Scope of Secretarial audit Under Companies Act 2013

Page Contents

Secretarial audit Under Companies Act 2013

Under Section 204 of the Companies Act, 2013, every listed company and any public business with a paid-up share capital of 50 crores or more or a revenue of 250 crores or more is required to conduct a secretarial audit. A corporate secretary is required to conduct the secretarial audit of the company.

Scope of Work – Secretarial audit as per Section 204 of the Companies Act 2013:

- Review and verification of the SBICPSL’s books, papers, minute books, forms and returns filed and other records maintained by the company.

- Examination of the books, papers, minute books, forms and returns filed and other records maintained by the SBICPSL according to the provisions of:

- The Companies Act, 2013 (the Act) and the rules made thereunder, as amended from time to time.

- Securities Contracts (Regulation) Act, 1956 (‘SCRA’) and the rules made thereunder, as amended from time to time.

- Foreign Exchange Management Act, 1999 and the rules and regulations made thereunder to the extent of Foreign Direct Investment, as amended from time to time.

- The Depositories Act, 1996 and the Regulations and Bye-laws framed thereunder to the extent of Regulations 74 and 76 of Securities and Exchange Board of India (Depositories and Participants) Regulations, 2018, as amended from time to time.

- following Regulations and Guidelines prescribed under the Securities and Exchange Board of India Act, 1992, (‘SEBI Act’) as amended from time to time:

- Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015

- Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations 2018

- SEBI- The Securities and Exchange Board of India (Share Based Employee Benefits and Sweat Equity) Regulations, 2021

- The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011;

- The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015;

- SEBI – The Securities and Exchange Board of India (Issue and Listing of Non-Convertible Securities) Regulations, 2021;

- The Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 regarding the Companies Act and dealing with client to the extent of securities issued;

- Following other SEBI, as may be amended may be applicable specifically to the SBICPSL:

- Reserve Bank of India Act, 1934 and Rules made thereunder

- Insurance Regulatory and Development Authority of India (Registration of Corporate Agents) Regulations, 2015. Also examine compliance with the applicable clauses of the following:

- Secretarial Standards issued by The Institute of Company Secretaries of India;

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

- Review of the Board-processes and compliance-mechanism in place

- To assess the Internal Controls on PIT (Prohibition of Insider Trading). Review of the compliance with the provisions of the Act, Rules, Regulations, Guidelines, Standards, etc. mentioned above

The period of Secretarial Audit exercise shall be for a period commencing from the April 01, 20X1 till March 31, 20X2. Upon acceptance of the assignment by the company, Professional will provide a checklist to enable the Co. to compile all the documents for the Secretarial Audit Exercise. The Company Management shall be required to create a proper data room, to facilitate the completion of Secretarial Audit Exercise in a timely manner.

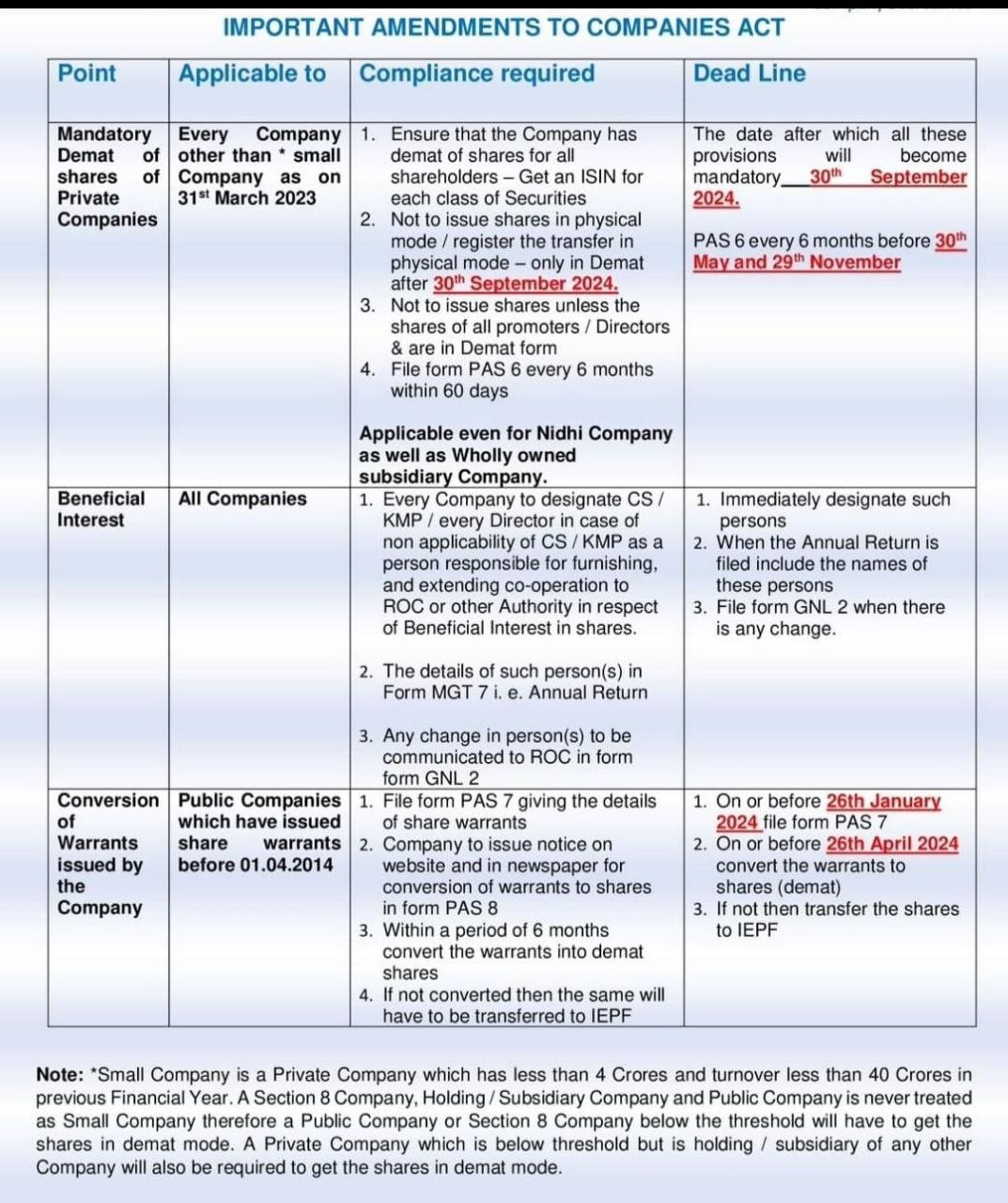

Recent Amendments in the Company Act!