High Value T/R which can bring you Tax Dept. Radar

Page Contents

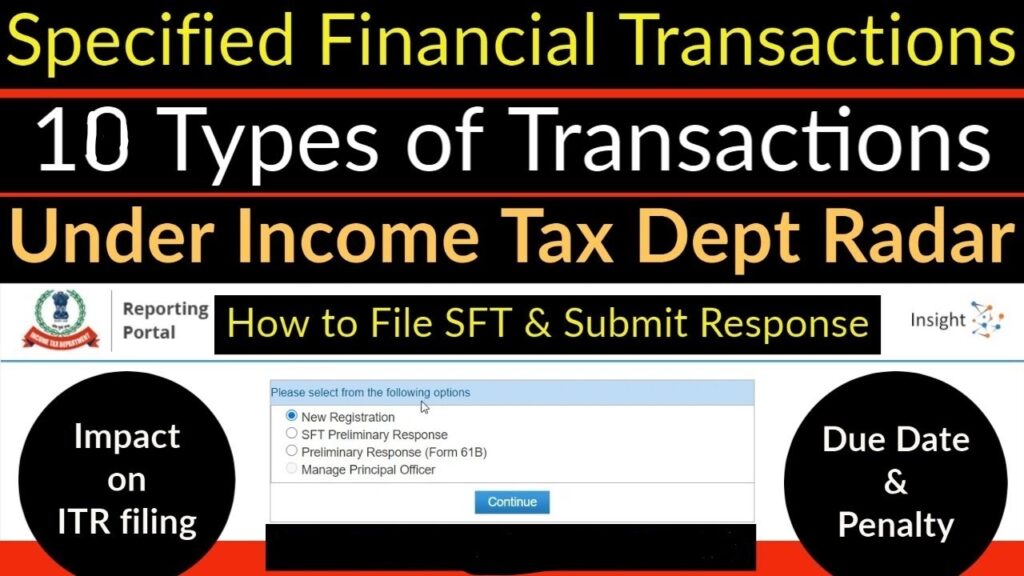

INCOME TAX DEPT IS MONITORING YOUR HIGH-VALUE TRANSACTIONS

Ten High-Value Financial Transactions that can bring you under the Radar of Income Tax Dept.

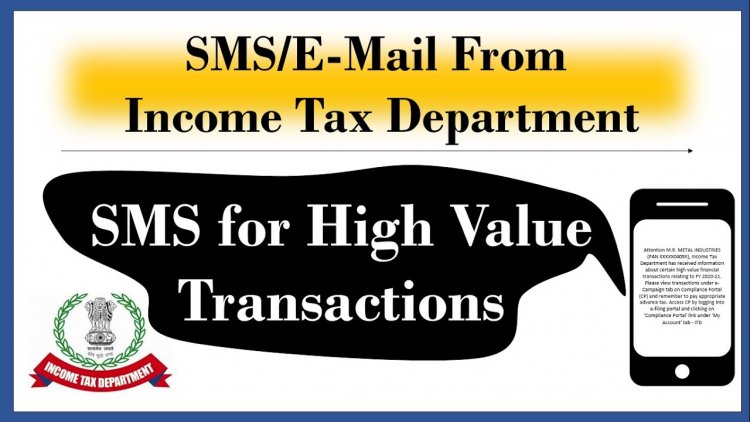

To check tax evasion, the Income Tax Department has stepped up its vigilance against undeclared income. Now, you have to report PAN on all your high-value transactions.

Property registrars and financial institutions with which you deal like your bank, insurer, Mutual Fund Company and Credit Card Company feed the tax department with information regarding your big transactions. Example of a few ways through which the tax department is monitoring your high-value transactions :

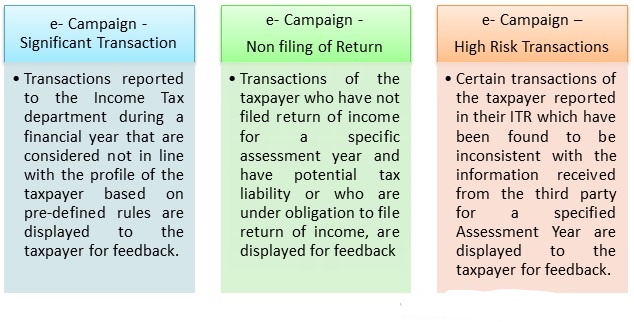

In filing tax returns, taxpayers need to take into account the high-value transactions they make. The tax department uses analytics to examine data to identify those who, despite having made a high-value transaction, have not filed tax returns (ITR) and under-reported earnings.

Recently the tax department launched a revised Form 26AS, an annual tax declaration that provides the taxpayer with details of all high-value transactions. The amendment is designed to encourage voluntary compliance and ease reporting so that such transactions can be included during filing returns in the calculation of correct tax liability.

Importance of SFT Code in Form No. 26AS

1. The Specified Financial Transaction (SFT) is an acronym for “Specified Financial Transaction.” It was created in accordance with Income Tax Act Rule 114E, which enumerates certain defined transactions that must be reported to the Income Tax Department by certain entities/authorities.

2. The section quote of the specified transactions carried out by the taxpayers was mentioned in Form No. 26AS. Please inform us of the SFT Code and its specifics.

| S. No | Particular | SFT number | Person liable to report | Amount (in aggregation of) |

| 1 | In case Purchase of bank drafts or pay order or any instrument in cash | SFT- 001: | Co-operative bank ; Banking Co. | INR. 10,00,000/- |

| 2 | In case Purchase of pre-paid instruments in cash | SFT- 002: | Co-operative bank ; Banking Co. | INR. 10,00,000/- |

| 3 | In case Cash deposit in current account | SFT- 003: | Co-operative bank ; Banking Co | INR. 50,00,000/- |

| 4 | In case Cash deposit in account other than current account | SFT- 004: | Post master office or Co-operative bank ; Banking Co. | INR. 10,00,000 |

| 5 | When you make Time deposit | SFT- 005: | Post master office or Co-operative bank ; Banking Co. or Nidhi or NBFC | INR. 10,00,000/- |

| 6 | On the Payment for credit card | SFT- 006: | Post master office or Co-operative bank ; Banking Co. or post office | INR. 1 lakh in cash or INR. 10,00,000 in any other mode |

| 7 | In case person Purchase of bonds or debentures | SFT- 007: | institution or Company or issuing bonds or debentures | INR. 10,00,000/- |

| 8 | If you Purchase of shares | SFT- 008: | issuing shares by company | INR. 10,00,000/- |

| 9 | In case Buy back of shares | SFT- 009: | Stock Exchange listed Company | INR. 10,00,000/- |

| 10 | In case Purchase of mutual fund units | SFT- 010: | mutual fund A trustee or any other authorized person | INR. 10,00,000/- |

| 11 | in case Purchase of foreign currency | SFT- 011: | FEMA Act Authorised person | INR. 10,00,000/- |

| 12 | If You sale or Purchase of immovable property | SFT- 012: | Inspector general or registrar or sub registrar | INR. 30,00,000/-(individual transaction) |

| 13 | In case Cash payment for goods & services | SFT- 013: | Tax Audit liable person whose audit u/s 44AB | INR. 2,00,000/- (individual transaction) |

| 14 | In case Cash deposits during specified period (9th Nov to 30th Dec, 2016) | SFT- 014: | post master office or Banking company, co-operative bank | INR. 2,50,000/- |

The above chart clearly shows that the SFT return must be filed by the person with whom the transaction was made, not the person who made the transaction. Taxpayers must simply check whether transactions are reported in 26AS when completing income tax returns.

Financial Transactions Statement (SFT)

- Honorable, honorable Indian Prime Minister Narendra Modi has started a new initiative for the income tax department to expand tax base in India, capturing all of the high-value transactions (HFTs). This document contains Specified Financial Transactions (SFR) and MTLs

- The SFT is a report by specified persons on certain financial transactions including a prescribed financial reporting institution. Submitting the Financial Transactions Statement to the income tax dept. or other authority or agency is a mandate to those specified persons who register, maintain or record such specified financial transactions.

- The Financial Transactions Statement shall include high-value transaction details of those specific entities, including banks, mutual funds, bond issuing institutions, and registrars or sub-registrars. Now, TCS (tax collected at source) at the rate of 1 percent is deducted and deposited to the tax department by the buyer in case of purchase of property over Rs. 50 lakh. This is just another way of reporting the transaction. You also have to give your PAN for the following transactions:

- Sale or purchase of vehicles other than two-wheelers

- Opening a bank or a Demat account; applying for a credit card

- Opening a fixed deposit of more than Rs. 50,000

- Payment of more than Rs. 50,000 towards insurance premium

- Paying more than Rs. 50,000 in cash towards restaurant or hotel or foreign trip bills

- Purchase of mutual funds, debenture, bonds worth more than Rs. 50,000

- Depositing cash or more than Rs. 50,000 in bank

Payment of educational fees, purchase of jewelry, white goods, paintings, marble and electricity consumption; domestic business class air travel

- The government recently proposed to extend the scope of the reports on SFTs by taking into account new value transactions such as domestic air travel/external transport, payment of fees/sponsorships for education, acquisition of jewelry, white goods, paintings, marble, and consumption of electricity above Rs. 1 lakh.

Life insurance payment & Health insurance premium payment

- The premium for life insurance cover Rs. 50 000 and pay for the health insurance premium above Rs. 20 000 can be scanned by the Department of Revenue Tax as it plans to expand the range of reports under the SFT.

More than INR 20,000 Hotel spends and Other

- This hotel can recently spend more than Rs. 20,000 in the radar of the Tax Department.

- TDS is another way of tracking the income of taxpayers. Banks deduct TDS if interest income on fixed deposits is more than Rs. 10,000 in a year.

- List of Third parties who report High-value Financial Transactions

- Companies issuing shares

- Mutual Fund Companies

- Companies issuing bonds or debentures

- Sub-Registrar offices on real-estate deals.

- Banks – They report High-Value transactions related to deposits credit card payments.

Financial Securities Investments

- In the financial year for acquisition of bonds, debentures, equity or mutual funds a company shall report receipt of Rs 10 lakh or more from an investor (other than the amount received on account of transfer from one scheme to another scheme of that Mutual Fund). Purchase of shares, debentures and mutual funds of Rs. 10 lakh or more will have to be reported by the companies to the tax authorities.

Payments by Credit Card

- If you pay more than INR 1 lakh p.a in cash mode (or Rs plus 10 lakh in Checks / NEFT transfers, etc. If you make credit card bill payments. 4) If you have made a cash payment of Rs. 1 lakh towards your credit card or Rs. 10 lakh or more through any other mode during the financial year, your credit card company will report the transactions to the tax authorities.

Current accounts deposits

- In one or more years, the bank will have to report cash deposits or withdrawals aggregated with Rs 50 lakh or more in 1 or more years. Any cash payment of Rs 10 lakh or more for the purchase of RBI bank drafts or pre-paid instruments in a financial year shall also be notified.

Cash Deposits in Bank

- The banks shall report in one or maybe more accounts (other than the current account or time deposit) of a person in financial year cash deposits aggregating Rs 10 lakh or more.1) Your bank will inform the tax department if you have deposited cash, made a demand draft, or fixed deposits aggregating up to Rs. 10 lakh or more in a financial year under different accounts.

- If you are earning more than Rs. 50 lakh a year, you have to report your assets and liabilities in a new ITR (income tax return) form this year. Now reporting of PAN is mandatory for making any purchase of goods and services of more than Rs. 2 lakh. Also, a TCS (tax collected at source) has been introduced from June 1 in case of purchase or sale of any goods and services for Rs. 2 lakh and more in cash.

Property Real Estate

- The property registrar is to report to the tax authorities all real estate purchases and sales of more than Rs 30 Lakh. The property registrar is liable to report the purchase or sale of immovable property exceeding Rs. 30 lakh.

Foreign Devises Sales

- An approved person under paragraph (c) of Article 2 of the Foreign Exchange Management Act of 1999 shall report receipts for the sale of a foreign currency by any person of an amount of Rs 10 lakh or more in the financial year.

- A 1 % luxury tax is levied on the purchase of a car priced over Rs. 10 lakh. It will be deducted by the seller of the car and will be applicable on the ex-showroom price. However, this extra payment could be set off against the total tax liability of the buyer.

The tax department compares this information with the income tax return filed by Assesse. Through Income tax reporting the income tax department is amylase and come out to compare your overall income with your expenses and investment along with tax paid to assess the correct tax liability and investments and finally the get the tax evasion there if any,

Newly added High-Value Transactions threshold limits

| S. No | Transaction Type | Min. Amount (Rs.) |

| 1 | Domestic class Air travel / Foreign travel | any |

| 2 | Deposit / Credits in non-current Accounts | 25 Lakhs |

| 3 | Health Insurance premium | 20,000 |

| 4 | Electricity Consumption per year | 1 Lakh |

| 5 | Share transactions in DMAT Accounts / Bank Lockers | any |

| 6 | LIC | 50,000 |

| 7 | Purchase of Jewelry, white goods, painting, marble, etc | 1 Lakh |

| 8 | Payment of educational fee/donations | 1 Lakh |

| 9 | Payment to Hotels | 20,000 |

| 10 | Deposit / Credits in Current Accounts | 50 Lakhs |

| 11 | Payment of Property tax per annum | 20,000 |

Additional threshold limits added to enforce the Income-tax

- Deduction/tax collection provision at a higher rate for no tax return filers.

- Compulsory returns for taxpayers Provision

- All professionals with sales above Rs. 50 Lakh

- All whose rental payment exceeds Rs. 40,000 a month

- Which transactions are above Rs. 30 lakh

Here are few tips for avoiding high-value financial transactions with Income tax notices;

- Stay up to date with your PAN details.

- Reveal in your ITR all and correct revenue you have earned during the FY.

- Before the deadline, you must always file your ITR.

- Cross-check your From 26AS for all the TDS entries. This exercise can be repeated once a quarter.

- If any AIR transactions are reported, check your Form 26AS.

- Record all your valuable financial transactions, investments and expenditures

Popular Blog: