Online file income tax returns

Page Contents

ONLINE FILE INCOME TAX RETURNS

After the introduction of Online Filing Income tax returns by the income tax department, it becomes very easy and simple task to file income tax returns online.

We would like to provide few simple steps to File Income Tax Returns Online.

- Identify the sources of income

- Collect all documents to prepare tax returns

- Register in easyitfiling.com to start your income tax returns filing

- Choose Sources of income, Tax Payments, Savings options applicable

- Review Total Income & Tax payable

- Enter Bank details for Refund

- Confirm Income Tax Filing

- A Identify the Sources of Income:-Based on the source of income, we can categorize income against the various heads u/s Income-tax Act.

- Income from Salary / Pension

- In Income from Business/Profession

- Income from House Property / Housing Loan ( Loss from Housing loan)

- The Income from Capital Gains

- Income from Other Sources

- Collect all documents to Prepare Income Tax Returns:-Collect all the documents that support your sources of income, Tax Payments, Savings Certificates and Tax Deducted Certificates.

- Income Exempt from Income tax

Income from Salary

- Form 16 (Provided by Employer)

- A Form 12 BA (Provided by Employer)

- Income from Business/Profession

- Balance sheet

- TDS (Tax Deducted at Source) Certificates

- Advance tax challans

- Bills/vouchers

Income from House Property

- Tenants Details

- TDS certificate Gross rent received

- Advance tax challan

Income from Capital Gains

- Contract notes

- Advance tax challans

- Sale/purchase documents of moveable/immovable assets

Income from Other Sources

- All documents related to income

- TDS certificates

- Advance tax paid

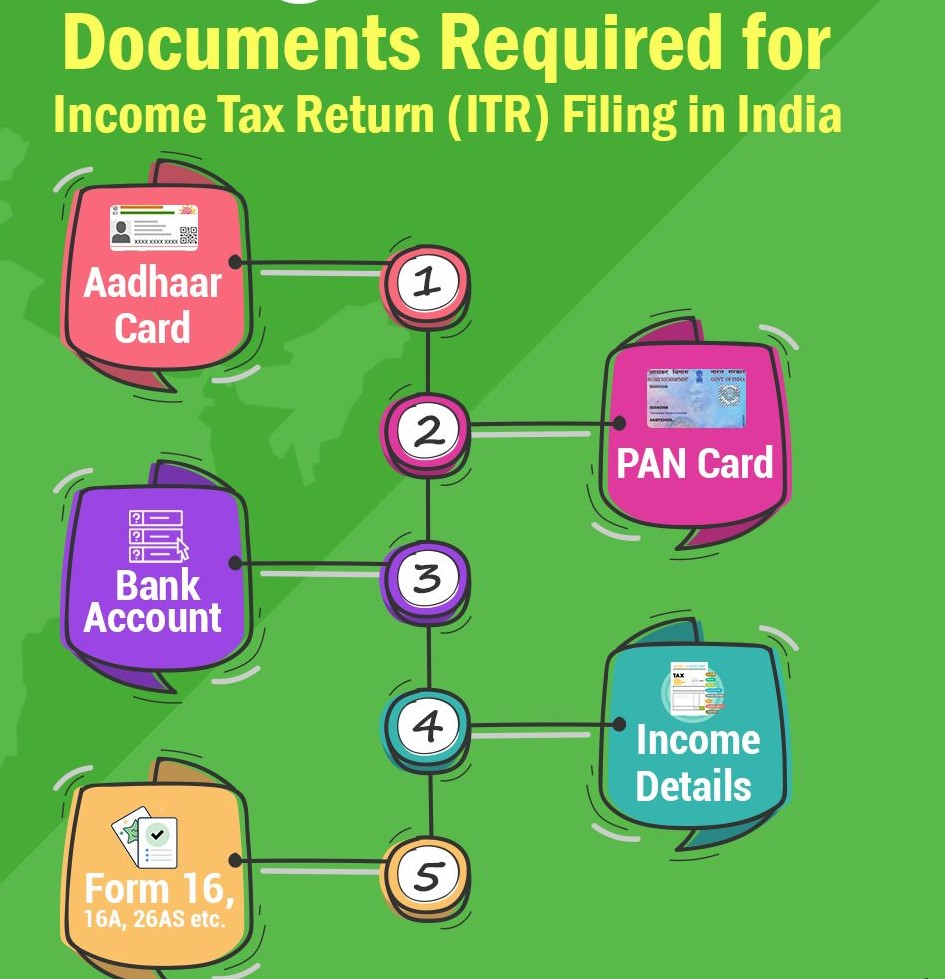

What are the Document Required Income Tax Filling?:

- While it depends on your income sources, it’s as easy as your Form-16 for the most part. Please check the list below to achieve maximum deductions and consistency!

- Copy of the last year’s tax return > to report any losses and other details.

- Your bank statements > refer the interest paid to your loans, balances, etc.

- TDS certificates > to include taxes already paid to the IT department.

- Your Savings Certificates/Deductions/Gifts > to include deductions.

- People with disabilities Certificates in your family > to include deductions

- An interest statement showing the interest paid to you. > Possibly from the bank and/or the postal office.

- If you have Business income/loss, have BS, P &L A/c, Bank Account statements, & other requisite Tax Audit Reports.

What are Advantages of filing income tax ? :

In recent decades, low-income tax filing compliance in India has been observed, and in recent years, the Government of India has taken strict measures to enforce the Income Tax Act by linking various benefits to prompt tax filers. Benefits of tax filing, including but not constrained to:

- Get your loans easier

- Avoid paying penalties, embarrassment,

- Get your refund on excess tax payments

- Free hurdle for foreign VISA Stamping with IT returns filing

- Enhance your creditworthiness with future loans

- Be a responsible citizen to support the growth of India and to make peace of mind for you as well as your family.

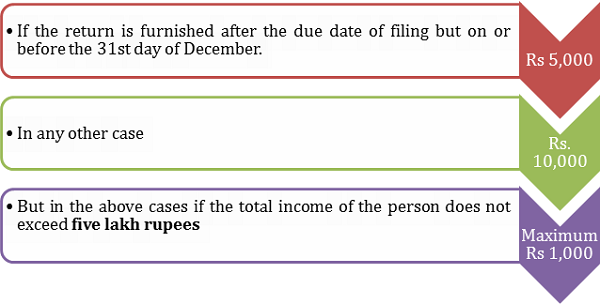

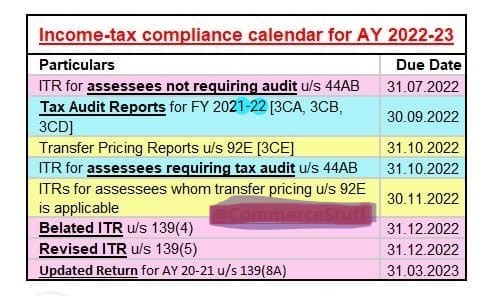

What is the Last date of filling of ITR For AY 2022-23?

For query or help, contact: singh@carajput.com or call at 9555-555-480

Popular Blogs :

Prevent popular errors while filing an income tax return

Needed to file Income Tax return of Bitcoin profit earned