CBDT Started mobile App called -AIS for Taxpayer

Page Contents

CBDT Started mobile Application called “AIS for Taxpayer” for Assesses to provide TDS and AIS :

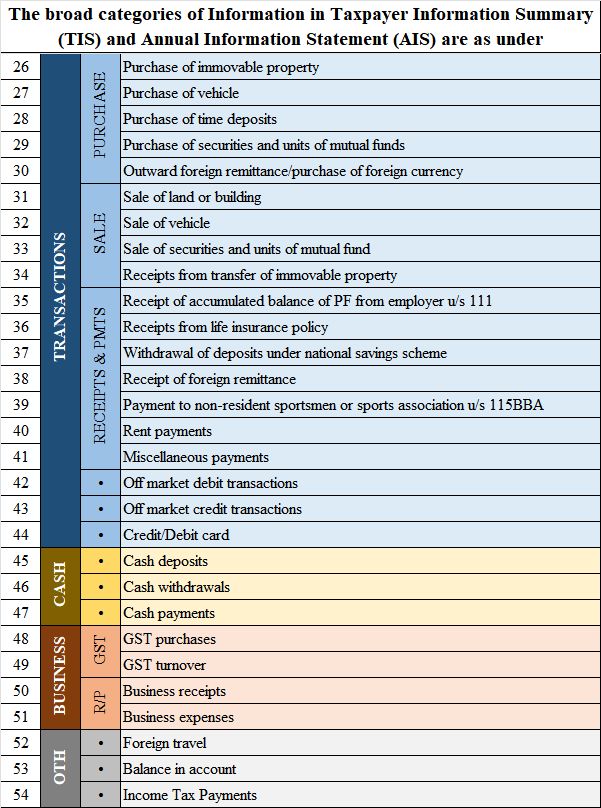

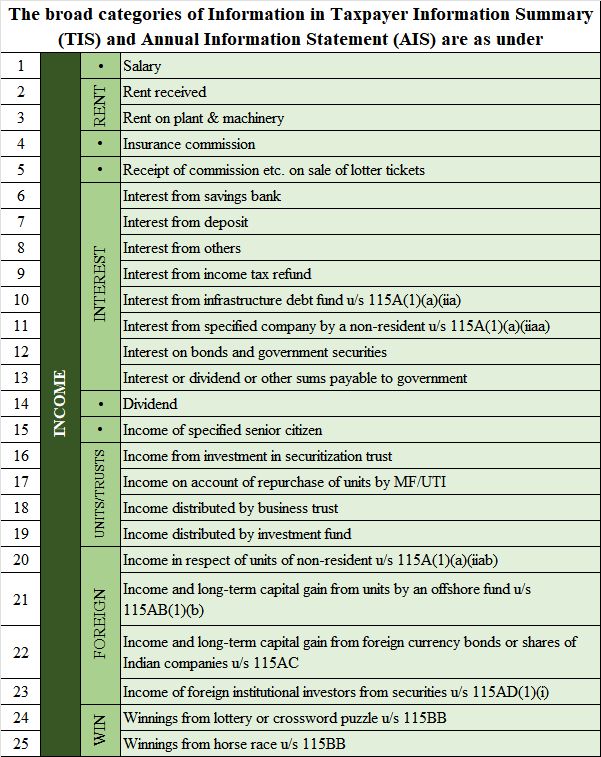

As we know, income tax tries to give Income tax statement in Form No. 26AS. Annual Information Statement is a much detailed one with more details included- ex: All mutual fund transactions & Saving account Interest during the year etc. Now, Annual Information Statement will be captured all the PY Financial transactions of the in the respect of below transactions:

- Interest on SB A/c and Deposits.

- Dividends

- Insurance

- Mutual Funds

- Shares

- Salary or Business income

- Purchase of property

- Stocks

- Credit Cards

Selected financial Transactions:

Apart from the above list is just an indicative transactions list. It is taxpayer overall financial profile & will getting fine-tuned to include more class of transactions.

- New form 26AS will also provide details on “Specified financial transactions” that include transactions for the purchase/sale of goods, properties, services, works contracts, investments, expenditures, receipt or approval of any loan or deposit of the value that may be approved but not less than Rs 50,000.

- FM also suggested steps to ensure full compatibility by extending the scope of monitoring and reporting on subsequent transactions in New Form 26AS

Income Tax Form 26AS

- Details on this Form 26AS at year-end will not be a one-time affair. This will be a live 26AS, as this will be updated regularly within 3 months from the end of the month that such information is gathered.

- For that specific year Form 26AS will now be a full taxpayer profile as opposed to the previous form 26AS, which only provided taxpayer information via TDS / TCS or self-assessment. This form will also have the e-mail, mobile no, and Aadhar no. of the taxpayer.

- An enabling provision has also been notified authorizing the CBDT to authorize DG Systems or any other officer to upload information received from any other officer, the authority under any law, in this form.

- Any negative action initiated or found or order carried under any other legislation such as custom, GST, Benami Law, etc. as well as data on turnover, import, export, etc.

- Above proposed details will also be placed in this form 26AS, so that taxpayer & tax authorities will understand and have access to the complete data basis.

- This 26AS form will provide information obtained from any other nation by the Tax Deptt under the agreement/exchange of taxpayers due to income data outside India.

- Implication of this new form 26AS will be financial institutions or any other authority or customer, buyer, etc. will now ask for form 26AS while performing via research of person/corporation worried so as to ensure that there are no significant problems about such kind of corporations & related people.

- It will now make it impossible for any taxpayer to keep secrets from any bank / financial institution/authority about any proceedings against any statute or tax demand, tax disputes, etc.

- Govt has also suggested deduct TDS / collect TCS at higher rates for those who do not file TDS/TCS Returns on income tax (ITR).

- There is also a proposal for the obligatory filing of ITR by those who have their bank transactions above INR 30 lakh, all professionals, companies with revenue above INR 50 lakh, & rent payment above INR 40,000/-

- New form 26AS will also provide the “selected monetary Transactions” information which includes:

- Buy / sale of goods or real estate transactions, delivering of services

- Transactions made by way of an expenditure or expense.

- Receiving or approving any loan or deposit of the amount specified but not less than Rs 50,000.

- Transactions under contractual works,

- Demand & Refund under the income tax act

- Pending and completed proceedings which may include assessment, re-evaluation under section 148,153A 153C, revision, appeal

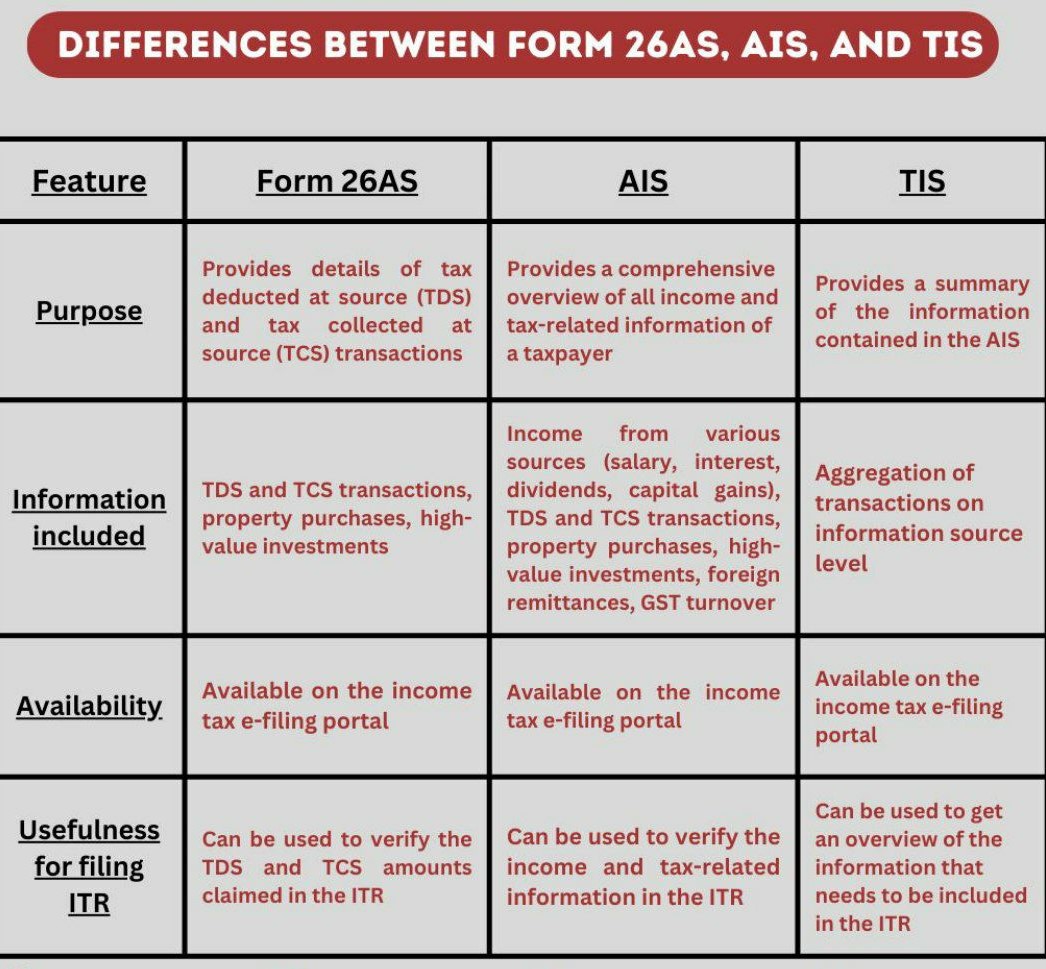

Differences between Form 26AS & AIS

- Below are a few considerable differences between Form 26AS and AIS. The new Annual Information Statement (AIS), which provides a income tax Assesses with a via understanding of the FT made during a FY, was started by the Tax Dept in 2021 and is accessible on the income tax Compliance Portal. But 26AS have the complete details Income demand & details information about TDS, TCS etc only,

- As per Income tax online portal Frequently Asked Questions on Annual Information Statement, “Annual Information Statement is the much more extension of Income tax Form 26AS. Income tax Form 26AS show complete information of high-value Annual Information Statement, property purchases, Moreover includes dividend, rent received, savings account interest, sale & purchase transactions immovable properties or securities, interest on deposits, foreign remittances, Goods and services tax sale etc.

- Annual Information Statement give us taxpayer option to provide responses on the transactions reported. Moreover, TIS additionally reports the aggregate transactions at the level of the information source.

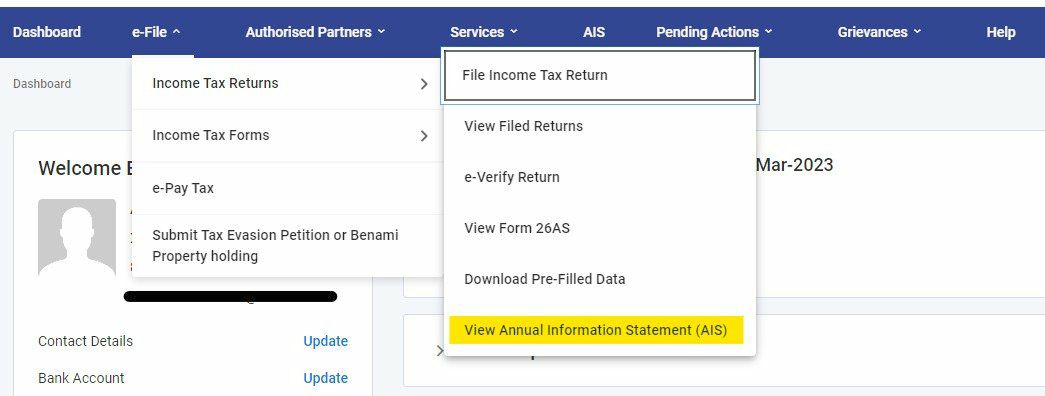

New tab inserted to access “AIS” directly

Now AIS can be viewed through 2 way

- Through separate tab “AIS”

- Through e-File>Income Tax Returns>View AIS

Popular Article :