Consequences if PAN & Aadhaar cards are not linked

Page Contents

What happens If Permanent Account No & Aadhaar cards are not linked

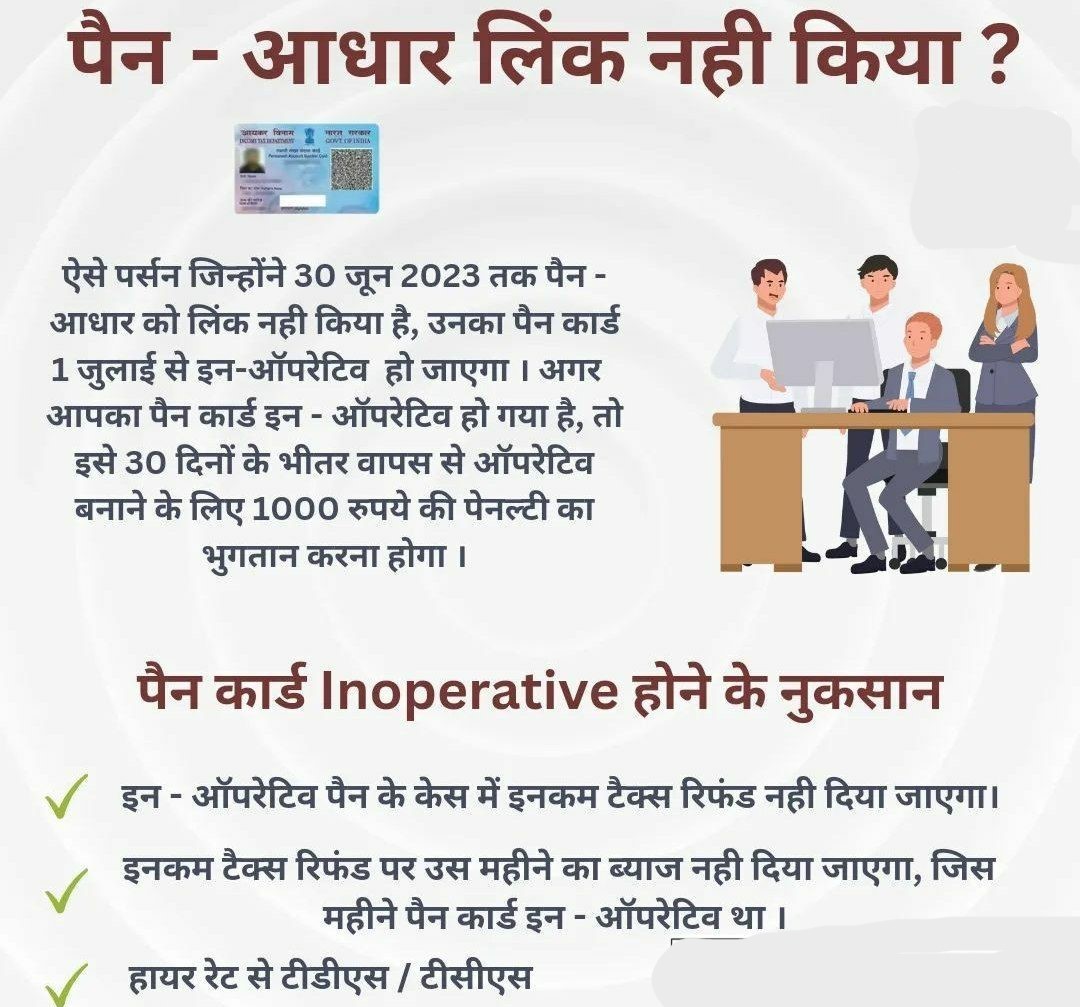

- Your Permanent Account Number will expire on June 30, 2023, if your Aadhaar & Permanent Account Number are not linked.

- You will not be able to provide, intimate, or cite your Permanent Account Number if it becomes inoperative, and you will be held accountable for all Act-related penalties for this failure.

- Few Permanent Account Number Holders who have not linked their Permanent Account Number with their Aadhaar are exploring the option to pay INR 118/- & get a new Permanent Account Number or go for E Permanent Account Number Aadhaar based for free rather than paying Rs, 1,000/- as a penalty

- It appears they are unaware that owning two or more Permanent Account Number cards sent to jail for possessing two or more Permanent Account Number cards.

- Please refrain from creating additional or extra Permanent Account Numbers if you already have one; you will be liable to pay additional fees and even going to jail.

Implication in case Permanent Account Number & Aadhaar cards are not linked

Above have various implication in case Permanent Account Number & Aadhaar cards are not linked like as:

- Tax will be needed to be deducted at a higher rate as Permanent Account Number becomes inoperative.

- Pending Income tax returns will not be processed.

- You shall not be able to file Income tax return using the inoperative Permanent Account Number.

- Pending proceedings as in the case of defective Income tax returns cannot be completed once the Permanent Account Number is inoperative.

- Pending Income tax refunds cannot be issued to inoperative Permanent Account Number’s.

- You may face a higher TDS Rate on your savings interest.

Above consequences will be take effect from 1.07.2023.

(Read about –Consequences of non-operative PAN)

How to Delink an PAN Card with Aadhaar Card?

Steps to delink if Aadhaar is linked with incorrect Permanent Account Number? Or Steps to delink if Permanent Account Number is linked with incorrect Aadhaar?

- You can file a application request to your Jurisdictional Assessing Officer for delinking Aadhaar from Permanent Account Number.

- After delinking, File or submit Link AADHAR request post fee payment of applicable amount, if not already done.

- To know your Jurisdictional Assessing Officer’s contact details, visit

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO

Post Income Tax Portal Login

Login to e-Filing portal>> Go to My Profile >> Click on Jurisdictional details.

Share with people & stay connected with CARajput