Tax & Statutory Compliance Calendar for July 2022

Tax & Statutory Compliance Calendar for July 2022

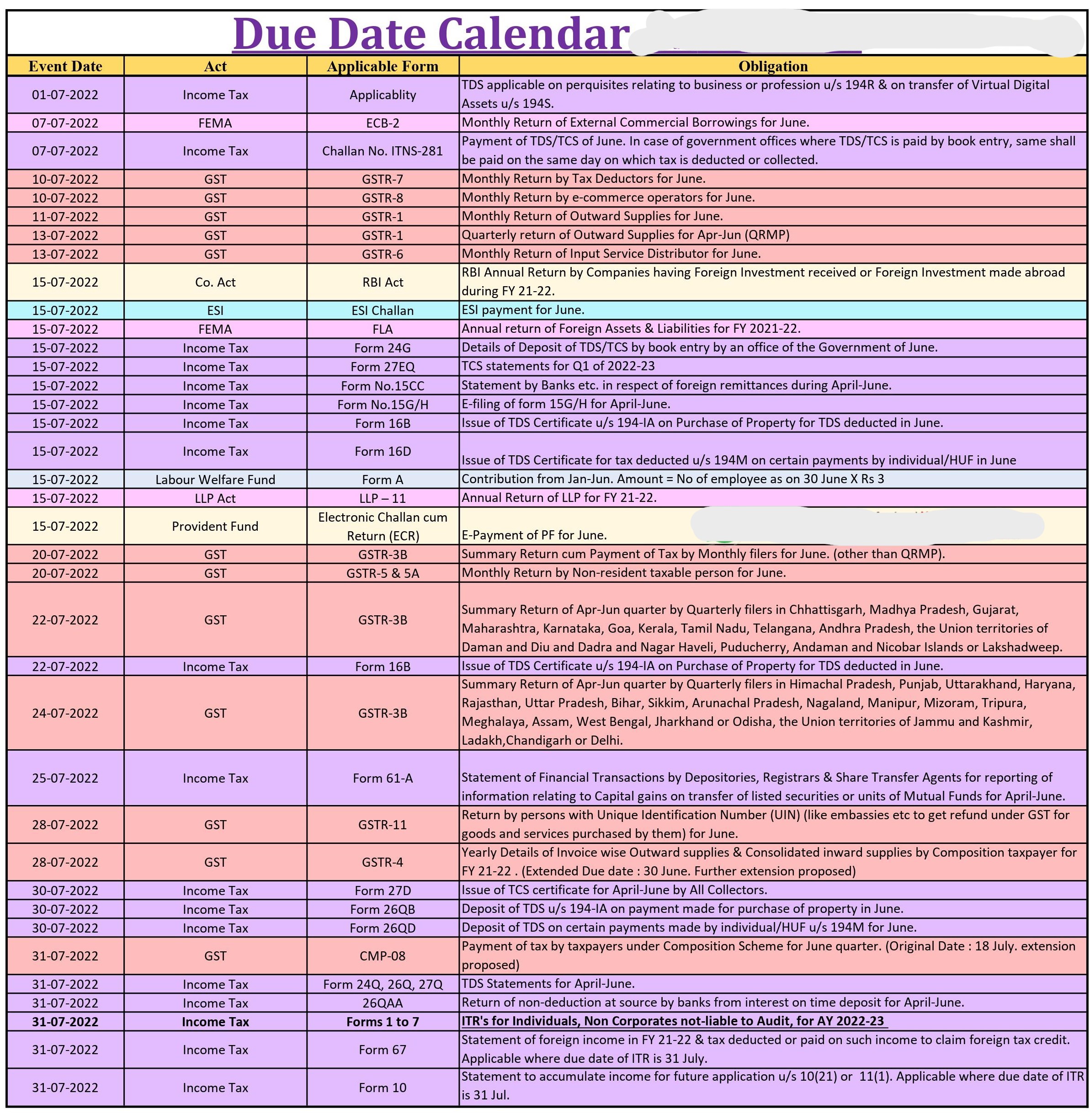

| S. No. | Statue/ Law | Purpose of Tax Compliance | Statutory Due Date | Statutory Compliance Period | Statutory Compliance Details |

| 1 | Labour Law | Provident fund / ESI | 15-Jul-22 | Jun-22 | Timeline/Due date for payment of Provident fund and ESI contribution for the previous month. |

| 2 | Company Law | Form 11 | 15-Jul-22 | F.Y. 2021-22 | Form-11 is an annual return to be filed all Limited Liability Partnership Firms. |

| 3 | Goods and Services Tax Act | GSTR -1 | 11-Jul-22 | Jun-22 | “1. GST Filing of returns by registered person with aggregate turnover exceeding INR 5 Crores during preceding year.

2. Registered person, with aggregate turnover of less than INR 5 Crores during preceding year, opted for monthly filing of return under QRMP”. |

| 4 | Goods and Services Tax Act | GSTR -7 TDS return under GST | 10-Jul-22 | Jun-22 | GSTR-7 is a return to be filed by the persons who is required to deduct TDS (Tax deducted at source) under GST. |

| 5 | Goods and Services Tax Act | GSTR- 8 TCS return under GST | 10-Jul-22 | Jun-22 | GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. |

| 6 | Goods and Services Tax Act | GSTR – 3B | 20-Jul-22 | Jun-22 | 1. GST Filing of returns by registered person with aggregate turnover exceeding INR 5 Crores during preceding year.

2. Registered person, with aggregate turnover of less than INR 5 Crores during preceding year, opted for monthly filing of return under QRMP. |

| 7 | Goods and Services Tax Act | GSTR-1-QRMP | 13-Jul-22 | Jun-22 | GSTR-1 of registered person with turnover less than INR 5 Crores during preceding year and who has opted for quarterly filing of return under QRMP. |

| 8 | Goods and Services Tax Act | GSTR -6 | 13-Jul-22 | Jun-22 | Timeline/Due date for filing return by Input Service Distributors. |

| 9 | Goods and Services Tax Act | GSTR – 3B | 22-Jul-22 | April to June 22 | *Timeline/Due date of filing of GSTR-3B for taxpayer with Aggregate turnover up to INR 5 crores during the previous year and who has opted for Quarterly filing of return under QRMP. |

| 10 | Goods and Services Tax Act | GSTR -5 | 20-Jul-22 | Jun-22 | GSTR-5 to be filed by Non-Resident Taxable Person for the previous month. |

| 11 | Goods and Services Tax Act | GSTR-5A | 20-Jul-22 | Jun-22 | GSTR-5A to be filed by OIDAR Service Providers for the previous month. |

| 12 | Goods and Services Tax Act | GSTR-4 | 28-Jul-22 | Apr-June 22 | GSTR-4 is annual return filed by a registered person opting for a composition scheme. The due date was extended from 30.06.2022 to 28.07.2022 by the 47th GST Council meeting. |

| 13 | Goods and Services Tax Act | GSTR – 3B | 24-Jul-22 | April to June 22 | **Timeline/Due date of filing of GSTR-3B for taxpayer with Aggregate turnover up to INR 5 crores during the previous year and who has opted for Quarterly filing of return under QRMP. |

| 14 | Goods and Services Tax Act | GST CMP-08 | 31-Jul-22 | Apr-June, 22 | Form GST CMP-08 is used to declare the details or summary of self-assessed tax payable by taxpayers who have opted for composition levy. Extended by 47th GST Council meeting. |

| 15 | Income Tax | TDS Challan cum Statement | 30-Jul-22 | Jun-22 | Timeline/Due date for furnishing of challan-cum-statement in respect of Tax Deducted at Source U/S 194-IA, 194-IB, 194-IM, in the month of June 2022. |

| 16 | Income Tax | TCS Certificate | 30-Jul-22 | Apr-June, 22 | Quarterly tax collected at source certificate in respect of tax collected by any person for the quarter ending June 30, 2022. |

| 17 | Income Tax | Non-deduction of Tax Deducted at Source by banking Company | 31-Jul-22 | Apr-June, 22 | Quarterly return of non-deduction of tax at source by a banking company from interest on time deposit in respect of the quarter ending June 30, 2022. |

| 18 | Income Tax |

Tax Deducted at Source (TDS) Return |

31-Jul-22 | Apr-June, 22 | Quarterly statement of deduction of tax at source deposited for the quarter ending June 30, 2022. |

| 19 | Income Tax | Income Tax Return | 31-Jul-22 | Financial Year 2021-22 | “Return of income for the Financial Year 2021-22 for all assesses other than:

1. corporate-assesses |

| 20 | Income Tax | Tax collected at source Return | 15-Jul-22 | Apr-June, 22 | Quarterly statement of tax collected at source deposited for the quarter ending 30 June 2022. |

| 21 | Income Tax | Tax Deducted at Source (TDS) Certificate | 15-Jul-22 | May-22 | Due date for issue of Tax Deducted at Source Certificate for tax deducted U/s 194-IA, 194-IB, and 194M in the month of April 2022. |

| 22 | Income Tax | 15CC | 15-Jul-22 | Apr-June, 22 | Quarterly statement in respect of foreign remittances (to be furnished by authorized dealers) in Form No. 15CC for quarter ending June 2022. |

| 23 | Income Tax | Form 3BB | 15-Jul-22 | Jun-22 | Timeline/Due date for furnishing statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes been modified after registering in the system for the month of June 2022. |

| 24 | Income Tax | Tax Deducted at Source (TDS) Liability Deposit | 7-Jul-22 | Apr-June 2022 | Timeline/Due date for deposit of Tax Deducted at Source when Assessing Officer has permitted quarterly deposit of Tax Deducted at Source U/s 192, 194A, 194D or 194H. |

| 25 | Income Tax | Tax Deducted at Source / Tax collected at source liability deposit | 7-Jul-22 | Jun-22 | Timeline/Due date of depositing Tax Deducted at Source / Tax collected at source liabilities under Income Tax Act, 1961 for the previous month. |

*Note 1: Not Opting for QRMP Scheme- Due Date for filling GSTR – 3B with Annual Turnover up to 5 Crore in State 1 Group (Chhattisgarh, Karnataka, Goa, Kerala, Tamil Nadu, Madhya Pradesh, Gujarat, Maharashtra, Telangana, Andhra Pradesh, Puducherry, Andaman, Nicobar Islands, Daman & Diu, and Dadra & Nagar Haveli, Lakshadweep).

**Note 2: Not Opting for QRMP Scheme- Due Date for filling GSTR – 3B with Annual Turnover up to 5 Crore in State 2 Group (Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Meghalaya, Assam, West Bengal, Manipur, Mizoram, Tripura, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi).

Popular Articles related to Tax Audit: