Get Tax incentives for NGO by Registering U/s 12A, 12AA,12AB

Page Contents

Get Tax incentives for NGO by Registering U/s 12A, 12AA,12AB

Relief for the poor, education, medical relief, environmental preservation, preservation of monuments or locations or things of aesthetic or historic importance, and development of any other aim of wide public value are all examples of charitable objectives.

In India, tax regulations for charitable institutions have traditionally been such that certain types of exclusions are available under Section 80G and Section 12AB of the Income Tax Act.

- In light of the current situation, the CBDT has once again extended the due date for applications under Sections 10(23C), 12AB, 35(1)(ii)/(iia)/(iii) and 80G of the Act in Form No. 10A/ Form No.10AB for registration/ provisional registration/ intimation/ approval/ provisional approval of Trusts/ Institutions/ Research Associations, etc. until August 31, 2021. The decision is believed to have been made in light of the present predicament in the country caused by the COVID 19 Pandemic.

- The additional compliances under the stated Sections of the Income Tax Code, namely Sections 10(23C), 12AB, 35(1)(ii)/(iia)/(iii), and 80G, were due to be completed by August 31, 2020, but were extended until December 31, 2020. The same strategy was then extended to the 1st of April 2021 and the 30th of June 2021, respectively.

New Section 12A and 80G compliance requirements were implemented in Budget 2020.

According to the revised compliance with section 12A and section 12AA of the IT Act, all NGOs that now enjoy exemption u/s 12AA of the IT Act must reapply by December 31, 2020. and will be required to seek a new registration under section 12AB.

Section 12A/12AB introduces a new registration method for charitable or religious trusts.

- Due to the Covid-19 circumstances, the Finance Act of 2020 added a new clause (ac) in section 12A(1) of the Income Tax Act, 1961, which could not be implemented in the Financial Year 2020-21. This rule could go into effect on April 1, 2021. In addition, a new Notification No. 19/2021 dated March 26, 2021 was issued to implement the method for applying section 12A(1)(ac) of the Income Tax Act.

- In this post, we’ll look at the newly included clause (ac) and Notification No. 19/2021 to see what current and new trusts will have to do in the future to get registered under section 12A. Clause (ac) of section 12A(1) of the Income Tax Act says that, notwithstanding anything in clauses (a) to (b), the person in receipt of income who wishes to claim the benefit of sections 11 and 12 must apply for registration of the trust in the appropriate form to PCIT or CIT.

- However, section 12AA has been repealed, and section 12AB has been added to make the trust registration procedure more effective. As a result, any trusts that were previously registered under sections 12A or 12AA must now apply for new registration under section 12AB.

What is the purpose of Section 12AB?

- Previously, an NGO’s registration to have its revenue exempted from tax was done under Section 12AA. After Section 12A Registration, all income is exempt from taxation. If a non-profit organization does not get 12A registration, income tax is due on any excess throughout the year.

- According to the new compliance with Sections 12A and 12AA of the IT Act, all NGOs currently receiving exemption under Section 12AA of the IT Act must reapply by December 31, 2020, and must acquire new registration under Section 12AB.

-

- All existing registered trusts under section 12A or section 12AA will be transferred to the new provision section 12AB.

- Newly formed trusts and institutions will be granted temporary registration for three years if they apply to the Income tax for the first time.

- The provisional registration will be in effect for a period of three years.

- An application for renewal of provisional registration, or rather registration, must be submitted within six months of the expiration of the three-year provisional registration period.

- All registrations under Section 12A or 12AA, once completed, will be needed to renew their registration every 5 years.

- Income tax may re-validate your trust or institution’s registration under sections 12AA and 80G for a period of 5 years after completing your application.

Section 12AB Registration Benefits

- There will be no taxation on income.

- Advantages of receiving funds from the government, overseas, or other organizations.

- The advantages of FCRA registration.

Section 12AB Registration Documents

- Company / Trust / Society registration certificates / registration documents • Copy of the directors / trustees’ PAN card

- Copies of the directors’ and trustees’ Aadhaar cards

- One of the directors/trustees’ digital signature

- Copies of the company’s bylaws, AOA, and MOA

- Audit reports for each of the company’s financial years from its inception

- All financial statements have been audited from the company’s inception.

Section 12AB Registration Documents

- Business/Trust/Society Registration Certificate

- Byelaws of this company, AOA, and MOA copies

- Information about the company’s operations since it was founded

- One of the directors/trustees’ digital signature

- Audit reports for each of the company’s financial years from its inception

- All financial statements have been audited from the company’s inception.

VALIDITY OF NEW REGISTRATION CERTIFICATE (Section 12AB)

- Provisional registration is valid for three years from the assessment year in which it is requested.

- Final registration will be valid for five years. (Where an application is submitted under 12A(a)(ac)(iii), the provisions of sections 11 and 12 apply from the first assessment year for which it was provisionally registered, according to the first proviso to sub-section (2) of section 12A of the Act.)

- What about situations where ITAT has returned a registration matter to CIT (E-file)’s and the matter is still pending with CIT(E) as of 31.03.2021? Will these situations be treated as pending applications, with provisional registration granted?

- What about situations where the ITAT has ordered the CIT (E) to approve registration, yet the case is still pending with the CIT(E) as of 31.03.2021. Is it likely that the trust in question will receive provisional or final registration?

- When is it regarded that trust has “begun its operations”, Upon receipt of money, payment of funds, or commencement of on-the-ground activities?

- In the event of trust with final registration (which was converted from provisional registration), the 5-year expiration term will begin from that year. Is it from the first AY when provisional registration was given or from the date when final registration was obtained?

Registration procedure U/s 12AB

As a result of the aforesaid modification, the following changes will take effect on June 1, 2020:-

All current charity and religious institutions (including non-governmental organizations) that are registered or approved under the provisions below-

- 12A Section

- Under Section 12AA

- Section ten (23C)

- Section 80G of the Code are needed to convert to section 12AB for new registration in order to maintain their exemption under section 10 or 11, as applicable.

Several institutions of trusts that were formerly registered under section 10(23C) or section 12AA must now renew their registration under section 12AB.

As a result, Section 12AA, which governs the registration process for trusts and institutions, will be repealed, and a new section 12AB will take effect on the later of:

- Date of grant of registration under section 12AB or the last date by which the application for registration and approval must be made; or

- The date on which the application for registration and approval must be made.

whatever earlier.

The aforementioned provision will take effect on June 1, 2020, and trusts and institutions must apply for registration and approval under section 12AB within three months after that date, i.e. by August 31, 2020.

Similarly, benevolent trusts and exempt organizations that get an exemption under section 80G will have to apply for a new registration under section 12AB by August 31, 2020.

Further, CBDT tweeted on May 8, 2020, “In light of the unprecedented economic crisis arising from the COVID-19 situation, CBDT has deferred the implementation of new procedure for approval/registration/notification of certain entities u/s 10(23C), 12AA, 35, and 80G of IT Act, 1961 to 1st October 2020.”

As a result of the above, the new compliances referred to in the preceding sections, which were to take effect on June 1, 2020, have been postponed until October 1, 2020, and must be finished by December 31, 2020.

In addition, on May 9, 2020, a press release was issued delaying the implementation of the revised process under section 12AB. On May 9th, 2020, a press statement was issued in this respect.

More updates for relates blogs are: FAQ’s on NGO’s Tax benefits & Tax Incentives

Applicant’s Appropriate Authority: –

The application must be submitted electronically, together with the relevant papers, to the Commissioner or Principle Commissioner, who must issue an order giving permission or denial within three months of the new rules taking effect, i.e. by August 31, 2020.

|

Category |

Time Limits |

|

Institutes already registered under section 12A or 12AA or having certificate under section 80G |

By 31st August (Now by 31st December 2020) |

|

Institutes who have obtained registration under section 12AB |

6 months prior to the expiry of tenure of 5 years (refer the Validity Period of Registration Paragraph) |

|

Institutions that have provisionally obtained registrations under section 12AB |

6 months prior to the expiry date of the provisional registration; or Within 6 months of the commencement of its activities; Whichever is earlier. |

|

Where institutions have modified the objectives |

Within 30 days from the date of such modifications. |

|

In any other case |

At least one month prior to the commencement of the previous year. |

Furthermore, if the Commissioner or Principle Commissioner determines that the charitable/religious trusts institution, etc. has failed to comply with the above-mentioned objects or any other law, the registration of the charitable/religious trusts institution, etc. will be canceled after a reasonable opportunity to be heard.

Registration Validity:

Once obtained, the registration will be valid for 5 years.

Procedure for registering under Section 12AB of the Income Tax Act of 1961: –

- The application may be submitted online at incometaxindiaefiling.gov.in by submitting Form 10A.

- Form may be found under the Income Tax Forms section of the income tax website’s e-file menu, which is accessible after logging in.

Form 10A must include the following information:

(1) The Trust, Society, or Institution’s name.

(2) Society, Trust or Institution’s PAN number.

(3) The Trust, Society, or Institution’s registered address.

(4) Decide on the sort of trust you want:

– Religious/ philanthropic/ religious-cum

-Charitable

(5) e-mail and mobile number of the Managing Trustee/Chairman/Managing Director/Any authorized person.

(6) The Trust’s Legal Status

(7) Trust’s Purposes

(8) If applicable, the date on which the objects were modified.

(9) Is a previously approved application being denied or the registration being revoked? If so, please provide details about the order cancellation.

(10) Is the applicant registered under the Fair Credit Reporting Act of 2010? If yes, please provide more information.

Documents necessary for registration under Section 12AB

The following is a list of papers as listed on the income tax website:

- A self-certified copy of the document forming the trust or establishing the institution, if the trust or institution is established under an instrument.

- Where the trust or institution is constituted without the use of an instrument, a self-certified copy of the document confirming the trust’s or institution’s creation or establishment;

(c) self – certified copy of registration with Registrar of Companies, Registrar of Firms and Societies or Registrar of Public Trusts, as the case may be;

(d) self – certified copy of papers showing adoption or modification of the objects, if any;

(e) where the trust or institution has been in establishment for any year or years prior to the financial year in which the application for registration is made, self-certified copies of the trust or institution’s annual accounts relating to such prior year or years (not more than three years immediately preceding the said application) for which such accounts have been prepared.

(f) a self-certified copy of an existing order granting registration under section 12A or section 12AB, as applicable; and (g) a self-certified copy of an order rejecting an application for registration under section 12A or section 12AB, as applicable.

(g) if applicable, a self-certified copy of an order denying an application for registration under section 12A or section 12AB.

Alternatively, Necessary documents for registration U/s 12AB of the Income Tax Act of 1961

During registration, the customer must provide the following papers, which must be attached to FORM 10A :-

- Certificate of Registration and Memorandum of Agreement / Trust Deed (two copies- self attested by the Managing Trustee)

- Letter of authorization from the landlord where the registered office is located (if place is rented)

- A copy of the Trustee’s PAN card.

- Electricity, property tax, and water bills

- Proof of welfare activities undertaken and a progress report on the same for the past three years or since start.

- Books of Accounts, Balance Sheet, and ITR (if applicable) for the last three years or from commencement.

- Donors’ list, including PAN and address.

- In the following manner, list the members of the governing body or members of the trust/institution.

|

Sr. No. |

Name |

Address |

Adhaar No. |

PAN |

Mobile No. |

Email id |

- Trust Deed for Original Registration Certificate and MOA Verification.

- Any additional information or documents that the Income Tax Department may request.

Latest Process & Compliances for Registration U/s 80G of the Income Tax Act of 1961

- These NGOs and their contributors have received many tax exemptions and advantages from the Internal Revenue Service. These NGOs must register with the Income Tax Department by filing an application under Section-11, 12A, 12AB, 80G, and other tax-related provisions.

- Previously, registering in these sessions was a time-consuming procedure. The Income Tax Department has now attempted to make this procedure easier, and the time required for CIT clearance has also been shortened, resulting in a considerably quicker approval process than previously.

- Sections 11, 12, 12A, 12AA, 12AB, and 13 of the Internal Revenue Code exclude income from charitable trusts. The basic requirement for receiving income tax exemption under this provision is that the NGO be legally constituted and that its goal fall under the meaning of the phrase “Charitable Purpose,” which is defined in Section 2(15) of the Income Tax Act.

- In a notification dated March 26, 2021, the CBDT published Income Tax (6th Amendment) Rules 2021, in which they enumerated the needed papers for obtaining registration under Section 80G of the Income Tax Act, 1961.

- We will look at registration under Section 12AB of the Income Tax Act and a thorough discussion of registration under Section 80G of the Income Tax Act, 1961 in this post.

- In a notification dated March 26, 2021, the CBDT published Income Tax (6th Amendment) Rules 2021, in which they enumerated the needed papers for obtaining registration under Section 80G of the Income Tax Act, 1961.

- All charity institutions that are presently registered under section 12A/12AA must apply for a new registration under section 12AB beginning April 1, 2021. In addition, any new companies seeking exemption under sections 11 and 12 must apply for registration under section 12AB.

- All charity institutions that are presently registered under section 12A/12AA must apply for a new registration under section 12AB beginning April 1, 2021. In addition, any new companies seeking exemption under sections 11 and 12 must apply for registration under section 12AB.

- All current NGOs (registered under section 12A/12AA) must apply for a new registration under section 12AB within three months.

- All other NGOs (not registered under Section 12A/12AA) must apply for registration under Section 12AB at least one month before the start of the preceding year relevant to the assessment year for which registration is sought.

- Note: Provisional registration will be granted for a period of three years from the assessment year from which registration is sought in the event of new registrants.

-

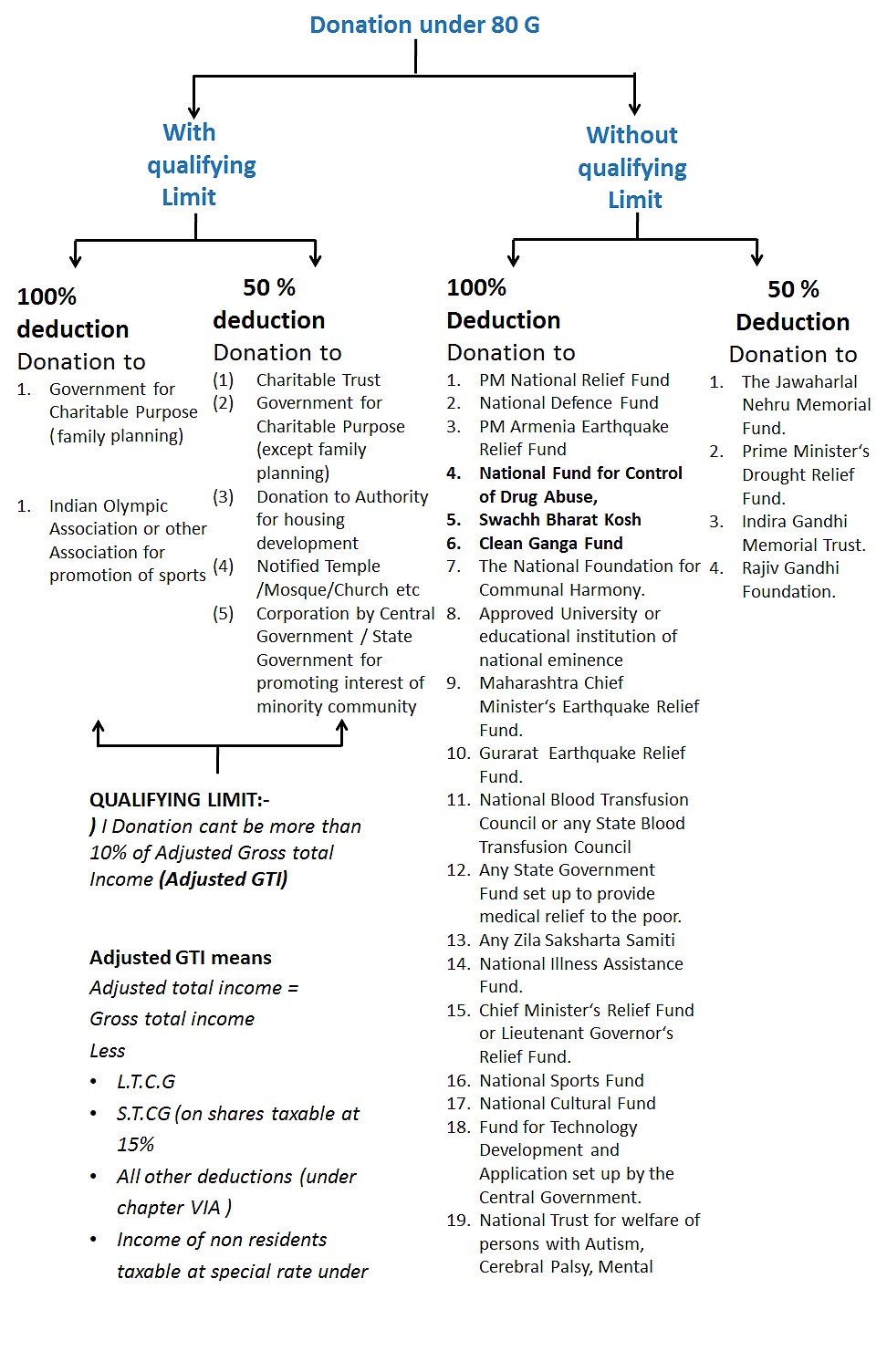

Quantum of 80G deduction

Also read : FAQs ON SECTION 12AB & 80G REGISTRATION

All current NGOs (registered under section 12A/12AA) must apply for a new registration under section 12AB within 3 Months.

All other NGOs (not registered under Section 12A/12AA) must apply for registration under Section 12AB at least one month before the start of the preceding year relevant to the assessment year for which registration is sought.

Note: Provisional registration will be granted for a period of three years from the assessment year from which registration is sought in the event of new registrants.

- The Finance Act 2020 introduced an amendment to Section 80G (5) of the Income Tax Act of 1961, requiring all organizations that are already approved under this section to apply for a new approval under the modified scheme of Section -80G. And any new companies that seek to register under this provision for the first time must apply for approval under the new procedure.

- Rule 11AA specifies the conditions for approval of a fund institution under clause (vi) of section 80G’s sub-part (5).

- The institution or fund (hereinafter referred to as “the applicant”) must submit an application for approval under clause (vi) of sub-section (5) of section 80G in the following form:

- Form No. 10A in the case of an application to the Principal Commissioner or a Commissioner approved by the Board under paragraph I or clause (iv) of the first proviso to subsection (5) of section 80G; or Form No. 10AB in the case of an application to the Principal Commissioner or a Commissioner allowed by the said proviso under paragraph (ii) or clause (ii) of the first proviso to subsection (5) of section 80G.

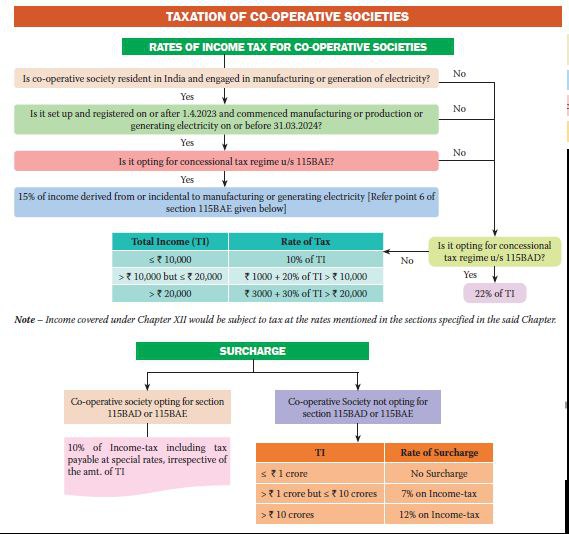

TAXATION OF COOPERATIVE SOCIETIES

For any information/queries, you can contact us. Our team (RJA) of experts can provide all the assistance in incentives for your NGO. For any information/queries, you can contact us. Our team of experts can provide all the assistance in related to FCRA. For Contact:

Website- Click here

Email id- info@carajput.com