New GST refund procedure under GST regime

Page Contents

New GST refund procedure under the GST regime

For GST REFUND: we have two scenario

-

a) Export with payment of IGST:

Form GST RFD-01/RFD-01A:

- GST export refund process will require the submission of the form RFD-01 (completely online) or RFD-01A (manual) in specific cases only.

(1) Export of goods:

- In the case of export of goods subject to payment of tax, no separate refund application is required, as the shipment bill itself will be treated as a refund application.

- The details entered in the form GSTR-1 will be matched to the details indicated in the shipping bill as filed with ICEGATE.

- ICEGATE will then process the refund and credit on the same bank account as the taxpayer has indicated on its portal.

(2) Export of Services:

- a request for a separate refund in RFD-01A is required. Such a taxpayer must login to the GST portal and select

Services > Refunds > Application for Refund > Export Services with Tax Payment > RFD-01A.

- Details on the export of services will need to be uploaded using the offline utility.

- It will also be necessary to provide the amount of refund and the bank account number in which the refund is to be credited.

- Upon successful filing, an Application Reference Number (ARN) will be generated which can be used to track the status of the refund application.

(b) Export without payment of IGST:

- Process of refunding the GST for exports involves a different document in this case.

- The option to export goods without payment of tax may be used either in the context of a letter of undertaking (LUT) or a bond. In such cases, any ITC accumulated on unused input/input services will be available for refund.

- LUT option is only available for a select number of exporters that meet the prescribed criteria.

- The procedure is similar to that for the export of services.

Form GST RFD-11:

- LUT can be filed on the common portal in Form GST RFD-11 by accessing

Services > User Services > Furnish Letter of Business (LUT).

- The required details are filled in and uploaded along with the digital signature as per the LUT filing procedure.

- GST export refund process will not be complete without this submission.

- In the case of a bond, it must be executed manually on a stamp paper, signed and submitted to the Deputy Assistant Commissioner, along with the relevant documents, such as Form RFD-11 on the taxpayer’s letterhead, bank guarantee, letter of authority, etc.

Form GST RFD-01/RFD-01A:

- Similar to the process of GST refund for exports in the event of a tax payment, this form should be used by taxpayers.

- Details relating to ITC attributable to zero-rated supplies must be entered and submitted on RFD-01 (completely online) or RFD-01A (manual).

- The taxpayer should confirm that RFD-11 has been filed.

- Upload the relevant documents and affix the digital signature to submit the form and the ARN will be generated for tracking.

- The invoice declaration procedure in Form GSTR-1 is the same, except that ‘Without payment of tax’ must be selected in the GST Payment field.

GST export refund process under the new GST export refund process

- The GST export refund process and the RFD-01A and RFD-11 refund application will remain the same under the new GST return system.

- In the return, there is a change in the reporting of export details. The following are the forms used to report the export refund details.

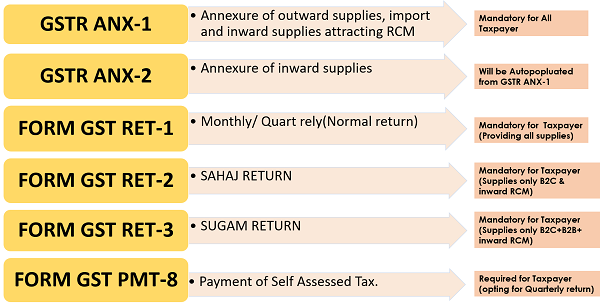

Form ANX-1:

- GST refund mechanism for exports under new GST returns will start with ANX-1.

- In this form, the export invoice details are to be uploaded in Table ‘3C – Exports with Tax Payment’ and Table ‘3D – Exports without Tax Payment’ depending on whether or not the IGST is paid for the supply.

- For the tax period, all such export invoices on which the shipping bills / bill of export are available until the date of filing of the GST returns, i.e. on the 20th of the next month for monthly filers, or on the 25th of the month following the quarter for quarterly filers, must be reported.

- The remainder will be reported in the next tax year.

The details required in this field would be as follows:

- Document details (invoice, credit or debit note, serial number, date, value)

- HSN code (six-digit level)

- Tax rate and taxable value

- Relevant tax amounts (in the case of export with payment of tax)

- Shipping bill/bill of export (no and date)

As soon as implementation begins, separate functionality will soon be b) It will then automate the process of refunding the GST for exports to a massive extent.

FORM RET-1:

- GST refund process for exports under the new GST return system will continue with the RET-1 declaration.

- The value and the amount of tax in relation to exports declared in ANX-1 will be auto-populated for outward supplies in Table 3A (rows 3 and 4).

- Therefore, the taxpayer simply has to verify the same and not re-enter the details.

New amendment return introduced:

- An amendment to the export details, whether or not with payment of IGST, may be made in ANX-1A to amend the original annex ANX-1 submitted for the tax period, either monthly or quarterly.

- This can be done by referring to the original details. These are going to be auto-populated to RET-1A. Note that an amendment to the export documents on which the refund has already been successfully claimed is not allowed.

- On the other hand, those export invoice details which have not been declared in previous periods may be reported in the current ANX-1 period itself.

Has the process of GST refunded for exports become easier?

- The major change that can be seen is that there is an auto-population of details entered in ANX-1 to RET-1. It is different from the current/old system where GSTR-1 reporting is independent of GSTR-3B.

- There will be an integrated facility for the importation of shipping bill details as well as an entry fee from ICEGATE to the GST portal for exports and imports.

- This manual document reporting process is temporary since the new GST system will have the portal auto-populating data directly from the ICEGATE database in the respective tables in the ANX-1 and 2 forms.

- No changes were observed in the process of applying for a refund in RFD-01/01A.

- When it comes to the export of goods, the filing of the shipping bill is considered to be an application for refund and continues under the new return filing system.

- In this case, quarterly return filers may have to wait longer for their refund to be processed.

- Thus, the overall impact of the export reporting and refund claims under the new return filing system appears to be minor but definitely easier.

As per New GST Amendment, I has been introduced that time period from the date of filing of Application on GST Refund under Form RFD 01 till the date of issuance of Deficiency Memo (RFD 03) shall now be remove while computing the limitation period of Two Year while computing the limitation period of2 years when a fresh refund application is filed after removal of deficiency.

It is more advantageous for exporters who file their refund application toward the end of the limitation period, i.e. within two years after the date of export.

Documents needed for Claiming GST Refund

Documents showing the tax payments needed to be included in the refund application should be minimal but sufficient so that it is simple for both the taxpayer and the tax authority to deal with the application. Usually, the following documents are required to obtain the right to demand the refund.

- Copy of TR-6/GAR-7/PLA/copy of return proof of payment of service. It is suggested that these forms are not needed, as in the gst Regime scenario, the payment of duty will be in an online format and the same should be conveniently visible on the screen to the refund regulating authority.

- Scan copy of original invoices for the purpose of evidencing the supply of goods. GSTN Committee made the request that taxpayers upload their relevant invoice details on a monthly. The process once completed & the Refund issued officer is able to review & display invoices on the system, the filling of invoices may be waived. Point to consider that the “Quantity” area is not incorporated in the invoice details plan to be submitted at GSTN Portal either before or along with the GST return. Moreover that these details would be required in the case of refunds in relation to exports. In such cases, the claimant must need the invoices or a statement containing specifics of the quantity along with the application for GST Refund. Documents showing the export. In the proposed GST scenario, it is suggested that ICEGATE and GSTN be interlinked, & all the documents can be properly verified online & therefore can be dispensed with.

- Records showing that the tax burden has not been passed on to the consumer. Because GST is an indirect tax, there would be a rebuttable expectation that the tax has been transferred to the end customer. There is also a need to establish the concept of “unjust enrichment” does not extend to a refund claim. It is suggested that the Chartered Accountant’s Certificate certifying the non-compliance by the taxpayer with the GST burden be claimed as a refund. The GST Law Drafting Committee can recommend a limit under which self-certification (instead of the CA Certificate) would be appropriate.

- Every other document as required by the regulating authority for reimbursement. It is suggested that the Central and state tax authorities jointly lay down the documentation needed to show the validity & validity of the refund claimed, and checklists can be formulated for the refund issue process.

The GST Refund applicant shall be required below details/documents to claim GST refund in the different prescribed case,

1. GST Refund for Accumulated Unutilised ITC: Refund of unutilised Input Tax Credit on account of exports of goods or services without payment of GST Tax (A proper valid Bond /LUT in Form RFD-11 required to be submitted)

- Copy of Self-certified copies of Issued invoices which are not found in GSTR-2A but filed in in Annexure-B

- FIRC/BRC in case of Export of services & shipping bill in case of goods- Applicable only in case of exports from ports which does not have Electronic Data Interchange facility

- Self-verified Statement of invoices

- Scan copy of GSTR-2A of the relevant period

2. GST Refund of tax paid on export of services made with payment of GST Tax

GST Refund Mechanism for Export of Services

- BRC/FIRC/any other document indicating the receipt of sale proceeds of services

- Verified declaration by assesse that the assesse has not been prosecuted for 5 Year from the relevant period where GST tax evaded is more than INR 2.5 crores

- Self-certified copies of GSTR-2A of the relevant period

- Self- certified copies Statement of invoices

- Self -verified Copies of invoices that are not found in GSTR-2A but entered in Annexure-B

3. GST Refund of unutilised Input Tax Credit on account of supplies made to Special economic Zone developer/units without payment of GST tax

- Scan copy of GSTR-2A of the relevant period

- Copies of invoices that are not found in GSTR-2A but entered in Annexure-B

- Self-certified copies Endorsement(s) from the specified officer of the Special Economic Zone regarding receipt of services/Goods for authorised operations

- Self-certified copies Statement of invoices (Annexure-B)

4. GST Refund of tax paid on supplies made to Special economic Zone developer/units with payment of GST tax

- Self-certified copies Endorsement(s) from the specified officer of the Special Economic Zone regarding receipt of goods/services for authorised operations

- Verified declaration by assess that the applicant has not been prosecuted for 5 years from the relevant period where GST tax evaded is exceeded than INR 2.5 crores

- Scan copies of invoices that are not found in GSTR-2A but entered in Annexure-B

5. GST Refund of Input Tax Credit unutilised on account of accumulation due to the inverted tax structure

- Self- certified copies Statement of invoices (Annexure-B)

- Verified declaration by assesse of invoices which are not found in GSTR-2A but entered in Annexure-B

- Scan copies of GSTR-2A of the relevant period.

For details refer : Guidance on GST Refund under inverted duty structure in GST

6. GST Refund on account of Appeal/ Provisional Assessment/Assessment/ any other order

- Relevant reference No of order & a copy of the Appeal/ Provisional Assessment/Assessment/ any other order

- Relevant reference No/proof of payment of pre-deposit made earlier for which refund is being claimed

7. GST Refund on account of any other ground or reason

- Copy of Documents in support of the GST refund claim.

GST Refund Documentation in case limit 5 Lakhs Exceed :

In addition to the electronically GST refund application submission, the claimant must also include those relevant documents. If the GST refund request is less than INR Five lakhs, a declaration must be made by the taxpayer claiming that the refund sum has not been used or transferred to any other person. If the GST refund request is greater than INR Five lakhs, then, along with the declaration, one must also include a record showing that the sum has been paid by the taxpayer.

Note:

- If the claimant is a Consulate, a United Nations entity or a foreign embassy, the request for GST refund should be submitted within 90 days from the end of the quarter) for which the goods or services have been purchased. The application must be completed in the form RFD-10.

- No refunds will be issued if the refund amount is less than Rs. 1,000/-

- The processing of a refund application takes about 30 days.

Popular blog:-

- Effect of GST on Advertisement and Cinema Industry

- GST Impact on Import and Export

- GST Impact on Real Estate

- all you know about documents required under the gst refund system

- The situation in which lead to claim GST refund