Complete knowledge about GST Registration

Page Contents

Registration Of GST Made Easier For Service Providers

- GST Registration for Service Providers Registration of GST has been made easier for service providers by implementing modified rules in the 23rd GST Council Meeting.

Turn Over limit remains the same for service providers as well

- Service providers to register for GST must have a turnover of Rs.20 lakhs or more per annum in all states and Rs.10 lakhs in some special category states.

GST Registration for Inter-State Sales Service Provider

- GST registration becomes mandatory for all businesses irrespective of annual turnover if the business involves the supply of goods from one state to another.

- Service providers, however, don’t require GST registration while doing inter or intra-state business with a turn over within Rs.20 lakhs or 10 lakhs in case of special category states. Businesses by service providers through the means of e-commerce platforms is also exempted from the GST registration requirement.

Mandatory GST Registration for specific service providers

- Though service providers get a lot of exemption from GST registration yet certain specific types have been kept under the mandatory requirement of GST registration irrespective of the annual turnover.

- Under this category are the OIDAR Service Providers, E-Commerce Operators, Non-Resident Taxable person supplying services to Indian residents, and Casual Taxable Person.

When to do the GST Registration

- A service provider with a service tax registration will have to change the same over to GST registration. In the case of a new business, the GST registration must be obtained within 30 days of starting the business.

- GST registration must be done within 5 days of commencing the business in case of a casual taxable person or non-resident taxable person.

Providing GST invoice for Services

- In the event of GST registration being not done a supply bill can be issued in which GST will not be mentioned. Without GST registration you are not entitled to collect the tax from customers as well.

- A tax invoice must be provided for services within 30 days of providing the services when a GST registration has been done already. The invoice must contain certain details that will mention the services provided, invoice date, the GSTIN of the customer, the invoice date and number, SAC code, applicable GST rate, and also the applicable GST.

GST Registration for Other than Service Providers

WHEN COMPULSORY GST REGISTRATION REQUIRED IN INDIA?

- Basic Turnover Condition: All taxpayers (Enterprises) with an annual turnover of more than forty lakhs are expected to get a new GST Registration.

- NRI taxpayers: NRI taxpayer (Enterprises) who does not have a place of business in India wants to start a new business, then has to apply for GST Registration in India before beginning a business in India. The new GST registration is valid for ninety days.

- Input service distributor & Agents of a supplier: All Input Service Distributor who wants to carry-forward the value of the Input Tax Credit needs GST registration.

- E-Commerce website: Every E-Commerce gateway (like OLX, Flipkart or Amazon) through which multiple vendors sell their product requires Gst Registration.

- Causal Taxpayer: If you supply products or services at events/exhibitions where you do not have a permanent place of business, you need to get GST Registration digitally before starting a new business. Such a dealer must pay GST on the basis of an average ninety-day sales. The period of validity of the causal GST Registration is Ninety days.

- Reverse Charge: Enterprises that are expected to pay tax under the reverse charge mechanism need to GST Registration.

What’s the GSTIN?

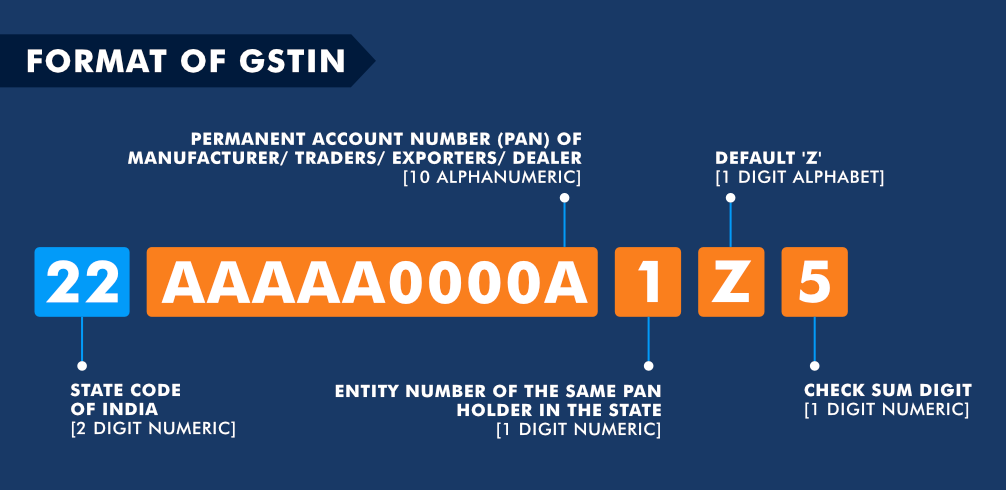

GSTIN is an abbreviation of the Goods and Service Tax Identification Number. It is made up of 15 alphanumeric digits. This is created by the government after you have completed successfully the registration of the GST.

- Display state code for the first 2 digits

- The next 10 digits show the PAN number

- Next 1 displays the serial number of Gst registrations in the state.

- The last two digits are natural random number

REQUIRED DOCUMENTS FOR GST REGISTRATION IN INDIA

List of documents checklist for GST REGISTRATION

| Kind of Taxpayers | What kind of Documents needed for GST registration |

| Company (Public & Private) (foreign and Indian) |

|

| Individual/Sole proprietor |

|

| LLP / Partnership firm |

|

| Hindu joint family |

|

Notes :

*Bank account details:

- Address Proof for Place of Business Documents such as a leasing agreement or a sale document along with a copy of the electricity bill or the latest receipt of a property tax or a copy of a municipal Partner/ Director/Khata document must be sent at the address specified in the GST application. statement (containing the first and last page (in JPEG format / PDF format, maximum size – 100 KB)