requirement of registration liability under gst

Page Contents

REQUIREMENT OF REGISTRATION LIABILITY UNDER GST LAW (SCHEDULE III) :

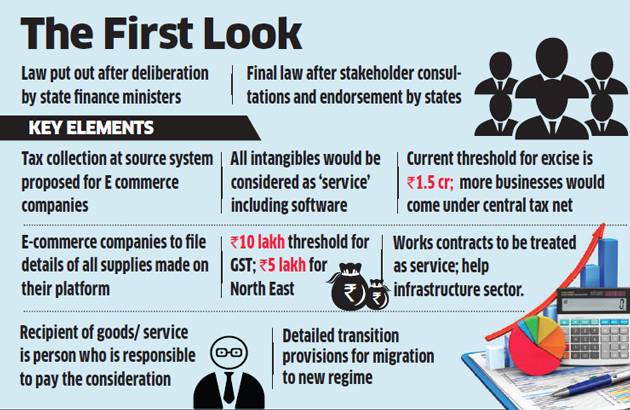

- Every supplier shall be liable to be registered under GST Act in the State from where he makes a taxable supply of goods and/or services if his aggregate turnover in a financial year exceeds [Rs. 9 (Nine) lakh] [The threshold limit of Rs. 4 (four) lakh will apply only if the taxable person conducts his business in any of the North East States including Sikkim.]

North Eastern State includes Seven Sister States (Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura), and the Himalayan state of Sikkim.

The supplier shall not be liable to registration if his aggregate turnover consists of only goods and/or services which are not liable to tax under this Act.

- Every person who is already registered or holds a license under an earlier law (like Excise Law, VAT Law, CST Law etc), shall be liable to be registered under this Act with effect from the appointed day.

- The following categories of persons shall be compulsorily required to be registered under GST Act: (Limit of Rs.9 lakh /4 lakh is not available to following)

(i) persons making any inter-State taxable supply,

(ii) casual taxable persons,

(iii) persons who are required to pay tax under reverse charge,

(iv) non-resident taxable persons,

(v) persons who are required to deduct tax under section 37;

(vi) persons who supply goods and/or services on behalf of other registered

taxable persons whether as an agent or otherwise,

(vii) input service distributor;

(viii) persons who supply goods and/or services, other than branded services, through electronic commerce operator,

(ix) every electronic commerce operator,

(x) an aggregator who supplies services under his brand name or his trade name, irrespective of the threshold limit of 9 lakh/4 lakh and

(xi) such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council.

FAQ ON GST REGISTRATION

Q1- what is the tax period?

Ans.- it is period for which the return is required to be furnished by the taxpayer.

Q2- ITC can be claimed without making GST Registration?

Ans. No, without GST no person can claim any input tax credit of GST paid by him.

Q3- can a person take multiple GST Registrations for different businesses in a state?

Ans. Yes, a person having multiple businesses in a State can obtain a separate registration for each business.

Q4- can a person get voluntary GST Registration under the GST Act?

Ans. Yes, a person may get himself GST Registered voluntarily under Section 22 and all provisions apply to a registered taxable person, shall apply to such person.

Q5. – what are the Document required for GST Registration?

Ans. Generally required following document for GST registration.

- Copy of Identity & Address proof of Promoters/Director with Photographs

- Copy of Address Proof of the place of business

- A copy of Aadhaar card

- Copy of Bank Account statement/Cancelled cheque

- DSC (Digital Signature Certificate)

- Copy of PAN of the Applicant

- Copy of Proof of business registration or incorporation certificate.

- A copy of Letter of Authorization/Board Resolution for Authorized Signatory

Q6. Cases where Goods and services are Not liable for GST payment.

Ans. Following services and goods are No liable for GST

Below Goods and Services is Not Applicable: There are certain goods and services which are not covered under GST, these are:

Services: The hotels and lodges with tariff below ₹ 1,000, plus IMM course books, bank charges on the savings account.

Goods: Rakhis without precious metals, bread, salt, sanitary napkins, raw material, eggs, besan, flour, natural honey, curd, sindoor, bangles, handloom, newspapers, deities made of stone, kajal, oat, rye, picture books, color books, manuscripts.

Q7. – What is GST Slab rate and List of goods.

Ans. Normal GST Rates

| New Updated 24th Apr 2021 | ||

| Slab Rates | Popular Services | Popular Goods |

| 28% | Star Hotels, Cinema, Food/Drinks/Stay at AC Five | Motorcycles, Pan Masala, Sunscreen, |

| 18% | IT services, Telecom services, Outdoor Catering | Camera, Shampoo, Washing Machine, |

| 12% | Temporary basis IP rights, Building construction for sale | purses and Handbags, Ghee, Nuts, Fruits, Pouches, |

| 5% | Takeaway Food, Restaurants, Newspaper printing, | Fertilizers, Spices, Plastic waste, Frozen vegetables, |

GST Tax Slab Rates List for Goods are mentioned below.

| 28% GST | 18% GST | 12% GST | 5% GST |

| Ceramic tiles | Instant food mixes | Boiled sugar confectionery | Footwear under ₹ 1,000 |

| Dishwasher | Shampoo | Packaged coconut water | Apparels under ₹ 1,000 |

| Aerated Water | Printers | Pickle | Real zari |

| Hair clippers | Tyres | Pack water bottle of 20 litre | Fish fillet |

| Sunscreen | Vacuum Cleaner | Drip Irrigation System | Frozen vegetables |

| Yachts | Camera | Fruits | Floor covering |

| Motorcycles | Curry paste | Art ware of iron | Fertilizers |

| Waffles plus wafers which are coated with chocolate | Pastries | Ghee | Tea |

| ATM Vending Machine | Preserved Vegetables | Pouches, purses and Handbags | Plain Chapati & Khakhra |

| Personal Aircraft | Washing Machine | Cakes | Spices |

| Pan Masala | Mixed condiments | Mirrors framed with Ornaments | Agarbatti |

| Weighing machine | Vanity case | Mechanical sprayers | Sabudana |

| Bidis | Biscuits | Butter | Pizza bread |

| Wallpaper | Soups | Almonds | Baby milk food |

| Tobacco | Pasta | Photographers | Rusk |

GST OTHER UPDATE

Under GST, apply for registration in 30 days to get an input tax credit for a period prior to registration. Else get ITC from the date of registration.

Under GST; TDS @ 1% will be applicable on notified supplies for contracts exceeding Rs. 10 lacs in value. TDS deposit by 10th of next month.

Under GST no refund up to 1000 in GST. Only declaration for refund less than 5 lacs. Prescribed documents for a refund of 5 lacs & above.

Under GST, refund of ITC allowed at end of Tax Period for exports & where ITC accumulated due to input tax rate higher than the output tax rate.

GST will make consumer goods cheaper, boost jobs: CBEC Spelling out benefits of the Goods and Services Tax (GST), the revenue department on Monday said it will make consumer goods cheaper, increase consumption and generate more employment by enhancing economic activity.

FOR FURTHER QUERIES CONTACT US:

W: www.carajput.com E: singh@carajput.com T: 9-555-555-480