Post incorporation compliances of a company

Page Contents

How to do the Ease of doing Corporate Compliances for Small or Medium Businesses

Today’s challenge is to protect businesses from Fines and Penalties and it can be done so by having a system of ease of doing compliances under various Statutes. Failing to meet regular compliance requirements in a timely manner leads to having big consequences in the present or in the future.

Compliance for a business especially in the form of a medium/small company is not something to be undertaken lightly and requires both investment of time & efforts and significant knowledge of financial and regulatory technicalities.

Freedom to entrepreneurs from regulatory compliance turns the attention of Promoters and Directors to concentrate on their core areas; creates valuable time to look at other opportunities available in the environment.

It also prevents the businesses from enterprise risks such as losing investors’ confidence, bankers’ trust, business credibility, authorities outlook, and loyal associates including employees.

What are the actions that must be taken within the company by the directors and managers? The internal requirement must be documented as part of company records, though they are the most commonly overlooked.

Post incorporation compliances of a company under Companies Act, 2013

- Post-Incorporation Requirements for a Pvt Ltd. Company: Simply forming a corporation and launching a business is insufficient. Obtaining an incorporation certificate is only the first step in starting a business.

- There are a number of compliances that must be met following the company’s incorporation. There are both annual and quarterly compliance requirements.

- Once a contract is incorporated, a series of compliance-related formalities must be completed in order to remain in compliance with the Companies Act of 2013.

- Noncompliance may result in fines and penalties imposed on the Board of Directors and the Company. As a result, those incorporating a company must be aware of the company’s post-incorporation compliance requirements.

- This article examines the post-incorporation compliances that a company must meet, such as statutory register maintenance, share certificates, auditor appointment, bank account opening, and more.

- The Companies Act of 2013 and its related rules are the controlling law, which lays out the series of compliances that a private business must follow after its incorporation.

Benefits of a Company’s Post-Incorporation Compliances

- Protects against penalties and fines.

- Increases market standing.

- Improves credibility.

- Increases working transparency.

- Aids in the expansion of the business.

- It saves time and money.

- Makes the decision-making process more efficient.

Part I: Complying with the Companies Act of 2013.

Types of Compliances for Companies Under the Companies Act of 2013,

Companies’ compliances can be divided into the following categories:

- Post-incorporation compliances

- Annual compliance.

This article discusses the compliance requirements that must be followed by a company after its incorporation.

Checklist for a Private Limited Company’s Compliance:

Open a bank account, appoint an auditor, and issue a share certificate, for example. Every registered business must meet certain post-incorporation standards.

| S.No. | Type of compliance | Remarks |

| 1 | Opening Current Account | Mandatory – within 180 Days |

| 2 | First Board Meeting | Mandatory – within 30 Days |

| 3 | Deposit Share Capital in Bank | Mandatory – within 180 Days |

| 4 | Issue Share Certificate | Mandatory – within 30 Days |

| 5 | Registered address | Mandatory |

| 6 | Auditor Appointment | Mandatory – within 30 Days |

| 7 | Company Name Board | Mandatory |

| 8 | Print Letter Heads | Mandatory |

| 9 | Disclosure of Interest | Mandatory |

| 10 | Statutory Register | Mandatory |

| 11 | Declaration of Commencement of Business | Mandatory – within 180 Days |

| 12 | Books of Account | Mandatory |

| 13 | Shop Act Registration | Mandatory |

| 14 | GST Registration | Mandatory- Event Based |

| 15 | PT Registration | Mandatory |

| 16 | Trade Mark | Optional |

Companies Act of 2013 mandates post-incorporation compliance:

Verification of Registered Office Form–

After a company’s successful incorporation, it must submit a verification of its registered office with the registrar of companies. They can communicate this information via SPICe Form at the time of incorporation. If this is not done, the information must be communicated to INC-22 within 30 days after incorporation.

STATUTORY & LETTERHEAD REGISTERS

According to the Companies Act 2013, which goes into effect on April 1, 2014, letterheads and other letters must follow a specific format, and certain things must be mentioned.

- Company’s name.

- The location of its registered office.

- Company’s CIN (corporate identity number).

- Phone numbers are provided.

- Fax number, e-mail address

- Website, if any, should be included on all business letters, billheads, notices, letter papers, and other official publications.

- It is required to paint, affix, or print its name, registered office, and place of business on the outside of every office, as well as to have its name engraved in legible characters on its seal.

- The Registers should be maintained and updated throughout time and should be stored at the company’s registered office. Some of the Registers must be available for review by Directors, Members, and Creditors, as well as others.

- On payment of specific fees, a Company is required to furnish extracts from the Registers if requested by Directors, Members, and Creditors, as well as other people.

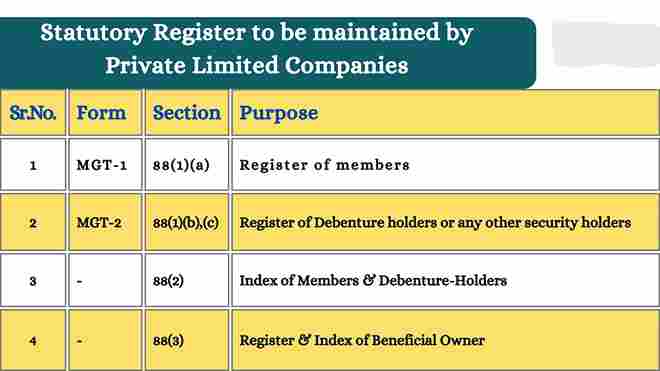

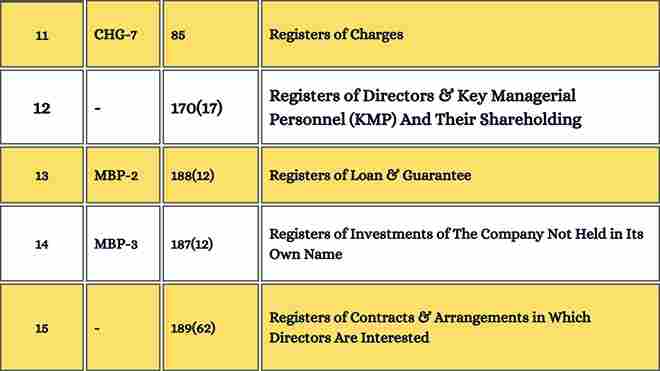

Types of registers that must be maintained in accordance with the Companies Act of 2013:

- MGT-1: Members’ Register.

- Form MGT-2: Debenture Holders’ Register and Beneficial Owners’ Index.

- MGT-3: Foreign Register of Members, Debenture Holders, Other Security Holders, and Beneficial Owners Residing Outside of India

- Form SH-2: Renewed and Duplicate Share Certificate Register

- ROC Form SH-3: Sweat Equity Shares Register

- Form SH-6: Employee Stock Option Register

- MCA Form SH-10: Shares or Securities Purchased Register of Directors and KMPs Register of Deposits

- Form CHG-7 Charges Register

- ROC Form MBP-2: Loan/Guarantee/Security/Acquisition by Company Register

- Form MBP-3: Register of Investments Not Held in the Company’s Own Name

- MCA Form MBP-4: Register of Contracts or Arrangements in which Directors have an interest

Open a company bank account:

After a company has been incorporated, it must open its current account with all transactions for which documents are requested as below:

- Memorandum and Articles of Association, and also a certificate of incorporation

- Board of Directors’ decision to open an account and the identification of those with authority to operate the account.

- The most recent list of Directors in accordance with the bank’s format.

- Proof of the company’s registered office address

- Identity proof for all Directors and Authorized Signatories PAN card for the Director

- Voter Identification Card

- Driver’s License

- The Unique Identification Authority of India issues Aadhaar cards (UIDAI).

- State/Central Government issues Senior Citizen Cards.

- A copy of the PAN allocation letter.

- The state or Central government issued identification card.

- License to Carry Arms

- Company’s share holding pattern in accordance with the bank’s format.

- Grants power of attorney to its managers, officers, or employees to transact business on its behalf (if applicable).

- a copy of the phone bill

Deposit the share capital money into a bank account-

- Within 60 days of its incorporation, the company is required to receive money from its memorandum subscribers and deposit it in a bank account.

- Once the funds have been deposited in the bank account, the company must complete an E-form INC 20 A declaration. A share certificate must be given regardless of whether the money has been deposited or not.

Note: Companies created after November 2, 2018 must file a declaration by the director with the Registrar of Companies within 180 days of the date of incorporation, declaring that each subscriber to the memorandum has paid the value of the shares taken by them.

ALLOCATION OF SECURITIES:

A Company must allot the shares to its subscribers within 60 days of the date of incorporation of the firm whose name is included in the articles of association and memorandum of association of the company, according to the Companies Act 2013.

THE SHARE CERTIFICATE WILL BE ISSUED IN 60 DAYS:

Share certificates are distributed to shareholders.

- A share certificate serves as proof of the amount of shares in a corporation that an individual owns. This certificate must be in the prescribed format, which is SH-10.

- It must also be appropriately stamped in accordance with state rules. A certificate of incorporation should be issued within 60 days of the date of incorporation.

- Any delay in its issuance will result in a penalty ranging from $25,000 to $500,000 in the case of a corporation, and from $10,000 to $100,000 in the case of an individual director. The following information must be included on the share certificate:

-

- Share certificate number,

- Name of the subscriber,

- Face value of the share,

- Number of shares purchased,

- Amount received,

- Type of share (equity or preference).

STAMP DUTY PAYMENT ON SHARE CERTIFICATE ISSUANCE:

According to the Indian Stamp Act of 1899, every instrument must bear a stamp duty of the appropriate amount, which must be paid to the appropriate department within 30 days of the date of issuing of share certificates (Revenue Department). It can be paid online using the SHCIL portal with the relevant attachments.

Read more about: Compliance for Foreign Subsidiary Companies in India

The corporation appoints the first auditors–

- Within 30 days of the company’s formation, it must appoint its first auditor, who must be a Chartered Accountant and must remain on the Board of Directors until the conclusion of the first Annual General Meeting.

- Board of Directors has the authority to recommend appointing a Statutory Auditor to serve from the end of the first Annual General Meeting until the end of the 6th Annual General Meeting.

- In the case of an appointment, the e-form ADT must be filed within 30 days of the appointment, albeit the filing of ADT-1 is not required for 1st Auditor.

APPLY FOR SHOPS AND ESTABLISHMENT ACT REGISTRATION:

- One of the few labour laws enacted and implemented by state governments in India is the Shop and Establishment Act. It is one of the most critical regulations that all businesses must follow.

- Shop and Establishment Act is intended to govern wages, working hours, leave, holidays, terms of service, and other work conditions for employees employed in shops and commercial establishments.

- The Delhi Shops Act, 1954 requires every establishment to be registered within 90 days after the start of business.

Directors' disclosure of interests—at the company's first board meeting, each director must disclose his or her interest. Every director must disclose his concern, interest, and shareholding in any corporation, firm, or association of individuals on form MBP-1. This information is crucial because it contributes to greater openness and the avoidance of related-party transactions.

REGISTRATIONS FOR GST/IEC:

- GST Registration- If your firm has annual revenue of more than Rs. 40 lakhs and provides services worth more than Rs. 20 lakhs, you must register for GST.

- Regardless of sales, anyone supplying goods or services to another state must register for GST.

Maintenance of the company’s minute book and other statutory books-

- The company is required to keep a variety of statutory registers, such as the register of members, the register of shareholders, and the register of directors, among others. In addition, the corporation keeps a record of the minutes of its general meetings and board meetings.

- Each book must be kept in a double entry system on an accrual basis. These books should present a true and fair picture of the company’s current condition of affairs. Rather than keeping physical books, a company can keep e-statutory books.

- However, in the case of dormant companies and one-person businesses, at least one meeting must be held in each half of the calendar year, with no more than 90 days between meetings. At the meeting, 1/3 percent of the entire number of directors or two directors, whichever is higher, should be present.

- Furthermore, due to the difficulties encountered as a result of the rise of COVID-19 and other requests received from stakeholders, the Board Meeting requirement has been extended by 60 days, resulting in a 180-day gap between two board meetings during the quarters of April to June 2021 and July to September 2021.

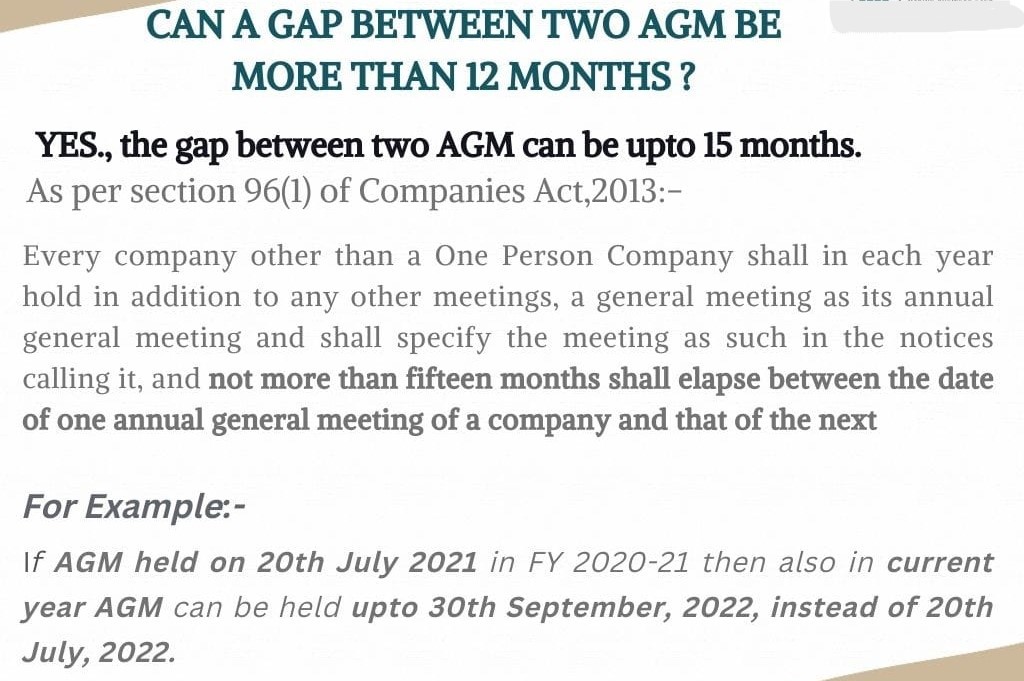

Annual General Meeting–

- The first Annual General Meeting should be held within 9 months of the end of the fiscal year, so an AGM in the year of incorporation is not required.

- Next Annual General Meeting should be conducted within 6 months of the conclusion of the financial year, with a maximum delay of 15 months between AGMs. Once a year, the AGM should be convened.

Analysis on Gap between two Annual General Meeting

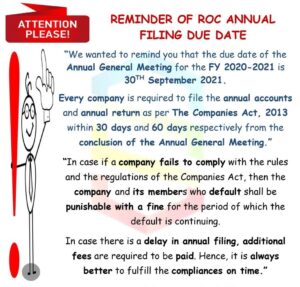

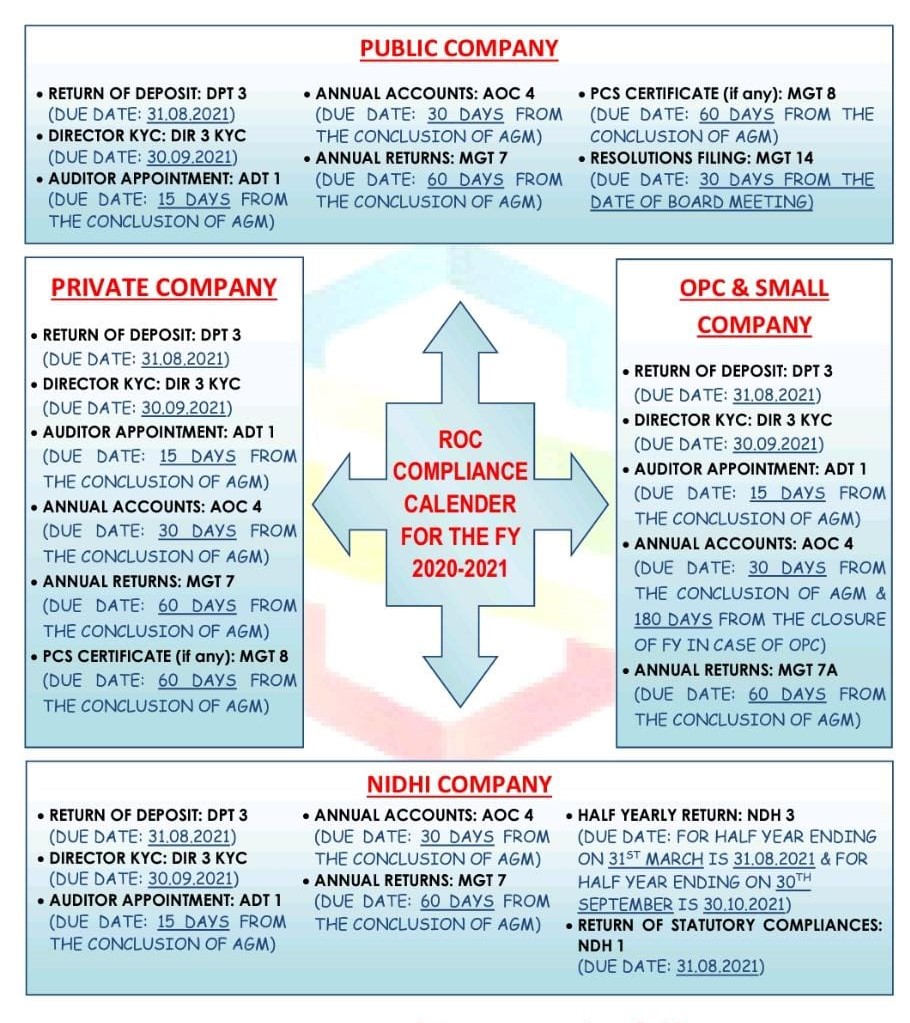

Annual Return to ROC-

This is an annual event that includes information on taxes paid, returns received, and any deductions claimed.

Such a return should be filed with the appropriate Registrar of Companies using the MCA portal (www.mca.gov.in) Non-filing may result in fines, penalties, and Income Tax department scrutiny. Even if the company does not make a profit, it must be filed. Companies with a paid-up share capital of ten crores or more, or a turnover of fifty crores or more, must be certified in practise by CS, and the certificate must be in Form No. MGT-8.

The Company is now required to file the Balance Sheet, Statement of Profit and Loss, and Cash Flow (if applicable), Directors Report, and other papers approved by the Members at the Annual General Meeting in the following forms within the time specified: –

-

E-Form ADT-1 (Appointment of Auditor):To appoint an auditor within 15 days of the Annual General Meeting. • E-Form AOC-4 (Filing of Financial Statements)–Within 30 days of the Annual General Meeting. The type of AOC-4 that is applicable varies; for example, if you have a subsidiary, you must file an AOC-4 CFS, and so on.

-

E-Form MGT-7 (Annual return)-to be filed within 60 days of the date of the Annual General Meeting, stating the list of Members as of the end of the financial year, as well as the list of share transfer list of Members and other information.

Part II: GST Act Observances.

Registration for GST:

In India, companies must register under the GST Act, or Goods and Services Tax Act. The government will issue a GSTIN to be used in future correspondences regarding the company’s business.

Returns must be filed:

The Company is required to file periodical (monthly and annually) returns as prescribed by the government on the prescribed due dates to provide detail regarding the sale and purchase of goods and services, as well as to claim input credit.

Part III: FEMA, RBI/FDI Reporting Compliances.

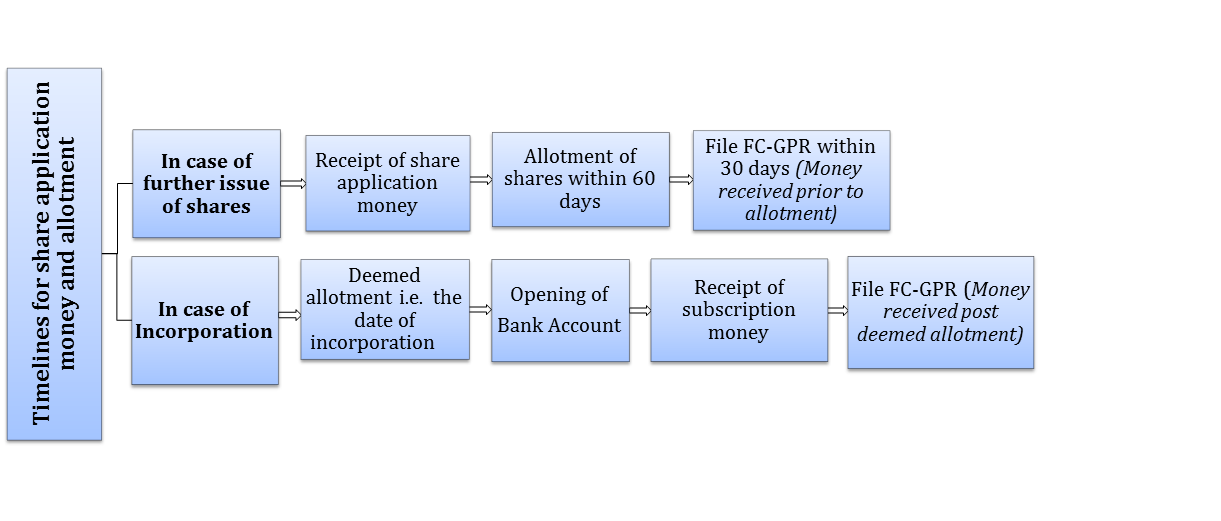

- Form FC-GPR must be completed on FIRMS, RBI Portal within 30 days of the date of allotment of subscription money. In order to report the FDI, the company must first register as an Entity User and a Business User on the FIRMS, RBI Portal.

- Annual Return of Assets and Liabilities (“FLA Return”) in respect of FDI must be filed on the RBI’s FLAIR portal by the 15th of July each year, and the company must register on the FLAIR portal to file the FLA Return.

Note: If the Company’s memorandums of association’s subscribers are foreign nationals, or the Company has received funds from a country other than India, the FDI Reporting under the FEMA Regulations, 1999, must be followed.

Part IV: DGFT Compliances (Director General of Foreign Trade)

- Import Export Code (“IEC”) application.

- Modification application in IEC.

- The company is required to notify the department of any changes in the information provided at the time of applying for the IEC in order for the IEC to be modified.

COMPLIANCES ON A Annual BASIS:

- A minimum of four board meetings, with a maximum of 120 days between two consecutive board meetings.

- Accounts must be audited by law.

- Annual Return Filing (form mgt-7).

- Submission of financial statements (form aoc-4).

- Organizing an annual general meeting.

- Preparation of the director’s report

FILINGS BASED ON OTHER EVENTS

A change in the Company’s authorized or paid-up capital.

- The issuance of new shares or the transfer of existing shares.

- Making loans to other businesses.

- Providing executives with loans.

- Appointment and remuneration of a managing or full-time director.

- Directors’ loans.

- Changes in bank account signatories or the opening or shutting of bank accounts.

- Appointment or removal of the Company’s statutory auditors.

- Change in the Company’s Registered Office (Inc-22)

- Changes in the Company’s Board of Directors (DIR-12).

- The Company’s auditor has changed (ADT-1).

- The Company’s goal has shifted.

- A change in the company’s name.

Also Read about: Summary of New MCA official updates under the Company Act 2013

Statutory register for private limited company

NON-COMPLIANCE:

If a company fails to comply with the Companies Act’s rules and regulations of the company, as well as every officer who is in default, will be fined for the duration of the failure.

If there is a delay in any filing, additional fees must be paid, which increase as the time period of non-compliance increases. It should be noted that some Annual Filing Forms can be revised, but the fees for subsequently revised filings will be charged as if it were a new filing.

In the event of non-compliance: If you do not follow the Post-incorporation compliance requirements, you will: • Face penalties and fines.

- Credit is difficult to come by.

- Dissatisfied shareholders

- Limits the scope of the firm

- Purposive sampling method effective operation

Conclusion:

- The compliances covered in this article, as per the Companies Act, 2013, are critical for every company incorporated in India.

- In order to prevent monetary and non-monetary fines, Private Limited Company Post-Incorporation Compliance is the most important and basic need from a compliance standpoint.

For any information/queries, you can contact us. Our team of experts can provide all the assistance related to Post Company Incorporate. For Contact:

Website- Click here

Email id- singh@carajput.com

Popular Blog:-

Summary of New MCA official updates under the Company Act 20

New Online filing eForm DIR-3 KYC Directors

Key Highlights of RACP Bill, 2020 and Companies (Amendment) Bill,2020