Types of ITR Form and ITR Form Applicability

Page Contents

TYPES OF ITR AND THEIR APPLICABILITY

-

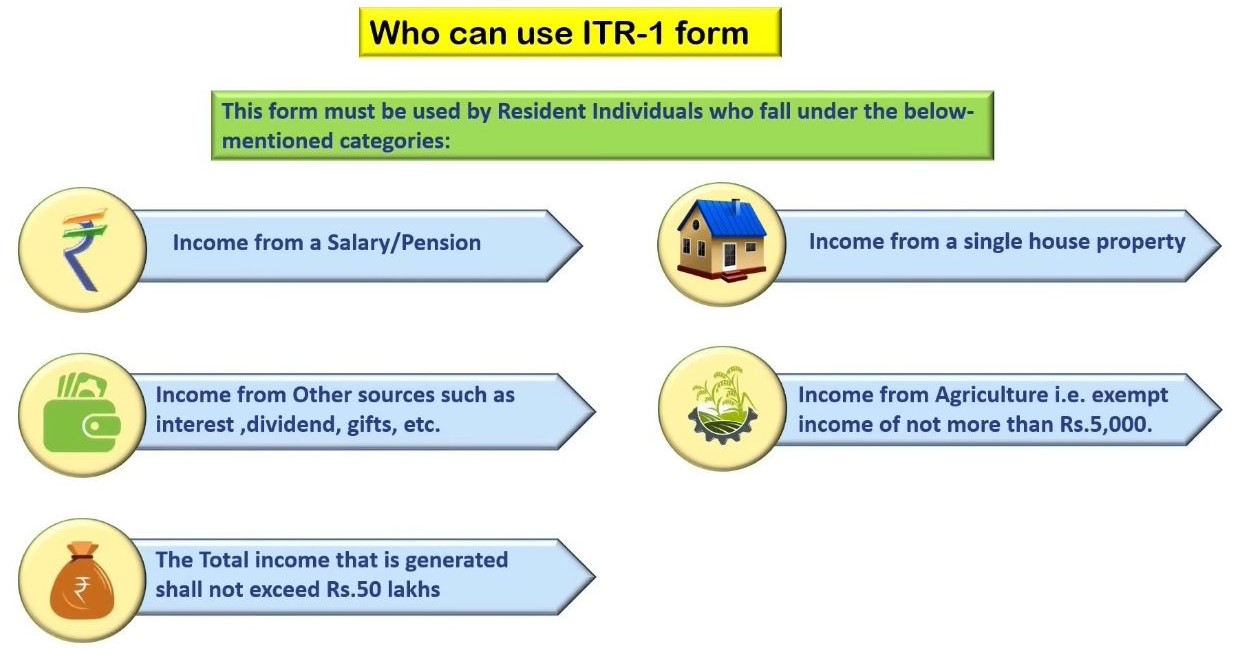

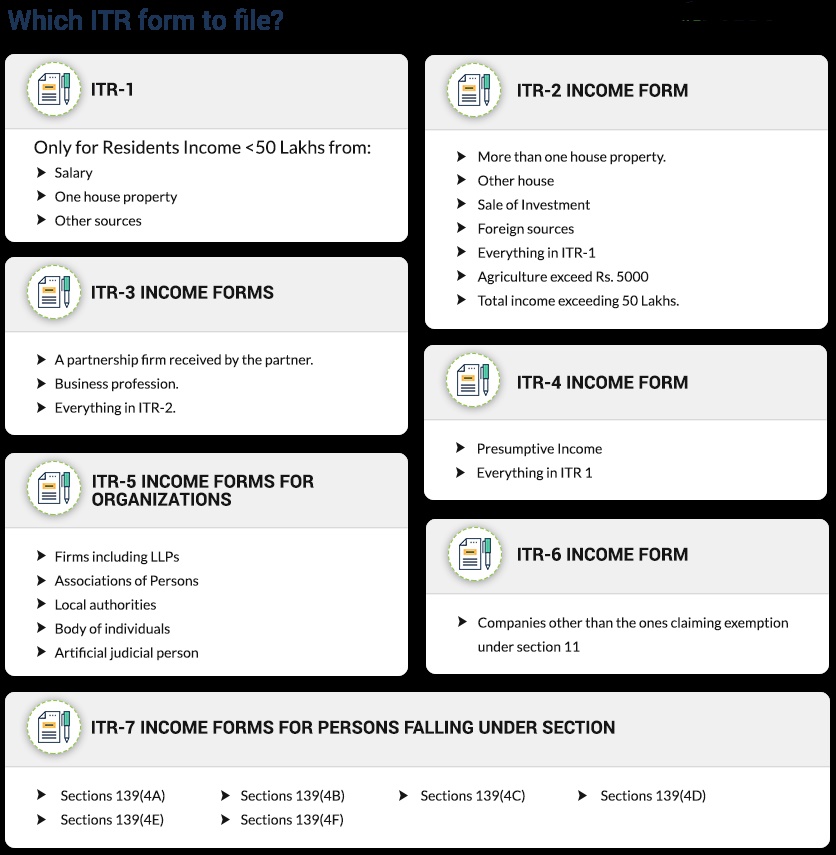

ITR 1

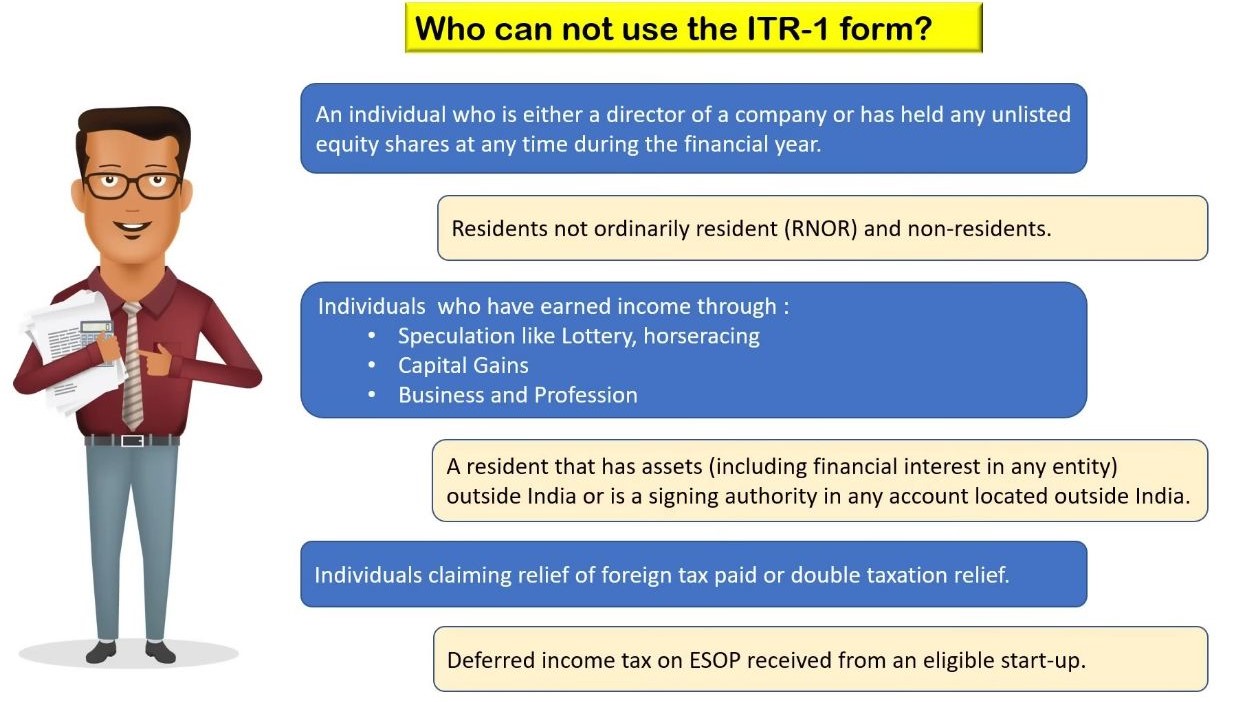

- This form is applicable to individuals who are residents and have total income of up to Rs 50 lakh constituting Income from Salary, one house property, income from other sources (including family pension and interest income), and income from agricultural activities maximum up to Rs 5000.

- ITR form does not apply to a Director in a company or made investment in unlisted equity shares or even in cases where TDS got subtracted as per section 194N where the ESOP taxation aspect has been deferred under new relaxation.

- It is applicable to Individuals and HUFs having income from different sources except from business or professional income.

- Thus, an individual or HUF, not eligible to file Sahaj ITR 1, can file ITR-2. Therefore, any director of a company, as well as anyone who owns unlisted equity shares of a company, will be required to file ITR-2 returns. Also, individuals having more than one house property should also file an ITR-2 income tax return.

-

ITR 3

It is to be filed by persons having income from a business or profession. Thus, the eligible source of income for ITR 3 are –

-

- Running a business or profession whether subject to audit or not.

- Income from all other sources like salary, house property, capital gain and other sources, be also included.

-

-

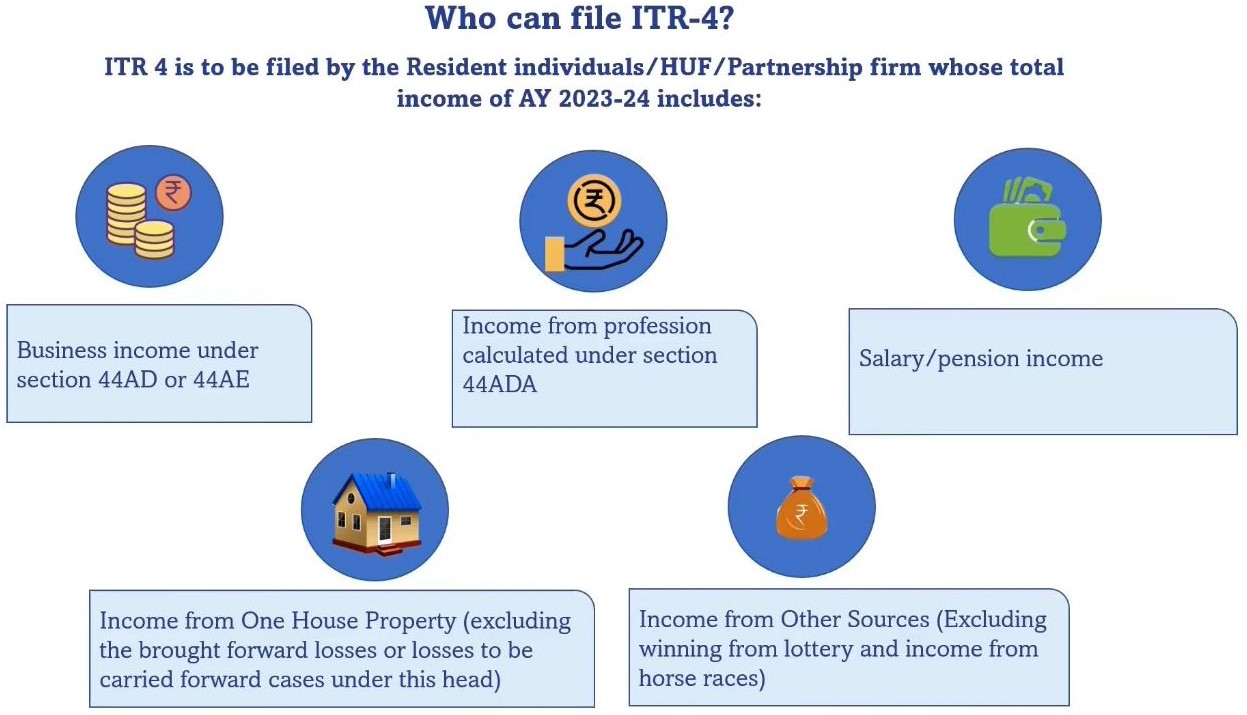

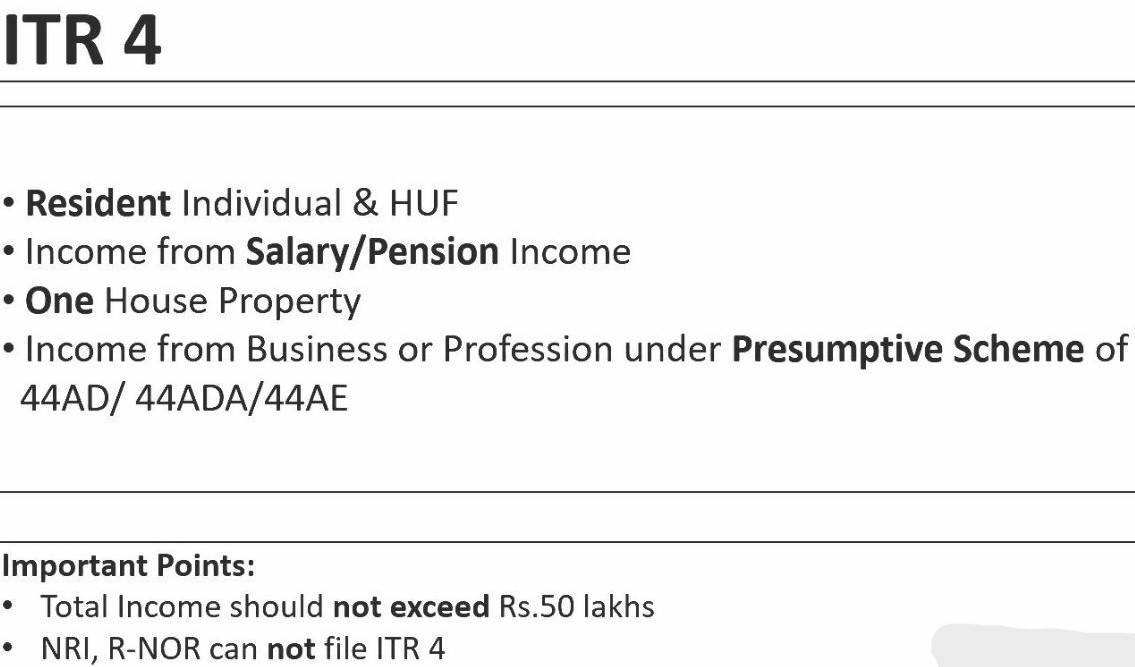

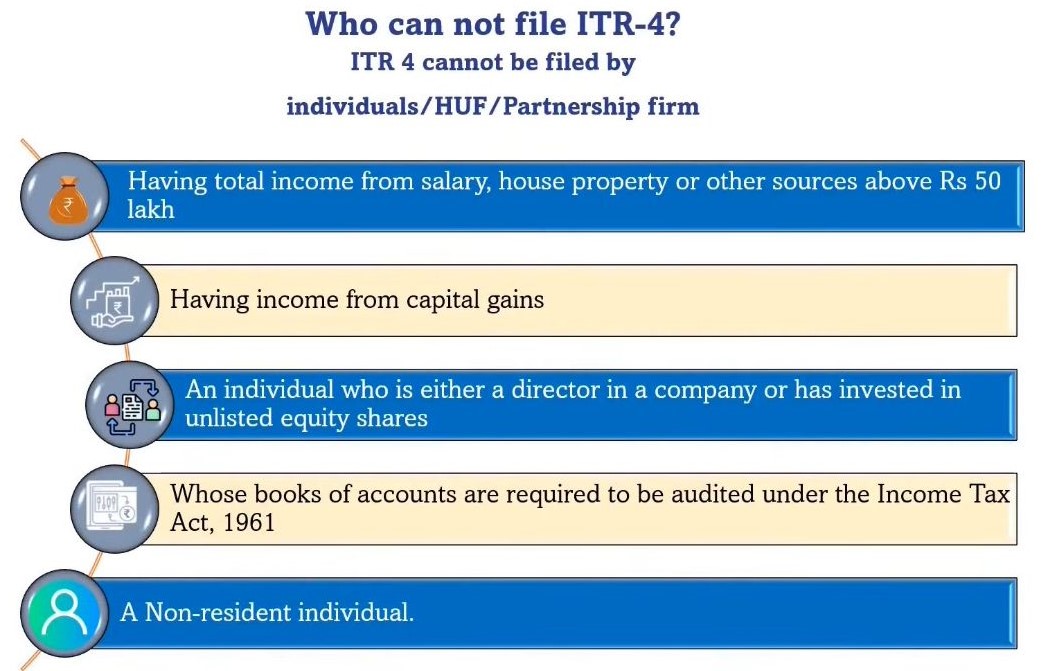

ITR 4

-

- It is applied to Individuals, HUFs, and Firms, excluding LLPs, who are residents and have total income up to Rs.50 lakh. Such income constitutes income from business and profession, subject to computation under sections 44AD, 44ADA, or 44AE.

- Apart from business or profession, it includes income from one house property with single ownership, interest Income, Family Pension, and agricultural income up to Rs.5,000.

-

ITR 5

- This form is to be filed by Firms, LLPs, Association of Persons, Body of Individuals, Artificial Juridical Person, legal heirs of deceased and insolvent persons, trust and investment-based funds.

-

ITR 6

- Such form is required to be filed by companies not eligible for an exemption under Section 11. It is to be noted that exemption under section 11 is provided to companies that receive income from property held for charitable or religious purposes. Such a return can be filed electronically and authorized with the assigned digital signature.

-

ITR 7

- It is to be filed by trusts, political parties, charitable institutions etc. receiving exempt income under the Act. Also, where the individuals and companies fall under section 139(4A), section 139 (4B), section 139 (4C), or section 139 4D, they can also file ITR-7 form.

- One of the required aspects of this form is that the taxes deducted, collected, or paid by or on their behalf, must match with their Tax Credit Statement Form 26AS. This form is divided into two parts with a total of 23 schedules.

Popular Article :