Requirements of LLPs at the time of Incorporation

Page Contents

Basic Requirements of LLPs at the time of Incorporation

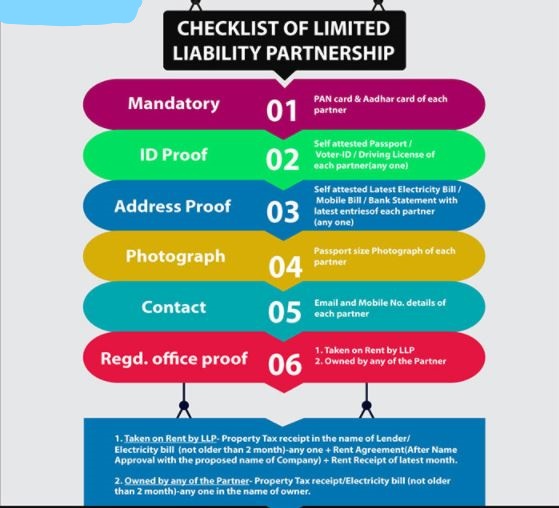

Documents Requirement for LLP incorporation

- Self-attested copy of PAN Card of all partners and Promoters

- Self-attested copy of Voter I’d/ Driving License/Passport as ID proof (Only copy of Aadhar required if have DIN)

- One Photo of each partners and promoter

- Electricity Bill/Telephone Bill/Gas Bill/Mobile Bill for Registered Office of the Proposed LLP (not older than two months)

- Electricity bill/ Mobile Bill/Telephone Bill/ Bank Statement as address proof self-attested by each partners and promoter (not older than 2 months), not required for DIN holder.

- Rent Agreement, Rent receipt and NOC for Registered Office of the LLP, if rented.

- NOC and KYC from the Trademark owner if name already exist

Information Requirement for LLP incorporation

- Name of the LLP (Description of name, if any)

- Occupation, Education Qualification, Place of Birth and Duration of Stay at present address (Not required, if have DIN)

- Object/Business activities of LLP

- Mobile No. and Email id of all partners

- Interest in other entity by all partners i.e. Designation, Type of ownership etc.

- Total Contribution of LLP and ratio of each partners

- Director Identification Number (DIN) of partners if have.

Checklist for LLP Incorporation

Requirements of Limited Liability Partnership (LLPs) at the time of Incorporation

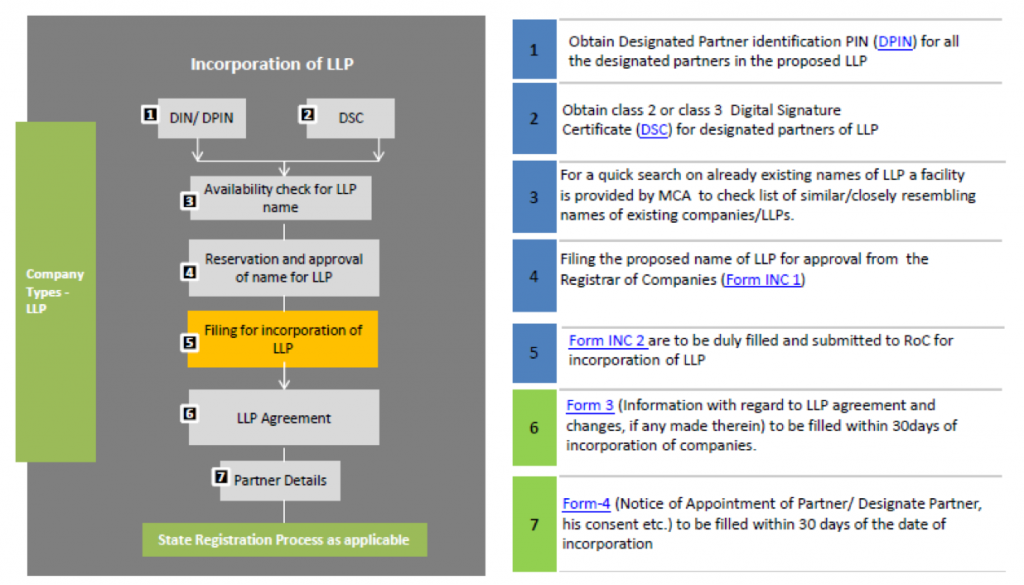

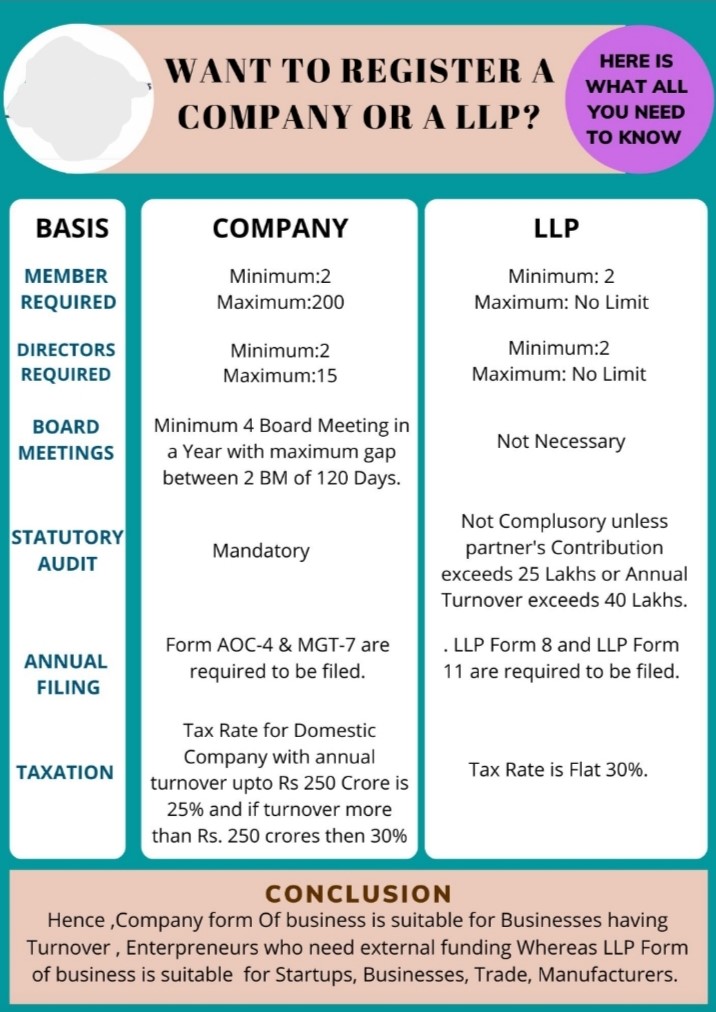

| Minimum Partners | Two |

| Maximum Partners | No Limit |

| Minimum Designated Partners | at least one designated partner shall be resident in India |

| Designated Partners Identification Number | All the designated partners shall obtain Designated Partners Identification Number (DPIN) by filing E-Form no. 7 online on the Limited Liability Partnership Portal. |

| Filing Fee for E-Form no.7 | Rs.100/- |

| Documents Required for obtaining DPIN | 1) Proof of identity,2) Proof of residence,

3) Latest passport size photograph 4) Digital Signature Certificate |

| Digital Signature Certificate (DSC) | Mandatory for all the Designated Partner |

| Financial year | Financial year means the period from the 1st April to 31st March of the following financial year. |

| Reservation of Name of Limited Liability Partnership | E-Form no.1 is filed for reservation of name of Limited Liability Partnership |

| Filing Fees for E-Form no.1 | Rs.200/- |

| Registration/Incorporation Document | E-Form no. 2 |

| Filing Fees for E-Form no.2 | (a) If a contribution does not exceed Rs. 1 lakh – Rs. 500(b) If the contribution is between Rs. 1 lakh to Rs. 5 lakhs – Rs. 2000

(c) In case contribution is Rs. 5 lakh to Rs. 10 lakhs – Rs. 4000 (d) If the contribution is more than Rs. 10 lakh – Rs. 5000 |

| Registration of Limited Liability Partnership Agreement | E-Form no.3 |

| Filing Fees for E-Form no.3 | The difference between the fees payable on the increased slab of contribution and the fees paid on the previous slab of contribution shall be paid through E-Form no.3 |

| Notice of Appointment of Partner/ assigned Partner and their consent | E-form no.4 |

| Filing Fees for E-Form no.4 | (a) If a contribution does not exceed Rs. 1 lakh -Rs. 50(b) If the contribution is between Rs.1 lakh to Rs.5 lakhs – Rs. 100

(c) In case contribution is between Rs. 5 lakhs to Rs.10 lakhs – Rs. 150 (d) If the contribution is more than. 10 lakh – Rs. 200 |

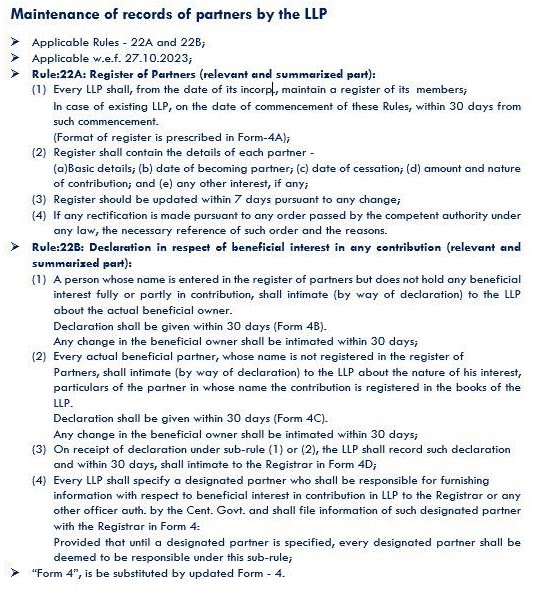

Maintenance of Record by LLP

New LLP filing fees from 1.4.2022

LLP additional fees filling fee for small LLP with effect from 1 April 2022