GSTR-9C Optional Vs Compulsory Tables

Page Contents

Overview GSTR 9C Optional Vs Compulsory tables For in Financial Year 2021-22

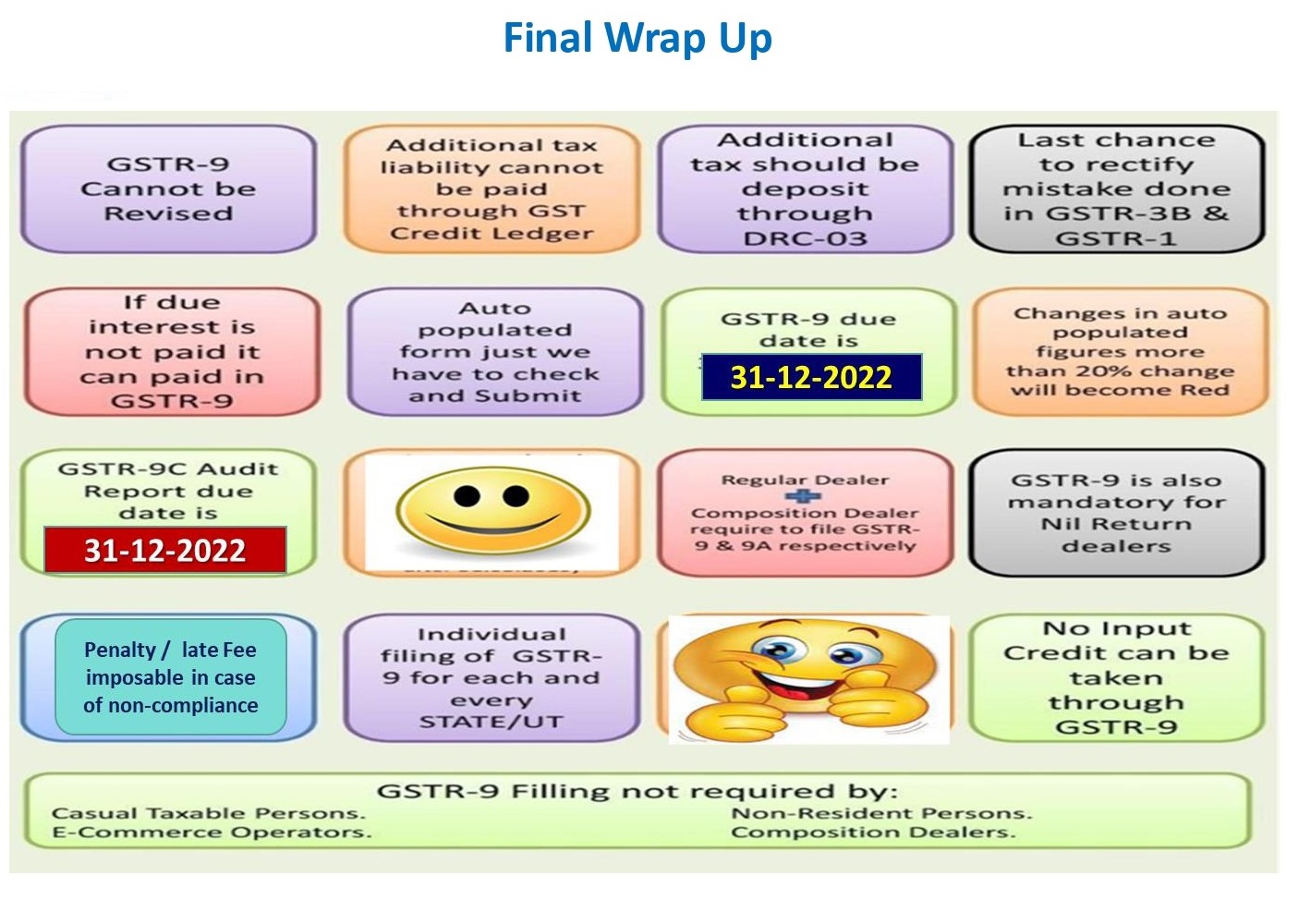

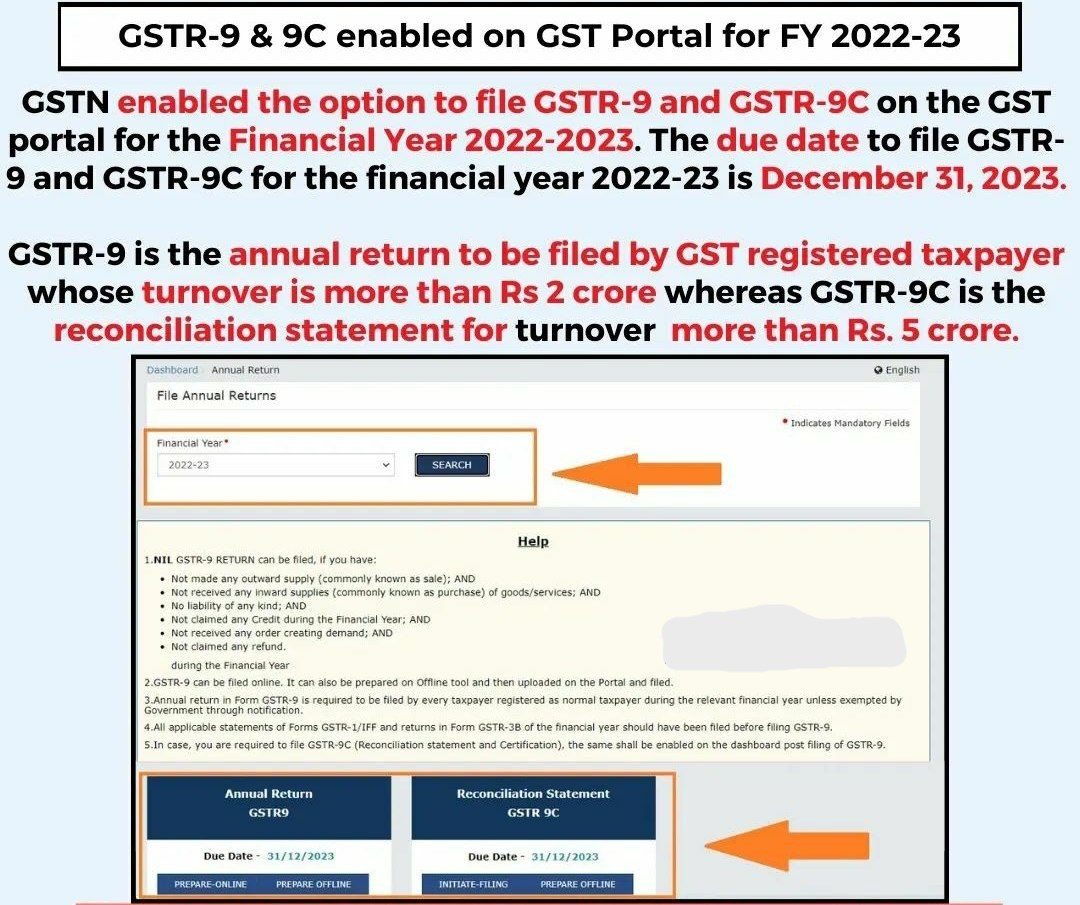

Overview on Goods & Services Tax Annual Return 9 & 9C

GSTR Annual Return : Applicability turnover

- INR 2 crores for GSTR-9

- INR 5 crores for GSTR-9C

- GSTR Annual Return : Due Dates : 31-12-2023 for both 9/9C

GSTR Annual Return : Late Fee

Turnover up to Rs.5 crore filing GSTR-9 after timeline date attracts a late fee of Rs. 50 per day (i.e., 25 under each Central Goods and Services Tax & State Goods and Services Tax act) subject to max cap 0.04% of turnover in state/UT (i.e., 0.02% each under Central Goods and Services Tax & State Goods and Services Tax Act).

- INR 5 crore to INR 20 Cr = INR 100 Per day

- Above INR 20 Cr = INR 200 Per day

GSTR Annual Return : Table 4 of GSTR-9

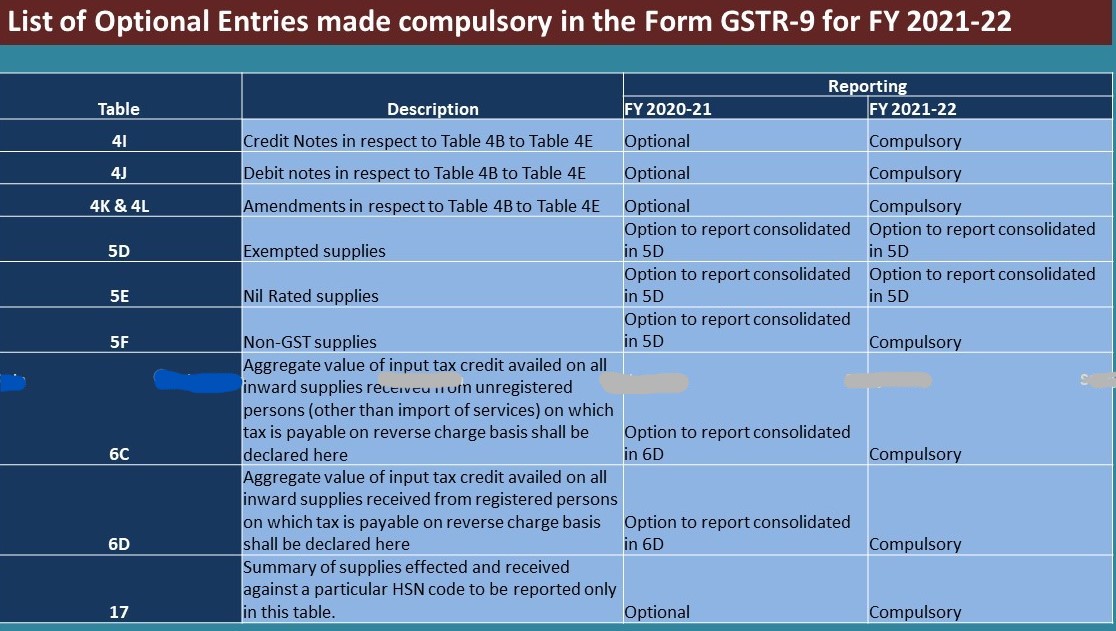

Table 4 – Amendments, credit notes & debit notes cannot be shown as net figures in B2B, B2C, etc. now. GSTR Annual Return Table 4I to 4L to be disclosed separately from FY 21-22.

GSTR Annual Return : Table 5D to Table 5F

The RP shall report Non-GST supply (5F) separately & shall have an option to either separately report his supplies as exempted & nil rated supply or report consolidated information for these two heads in the ^exempted row only.

GSTR Annual Return : Table 6B to Table 6E

Option to either report the breakup of inputs & input services or report the entire remaining amount under the “inputs” row only.

GSTR Annual Return : Table 6C & Table 6D

Option to either report Table 6C & Table 6D separately or report the consolidated details of GSTR Annual Return Table 6C & 6D in GSTR Annual Return Table 6D only.

GSTR Annual Return : Table 6E

The RP shall report the breakup of input tax credit as capital goods & have an option to either report the breakup of the remaining amount as inputs & input services or report the entire remaining amount under the “inputs” row only.

- This Post a List of firm or corporate in Form GSTR-9C (Reconciliation Statement under the Goods and services Tax) that were compulsory or optional in Financial Year 2021-2022.

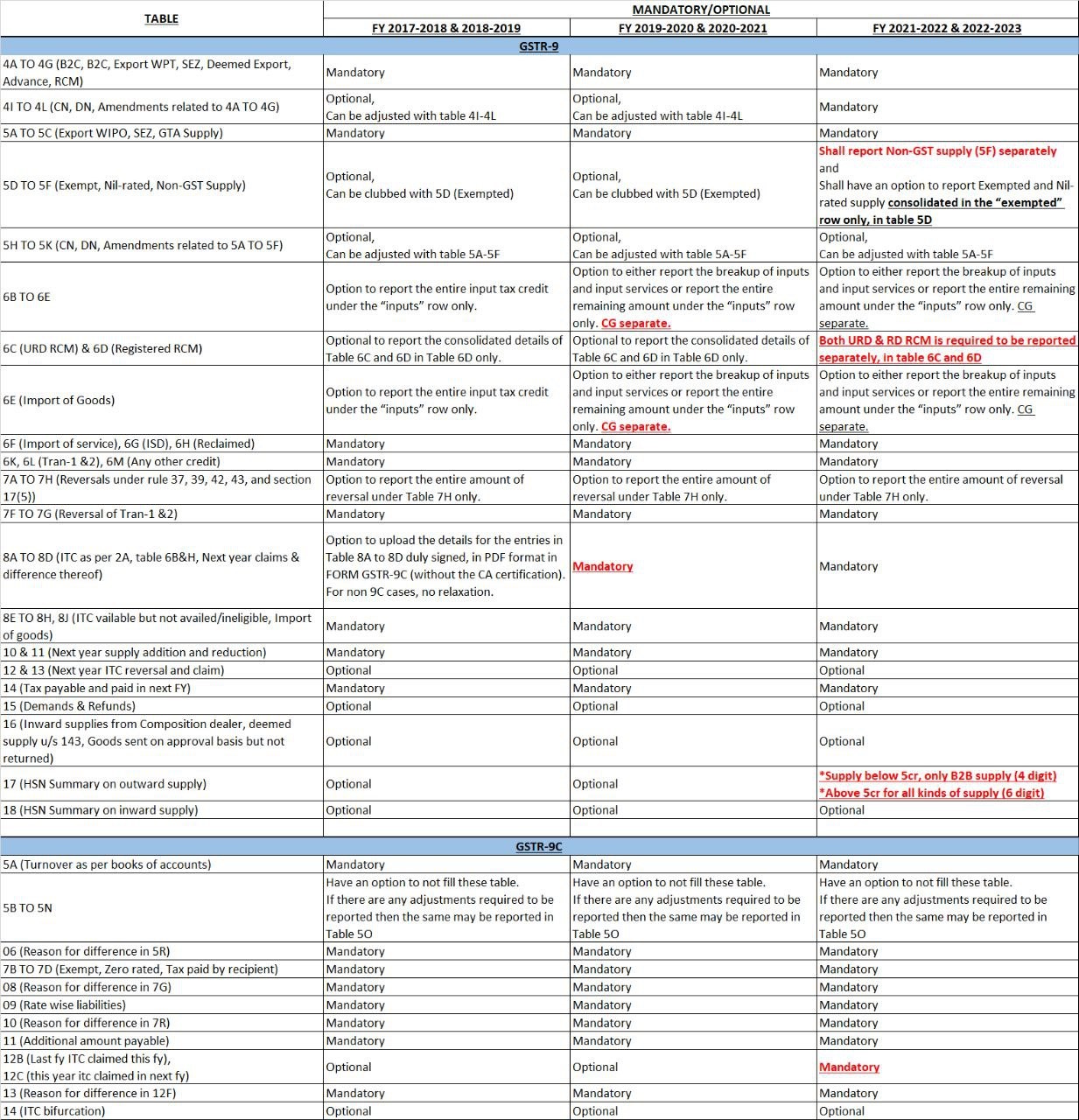

- For Financial Year 2017-2018, 2018-2019, 2019-2020, & Financial Year 2020-21 the GST Registered person shall have the option to fill Table 4B to Table 4E net of Credit Notes (Table 4I), debit notes (Table 4J), and Amendments (4K & 4L) in case there is any difficulty in reporting such details separately in this Table.

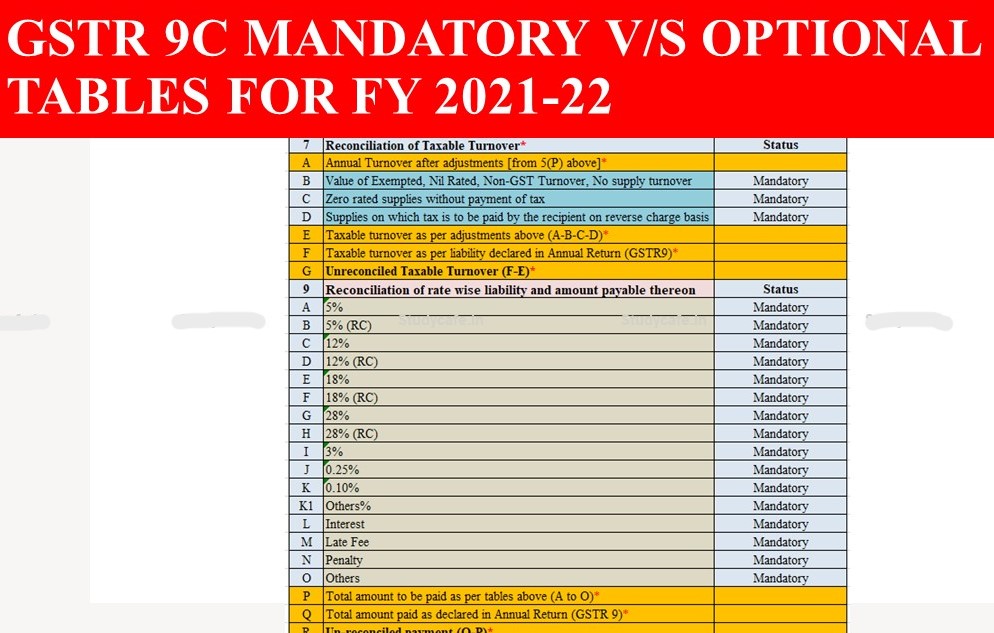

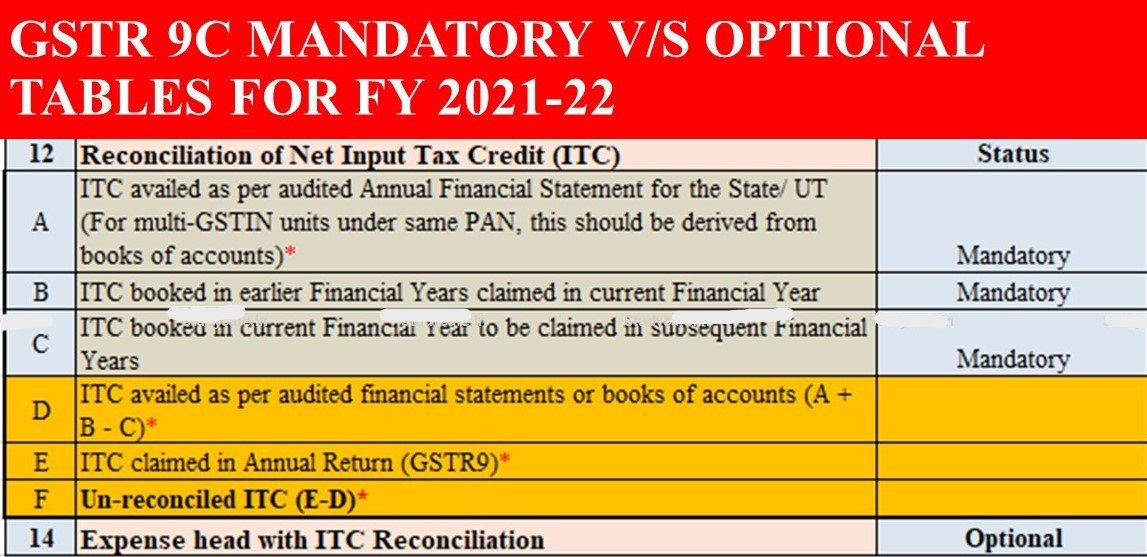

Summarized in below Table:

By comparing Data supplied in GSTR 9/9C & GSTR 3B, the govt has started sending out notices & issuing information requests.

- Along with this, this post is objective to clarify the filing of annual returns (Form GSTR 9) & reconciliation statements (Form GSTR 9C), as well as necessary reconciliations, best – practice, advanced issues & solutions, & tips as applicable for financial year (FY) 2021–22, taking into consideration the various changes to the GST law in recent times.

These Tables have been made compulsory for Financial Year 2021-22.

Annual Goods and services Tax return GSTR-9C can only be submitted after the filling of GSTR-9 is filed. all the GST taxpayers who have not yet paid GSTR Tax liability or have unclaimed Input tax credit pertaining for Financial Year 2021-22, Those still have option to amend or correct their claim Input tax credit & supplies by 30th Nov, 2022. (GST Notification No. 18/2022)

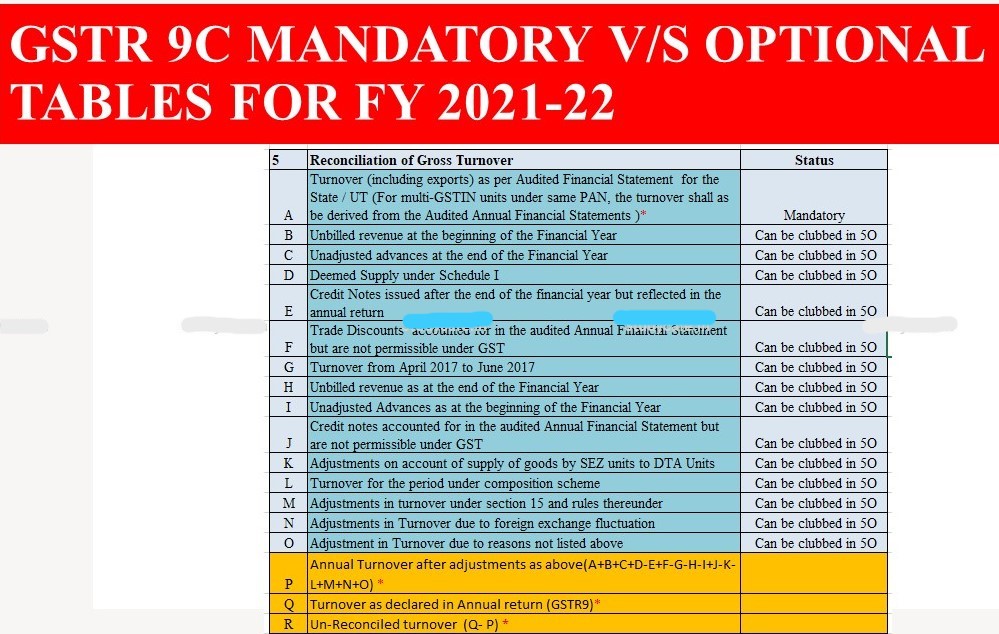

GST Reconciliation status of Gross GST Turnover

Reconciliation status of Taxable GST Turnover

GSTR Reconciliation status of Net ITC (Input Tax Credit)

Summary of of GSTR-9 & 9C Optional and mandatory tables, Since FY 2017-2018

- Relevant notifications –

56/2019 (14-11-2019)

79/2020 (15-10-2020)

30/2021 (30-07-2021)

14/2022 (05-07-2022)

38/2023 (04-08-2023)

Due date of annual return filling

- The due deadline has been Annual GSTR extended in the earlier periods, But this extension should not be expected this time, Due date will be in financial year 2021–22 i.e Due date: December 31, 2022.

Conclusion

The process of submitting Form GSTR 9 & 9C is now more essential because it is expected to include the final values (along with any required corrections of ITC and values of supplies ) for a Financial Year. This paper is also being examined by the GST Dept. Establishing procedures to ensure correct data gathering in GST return & GSTR Reporting is therefore crucial.

Rajput Jain and Associates is an established chartered accountant firm in India & have extensive expertise in the area of auditing, taxation, ROC, GST, and secretarial concerns, among others. RJA have expertise in GST and published various videos and post more than a thousand articles on subjects connected to auditing, GST & Taxation. you may in touch with email singh@carajput.com or call us on 9555 555 480