Is Digital Currency different from Virtual Digital Assets?

Page Contents

How are Digital Currency different from Virtual Digital Assets?

- Even if it is a crypto, a currency is only a currency if it is issued by a central bank.

- Conversely, anything outside of that is referred to as cryptocurrency by everyone, although it is not a currency.

- These are known as Virtual Digital Assets.

- Indian Finance Minister explained that what the Reserve Bank of India will issue in the next financial year will be the digital currency. The above is referred to as the Digital Rupee.

- Non-fungible tokens, commonly known as NFTs, are cryptographic assets on a blockchain having unique identifying codes and metadata that distinguish them from one another. NFTs can be used to represent people’s identities, property rights, and other things.

- This is in contrast to fungible tokens, such as cryptocurrencies, which are identical to one another and hence can be used as a means of exchange.

- Virtual currency is a kind of digital currency which is unregulated. It is not issued or controlled by a RBI. for instance of virtual currencies include Litecoin, Bitcoin & XRP.

- Digital currencies are stored in and transacted via applications, designated software, & networks in digital form

- The Digital currency is a form of currency that just present in digital form However on the other hand, crypto is a digital currency however in form of decentralized digital currency. It need cryptography and no central authority to Control & manage its ledgers & balances,

- The Financial Action Task Force guidelines are applicable to virtual currencies, which are almost always regarded as virtual assets. The development of virtual currencies over the past 10 years has increased the risk of abuse, corruption, and illegal activities, which is what prompted the Financial Action Task Force recommendations.

Taxation on Digital Currency & Virtual Digital Assets

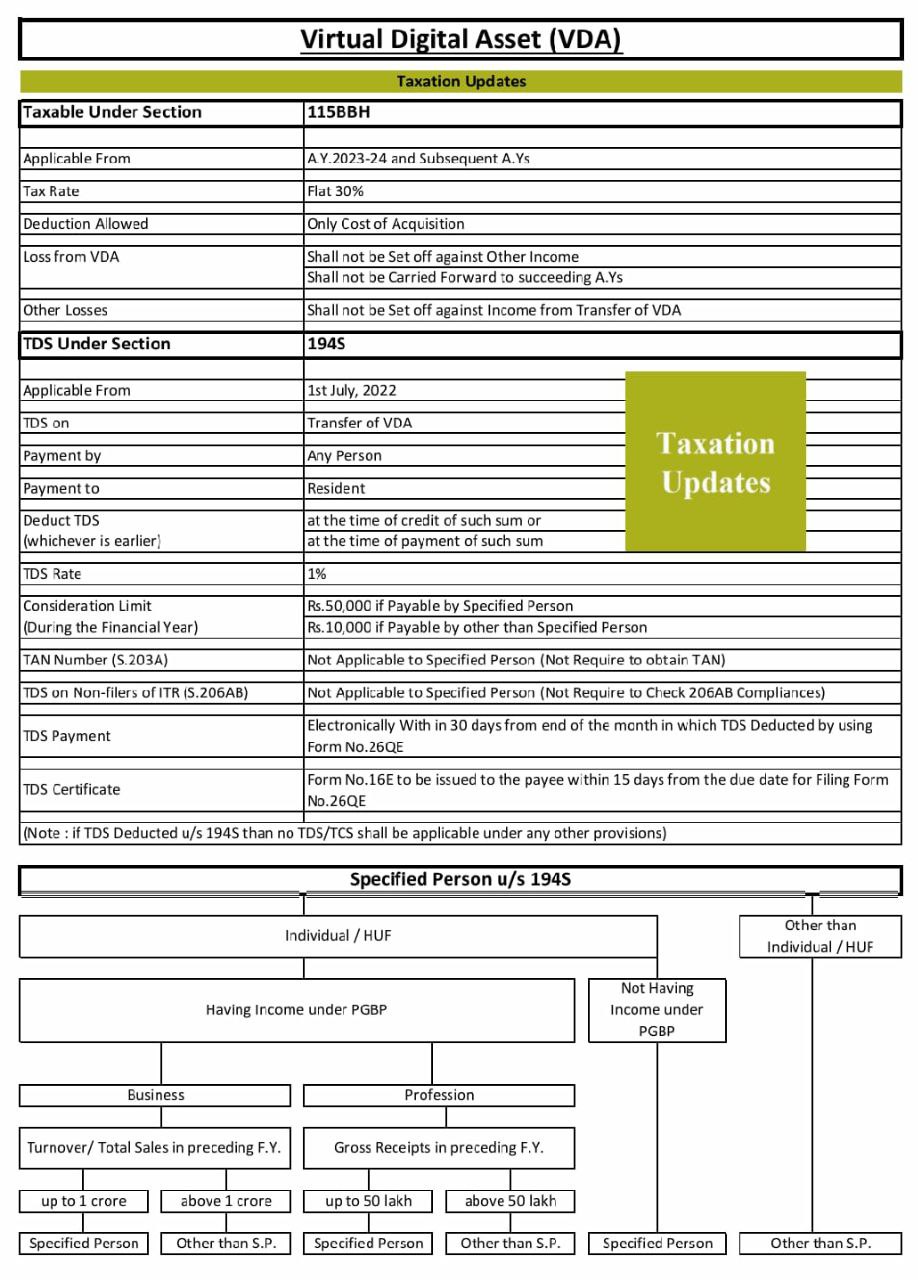

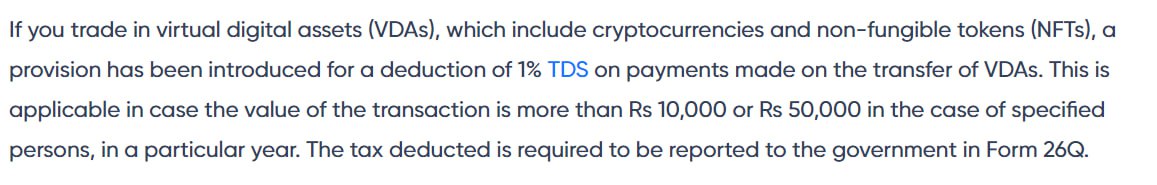

The new proposal would tax virtual digital asset transfers at a rate of 30% (without allowing for any deductions for expenses other than acquisition costs). A 30% tax is currently imposed on income derived from sources like lottery, betting, horse race, and other winnings.