NRI deductions are allowed & deduction not allowed

Page Contents

Q.: What deductions are allowed and which are not allowed for NRIs?

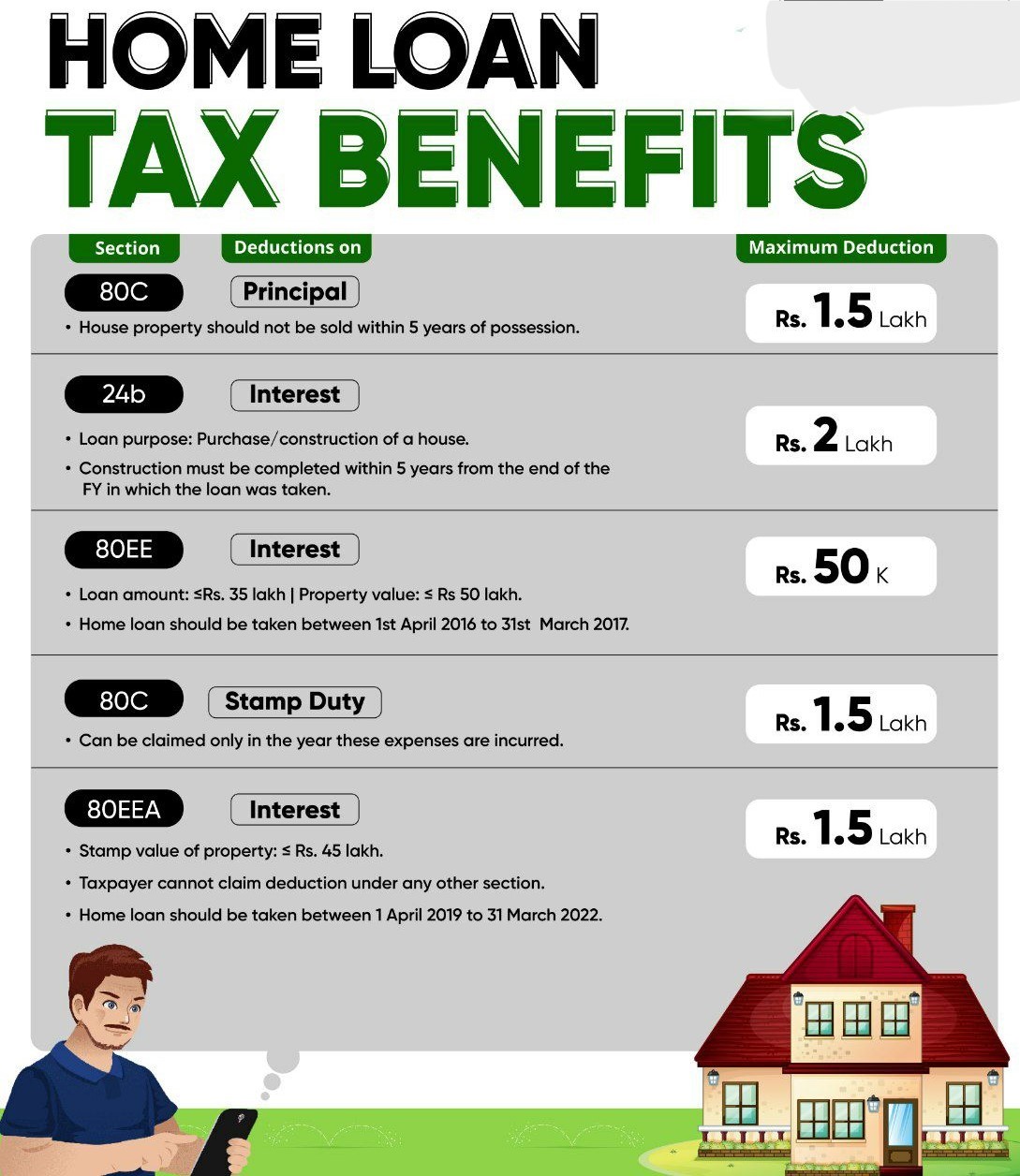

An NRI is entitled to a 30% basic deduction, a deduction for property taxes, and a deduction for interest on mortgages. A deduction for principal repayment is also permitted to NRIs under Section 80C. NRI can also deduct stamp duty & registration fees U/s 80C if you paid them when you bought a property.

| Deductions Allowed | Deductions Not Allowed |

Sec 80C

|

Sec 80C

|

| Sec 80D-

Medical Insurance |

Sec 80CCG-

Investment in Rajiv Gandhi Equity Saving Scheme (RGESS) |

| Sec 80E-

Interest paid on Education loan |

Sec 80DD-

Deduction for maintenance including medical treatment of dependant handicapped as defined under the section |

| Sec 80G-

Payments made in the form of eligible Donations |

Sec 80DDB-

Deduction for medical treatment of dependant handicapped (as certified by a prescribed specialist) |

| Sec 80TTA-

Interest on Savings Bank Account |

Sec 80U-

Deduction allowed to a taxpayer who himself suffers from disability |

Q.: What is the taxability of rental income from an Indian property?

Regardless of residency status, rental income from property in India is considered income earned in India and taxable in India. As a result, NRI rental income is taxable. This is subject to a basic exemption limit of Rs. 2.5 lakh. NRI Taxation on sale of property can be handle by tax consultants in India.

Q.: I am a non-resident alien; do I have to pay advance tax?

Yes, you must pay advance tax if your tax liability is $10,000 or more in a given fiscal year. Advance tax must be paid quarterly by the specified deadlines. If you fail to pay advance tax by the deadlines set by the government, you will be subject to interest under Sections 234B and 234C.

Q.: I’m looking to sell a house in India. What are the tax implications if I am a non-resident alien?

If your property is three years old (two years from F.Y 2017-18), you will have a long-term capital gain if you sell it. Tax is due at a rate of 20% on such gains. You can, however, decrease your tax responsibility by utilising investing opportunities provided under various rules to avoid paying capital gain tax. When it comes to inheritance, NRIs face tax issues as well. If the property was inherited, remember to factor in the original owner’s purchase date when determining whether the capital gain is long or short term. In this situation, the property’s cost will be the cost to the prior owner.

Q.: I am a non-resident Indian living in Canada who has sold some stock. I paid STT on them 1.5 years ago when I bought them. Is there any more tax I have to pay on them?

Long-term profit/loss arises on shares sold after 12 months from the date of purchase. If a profit is made and STT is paid, the profit is tax-free under section 10(38) of the Income Tax Act of 1961. Please check if there is a 1 lakh limit.

Q.: I am an Indian national looking for work in another country. I’d like to discover if I’m eligible for an income tax exemption under the NRI category.

According to Indian tax legislation, you must first determine your residency status. If you fall into the Non Resident category, you will be subject to all of the provisions that apply to Non Residents.

If your foreign income is moved to your NR account in India, it will not be taxable if you are a non-resident Indian. Q How will income from an NRE account be taxed?

Section 10(4) (ii) of the FEMA, 1999 exempts any interest generated on a deposit in an NRE account for an individual who is a “person living outside India” as defined by the FEMA, 1999, or who is a person allowed by the Reserve Bank of India to maintain the account.

If you are an NRI and are allowed to open such an account, your interest income is tax-free. However, once you become a resident, interest generated on NRE accounts becomes taxable to you.

Q.: How will income from an NRO account be taxed?

Interest earned on any sort of NRO bank account is subject to taxation. Compliance of Such NRI taxation services is essential.

Q.: What is the taxability of FDR interest income?

In India, interest generated on NRE fixed deposits is tax-free. Interest earned on an NRO account, on the other hand, is taxable in the hands of NRIs.

Q.: How can I request a refund for the taxes that have been deducted?

You can get a refund of overpaid taxes if you file an income tax return.

Q.: Is there a limit to how much foreign income is taxable?

In India, income earned and received outside the country is not taxable. Any income generated, accrued, or received in India, on the other hand, is taxable at the applicable income tax slab rate.

Q.: What is the Double Taxation Avoidance Agreement (DTAA) and what is its purpose?

A Double Taxation Avoidance Agreement (DTAA) is a treaty between two countries that intends to avoid double taxation on the same income in both countries.

The assesses must show a Tax Residency Certificate to get the DTAA benefit in India. The assessee might get a Tax Residency Certificate from the government of the nation where the NRI resides.

Q.: What is the benefit of Home loan ?

Q.: What is the NRI income tax rate?

For NRIs, the income tax slab rate is the same as for people. NRIs, on the other hand, are not eligible for the slab advantage for senior and super senior nationals.

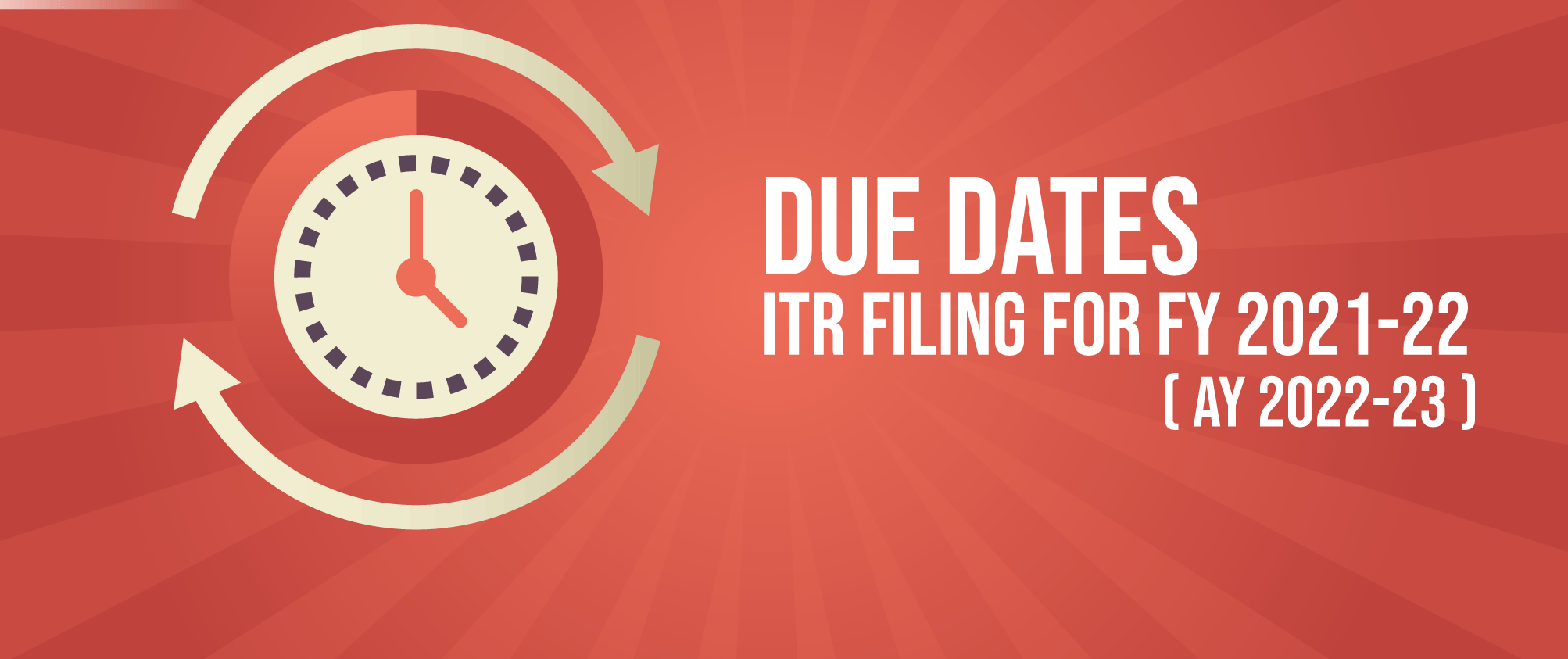

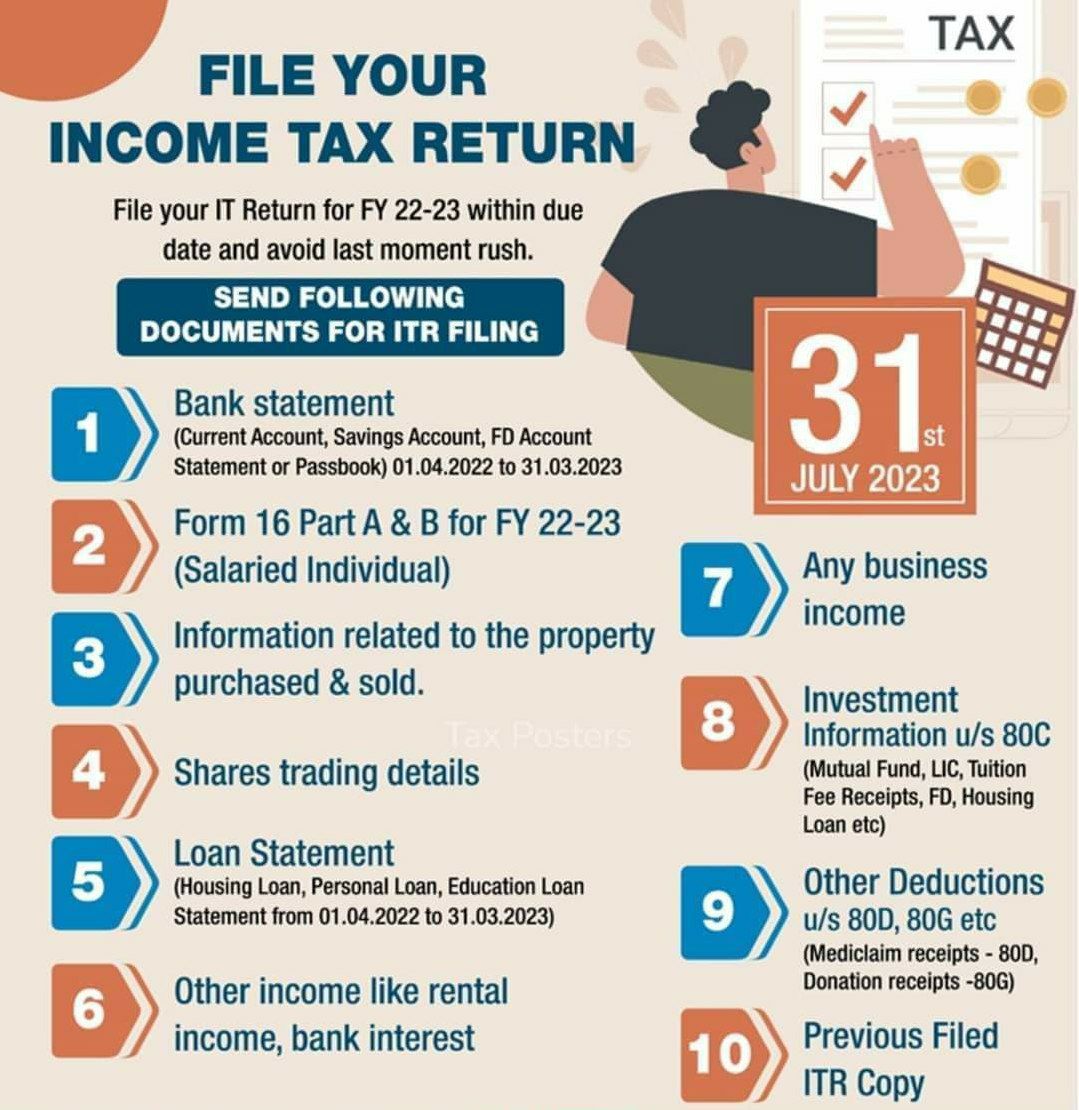

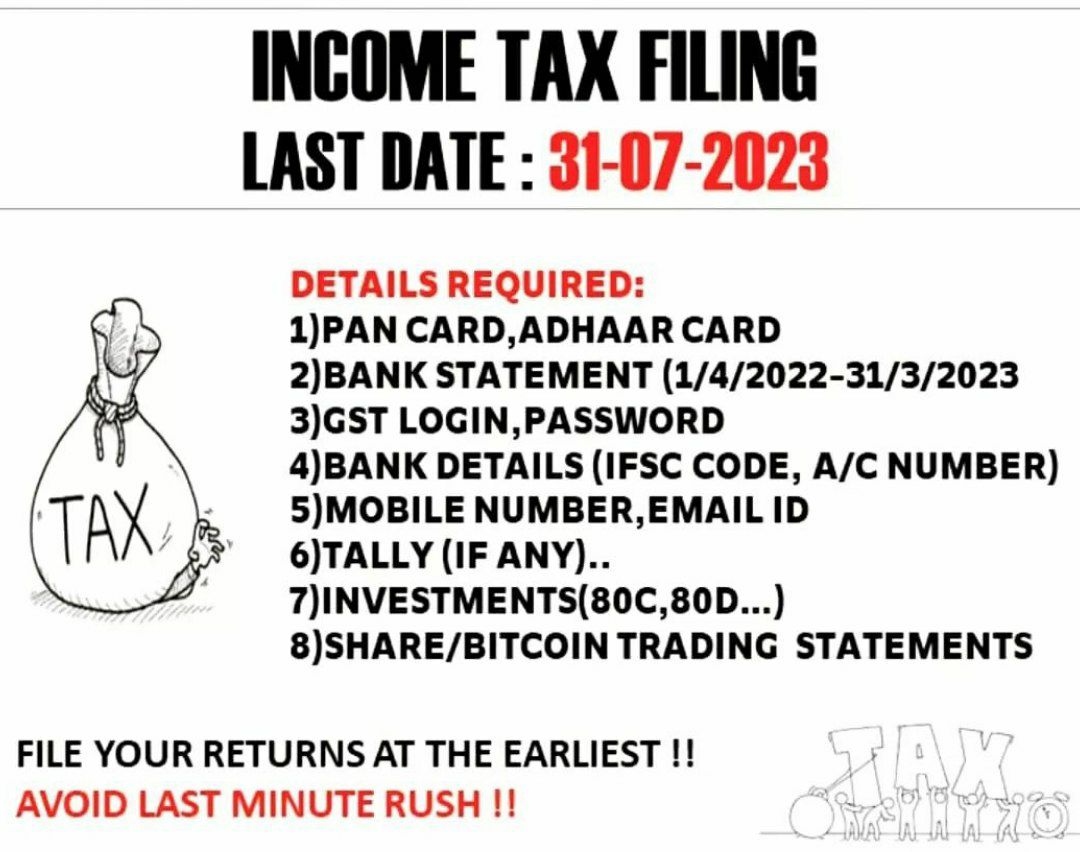

Q.: What is due date of Income tax Return filling ?

Any income tax return filed U/s 139(4B), 139(4C), 139(4A), or 139(4D) required to be submit on or before 31st October of the relevant AY, But in any other case, the Timeline date for filing a ITR would be the 31st of July of the relevant AY. You can find the due date of filling of itr are mention below:

We are providing NRI taxation in India. Expert NRI tax advisor is required in such case, We are the top NRI Income Tax Return Filing Consultants near me.

More read for related blogs are:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

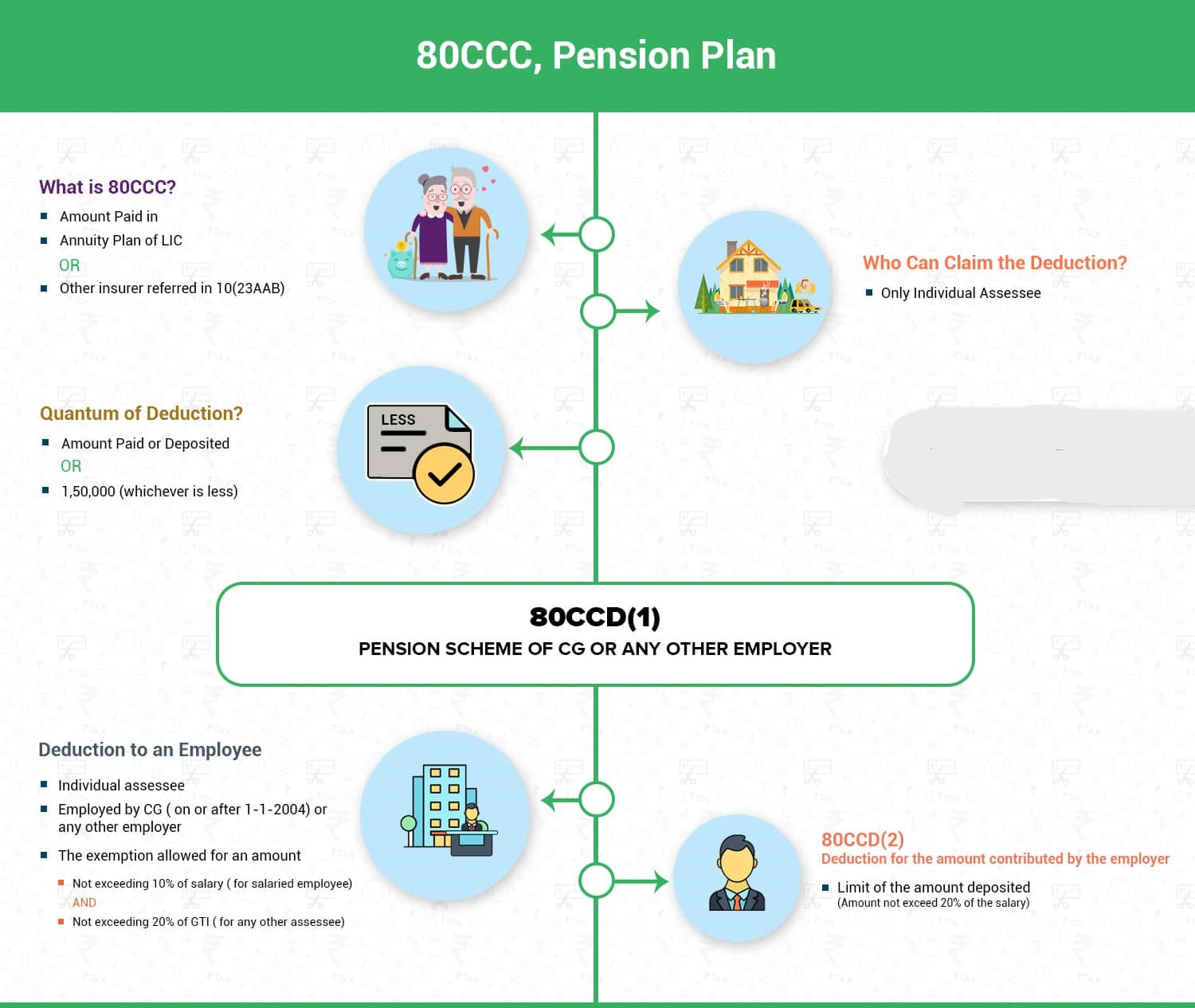

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

- What is the process of applying instant free pan through adhaar e-KYC

- Basic of aadhar card significance process aadhaar linking with PAN

- Tax Audit

- Implication of cash transaction under income tax Act

Contact Us

For query or help, You may find us via email at singh@carajput.com or by phone at +91 9555 555 480, Get in touch with us today to find out more about the services we offer! Call us at +91-9555 555 480. You can contact our NRI tax consultant in India or NRI tax filing services in India, We also offer Taxation compliance & Registration services!