All about TAN (Tax Deduction & Collection Account No)

Page Contents

Complete Coverage about TAN (Tax Deduction & Collection Account Number)

WHAT IS TAN?

- TAN is a Tax Deduction and Collection Account Number. It is a ten-digit alphanumeric number code and mandatory for firms or individuals or Companies deducting Tax Deductions at sources.

- Tax Deduction and Collection Account Number(TAN) which is required to be quoted on all Tax Deduction at sources (TDS)/Tax Collected at sources (TCS)/Annual Information Returns (AIR), TDS Certificates and Payment TDS Challans,

- You may take reference of our post on tracking or check the status of your PAN card. Now don’t think about checking the status of the TAN.

Why is Tan Necessary?

- According to section 203A of the Income Tax Act, any person responsible for deducting and collecting the tax number is required to obtain a TAN for the filling of returns by TIN facilitation centers.

- It is Compulsory for all assesses/companies/ firms liable to deduct TDS are required to keep a TAN Number required to be quoted in all communications relevant to the TDS status.

- TAN status can be view by using the acknowledgment number or date of birth. In the case of a business, the date of incorporation shall be used instead of the date of birth.

- In case person does not apply for the same amount, he/she is responsible to pay a fine of INR 1.00 000.

- If it is not comfortable for you to check the status of your TAN application online, you can always check it out. We have also shown online here how to register for a tax deduction/collection account number online.

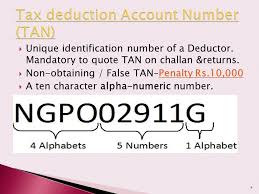

Structure of TAN Card

TAN structure has been updated in the last few years and the 10-digit alphanumeric code is actually organized as follows.

• Very first four characters are letters of which the first three characters point to the code of authority and the last letter points to the first character in the title of the deductor.

• The next 5 letters are numerals that symbolize the five-digit number. The last character is a character in the English alphabet.

• The last letter is a letter in the English alphabet.

More reads : Basic of Adhaar Card, significance, process, Aadhaar linking with PAN

Kind of TAN applications

TAN applications are of 2 kinds: the request for a mission and the application for a modification or correction.

| Application for the allocation of new TAN: | Application for change or correction of TAN data for assigned TAN: |

| Applications may be made online on the NSDL-TIN website or uploaded to be sent offline.

It requests information such as nationality, PAN, current TAN, name, address, contact number, etc. Applicants must pay a TAN processing fee of Rs 65 (Rs 55 as application fee + 18% GST).

|

|

How to Enroll for TAN

Application Form 49B for Application of TAN

- Needs to fill out form 49B for every deductor or collector who’s never applied for TAN or doesn’t even have a TAN and wants to apply for the same very first time.

- We must complete ‘Form for Changes or Correction in TAN data for TAN Allocated Form’ for a deductor or collector who wants to make changes or correct the TAN data for the TAN number already allotted to him. At tin-nsdl.com, you can download all these forms.

- Any individual or business may apply for a TAN number via online or offline mode. With the application of TAN, a nominal payment of about Rs. 63 is to be made.

- Make the payment by credit/debit card or net banking online. You can use DD or cheque while you play in offline mode. Using form no. 49B to apply for TAN status online.

- Download the form from the portal on tin-nsdl.

Read Also: How to check the status of TAN and PAN Application

Download the Form-49B for Application of TAN

- You will get an acknowledgment page after you complete all the information in Form49B and upload the form online. The 14 digit acknowledgment number will be included.

- To track the TAN status online, retain this number. We also recommend that you print out this certificate for your records.

Also Read: How to check the status of TAN and Pan Application

The basic point to be considered for filling Form- 49B

- Fill out the form in the English Language: Information of Form 49B must be done in English only and in capital letters only.

- Provision for Fingerprint Impression: You must be approved by a magistrate or notary public or a gazetted officer under official seal and stamp if you are using your left-hand fingerprint to submit the application form.

- The information of the assessing officer (TDS / TCS) needs to be given by the deductor or collector. The income tax office will collect this information.

- In addition, the deductor collector must also fill in the appropriate fields of the application form with the area code, AO type, Range code, and AO number.

- Mention the prefix of a person: where applicable, the deductor or collector must mention the “prefix of the person responsible for paying/collecting tax” in the required field.

- Fill up the Name as predicated on Category: There are various categories of persons who can fill in the application form. based on the category of persons you belong to, you need to fill in the name information in one of the fields from 1(a) to 1(h) only. If you fill in more than one category of information, then your application form will be rejected.

Read our articles : Basic of Adhaar Card, significance, process, Aadhaar linking with PAN

- Address Should be Indian: It is relevant to consider that the address of the location where tax is being deducted should be mentioned by the deductor or collector. In addition, he must mention any of the 2 information from the following as state below;

- Number for Flat / door / block

- Premises / building / village name

- Street / road / lane / post office

- Area / locality / taluka / sub-Division

- But, the following information must be compulsorily filled in by the deductor or collector

- State/Union Territory

- Town/District/City

- Pin code: A foreign address should not be listed by the deductor or collector only Indian address.

- Telephone Number and Email ID: If you state your telephone number, you may need to mention your STD code. And you should use the country code in the STD code area in the case of a mobile phone number.

- If you have stated the WLL mobile phone, it is important to mention the STD code. In addition, it is best to state your telephone number in the application form so that you can be contacted by the appropriate authority in the event of a mistake in the application form.

- To collect information about the status of your application form by email, mention you’re correct email IDs.

- Nationality of Deductor or Collector: This submission should be obligatory for all types of deductor or collector.

Read Also : How to check the status of TAN and PAN Application

- Permanent Account Number: In the requisite file, you need to mention your existing 10-digit PAN number assigned to you. However, you can leave this blank space if you do not have a PAN number.

Also Read: Basic of Permanent Account Number

- Existing Tax Deduction / Collection Account Numbers (TAN): As a deductor or collector, you must mention the same in the required fields if you have an existing TAN in the old format.

- Multiple TAN should not be allotted: If the 10 digits alpha-numeric TAN has already been allocated to you, you should not apply again because it is illegal to have more than one TANs. However, if you have different branches or divisions as a deductor or collector, then you can apply for separate TANs for each of the branches or divisions.

TAN VS PAN

| Point Of Difference | TAN | PAN |

| Application Form | 49B | 49A- Indian 49AA- Foreigners |

| Role | This TAN card is Provides information about tax deducted at source for any entity. | This pan card is Helps us to identify taxpayers in the country. |

| Proof of Identity | WE cannot use the Tax Deduction Account Number for identity proof. | A Permanent Account Number card can be used as an identity proof document |

| Full-Form | Tax Deduction Account Number is known as TAN | Permanent Account Number is known as PAN in short |

| Purpose | It is used for filing Income Tax Returns under the Income-tax act of the following:

· Challans for payment of TDS/TCS · TCS statements i.e. return · Statement of financial transactions or reportable accounts · TDS/TCS certificates · TDS statements i.e. returns |

It is used for quoting Income taxes identification No of an assesse. |