Cancellation of GST Registration

Page Contents

Cancellation of GST Registration

- In today’s business world every businessman wants GST registration whether by way of voluntary or compulsory. There are many reasons for it because he wants to claim an input tax credit on his inputs, he wants to do business on large scale, and many more reasons.

- For increasing his business at large scale businessman a businessman gets registration. Getting registration is also compulsory in case his threshold limit of turnover increases by 20 lakh or 10 lakh(special category of states).

- But due to some reason the businessman needs to cancel his registration whether by himself or by the order of the proper officer. We can take cancellation of GST registration as the penalty for not following the provisions or rules of the GST act.

- The cancellation means that the taxpayer no longer has to pay or collect the taxes; it is no longer the taxpayer’s registered GST individual.

- In the event of a closure of their business or any other situation, taxpayers who have previously registered under GST Act may request cancelation of GST registration.

- Upon cancelation of the registration, the taxpayer shall no longer have to pay tax or collect tax from common people.

Read Also : More read: Reasons for the Movement of Goods under the GST

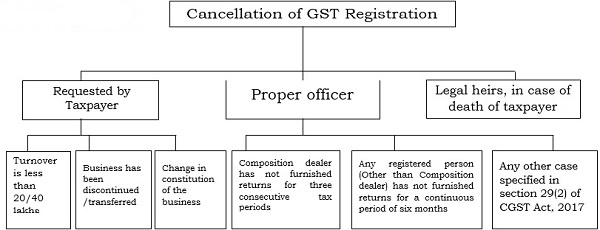

SITUATION WHERE A BUSINESSMAN NEED TO CANCEL HIS REGISTRATION

If a business is discontinued by the businessman it can be due to any reason due to losses in business, order of a court or it can be voluntary, etc. in that situation businessman need to cancel his registration.

- Cancellation can due to a change in the constitution of the business.

- a taxable person who is registered under GST but now he is no longer need to get registration under compulsory registration person[sec. 24] or his turnover falls below the limit of 20 lakh or 10 lakh(special category of states)[sec. 22].

- if the business is amalgamated with the other legal entity.

- If a businessman transfers fully business due to any reason it can be due to the death of the proprietor.

Read Also : Refund mechanism under GST service export

Procedure of GST Cancellation

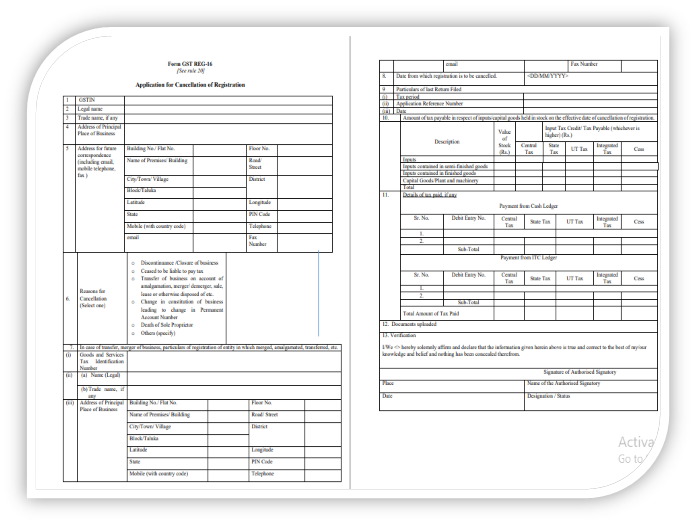

- Application for cancellation of registration is given in FORM GST REG – 16 within 30 days of the occurrence of cancellation of registration event.

FORM GST REG – 16

- All the details of input held in stock and capital goods held in stock on the date of the cancellation are given in FORM GST REG – 16.

- The proper officer either on his own or based on the application cancel the registration.

Effect of Tax Paid on Inputs at the time of Cancellation of Registration

- When the application of cancellation of registration is filled then at that time in FORM GST REG – 16 value of stock and tax liability of the stock is filled then that liability is offset from E-Cash Ledger / E- Credit ledger equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished goods or finished goods held in stock on the last date of cancellation of registration.

- In capital goods, the person will pay an amount equal to the input tax credit that has been taken on the said capital goods and reduced by such percentage as prescribed or tax on the transaction value of capital goods, whichever is higher.

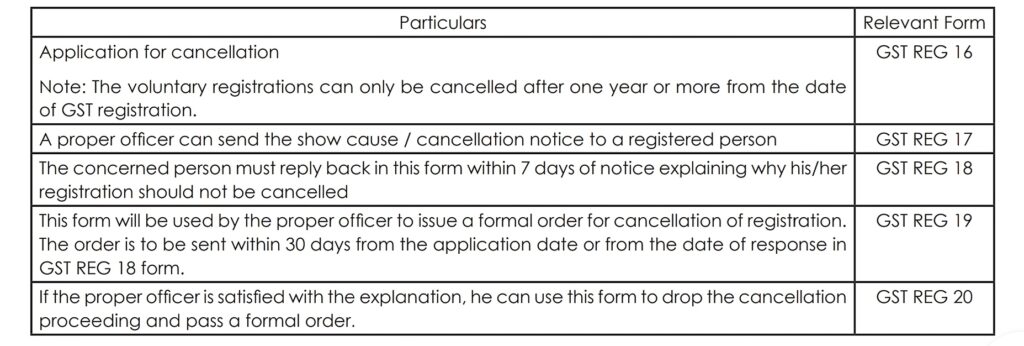

Important Forms under GST Registration Cancellation

- GST REG-16 is for giving the application for cancellation of registration

- GST REG-17 is for giving the show cause notice for cancellation of registration

- GST REG-18 is for giving the show cause Notice issued for cancellation for registration

- GST REG-19 giving the order to cancellation of registration

- GST REG-20 is for giving the order to leave the proceedings for cancellation of registration

- GST REG-21 is for giving the revocation of cancellation of Registration

- GST REG-22 is for giving the order for revocation of cancellation of registration

- GST REG-23 is for giving the show cause notice to rejection of application for revocation of cancellation of registration.

- GST REG-24 is for giving the rejection of the application for revocation of cancellation of registration.

Situation where a proper officer cancel the GST registration

In case the registered person has not followed the rules/provision of the GST act then he is liable for cancellation of registration by the proper officer.

- In case a businessman issue invoices/bill without actual supply of goods or services.

- If the registered person did not fill return of 6 months.

- The businessman did not commence his business within 6 months of registration.

- Registration has been obtained by fraud by the person.

- Businessman did not conduct his business from a registered place of business.

Procedure of cancellation of GST registration by the proper officer

- The proper officer will cancel the registration but before that he will send a show-cause notice to the person in FORM GST REG – 17.

- Within 7 days of receipt of the notice, the person must give his response in FORM GST REG – 18 that why his registration is not canceled.

- If the proper officer is satisfied with the response then he will not cancel the registration of the person.

- After not canceling the registration of the person the proper officer will pass the order in FORM GST REG – 20.

- But if the response of the person is not satisfactory he will the liable for cancellation and a proper officer will pass the order in FORM GST REG – 19.

Revocation of cancellation of GST Registration

The request cannot be filed even so if the registration is canceled because the return has not been submitted. These returns must be furnished first and all tax, interest, and penalty duties must be paid.

GST Registration Cancellation Consequences

- For businesses, whose GST Registration is compulsory, If GST registration is canceled & still business is continued, it will mean an offense under GST & they heavy penalty will apply.

- Taxpayer No need for furnishing any GST return.

- A taxpayer cannot collect & will not require to pay GST anymore.

4 Must-Know Facts concerning the New 90-Day Revocation Limit for GST Numbers After Officer Cancellation

We’ve received a significant update from the GST department on the revocation of the GST number cancellation.

The deadline for the department to revoke the deletion of the GST number has been extended to 90 days, up from the previous restriction of 30 days. But, there are a few things you should be aware of in this regard:

- You must send an application to the Joint Commissioner/Additional Commissioner within 30 days of the cancellation of the GST number, and between 31 and 60 days of the cancellation of the GST number. You must submit an application to the Commissioner between 61 and 90 days. In the latter situation, the application must first be submitted to the Jurisdictional Officer.

- The application was also sent via email.

- To improve your prospects of having your cancellation revoked, you must file an application with compelling reasons and supporting proof that will satisfy the officer’s concerns.

Before a decision is made, you will have to attend a hearing. You have the right to appeal if your application is denied at the hearing. Virtual Hearings are now available upon request.

- It is not stated that this technique is not applicable to prior cases. This means that any case filed within 90 days of today will be considered under the new rules.

Have a similar case or question?

Confused about issues related to GST?

Contact Us to get your GST issues resolved by experts, along with getting robust GST solutions for almost all your GST related issues. We help you automate most of the taxation related responsibilities in your Business!!!

GST issues at the time of inspection:

GST officers found various issues at the inspection:

- The GST Registration Certificate number was not displayed at a prominent place inside the office premises.

- There was a discrepancy between the stock register entry and the actual quantity of stock.

- The Aadhar number was not updated on the GST portal.

GST officers may asked for an details explanation for all above points,

1. GST stock registration was out of date, resulting in a present discrepancy.

2. Company has followed a procedure in which they update stock in the stock register as soon as the invoice is received, even if the goods are in the godown of the transporter.

3. They also had the model of selling things to clients before they arrived at their workplace. Even before the products arrive at the customer’s workplace, the commodities are transferred to them.

The vendor creates an invoice in this procedure, but the corporation does not update the stock because neither the invoice nor the items have been received. The corporation, on the other hand, adjusts the stock, decreasing the quantity to the amount specified in the invoice they created.

Hearing this, the officers suspected tax evasion and began preparing a Summary Assessment under section 64 of the CGST Act, as well as a demand.

FAQ ON CANCELLATION OF REGISTRATION UNDER GST

Q1- is the taxpayer get a chance for giving his representation before the cancellation of registration?

Ans.- yes, a registered person can give within 7 days of receiving show cause notice give his response in FORM GST REG – 18.

Q2- all the liability of a registered person comes to an end after the cancellation of registration?

Ans.no, all the liability up to the date of cancellation is still payable by the registered person.

Q3- what is the time limit for filing an application for cancellation of registration in case of voluntary cancellation?

Ans.- within 30 days application is to be filled from the date on which the person liable to cancel the registration.

RJA provides clients with adequate support and guidance from our side in dealing with various GST issues (GST registration, filing of GST declarations, requesting refunds, and GST audits). Contact us if you have a question or want to know more about GST cancelation.