Profit-oriented NGO/trust can’t claim exemption u/s 10(23C)

Page Contents

Profit-oriented NGO or trust can’t claim exemption u/s 10(23C).

- Charitable institutions registered under section 12AA of the Act may apply for exemption under section 11 if all the conditions have been fulfilled, . While Section 10 (23C) under income tax act is a specific exemption provision applicable to some public and private educational institutions, Section 11 is a general provision that applies to all charity NGO. The exemption provided for educational institutions under Sections 10(23C) & section 11 of income tax law is emphasized in this article.

- It is prohibited from participating in any for-profit activity, meaning that such institutions are prohibited from having goals that are unconnected to the delivery of education or other educational activities. According to the aforementioned Court, the word “solely” does not mean “predominant or principally,” but rather, “to the exclusion of all others.”

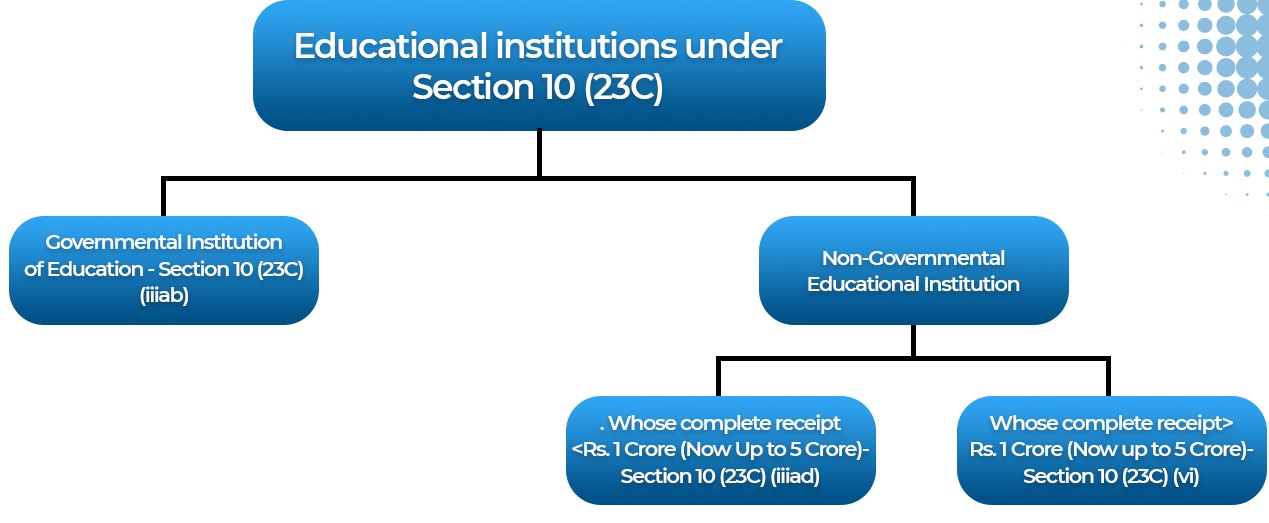

Exemption u/s 10(23C).

- University or educational institution or Charitable Trusts having multiple educational institutions having multiple educational institutions are facing many issues especially of exemptions u/s 10(23C)(iiiad) of the Income Tax Act, 1961

- According to Section 10(23C)(iiiad) of income tax act 1961, any university or educational institution or Charitable Trusts having multiple educational institutions that exists solely for educational purposes & not for profit shall be free from income tax on income received by such university or educational institution or Charitable Trusts if its aggregate total annual receipts do not exceed INR 5 Crore.

- It is prohibited from participating in any for-profit activity, meaning that such institutions are prohibited from having goals that are unconnected to the delivery of education or other educational activities. According to the aforementioned Court, the word “solely” does not mean “predominant or principally,” but rather, “to the exclusion of all others.”

Who can claim the submit 10(23C) exemption claim?

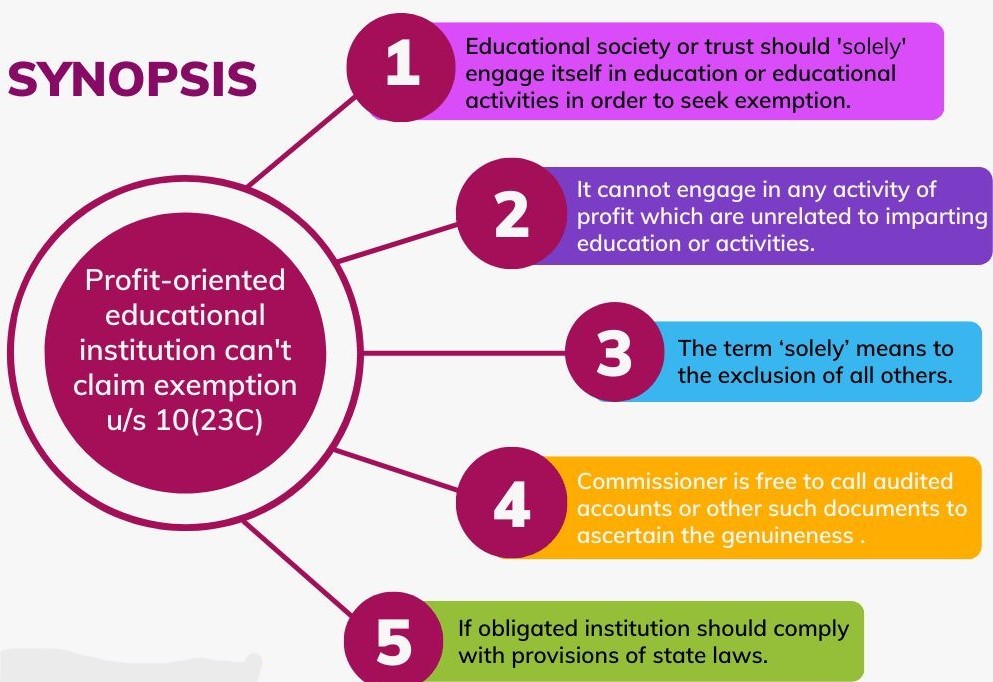

- Supreme Court of India in the matter of M/s New Noble Educational Society vs commissioner of Income Tax (Appeals) has held that trust or educational society should ‘solely’ engage itself in educational activities or education only in order to seek exemption u/s 10(23C).

- The Supreme Court has ruled that profit-oriented educational trusts cannot claim an income tax exemption; education must be the only goal. The Supreme Court ruled that educational trusts or societies should only be associated with education or activities related to education in order to be eligible for exemption under Section 10 (23C) of the Income Tax Act.

- Supreme Court of India in the matter of M/s New Noble Educational Society vs commissioner of Income Tax (Appeals) has held that trust or educational society should ‘solely’ engage itself in educational activities or education only in order to seek exemption u/s 10(23C).

- An institution may also be qualified for exemptions under Section if it complies with Sections 11, 12, and 13 and 10 (23C), As a result, the exemption is dependent on each of those conditions being satisfied.

The income tax authorities should pay attention to the Assessing Officers’ tendency to deny the exemption under Section 11 for particular reasons, even though the Inspector authorised by the Assessing Officers as per Section 10 (23C) certain guidelines are set out,

- Although the Assessing Officers may have a justification for doing so, there are a few requirements to be met in order to waive an exemption under section 10 (23C). The authorities will do well to address these problems while maintaining inspection guidelines.