New Insolvency Resolution Framework MSME

Page Contents

Insolvency Resolution Framework MSME Under the IBC

- Meaning

- Under this framework, MSMEs themselves will be able to apply to initiate bankruptcy proceedings through this mechanism.

- Existing Provisions/ Development

- Currently, Section 240A of the Code deals with MSME where exception is granted form section 29A (barring promoters to bid for company). Separate Framework dealing with resolution of MSME is expected to come soon.

- Impact

- Follow “debtor in control” model while ordinarily the corporate insolvency resolution process follows a “creditor in control” system.

- No change in control

- Self restructuring plan

Individual Resolution and Bankruptcy for Individual under the IBC

- Meaning

- A debtor or creditor can file for Insolvency Resolution and upon failure on resolution, Bankruptcy proceedings can be initiated.

- Existing Provisions/ Development

- Currently, Section 94- 148 of the Code deals deal with the Individual Resolution and Bankruptcy. Provisions in respect of personal guarantors are enforce however with respect to Individual and partnership are not yet enforced.

- Impact

- Poor frameworks for recovery have had an adverse impact on the credit market, notifying individual insolvency provisions will bring financial discipline in the people as well.

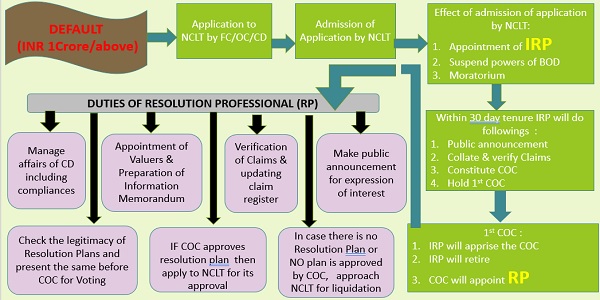

What are the default Amounts under the IBC ?

Company or an LLP.

-

- Minimum amount of Rs. 1 Lakh

- The Central Government may specify higher amount which shall not be more than Rs. 1 crore.

Partnership Firm or an Individual

-

- Minimum amount of Rs. 1 thousand

- The Central Government may specify higher amount which shall not be more than Rs. 1 lakh.

What are the COVID related amendments under the IBC?

- Enhancement of minimum default limit from Rs. 1 lakh to Rs. 1cr

- Suspension of Fresh Insolvency Proceedings for Six months (from 03.2020) which may be extended to 1 year

- No application shall ever be filed for the defaults occurred i.e. on or after 25.03.2020 (for Six months which may be extended to 1 yr).

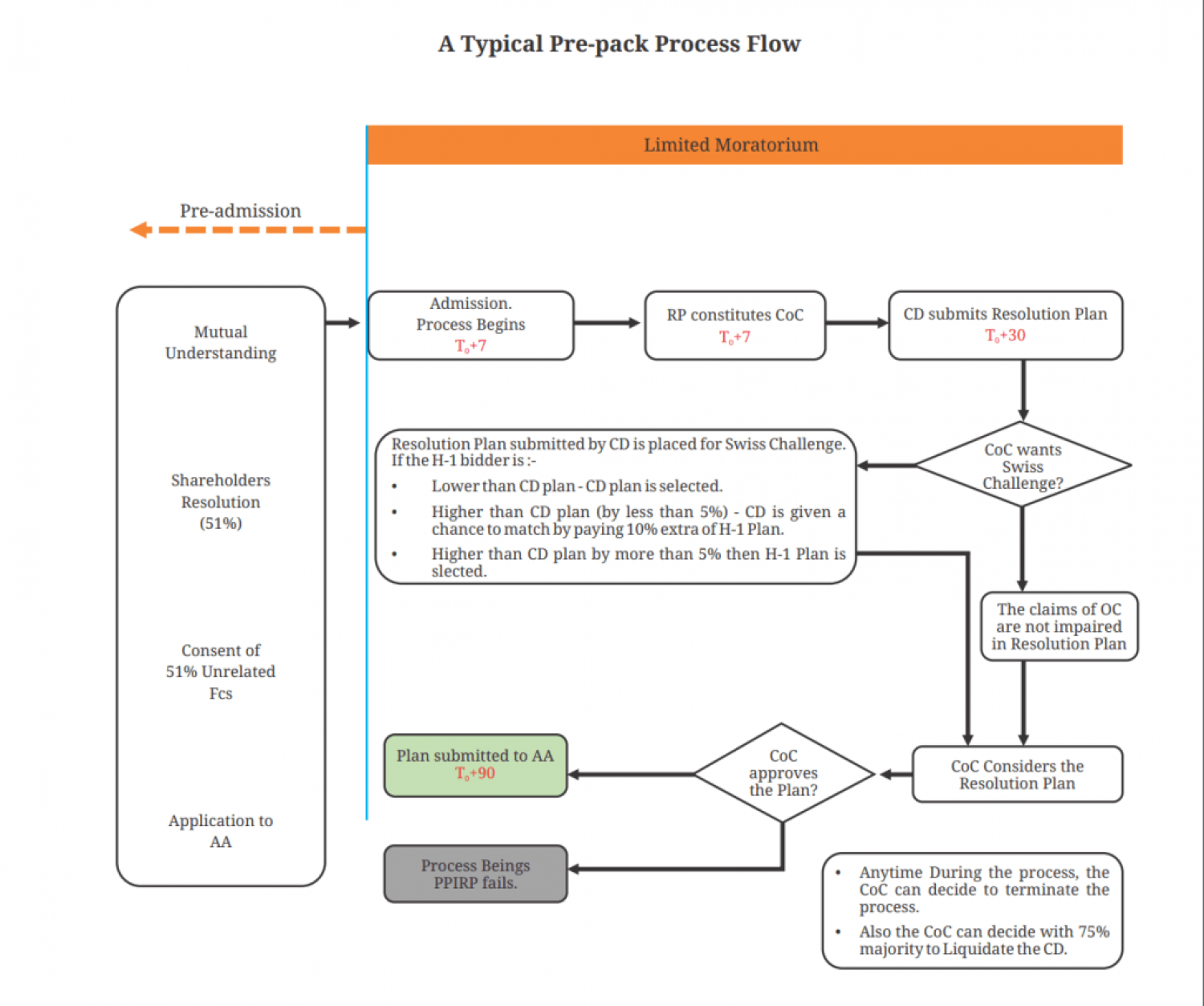

What are the pre package insolvency under the IBC?

- Meaning

- A pre package insolvency is a pre planned process in which financially distressed company and its creditors reach an agreement with a buyer for its sale prior to initiating CIRP.

- Existing Provisions/ Development

- Currently, there is no provision under the Code dealing with pre package insolvency. Separate Framework dealing with pre package insolvency is yet to come.

- Impact

- It will promote early debt restructuring in a manner that best achieves the Code’s objectives.

- Offer a chance to debtor company to revive the

- company while negotiating with creditors.

- Management to put genuine efforts for revival

- Continuity of business

New Professional – Insolvency Professional

- Insolvency Professional, who will conduct the insolvency resolution process, take over the management of a company, assist creditors in the collection of relevant information, and manage the liquidation process.

- Enrolled as a member of an insolvency professional agency and registered with the Insolvency and Bankruptcy Board of India.

- Every insolvency professional shall abide by the code of conduct.

What are the Opportunities in the Insolvency Professional?

- Interim Resolution Professional – IRP.

- Resolution Professional-RP.

- RP for Class of Creditors.

- Monitoring Member – RP.

- Stakeholders Steering Committee – Member.

- Transactional Auditor / Forensic Auditor – PUFE Transactions.

- Valuers – If MBA (Finance / Civil / Mechanical – Engineers) Holders.

- Bankruptcy Trustee.

- SEBI Administrators

- Preparation of Information Memorandum.

- Preparation of Resolution Plans.

- Information Utility – Uploading of Information.

- Presentation of Case in NCLT / NCLAT (for LLB Qualification – Added Advantage).

- Guidance to Corporate Debtor (i.e., Companies / SMEs).

- Representation from Bankers (To participate in CoC Meetings – Private Sector Banks).

- Assist to Operational Creditors (Those who supply Raw Material / Utility Services to CD).

- Provide Compliance – IBBI / Services etc. etc.

Popular blog: –