Can NRIs claim DTAA benefits in India?

Page Contents

Is NRIs can Claim DTAA Benefits?

- NRIs is not be exempted from taxation under the Double Tax Avoidance Agreement, However they will be relieved of the burden of paying multiple income taxation in both nation.

- The Double Tax Avoidance Agreement is a treaty that is signed by the two countries. This agreement is undertaken by the countries to provide benefits to NRIs to get relief from paying taxes multiple times.

- DTAA does not imply that the NRI will be relieved from tax liability, it’s just that they have to pay the tax in a single country, once. Another important aspect is the rate of tax.

- There could be different rates for taxing an income in two countries, thus DTAA also reduces taxes for uniformity and hence helps in reducing the instances of tax evasion.

DTAA Rates

- As discussed above, the DTAA assigned by India to different countries involves fixing a specific rate at which tax has to be deducted on income received by the residents of that other country.

- Thus, the NRIs earn an income in India, and the TDS to be deducted will be according to the rates set in the Double Tax Avoidance Agreement with that country.

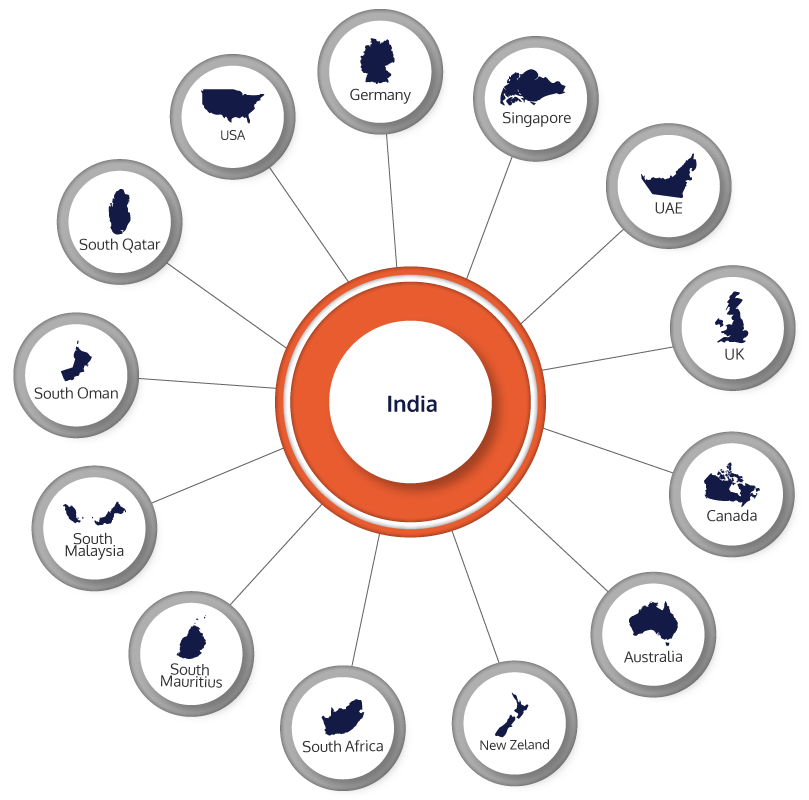

COUNTRIES HAVING DTAA WITH INDIA

- India is in a Double Tax Avoidance Agreement with almost every major nation, subject to the residence of Indians in their nation. Some of these countries and their DTAA rates are as follows –

| COUNTRY NAME | DTAA RATE |

| UNITED STATES OF AMERICA | 15% |

| UNITED KINGDOM | 15% |

| CANADA | 15% |

| AUSTRALIA | 15% |

| GERMANY | 10% |

| SOUTH AFRICA | 10% |

| NEW ZEALAND | 10% |

| SINGAPORE | 15% |

| MAURITIUS | 7.5% TO 10% |

| MALAYSIA | 10% |

| UAE | 12.5% |

| QATAR | 10% |

| OMAN | 10% |

| THAILAND | 25% |

| SRI LANKA | 10% |

| RUSSIA | 10% |

| KENYA | 10% |

TYPE OF INCOME UNDER DTAA

-

SALARY RECEIVED IN INDIA

- As mentioned earlier, salary income is taxable, if received in India. Thus, an NRI who receives a salary in their Indian account is liable to pay tax.

- Such income is at their specified tax slab limits. Also, any income earned from services provided in India by an NRI is liable to be taxed in India.

-

HOUSE PROPERTY INCOME

- Coming on to the house property, an assessee is liable to pay tax on income received in respect to any property situated in India. Applying the provisions of the Income Tax Act, 1961, we can make out that whether the property is vacant or rented, tax shall be calculated on the deemed income.

- In the case of NRI, the same provisions apply and they can also claim a 30% standard deduction on house property. Apart from this, they can claim a deduction against principal repayments, for expenses incurred in respect of stamp duty and registration, under section 80C.

- Where rent is received by a Non-Resident Indian, the tenant is required to deduct TDS at a rate of 30% and also required to submit Form 15CA through the online portal.

- In certain specified cases, the Form 15CB may be submitted by a chartered Accountants, which shows the details of payments, TDS rate, and TDS deduction.

- It is to be noted that Form 15CA is required to be submitted, where the rental payment exceeds RS. 50,000 (single transaction) and RS. 2,50,000 per financial year.

-

INCOME FROM OTHER SOURCES

- Almost every Non-Resident Indian is required to keep a bank account in India, either as an NRO Account and NRE Account.

- Thus, the interest earned from these deposits is taxable in the hand of the concerned holder, and TDS is also deducted thereon.

- However, it is to be noted that interest income from NRE accounts is exempt from tax. NRIs are required to report Interest income from both types of accounts i.e., NRO as well NRE in the ITR form.

-

INCOME FROM CAPITAL GAINS

- Any sought of capital gain received on transfer of capital asset situated in India, is liable to tax in India. Such capital assets also include the securities and bonds purchased in India.

- Where a Non-Resident Indian sells his house property, situated in India, the buyer is under an obligation to deduct TDS at 20%. However, NRI’s are also provided with the capital gain exemption under Section 54 and section 54EC.

-

REDEMPTION OF INSURANCE POLICY

Some NRIs do invest in Insurance policies (ULIPs etc) in India and on the redemption of policy, Insurance companies deduct TDS on the payment of the said amount.

A Non-Resident Indian is required to disclose such income to the IT Department via filing an ITR with the exact amount of income element of the Insurance Policy and also claim TDS.

-

INCOME FROM INVESTMENTS

Some investments that can be made in India are –

- Interest received from deposits made with Indian banks.

- The Investment in Government dated securities and treasury bills.

- Purchasing of units of mutual funds of domestic companies.

- Investment in Non-convertible debt instruments.

- Purchasing of bonds issued by any PSU in India.

- Banks in India issue debt capital instruments for investment purposes.

- Shares or stocks of Indian companies under the FDI scheme.

- Investment in Shares and convertible debentures of Indian companies through stock exchange under Portfolio Investment Scheme.

Where the income from the above sources is also taxable in the NRI’s country of residence, they can apply for DTAA, to avoid payment of taxes on it in India by availing the benefits of DTAA.

Popular blog:-