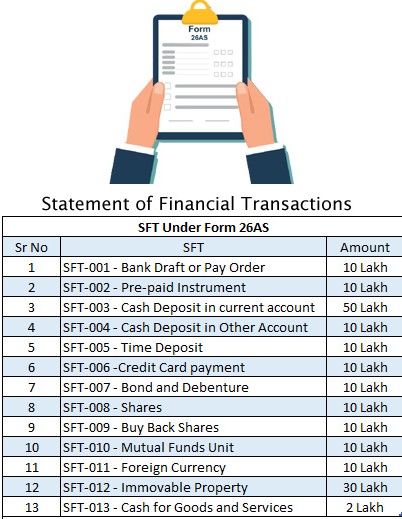

ALL ABOUT STATEMENT OF FINANCIAL TRANSACTION

Page Contents

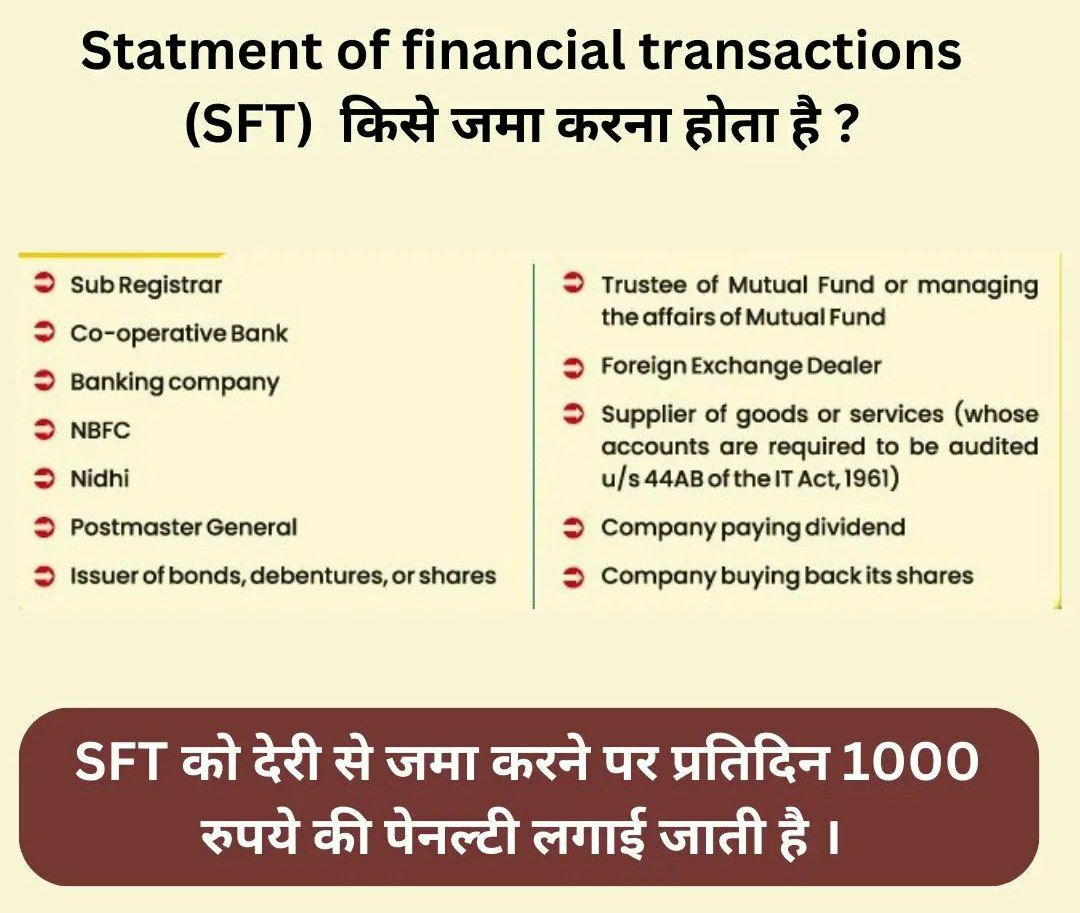

The Statement of Financial Transactions (SFT) is a document or report that provides a comprehensive overview of an entity’s financial transactions over a specific period. It is a critical component of financial reporting and is typically prepared by businesses, organizations, and government agencies to accurately depict their financial activities and position.

IS FILING OF NIL STATEMENT OF FINANCIAL TRANSACTIONS IS COMPULSORY:

- In case there is no reportable transaction, No statement of financial transactions (i.e., Form No. 61A) is required to be filed. Tax Dept Reporting Entity Identification Number (ITDREIN) is compulsory only if there are any reportable transactions. No Tax Dept Reporting Entity Identification Number is needed if there is no transaction.

- A new simple functionality titled “statement of financial transactions Preliminary Response” has been provided at the e-Filing portal for the reporting persons to indicate that a prescribed Transaction type is not reportable for the FY.

- It is advisable to file a “statement of financial transactions Preliminary Response” even if there is no reportable transaction.

- CBDT has issued a press release dated 26/05/2017 aptly clarifying that registration of reporting person (ITDREIN registration) is Compulsory only when at least one of the Transaction Type is reportable & not otherwise.

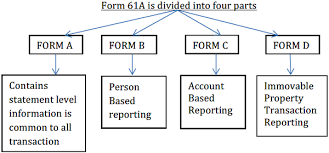

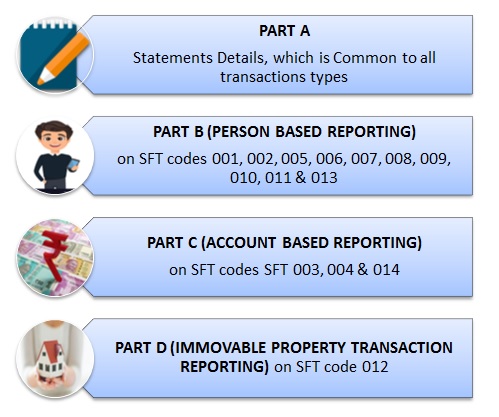

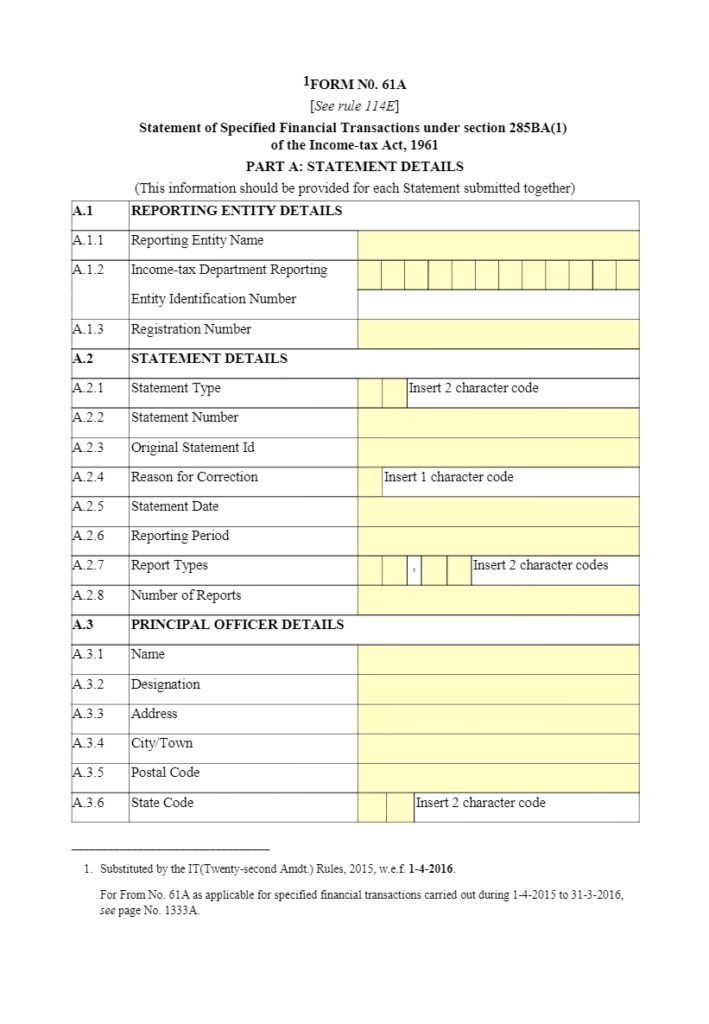

PARTS OF FORM 61A

SFT Filling Date Due Date:

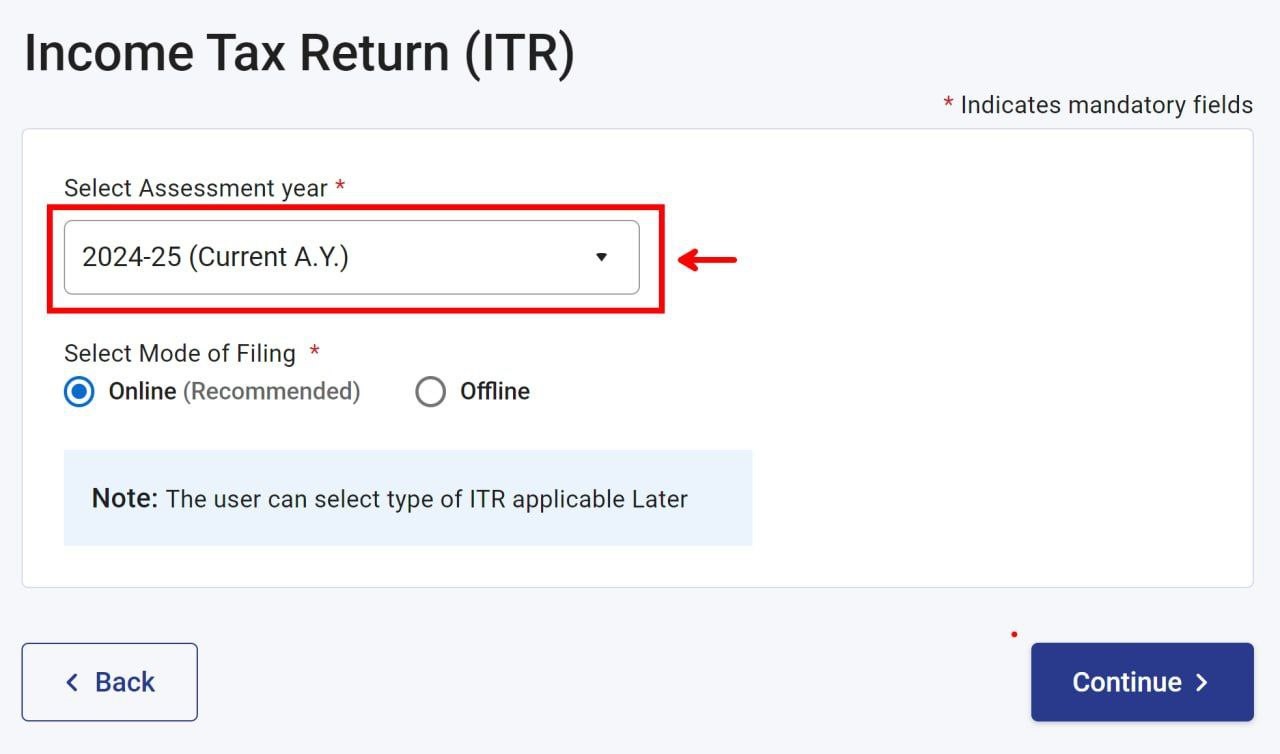

The statement of financial transactions shall electronically be submitted in relation to an FY by reporting entity with a DSC of the person responsible for verifying the declaration in Form No. 61A. The statement of financial transactions shall be submitted instantly after FY in which the transaction is registered or registered, on or before 31 May.

Failure to furnish SFT

In case of non-furnishing of the statement of financial transactions within due date, Total, a penalty of Rs 500/- per day from the expiry of original due date till the due date mentioned in the notice and Rs 1,000 per day beyond the due date specified in the notice. (Reference from Section 271FA of the Act)

The penalty of Rs 50,000 will be levied on prescribed reporting financial institution if it provides inaccurate information in the statement where:

- Person discovers the inaccuracy after the statement of financial transaction or reportable account is furnished and fails to inform and furnish correct information within 10 days. Or

- the person knows of the inaccuracy at the time of furnishing the statement of financial transaction or reportable account, but does not inform the specified Tax authority or any other authority or agency; or

- inaccuracy is due to a failure to comply with specified due diligence needed or is deliberate on the part of that person; or { As per provision of section 271FAA of Income Tax Act,}

Tax Dept Releases E-Flyer: Say No to Understand Cash Transaction & its Limits for FY 2023-24

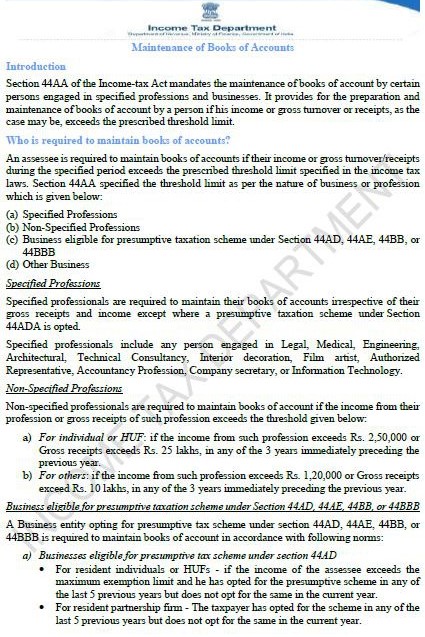

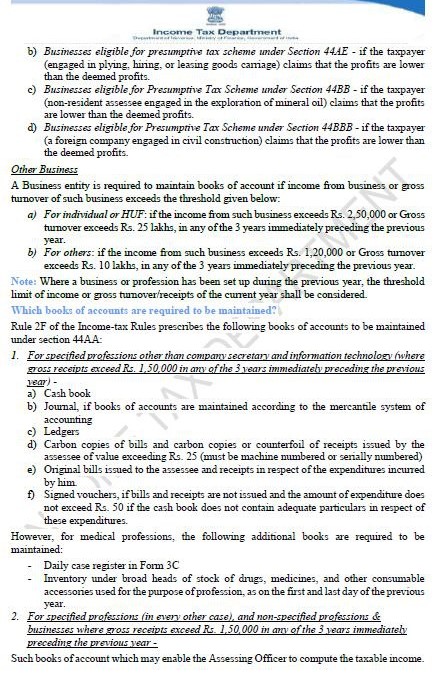

Income Tax E-Flyer on Maintenance of Books of Accounts

Popular Article :More read for related blogs are:

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

- What is the process of applying instant free pan through adhaar e-KYC

- Basic of aadhar card significance process aadhaar linking with PAN

- Tax Audit

- Implication of cash transaction under income tax Act

- How to file Revised Return of Income Tax E-Filing: Income Tax Department

- Prevent popular errors while filing an income tax return

- Needed to file Income Tax return of Bitcoin profit earned

Contact Us

You may find us via email at singh@carajput.com or by phone at +91 9555 555 480, You can contact our NRI consultant in India or NRI ITR filing services in India, We also offer Income Tax compliance & Registration services!