Needed file online Form No 10BD for Donations eligible 80G

Page Contents

Overview on Needed file online Form No. 10BD for Donations eligible u/s 80G

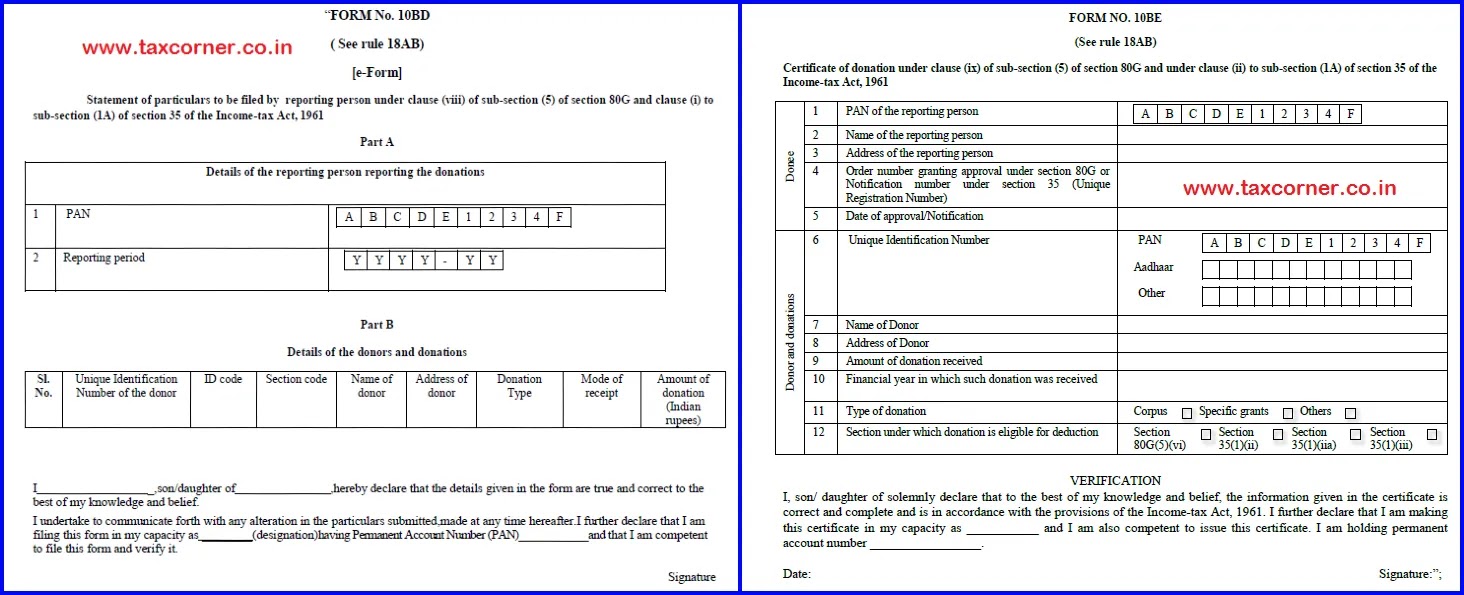

Now according to income tax provision – all the NGO who have 80G certificate is required to submit – Statement of Donation received by NGO or fund in Form 10BD & Certificate of donation in Form No. 10BE – this is Applicable with effect from 01 April 2021.

According to the claim made by the assessee or, at the at minimum, according to the copy of the contribution receipt that the assessee provided, the income tax department approved the deduction under Section 80G of the Income Tax Act.

There was no way to verify the accuracy of the donations paid up until the last financial year. According to this, the trust receiving the donation is obliged to give the Income Tax Department a statement of donation every year to give the donor a certificate of donation. The TDS Reconciliation system (TRACES) of the Income Tax Department and this process have certain similarities.

CBDT via notification no. 19/2021 has been issue Form 10BD & Form 10BE to provide the facilitate more clear & transparency with accuracy on reconciliation of deductions claimed by the Tax payer & donation received by the registered NGO.

Trusts receiving the donations eligible u/s 80G for FY 2021-22 required to be submit in Statement of Donation received by NGO or fund in Form 10BD & Certificate of donation in Form No. 10BE should be electronically submitted & signed by the Managing Trustee/Office Bearer before 31st May 2022

What is Process & Time limit for filing income tax form 10BD?

- Online form 10BD is needed to be filed by donation receiving NGO.

- Form 10BD shall be signed via a DSC of a person authorized to sign the ITR. Otherwise it can be submit via Online EVC code.

- The form 10BD is needed to be submit once in a FY.

- Due date for submission form for FY 2021-22 is 31st May, 2022

- Information for submission of form 10BD Every NGO is needed to gather required information from donors while donations receiving & maintain the list of the details.

Below information to be filled up

- Donor Name

- Donor Address

- Donation Nature

- Receipt Mode

- Donation Amount

- Section code under which donation was received.

- Aadhar number /Permanent account number / Tax Identification number of the donor (in case of Foreign donor)

What is process of Issuance of certificate of donation in Form 10BE ?

- After submission of Form 10BD(statement of donations)

- NGO is needed to download & issue Form 10BE (i.e Certificate of Donation)

- certificate Form 10BE must have details of NGO like NGO Name, PAN, Address, approval number u/s 80G & 35(1) along with details of donations & donor.

- For the FY 2021-22 Form 10BE must be issued by 31st May 2022.

- After introduction of Form 10BD, It is important for donor to not only receiving a donation receipt but also Form 10BE (Certificate of Donation) in order to claim deduction in the income tax returns.

After submission of Form 10BE, Form 10BD has to be downloaded & This Certificate of Donation is to be issued to each Donor before 31st May of every year & containing below details:

- Name of NGO Charitable Organization

- Permanent account number

- Aadhar number

- Approval No under section 80G

There is Late fees & Penalty for not filing Form No. 10BD.

- Late fees shall amount to Rs 200/- per day for delay in uploading Form 10BD.

- Income tax Officer may impose a penalty from Starting INR 10,000/- to Maximum INR 1,00,000/-.