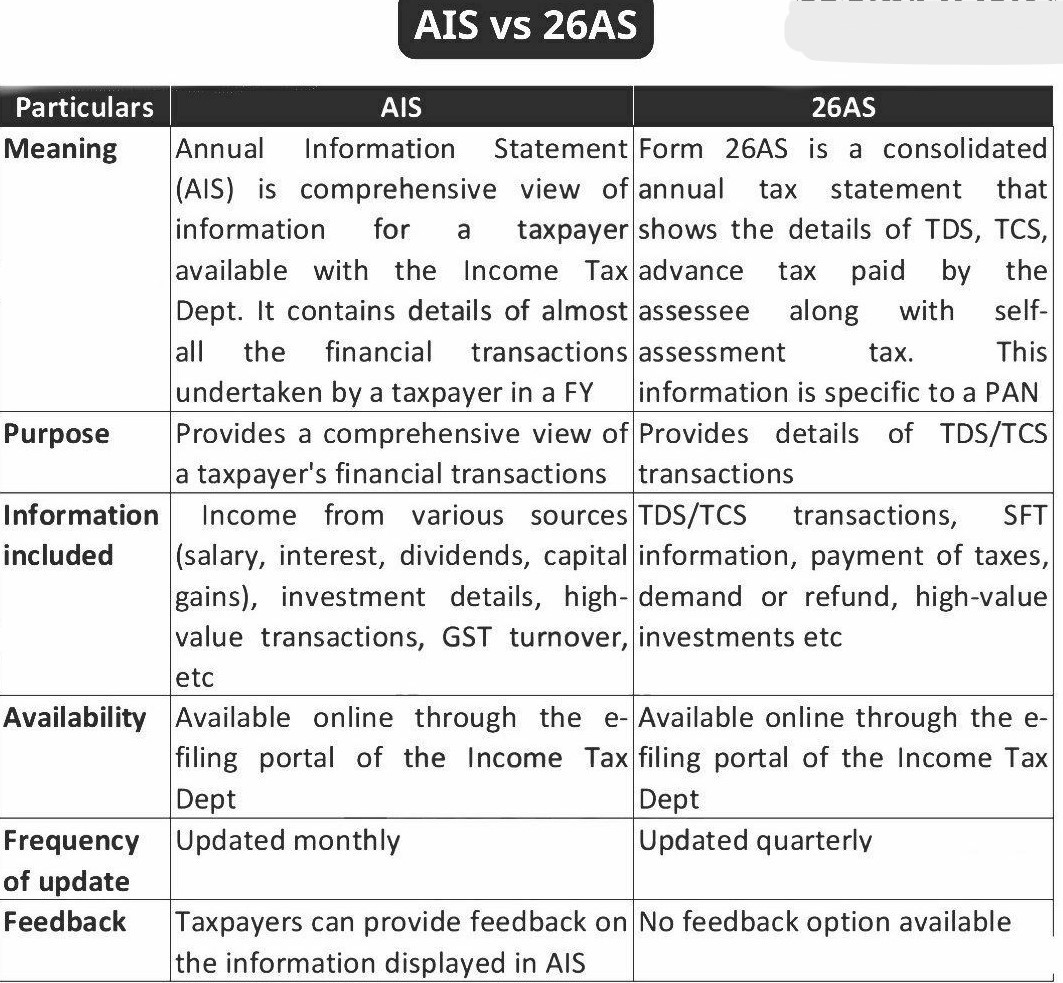

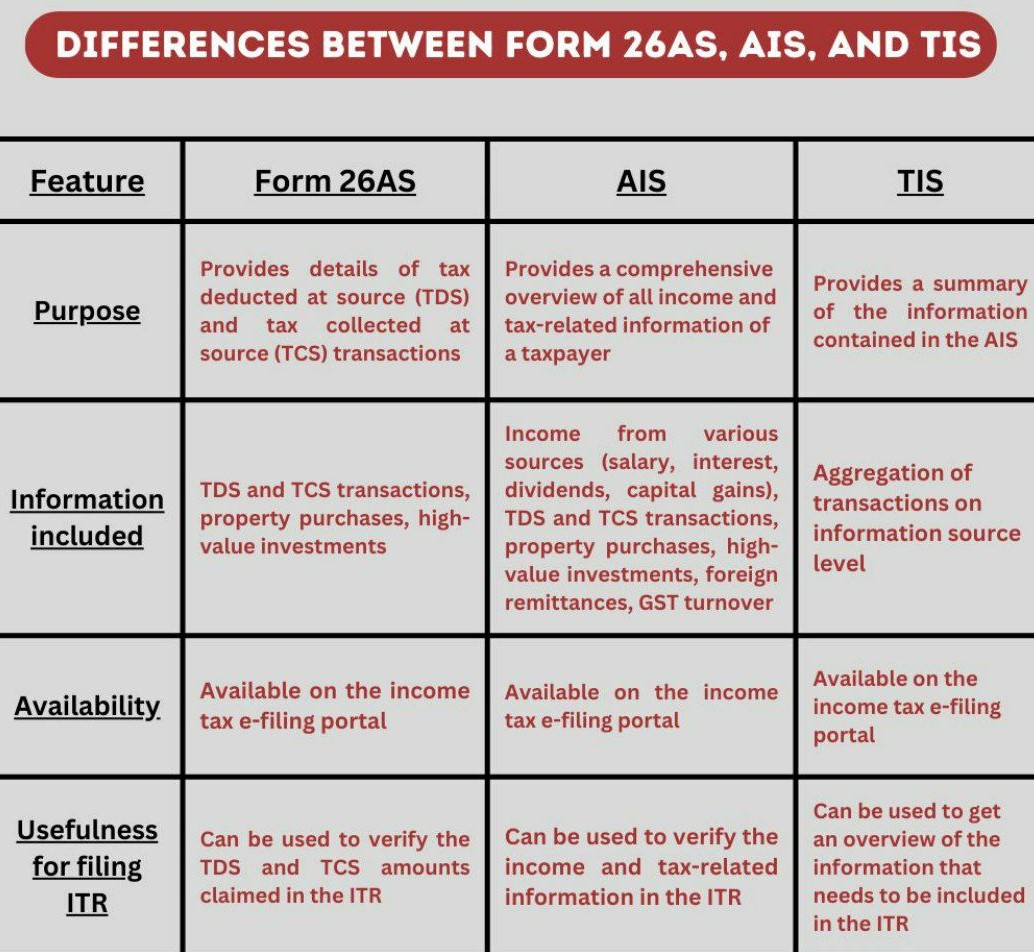

- Originally, the detail of TDS, TCS & Advance Tax are contained by Form No. 26AS.

- But, Scope has been relevance subsequently to disclose details & information more than tax & so nomenclature has been changed into “Annual Information statement (AIS)”.

- This Post are specially designed for give the information about your financial transactions during the Year as reflected in Annual Information statement. Let`s have an attempt to learn step wise about Annual Information Statement:

What is AIS (Annual Information Statement)?

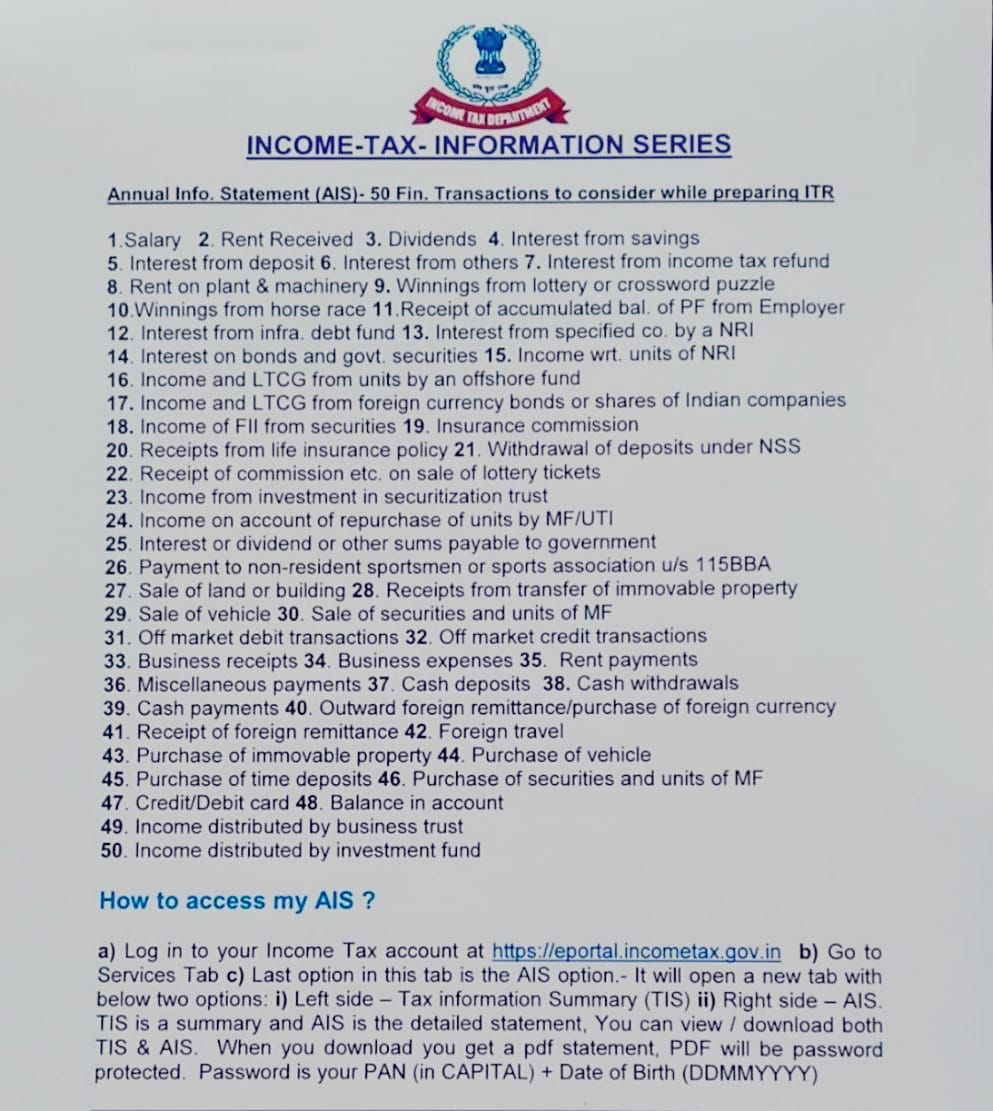

As we know, income tax tries to give Income tax statement in Form No. 26AS. Annual Information Statement is a much detailed one with more details included- ex: All mutual fund transactions & Saving account Interest during the year etc. Now, Annual Information Statement will be captured all the PY Financial transactions of the in the respect of below transactions:

- Shares

- Salary or Business income

- Interest on SB A/c and Deposits.

- Mutual Funds

- Dividends

- Stocks

- Purchase of property

- Credit Cards

- Insurance

Aforesaid list is just an indicative list of transactions. It is Income taxpayer overall financial profile & will getting fine-tuned to include more class of transactions.

Had Income tax statement Form No. 26AS been Stopped NOS?

a) Now one person/ Income taxpayer can get both Income tax statement 26AS as well as Annual Information Statement (AIS).

b) Both Income tax statement 26AS as well as Annual Information Statement (AIS) put together, Income Tax department knows all your financial transactions.

c) It’s good to found it very simple & easy to be known and submitted information or details for your Tax Return under income tax Act

How to access Annual Information Statement (AIS)?

Now Here is a simple guide for accessing stepwise under the Annual Information Statement:

a) Initially Login to your Income Tax Account at https://incometax.gov.in

b) Next we needed to Go to Services Tab

c) Last option in this tab is the Annual Information Statement It will open a new tab with below 2 Options:

a) Left side – Tax Information Summary (TIS)

b) Right side – Annual Information Statement

Both are the same. Tax Information Summary is a brief, However Annual Information Statement is the detailed information statement. You can download TIS & AIS (both). When you download you get a pdf statement (There is a jpeg option also, but let’s stick to PDF now).

PDF will be protected through password. Password is ur Permanent Account No (in CAPITAL) + Date of Birth (DDMMYYYY)

For example, your Permanent Account Number is ABCDE1234K and date of birth is 12122001 then password would be ABCDE1234K12122001

Password: aanpj1234k121001

50 ITR Reporting by Annual Information Statement

Tax Dept started mobile Application for Assesses to provide TDS and AIS

Central Board of Direct Taxes Started a mobile application called “AIS for Taxpayer” On March 22 2023 i.e which started for Assesses to view their tax related information in AIS, for complete press Release you may view below link AIS for Taxpayer

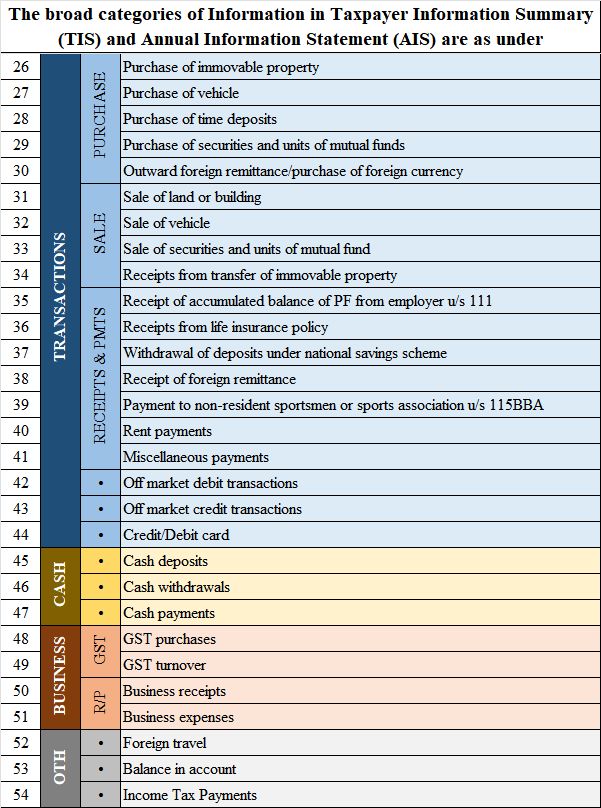

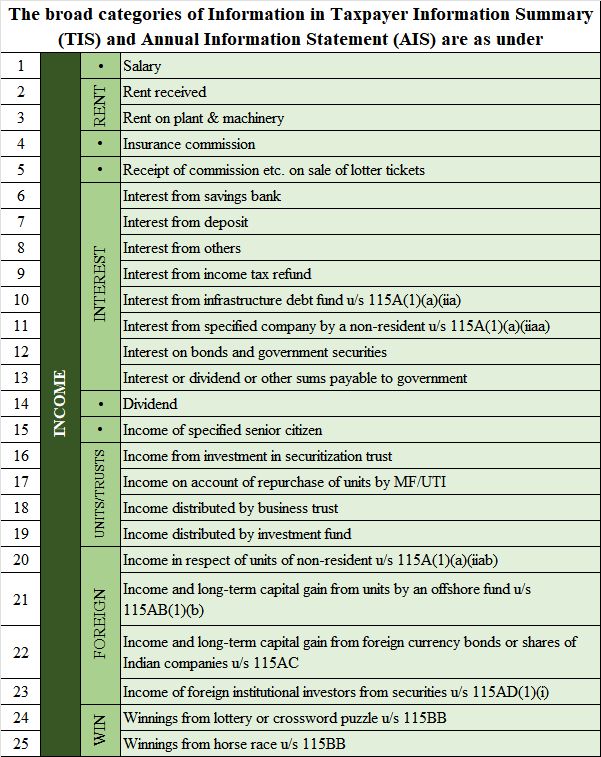

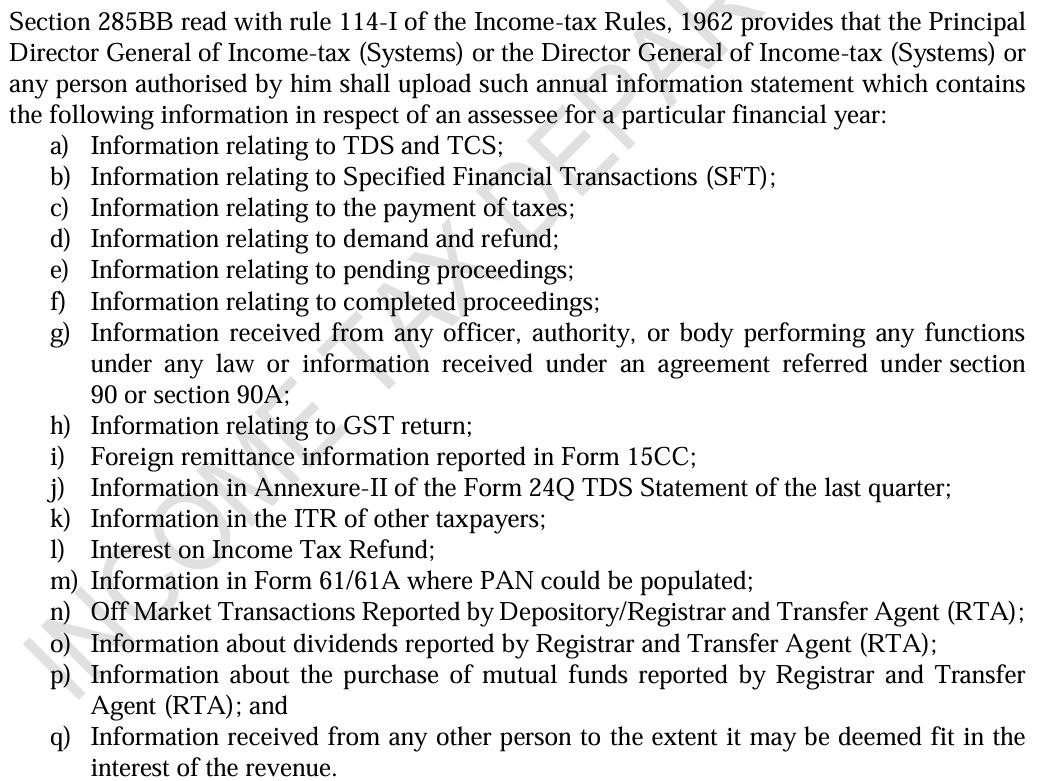

Information covered in Income Tax AIS

Its very important to wait for fully updated AIS, TIS and 26AS before filing ITR.

What is to do when TDS 26AS mismatch in our income. & received demand notice from income tax ?

When there’s a TDS (Tax Deducted at Source) mismatch in your income as compared to what’s reflected in your Form 26AS, and you’ve received a demand notice from the Income Tax department, here’s what you can do:

- Cross-check the TDS information: Compare the TDS information from the Form 16 (provided by your employer) and Form 16A (provided by banks) with your Form 26AS

- Inform your deductor: If there is a mismatch in TDS, inform the employer or deductor responsible for deducting TDS from your income. Your employer or deductor needs to file a revised TDS return

- File a revised return or rectification request: If you have not received an intimation u/s 143 (1), you can file a revised return.

- Alternatively, you can file a rectification request through the Rectification request service if you have received an intimation u/s 143 (1) .

- Remember, the objective of the TDS and Form 26AS system is to ensure tax compliance and not to create unnecessary hurdles for businesses

It’s essential to address the demand notice promptly and take necessary actions to rectify the discrepancy to avoid any further consequences such as penalties or legal proceedings. Keep records of all communications and documents exchanged with the Income Tax department for future reference.