What is Tax Audit Limit for the AY 2022-23?

Page Contents

What is revise Income Tax Audit Limits for FY 2021-22?

Under the Income tax section 44AB of the Income tax Act, every person carrying on business is needed to get his accounts audited, if his Total turnover, sales, or gross receipts, in business More than INR 1 Cr in any previous year.

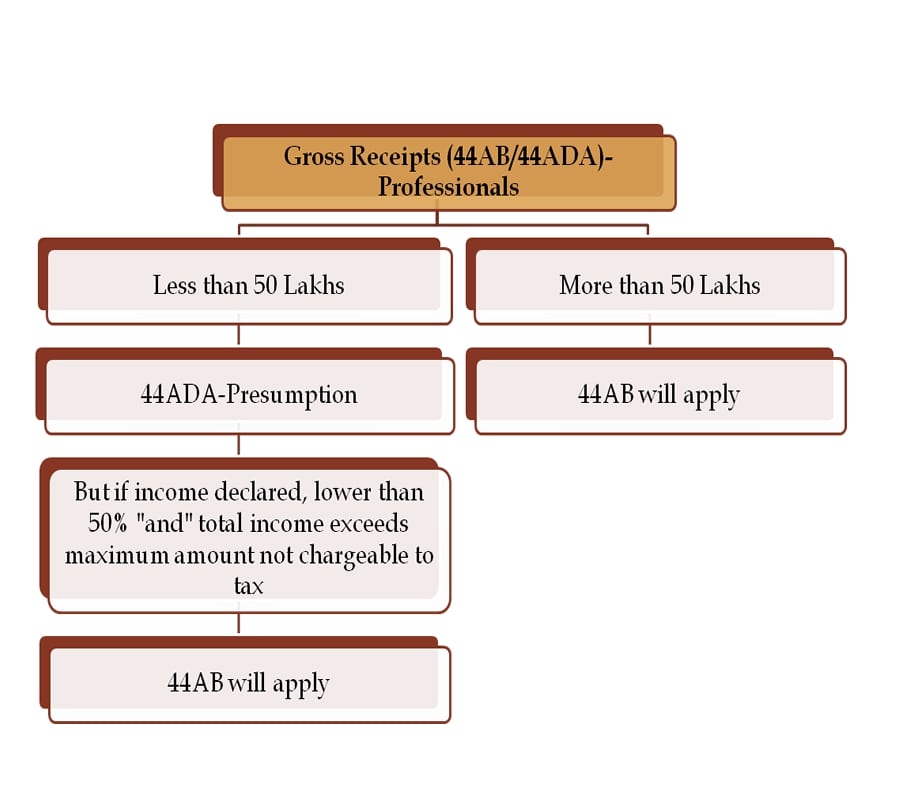

If a person Doing the profession he is needed to get his Books of accounts audited, In case Total receipt in profession More than, INR 50 lakh in any previous year.

With effect from Finance Act 2020, the above threshold limit for a person carrying on business was increased from INR 1 Cr to INR 5 Cr in cases where,-

- Total receipts in cash during the previous year does not More than 5% of such receipt; &

- Total payments in cash during the previous year does not more than 5% of such payment.

Above changes is made to decreased compliance burden on MSME enterprises.

It is suggested to increase the threshold from 5 Cr to 10 Cr in circumstances specified above in order to encourage non-cash transactions, promote the digital economy, and further reduce small and medium enterprises’ compliance burden.

If a person involved in profession & choosing for presumptive taxation U/s 44ADA:

| Last Year aggregate turnover, sales, or gross receipts limit | Profit Amount with respect to turnover (in %) | Status of Applicable of Tax Audit on Assesses |

| Excess than INR Fifty Lakhs | N.A. | Yes, Tax Audit is applicable U/s 44AB(b) |

| Upto INR Fifty Lakhs | More than 50% | NO |

| Upto INR Fifty Lakhs | less than 50% (Under Section 44ADA) | Yes, Tax Audit is applicable U/s 44AB(d) |

Below are “specified profession” – Sec 44AA

- Engineering profession – Services provided by consulting engineers, technical certification, structural engineers, design and drawing services etc.

- Legal profession – Services provided by an advocate/firm of advocates.

- Company Secretary

- Cost Accountant, Chartered Accountant,

- Medical profession – Services provided by doctors.

- Interior decoration Services ie planning, designing, consulting etc.

- Profession of Advertising -film artiste such as an a director, actor, a cameraman, etc.

- Architectural profession – Services provided by an firm of Architects/Architect

- Profession of Technical consultancy -business consultant, marketing consultant etc.

- Authorised representative – a person, who represents any other person, on payment of any fee or remuneration, before any Tribunal or authority constituted or appointed by or under any law for the time being in force

- Professional in sports – Sports Persons, Team Physicians and Physiotherapists, Event Managers, Commentators, Umpires and Referees, Coaches and Trainers, Anchors and Sports Columnists.

If a person involved in business & choosing for presumptive taxation U/s 44AD:

| Last Year Turnover limit | Profit Amount with respect to turnover (in %) | In case cash receipts less than 5 Percentage of Turnover | In case cash payment less than 5 Percentage of total payment | Status of Applicable of Tax Audit |

| Exceeds than INR Ten Cr. | N. A. | N. A. | N. A. | Yes, Tax Audit is applicable |

| Exceeds than INR Two Cr but upto INR Ten Cr | N. A. | Yes | Yes | No |

| Exceeds than Two Cr but upto INR Ten Cr | N. A. | No | No | Yes, Tax Audit is applicable |

| Exceeds than One Cr but upto Two Cr | Excess than 8 Percentage or 6 Percentage of Turnover | N. A. | N. A. | No |

| Exceeds than INR One Cr but upto Two Cr | Less than 8 Percentage or 6 Percentage of Turnover | N. A. | N. A. | Yes, Tax Audit is applicable. |

| Less than INR One Crore | More than 8 Percentage or 6 Percentage of Turnover | N. A. | N. A. | No |

| Less than INR One Crore | Less than 8 Percentage or 6 Percentage of Turnover | N. A. | N. A. | Yes, Tax Audit is applicable |

Key Note:

- If total income more than the basic exemption limit only then tax audit is applicable.

- Where the Income Taxpayer is covered U/s 44AB then he is required to get the books of accounts audited by a CA.

- Income tax Audit report would be furnished in under the form 3CB CD, where report of Tax Audit complete by the CA is to be file in Form No. 3CB & details of audit are to be reported in Form No. 3CD.

- In case the Income Taxpayer is liable for Income tax & that person fails to Complete Tax audit of Firm books of accounts than he is responsible for a payment of penalty of lower of the below two:

- Rs. 1,50,000. or

- 0.5 percentage of Total receipts.

No Penalty for Failure of Tax Audit U/s 271B in case of Reasonable Causes with Case Laws.

- If the tax audit report is not submitted on time or before the deadline, no penalty under section 271B will be enforced. The provisions of section 271B must be applied, however, if the audit report is not submitted by the deadline.

- No Penalty for Failure of Tax Audit under section 271B of the Income Tax Act,1961 in case of Reasonable Causes with Case Laws

Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@carajput.com or call at 9555555480

Popular blog: