How to charge GST on expenses in the Invoice

Page Contents

How to charge GST on expenses in the Invoice

There are following possible options for charging expenses like: Freight, Packing Charges, and Loading/Unloading Charges:

| Options | Appropriate | |

| Option 1 | Charge GST (at rate on services respectively) on the expenses paid in the invoice with value of goods. | Most Appropriate |

| Option 2 | Charge freight & other expenses paid in bill but do not charge GST in them. | Lawfully wrong* |

| Option 3 | A Charge freight & other expenses as reimbursement as Pure Agent and do not charge GST on them (2 Invoices) | Not Appropriate |

* Note: Any amount charged in invoice must be either charged to GST or exempt under any provision and must be mentioned on the invoice

Option 1: Charge GST (at rate on services respectively) on the expenses paid in the invoice with value of goods:

| S. No. | HSN Code | Particulars | Value |

| 1.2. | XXXXXXXXXX | Name of GoodsName of Goods | 10000.0015000.00 |

| CGST @ 2.5% 625.00SGST @ 2.5% 625.00 | 1250.00 | ||

| 1. | XXXXX | Freight | 500.00 |

| 2. | XXXXX | Packing charges | 50.00 |

| 3. | XXXXX | Loading Charges | 100.00 |

| CGST @ 9% 58.50SGST @ 9% 58.50 | 117.00 | ||

| TOTAL | 27017.00 | ||

Option 2: Charge freight & other expenses paid in bill but do not charge GST in them:

| S. No. | HSN Code | Particulars | Value |

| 1.2. | XXXXXXXXXX | Name of GoodsName of Goods | 10000.0015000.00 |

| CGST @ 2.5% 625.00SGST @ 2.5% 625.00 | 1250.00 | ||

| Freight | 500.00 | ||

| Packing charges | 50.00 | ||

| Loading Charges | 100.00 | ||

| TOTAL | 26900.00 | ||

Option 3: Charge freight & other expenses as reimbursement as Pure Agent and do not charge GST on them (2 Invoices):

Tax Invoice:

| S. No. | HSN Code | Particulars | Value |

| 1.2. | XXXXXXXXXX | Name of GoodsName of Goods | 10000.0015000.00 |

| CGST @ 2.5% 625.00SGST @ 2.5% 625.00 | 1250.00 | ||

| TOTAL | 26250.00 | ||

Bill of Supply: Reimbursement Charges as Pure Agent

| S. No. | Particulars | Value |

| Freight (Charges recovered as Pure Agent) | 500.00 | |

| Packing Charges (Charges recovered as Pure Agent) | 50.00 | |

| Loading Charges (Charges recovered as Pure Agent) | 100.00 | |

| TOTAL | 650.00 | |

Input tax paid on such charges

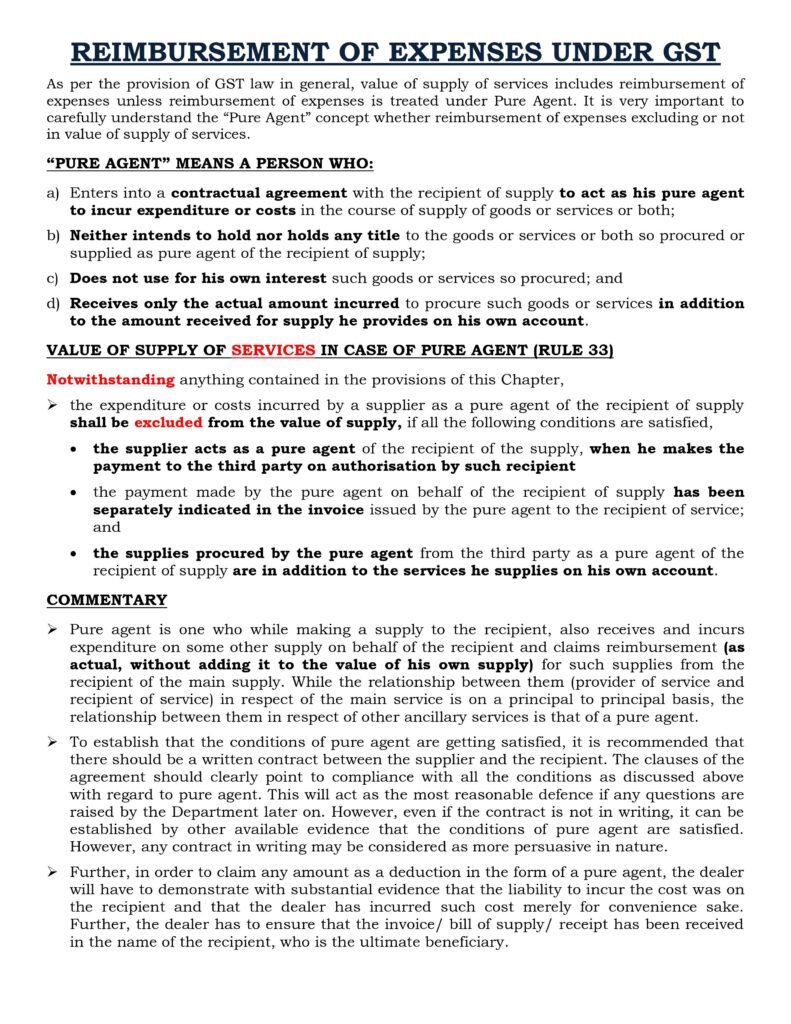

REIMBURSEMENT OF EXPENSES/PURE AGENT.

Notification No. 13/2017 (Services under Reverse Charge Mechanism)

Notification No. 13/2017 (Services under Reverse Charge Mechanism)

| S. No. | Category of Service | Supplier of Service | Recipient of Service |

| 1 | Supply of Services by a goods transport agency (GTA) in respect of transportation of goods by road | Goods Transport Agency (GTA) | (a) any factory registered under or governed by the Factories Act, 1948(63 of 1948)(b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or(c) any co-operative society established by or under any law

(d) any person registered under the Central GST Act or the Integrated GST Act or the State GST Act or the Union Territory GST Act (e) body corporate established, by or under any law (f) any partnership firm whether registered or not under any law including association of persons (g) Any casual taxable person.

|

Note: The person who pays or is liable to pay freight for the transportation of goods by road in goods carriage, located in the taxable territory shall be treated as the person who receives the service for the purpose of this notification.

Rate of tax on services from GTA: 5% (without ITC)

Input Tax Credit under RCM

- The service recipient can avail Input Tax credit on the Tax amount that is paid under reverse charge on goods and services.

- The only condition is that the goods and services are used or will be used for business or furtherance of business.

- Unfortunately, ITC cannot be used to pay output tax, which means that payment mode is only through cash under reverse charge.

Conclusion:

Consignor has to pay GST @ 5% on transportation charges of which he can take Input Tax Credit against the Output tax from supply of goods or services.

Popular blog: