Decoding of Leave Travel Allowance (LTA)

Page Contents

Decoding of Leave Travel Allowance (LTA)

Key takeaways of Rules, Exception with Calculation of Leave Travel Allowance (LTA)

Leave travel Concession

Leave Travel Concession is the part of the overall Cost of Company (CTC) of an employee. An employee may claim exemption U/S 10(5) of the Income Tax Act, 1961, also known as the Leave Travel Allowance (LTA), for expenses incurred for travel while on leave anywhere on behalf of the principal within the national region.

Terms & Conditions of application for Leave Travel Concession

- Let’s go over the requirements and obligations necessary for the exemption to be obtained.

- In order to qualify for the exemption, the applicant must cover the entire trip.

- The trip should be within the borders of the country. International travel is also not required to be claimed or protected by the LTA.

- In order to be eligible for an allowance, the employee or claimant must travel alone and with his or her spouse.

- The concept of the family involves the employee’s spouse, children, dependent parents, employees’ siblings.

- Exception is limited to only two children of the employee who are born on or after 1 October 1998. This means that children born before 1 October 1998 do not fall under the limits of 2 kids.

Leave Travel Concession is primarily split into two categories:

- Any travel Allowance or help that the employee receives for himself and his family from his employer to offset costs sustained while travelling on leave.

- Travel Allowance or concession aid obtained by an employee for himself or his family from his last employer to offset costs resulting from travelling after the retirement or cessation of services.

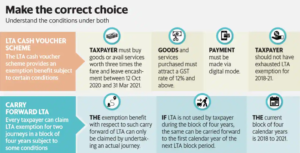

What is the present new Leave Travel Concession Block Years?

- Leave Travel Allowance block years are Four year periods established by the CBDT under the Income-tax regulations, where deductions can be obtained twice for each block cycle.

- The presently Ninth block year is an ongoing block year. i.e 2018, 2019, 2020 and 2021 years.

- An employee can then claim two more journeys between the years 2023 and 2025. Also, the exemption is restricted for the expense incurred on domestic travel only.

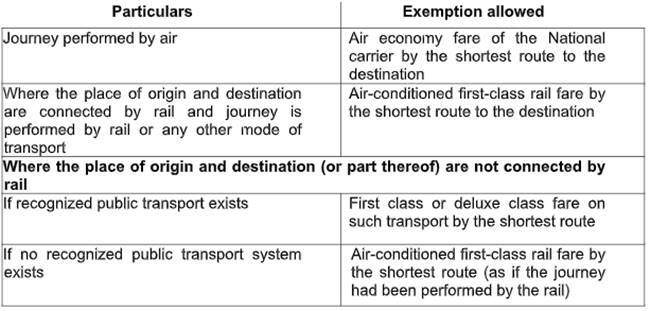

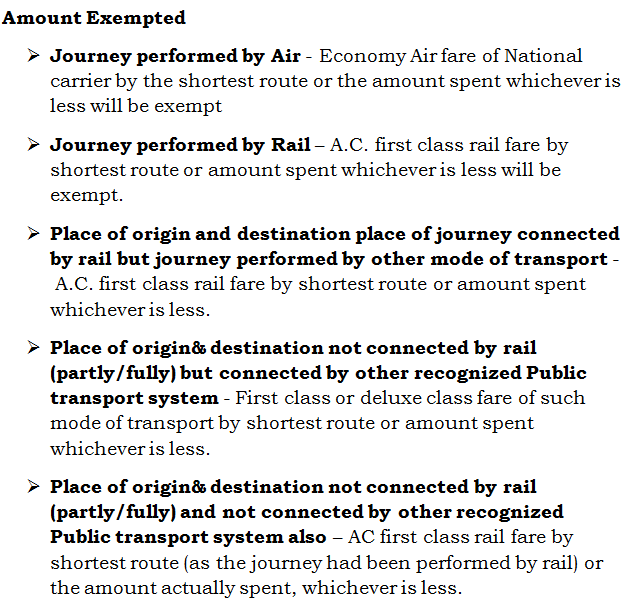

List of expenditure payments that have been exempted under LTA

When travelling by Airplanes mode,

The national carrier’s economy class airfare is with the shortest route or the total actual amount paid on flying/ Spent on travel, whichever is less.

When travelling by train mode, Expenses covered by the LTA

Presently, the LTA exemption allows for the relevant travel expenses incurred by an employee:

- The Aircondisanar (A.C) Ist class train fare is exempted from tax for the shortest path or the total amount paid on travel, whichever is less.

- If the point of origin and destination of the journey are attached/linked by train, but the journey is carried out by other modes of transport, not by air or train.

- The Aircondisanar (A.C) Ist class train fare is exempted from tax for the shortest path or the total amount paid on travel, whichever is less.

- In case the origin point and destination point are not connected (fully/partly) by train or air but connected by other recognised Public transport system/ networks.

- The AC first-class train fare is exempted from tax on the shortest path (if the trip is carried out by train) or the amount paid on fares, whichever is lower.

How to Carry Over LTA concession?

- If the assessor is unable to use the Leave travel Concession offered by his employer within a block period of four years, either once or twice (the permissible limit),

- He can also assert the LTA exemption by using the LTA in the year immediately following the block period of Four Years.

- That is referred to as the carry-over concession of LTA.

Know the procedure of LTC Claim

- The procedure for Leave travel Concession Claim is normally employer-specific.

- Each employer shall determine the due date by which the employee may Leave travel Concession Claim and must require the employee to have proof of travel like travel agency invoices, boarding passes, such as tickets etc., along with the necessary declaration with regard to LTA.

- It is not mandatory for employers to gather documentation of travel,

- it is often advisable for workers to retain backups of their related records as per requirement and to submit on LTA Claim documents to employers on the basis of the company’s Leave travel Concession policy/tax authority as per requirements.

Conclusion

- Exemption from the LTA is accessible from your employer /workplace.

- The employee only has to apply along with proper supporting documents and the Business owner can add tax concession on Form 16.

- This is an authentic good tool to save taxes on holidays in the nation region.

- The Benefit of tax exemption for the expenditure of cash equivalent of the LTC fare is now made accessible to non-Central Government employees too though.

- Non-Central Government Employees can now also benefit from the benefit of the tax exemption on payment of the cash equivalent of the LTC fare, in compliance with the benefit given to the Government Employees empty dated 12 October 2020.

Popular blog :-

key takeaways on taxable non-taxable partly taxable allowances