GST Registration cancellation: Principle of Natural Justice

Page Contents

Principles of natural justice if no hearing provided to the taxpayer during the Cancellation of GST registration:

IN THE GUJARAT HIGH COURT VIKRAM NATH, CHIEF JUSTICE & J.B. PARDIWALA,

J. Mahadev Trading Company v. UOI

- In the above case of the taxpayer was that without fixing a date for hearing and without waiting for any reply to be filed by the taxpayer, the cancellation order was passed by authority whereby registration of the taxpayer with GST Dept was cancelled.

- Even cancellation order refers to a reply submitted by taxpayer & also about personal hearing, according to the assessee neither he had submitted any reply nor afforded any opportunity of hearing.

- It is held that the Show-cause notice (SCN) was as vague as possible & did not refer to any particular facts, much less point out so as to enable the notice to give his reply. So, cancellation of registration resulting from said show-cause notice also cannot be sustained.

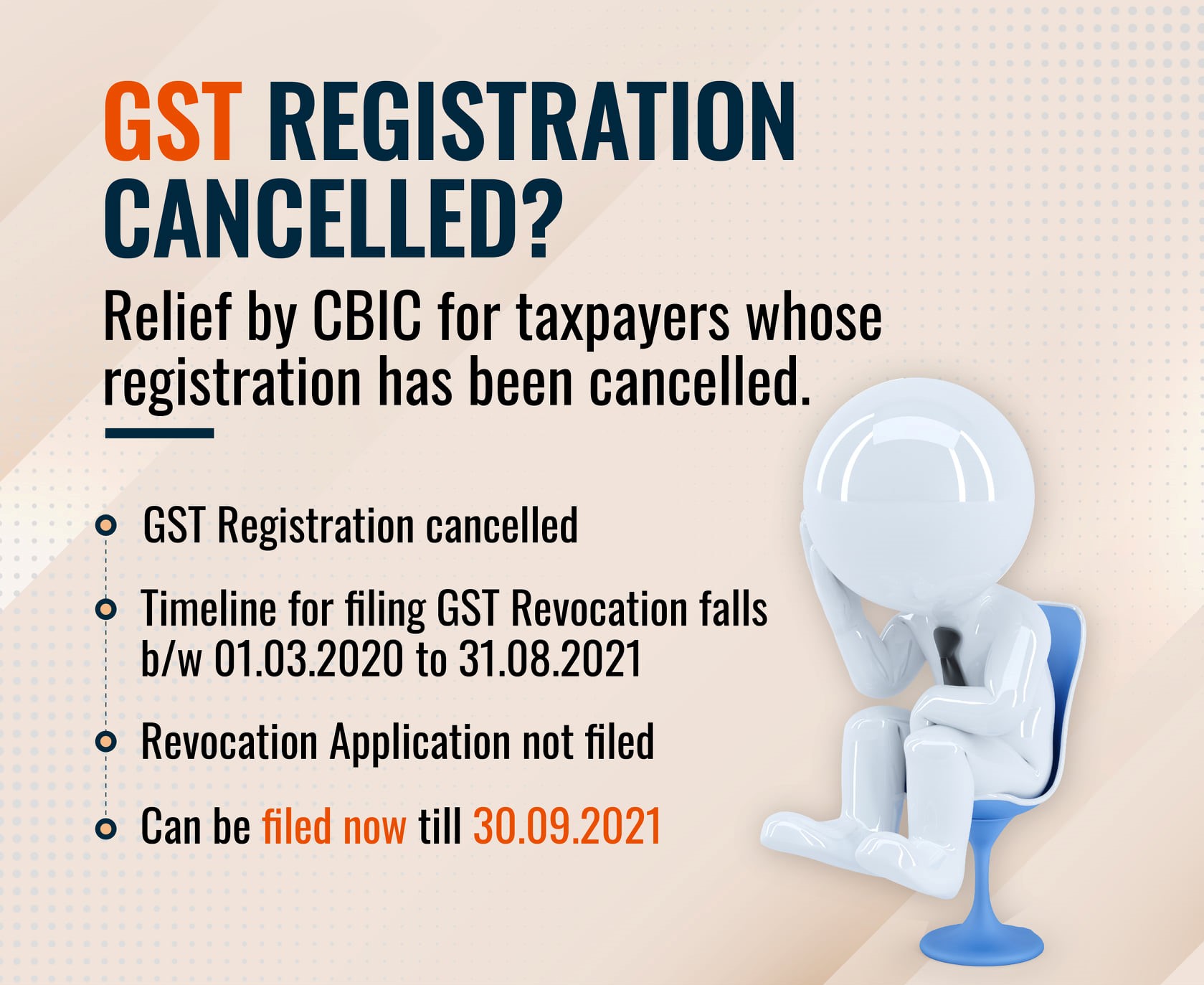

(CGST Circular 148/04/2021- GST)

- Standard Operating Procedure (SOP) for implementing section 30 of the CGST Act, 2017 and rule 23 of the CGST Rules, 2017’s provision of extending the time limit to request for reversal of cancellation of registration.

- At Rajput Jain and Associates, we help our clients in dealing with various of GST matters (GST registration, GST tax return, refund claims & GST audits) by supplying them with sufficient guidance and support from our end.

- If you have any questions or would like to understand more about cancelling your GST registration, Our Below mention Services Include under GST registration cancellation.