Start-up Funding Documentation

Page Contents

Start-up Funding Documentation

Brief Introduction

In this Start-up Era, brilliant business ideas enhance value addition to society. it’s rightly said the first mover reap good advantage.

After comparing the millennial classics in the Food tech space namely – Swiggy & Zomato food delivery, we can conclude that they made an interesting contribution. Ideas generated and executed finely are clad to be a necessity within the lifestyle of recent India.

Popularly such a start-up is termed a Unicorns, which implies their valuation has surpassed USD 1 Billion. If they’d waited a bit longer to execute ideas, their names wouldn’t be the talk of the town.

But this can be only 1 part of the story, what makes these companies truly valuable is the value perceived by their Investors because these are unlisted Companies, and also the public cannot invest in these start-ups.

Elite Individuals or firms whom we call Angel Investors, Private Equity, venture capital, and Investment bankers pick and value more highly to invest in such innovative and revolutionizing start-ups.

In the case of Swiggy – they raised USD 2.2 Billion till April 2021, which comprises of first funding was USD 2 Million (Series A) and later in series J. Every round of funding, the start-up had to convince its investor with not only its business plan but also the governance of the corporate and legal documentation.

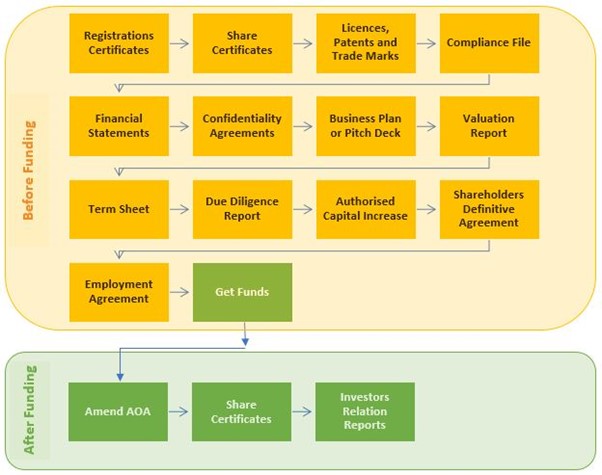

STARTUP FUNDING DOCUMENTATION

-

REGISTRATION CERTIFICATES

These are the source documents for your company and should be maintained and updated at all times.

-

SHARE CERTIFICATES

Share Certificates are important documents that entitle ownership of the corporate to the shareholders or the promoters. Any inconsistency can cost the corporate additional fees like stamping or franking costs and logistics.

Usual issues are when: –

-

LICENCES, PATENTS, AND TRADEMARKS

Every Start-up now derives most of its value from the holding (IP) that it possesses. Some of them could be as follows –

It is necessary that the start-up protects its IPs by registering a patent or copyright or trademark with relevant authorities looking at the geography within which they’re operating and maintaining such certificates.

-

COMPLIANCE FILE

Now that you just have all basic registration documentation in hand, the next step is that they maintain a monthly tracker and compliance file to make sure that each regulatory requirement is taken care of and recorded regularly. Any compliance lapse may result in: –

-

FINANCIAL STATEMENTS

Financial Statements are an absolute necessary set of reports which depict the performance of an organization. Basic statements included here are.

-

CONFIDENTIALITY AGREEMENTS

Most often start-ups assume that customer data, formulas, processes, and techniques aren’t critical for creating or breaking the venture. However, it’s found that these secrets are the explanation for the start-up being successful.

So, it’s necessary that employees, consultants, and prospective investors with whom sensitive data would be shared must be covered by a well-drafted Non-Disclosure Agreement. It is advisable to get the same signed by NDA, before sharing the same with an investor.

-

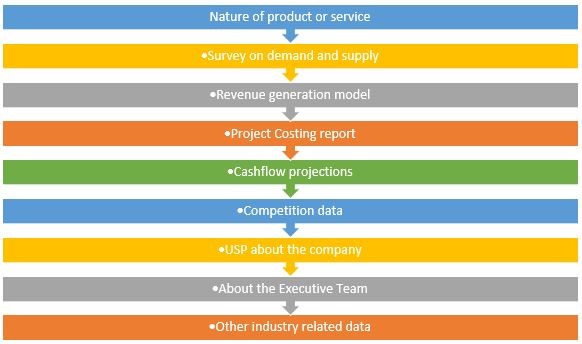

BUSINESS PLAN OR PITCH DOCUMENT

Pitch Document is a politician presentation about your business to the investors. It is a straightforward PPT that defines the following aspects of your business.

A pitch document should convince an investor that it’s a winning idea and also that you just have the most effective team to execute it.

-

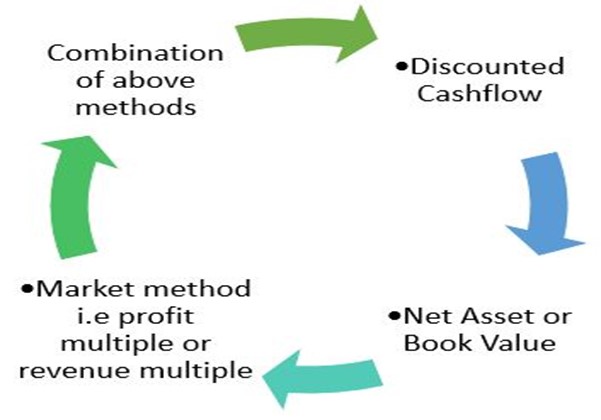

VALUATION REPORTS

As per the Companies Act 2013, Enterprise and Share Valuation should be performed by a registered valuer, approved by IBBI. The Start-up can get its company valued which can help it to form a more robust pitch document and help promoters to determine dilution in shareholdings. Commonly used methods of valuations are.

-

TERM SHEET

Now that you simply have followed all the steps in getting your company ready, you’ll be able to now approach a possible investor. Once you have got generated enough interest with the investor, the investor will ask you to sign a term sheet to transfer money in tranches. this can be like signing a purchase agreement while buying a property. The term sheet basically includes the following aspects –

-

DUE-DILIGENCE

When you have signed a term sheet, it contains various terms and conditions supported by which the investor will release funds.

Types of Due- diligence

-

- Financial Due Diligence

- Legal Due Diligence

-

AUTHORISED CAPITAL INCREASE

Hola! Once the investor has agreed to fund your venture, the opening move is to approach your Company Secretary to hold out the secretarial compliance process, namely.

-

SHAREHOLDERS DEFINITIVE AGREEMENT

This can be called with different terms like Debenture holders’ Definitive agreement etc. This agreement is the foremost important document binding the investors and therefore the promoters here onwards. Most of the days it’ll be an extension of the Term sheet running into several pages and having intricate details. Some points that may be additionally included maybe

-

EMPLOYMENT AGREEMENT

Most of the investors demand a good contract with the founders within the term sheet. this is often to shield the interest of the investors and to induce future commitment from founders. Usual terms which will be included here are

-

AMENDMENT OF AOA AND SHARE CERTIFICATES

Now that the legal process is complete, the corporate secretary should complete the allotment process, which involves

-

INVESTOR RELATION REPORTS

Now that you just have successfully completed the round of funding which could usually take 3 – 9 months to execute, it’s pertinent to require the care of investors by adhering to the conditions mentioned within the definitive agreement and also following best practices.

Providing regular reports on the development of the corporate or project can motivate investors to pump in additional. a number of the reports maybe

Monthly Quarterly performance report

- Compliance Reports

- Project report

Popular blog:-