TCS & TDS Rate chart for the FY 2023-24 (AY 2024-25)

Page Contents

Tax collection at source Rate Chart for Assessment Year 2024-2025 – Income Tax

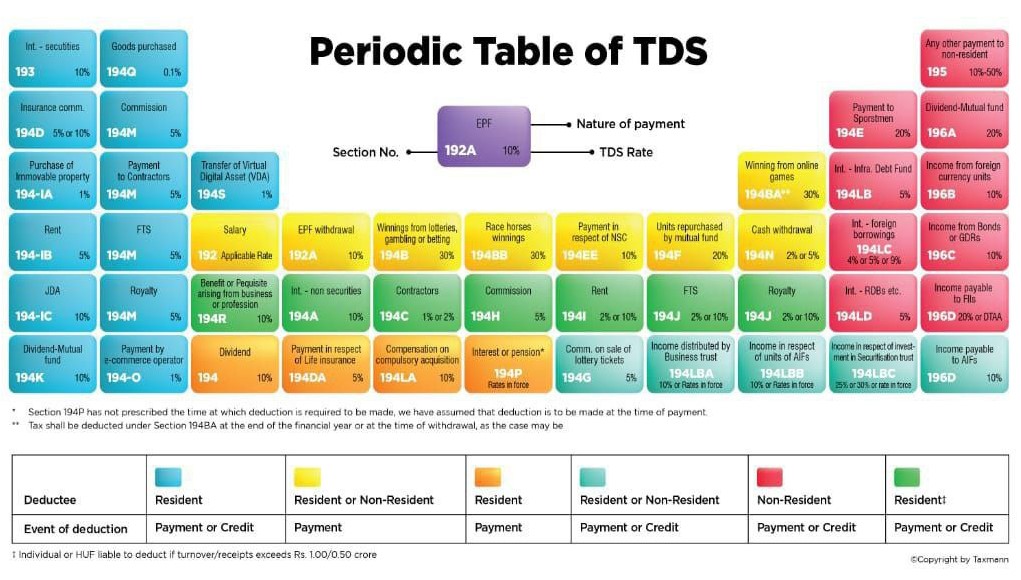

- TDS is one of the key regulatory frameworks for the Income Tax Authority. Each deductor shall deduct the TDS at the specified rate if the payment exceeds the limit specified in that respective section under income tax.

- There are different sections of the Income Tax Act that define distinct TDS rates, the nature of the payment, and its limit for TDS, and the same has been summarised in this Article.

- Every Year Budget is announces by FM under Direct Tax changes under the respective Finance Act Proposals, a No of changes are also incorporated in regard of TCS/TDS.

TCS Rate Chart for financial Year 2023-24

| Under Section | Nature of Payment | Applicable limit for Tax collection at source | Tax collection at source Rate in % |

| 206C(1) | Sale of Timber obtained under a forest lease or other mode | Not applicable | 2.5 percentage |

| 206C(1) | Sale of Tendu Leaves | Not applicable | 5 percentage |

| 206C(1) | Sale of Scrap | Not applicable | 1 percentage |

| 206C(1) | Sale of Minerals, coal lignite, Iron ore by a trader | Not applicable | 1 percentage |

| 206C(1) | Sale of Alcoholic Liquor for Human Consumption | Not applicable | 1 percentage |

| 206C(1) | Sale of any other forest produce not being Timber or tendu leaves | Not applicable | 2.5 percentage |

| 206C(1F) | Sale Value of Motor vehicle whether in cheque or in any other mode of receipt | INR 10,00,000/- per transaction | 1 percentage |

| 206C(1G) | Foreign remittance through Liberalised Remittance Scheme (LRS) of exceeding INR 7,00,000/- in a FY, remitted amount is out of loan obtained from any financial institution under section 80E to pursue any education | Not applicable | 0.5 percentage |

| 206C(1C) | License/ Lease of Parking lot, toll plaza, mining and quarrying | Not applicable | 2 percentage |

| 206C(1G) | Foreign remittance through Liberalised Remittance Scheme (LRS) in any other case | Not applicable | 20 percentage |

| 206C(1G) | Selling of overseas tour package | Not applicable | 20% (FY 2022-23, it was 5%) |

| 206C(1G) | Foreign remittance via Liberalised Remittance Scheme (LRS) for medical purpose & education | INR 7,00,000/- | 5% (FY 2022-23, it was 5% in excess of INR 7,00,000/-) |

| 206C(1H) | Sale of goods (Other than those being exported) of value exceeding INR 50 Lakh where aggregate Sale/ gross receipts/turnover from business exceeds INR 10 Cr during immediately FY | Not applicable | 0.1% |

| 206CC(1) | Non-Filer of Income tax return | Not applicable | Twice the TCS Rate or 5% whichever is higher (Maximum Rate will not increase 20%) |

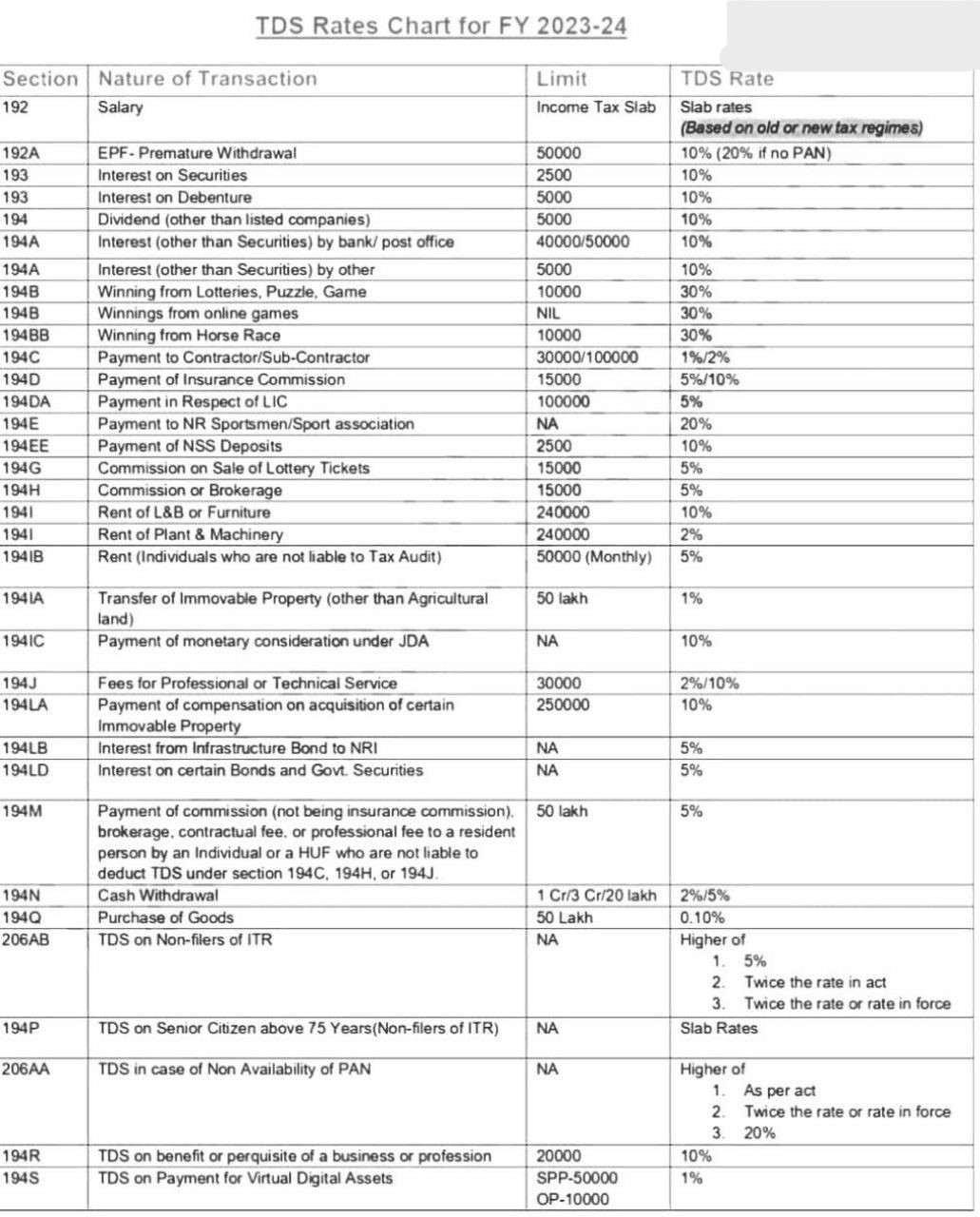

Tax Deducted at source Rate Chart for AY 2024-2025 – Income Tax

TDS Rate Chart for FY 2022-23

| Under Section | For Payment towards | Threshold limit (Amount in Rs ) | Tax deduction at source Rate in Percentage |

| Section 206AA | Tax deduction at source rate in case of Non availability of permanent account number |

– | Higher of – As per act 2 time of rate or rate in of Tax deduction at source in force 20% |

| Section 206AB | Tax deduction at source on non-filers of ITR at higher rates | – | Higher of – 5% – 2 time of rate or rate in of Tax deduction at source in force |

| Section 194 | Income from Dividend | INR 5,000 | 10 Percentage |

| Section 194A | Interest bypost office or banks other than on securities | INR 40,000 (INR 50,000 for Senior Citzens) |

10 Percentage |

| Section 194A | Interest by others other than on securities | Rs. 5,000 | 10 Percentage |

| Section 194B | Winnings from Lotteries / Puzzle / Game | Rs. 10,000 | 30 Percentage |

| Section 194BB | Winnings from Horse Race | Rs. 10,000 | 30 Percentage |

| Section 194C | Contract | Rs 30,000 (Single Transaction) Rs 1,00,000 (Aggregate of Transactions) | 1 Percentage (Individuals/HUF) 2 Percentage (Others) |

| Section 194D | Payment of Insurance Commission | Rs. 15,000 | 5 Percentage (10 Percentage in case of domestic companies) |

| Section 194DA | Life Insurance Policy on Maturity | INR 1,00,000 | 5 Percentage |

| Section 194E | While making the payment to Nonresident sportsmen / sports association | INR 0 | 20 Percentage + Cess |

| Section 194G | While making the payment for Commission on Sale of Lottery tickets | INR 15,000 | 5 Percentage |

| Section 194H | While making the payment for Commission or Brokerage | INR 15,000 | 5 Percentage |

| Section 194I | While making the payment for Rent of Land, Building or Furniture | INR 2,40,000 | 10 Percentage |

| Section 194I | While making the payment Rent of Plant & Machinery | INR 2,40,000 | 2 Percentage |

| Section 194 IA | Transfer of Immovable Property ( other than Agricultural land) | INR 50 lakh | 1 Percentage |

| Section 194 IB | Making payment Transfer of Other Rent | INR 50,000 (per month) | 5 Percentage |

| Section 194IC | Payment of monetary consideration under JDA (Joint Development Agreements) | INR 0 | 10 Percentage |

| Section 194J | Fees for professional or technical services | Not applicable 30,000 ( INR 0 in case of Directors) | 2 Percentage (Technical services or call centers), 10 Percentage (Professional services) |

| Section 194K | Income in respect of units (UTI/MF) | INR 5,000 | 10 Percentage |

| Section 194LA | Payment of compensation on acquisition of certain immovable property | INR 2,50,000 | 10 Percentage |

| Section 194 LB | Interest from Infrastructure Bond to NRI | Not applicable | 10 Percentage |

| Section 194 LD | Interest on Rupee denominated bond, municipal debt security and govt. Securities | Not applicable | 5 Percentage |

| Section 194M | Contract, commission, brokerage or professional fee (other than 194C, 194H or 194J) | INR 50,00,000/- | 5 Percentage |

| Section 194N | Cash withdrawal from bank and ITR filed | INR 1,00,00,000/- | 2 Percentage |

| Section 194N | Cash withdrawal from bank and ITR not filed | INR 20,00,000/- | 2 Percentage |

| Section 194N | Cash withdrawal from bank and ITR not filed | INR 1,00,00,000/- | 5 Percentage |

| Section 194O | E-commerce sale | INR 5,00,000/- | 1 Percentage |

| Section 194P | Tax deduction at source on Senior Citizen above 75 Years (No ITR filing cases) | INR 3,00,000/- | Normal Income tax Slab Rates |

| Section 194Q | Purchase of goods | INR 50,00,000/- | 0.10 Percentage |

| Section 194R | Benefits or perquisites arising from business or profession | INR 20,000 | 10 Percentage |

| Section 194S | Tax deduction at source on payment for Virtual Digital Assets or crypto currency (with effect from 01.07.2022) | – | 1 Percentage |

| Section 192 | Income from Salary | INR 2,50,000 | Normal Income tax Slab rates |

| Section 192 A | Employees’ Provident Fund – Premature withdrawal | INR 50,000 | 10 Percentage |

| Section 193 | Interest on Govt Securities | INR 10,000 | 10 Percentage |

Tax Collected at Source(TCS) Rate

- Under the Proposed section, 206CCA of the income Tax Act would apply on any amount received by a person from a specified person.

- In case of non-furnishing of Aadhaar/PAN by collectee, Tax Collected at Source will be charged at twice of the normal rate applicable or 5% {1% in case of sale of any goods (given in the last point) of the value exceeding 50 Lacs}, whichever is higher.

- In other words, The proposed Tax Collected at Source rate in this section is higher than the Below given Rates

- twice the rate specified in the relevant provision of the Act; or

- the rate of 5%

TCS Rate in case of Non-Availability of PAN & Not filing of ITR Return:

- Provision of section 206CC (i.e. PAN not available) of the Income Tax Act is applicable to a “specified person”, in addition to the provision of this section,

- the TDS shall be collected at higher of the 2 Rates provided in this section & in section 206CC of the Income Tax Act 1961.

CBIC Instructions on issue of SCN

- Central Board of Indirect Taxes and Customs issued instructions on dt 26/10/2021 regarding Indiscreet issue of SCNs by Service Tax Authorities.

- Proper verification & reconciliation required on difference in Income tax return & TDS data (Form 26 AS) and Service Tax Returns for issue of SCN

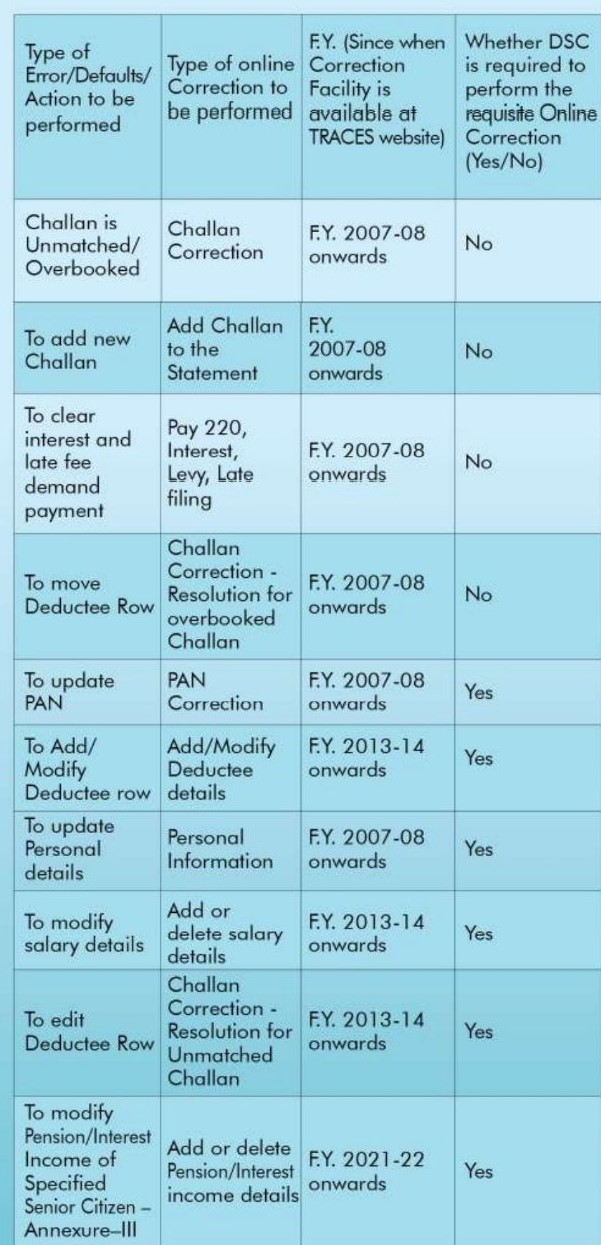

Guidelines for Online Corrections in TDS/TCS Statements

Note: TCS Rates on Non Filing of ITR u/s. 206CCA w.e.f 01/07/2021 (Budget 2021 Amendment)

- Extention of TDS/TCS statement filing Date

- TDS Deduction Rate Chart for (AY 2023-2024) FY 2022-2023

- New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

- key features of TCS on goods sale section-206c

TDS Rates & TCS Rate Chart Compiled by CA Swatantra Kumar Singh singh@carajput.com You can reach us at singh.swatantra@carajput.com for any queries, issues, and recommendations relating to the Blog. Any kind of feedback for improvement would be really appreciated,