Common mistakes in filing GSTR return which needed to avoid

Page Contents

What is Common errors in filing of GSTR returns which needed to avoid.

- Prior to the GST regime, there was the VAT system, which enabled for returns to be amended if an error was detected. Despite the fact that the GST Act has been in effect for three years, those who are registered under it continue to make numerous errors while filing their GST reports. To avoid departmental lawsuit, it’s critical to file GST returns as accurately as possible.

- Since there is no provision under GST law for amending a return, we must ensure that GST returns are correct at the time of filing.

- The assessee must be exceedingly cautious in completing GST returns to avoid any extra problems in the future.

- Taxpayers are required to file GST returns. Because it’s such a complicated operation, it’s crucial to be vigilant about every entry made on the GSTN portal. There is no way to undo a mistake. Make sure you’re aware of the most prevalent blunders and avoid making them.

- We’ll go over a Some of the most typical common mistakes while filing their GST returns below. Avoid these Common GST Return Filing Mistakes

Common mistakes that a GST registered person must avoid while filing of GST returns

The Below list would be primarily indicative kinds of mistakes, errors /negligence that can be happen by the GST taxpayer in India.

Payment & Disclosure GST tax under the wrong GST head.

- When filing GST reports, there are several tax heads to record, such as IGST, CSGT, and SGST. Many taxpayers make the error of filing their GST liability or input tax credit under the wrong GST heading.

- Even GST tax is sometimes paid under the incorrect heading at the time of payment, or interest is paid under the erroneous tax heading, and so on. When paying taxes, one must be cautious because the GSTN currently prohibits the interchangeability of taxes.

- Due to unforeseeable cash flows, this could lead in an unfavourable working capital position.

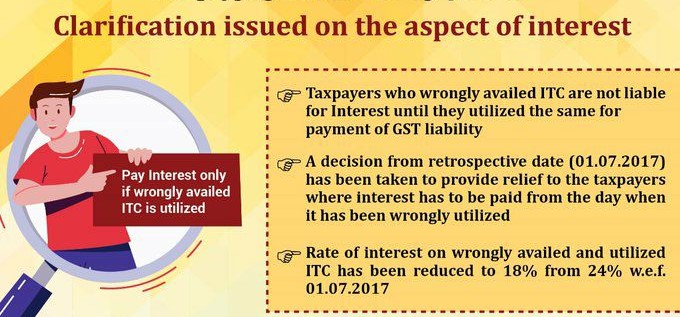

Wrongfully claiming an input tax credit

- GSTR-2A is an auto-generated return in which the supplier declares a taxpayer’s registered purchases and accompanying input tax credit. When submitting returns, a taxpayer, on the other hand, must disclose their input tax credit individually. They should also submit and claim the correct amount of input tax credit. If a higher value is declared, there is no opportunity to alter the return, thus the difference must be paid in the following month’s return, along with interest.

Delay in Submitting of GST return

- It’s important to keep in mind to file GST returns on time. Failing to file GST returns on time may result in the cancellation of your GST registration. It also lead to monetary penalties.

Not Submitting your NIL return

- Some taxpayers believe that if they have no transactions to report for a tax period, they do not need to file a GST return. Penalties may be imposed as a result of non-filing or late filing of taxes.

- Even if a taxpayer has no transactions to report for a given time, they should file a NIL return. This would also allow for further submission of taxes, as the GSTN prohibits submitting returns if any preceding period’s returns have not been filed.

Place and type of supply

- B2Cs, nil-rated, exempted, and non-GST supplies must all be aggregated by taxpayers. Also, the location of supply must be chosen correctly. Because the location of supply determines whether the supply is inter-state or intra-state.

Not charging Correct GST Rate.

- Unless it’s an export or a GST-free sale, every sale (“taxable supply”) is subject to GST once you’ve registered. A person may face challenges and penalties if they charge a higher rate. Charging a lower GST rate may result in a cash flow from the pocket during the assessment process. It is necessary to check the rate of goods or services on the CBIC website from time to time.

Declaring Export sales in the column of regular sales

- If a person declares an export sale in the regular sales column instead of zero-rated supply, the GST refund may be rejected. So a GST Taxpayer should ensure while filling export sales details.

Errors while uploading data invoice-wise in GSTR-1

- GSTR-1 demands that all outbound supplies have invoice-level data supplied, including invoice date, invoice number, place of supply, tax rate, and so on. Due to the large amount of data to be provided, taxpayers occasionally make mistakes when inputting it, resulting in a mismatch between GSTR-1 and GSTR-3B. A taxpayer must exercise caution because there is no way to modify a return once it has been filed.

Not making payment of Reverse Charge mechanism (RCM)

- The government has established a list of items and services for which recipients must pay RCM. If reverse charge tax is not paid, it may result in additional interest payments and the loss of input tax credit. It should also be noted that ITC cannot be used to pay for reverse charge tax.

- We can say that, GST under the Reverse Charge mechanism has to be paid via challan only. After payment of RCM Challan, GST registered person can claim ITC of the same which can be claim with output tax.

Ignoring reconciliation of GSTR 3B & GSTR 1

- A GSTR Registered person is making a big mistake if he does not match his GSTR 3B and GSTR 1 returns on a regular basis. Before filing GST returns, each person should double-check that their GSTR 3B and GSTR 1 reports are matched on a monthly basis. For example, if a person declares sales of Rs. 2 crore in his GST return for the month of May 2020 and sales of Rs. 2.50 crore in his GSTR 1 for the same month, he may face unnecessary litigation with the GST department.

Avoiding GSTR 2A before claiming ITC on GSTR 3B return

- According to the GST Rule 36(4) under the GST law, Irrespective of how many invoices he has, he can only claim an ITC credit of 110 % of qualifying ITC shown on form GSTR 2A OR iitc as per books, whichever is lower.

Feeding wrong Invoice details at the time of Filling the GSTR 1 return

- When the recipient of goods and/or services provides his GST number to the supplier of goods and/or services, the supplier is required to submit invoice-by-invoice details of the recipient.

- The recipient can claim input tax credit from the GST tax paid to the supplier so because invoice details provided by the supplier in GSTR 1 are auto-populated in form GSTR 2A.

- If the supplier feeds the wrong invoice and/or fails to report the invoice, the recipient may be denied the input tax credit for the invoice that was erroneously reported in the GSTR 1 return.

- While Feeding Including B2B sales in sales of B2C.

- Feeding incorrect invoice No.

- Incorrectly Feeding & showing IGST tax as CGST and SGST & vice versa.

- Feeding an wrong date.

- Above mentioned GSTR mistakes in GSTR 1 returns can be corrected right of the recipient to book ITC

Categorising Zero Rated & Nil rated supply the same or vice versa

- Many people are confusing zero-rated and nil-rated supplies. However, there is a significant difference between zero and nil rated supplies. Nil rated supplies are those that are taxable but have a GST rate of zero (0) percent in the GST tariff because they are exported out of India or to be located in a Special Economic Zone.

- Zero rated supplies are those that are taxable but have a GST rate of zero (0) percent in the GST tariff because they are exported out of India or to be located in a Special Economic Zone.

- If a person is supplying zero-rated supplies but declares them in a column of nil-rated supplies on his GST return, he may have difficulties when claiming a refund for zero-rated supplies.

GST Taxpayers not claiming TCS & TDS

- It has been noted on several occasions that taxpayers are unaware of how to claim Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) and make mistakes when completing GST returns under the requirements of GST.

- TDS is deducted at a rate of 1% by the Central Government, State Governments, Government Agencies, Local Authorities, and Notified Persons under the GST scheme when the total value of supply under a contract exceeds 2.5 lakh Rupees as per the invoice exclusive of GST. This TDS must be put in the government’s credit account, which the receiver can then claim.

- This TDS is reflected in the assessee’s Electronic Cash Ledger, which can subsequently be utilised to pay down the assessee’s GST liability, including the debt under the RCM.

- According to GST, Every e-commerce operator is required to collect 1% of the net value of taxable supplies made through its platform by suppliers where the e-commerce operator collects the consideration paid for such supplies.

- TCS must be deposited in a government credit account from which the beneficiary can claim reimbursement.

- This TCS is reflected in the assessee’s Electronic Cash Ledger, which can subsequently be utilised to pay down the assessee’s GST liability, including the debt under the Reverse Charge Mechanism.

One of the most common errors in submitting GST returns is taxpayers’ incorrect perception that TDS/TCS falls under Income Tax and that they must account for it. The TDS/TCS that the taxpayer does not claim is a direct loss to them.

Reversal of ITC & Blocked Credits

- In certain cases, such as payments not made to suppliers within 180 days, inputs utilised partly for personal reasons, capital goods sold, free samples supplied to consumers or business partners, items destroyed, etc., the Input Tax Credit should be revoked.

- In addition, some goods and services are not eligible for credit. The consequences of claiming the same must be considered by taxpayers. Failure to do so could result in the GST department issuing notices, which could lead to the imposition of interest and penalties.

Few other small things like GSTIN, Invoice No, HSN,

- GSTIN, Invoice No, HSN/SAC should be included on all invoices. The amount of digits used by firms in their HSN/ SAC vary depending on their turnover. Along with HSN/SAC, the taxpayer should check whether the GSTIN entered by the counterparty is accurate.

- A tax invoice issued by a registered individual should have a sequential serial number of not more than sixteen characters, in one or more sequences, containing alphabets, numerals, or special characters-hyphen, dash, and slash symbolised as “-“and” / “respectively, and any combination thereof, specific for a financial year.

Restrictions on ITC available Non-compliance with GST Rule 86B under the GST

- Noncompliance with Rule 86B, which prohibits the use of an electronic cash ledger, is one of several mistakes made while filing GST returns. Rule 86B which is come into effective on January 1, 2021. This rule states that the taxpayer may not use the amount in the electronic cash ledger to discharge an output tax liability that is excess than 99% of the total GST tax liability. When the total value of taxable supplies, excluding exempt and zero-rated Supply exceeds 50 lakh rupees.

- Many taxpayers have recently received notices from the GST authority for non-compliance with Rule 86B. As a consequence, it is essential for taxpayers whose monthly taxable value exceeds Rupees 50 lakhs to check whether Rule 86B has been implemented.

Incomplete Aadhaar verifications by the GST registered person

- Incomplete Aadhaar verification of the taxpayer is one of the mistakes made when filing GST returns. Rule 10B, which goes into effect on January 1, 2022, requires taxpayers to have their Aadhaar verification done for the specified objectives:

- To file an application for revocation of cancellation of GST registration

- For filling the GST refund application under the form RFD-01

- To claim a refund under rule 96 of the IGST paid on goods exported outside India,

- If a taxpayer fails to have his Aadhaar authentication completed, he may face a variety of issues, including having his GST registration revoked and having to apply for revocation of such cancellation.

Paying GST in the incorrect category

- Many businesses have suffered losses as a result of paying under the incorrect categories. Make sure you’re paying your GST in the correct category when filing your GST returns. Do not file your return under any other category if it is intended to be filed under the State Goods and Services Tax (SGST).

- Before you file your taxes, make sure you have all of the information you need about the different forms of GST returns. Note that all interstate transactions will be subject to the IGST tax, while all intrastate transactions will be subject to the CGST+SGST tax.

- Advice- In the sense that you won’t be able to move the amount to other categories, the error here cannot be corrected instantly. Instead, the remaining IGST amount can be carried forward and refunded for future payments.

Conclusion

- A registered person can face a significant penalty and interest if he or she files a GST return wrongly. After the GST regime in existence, GST taxpayer has no longer has the option of revising his or her GST returns, it’s more Important to avoid making mistakes when filing GST returns.

- Incomplete Aadhaar Authentication by the taxpayer, non-compliance with Rule 86B on restrictions on the usage of electronic cash, and not claiming TDS and TCS are all examples of GST mistakes, as not claiming TDS and TCS is a direct loss to the taxpayer.

- Before filing GST returns, make sure you understand the various forms of GST returns. To avoid financial losses, keep a close check on every detail and data entered into the filing of the taxes. Make sure you consult a Chartered Accountant India before filing your Goods and Services Tax return.

Read our articles: