Tax Dept issuing Notice to those making false claims for HRA

Page Contents

Taxpayers who falsely claimed for a HRA allowance received income tax notices.

Income Tax Notices: By sending notices, the Income Tax Department is pursuing hundreds of individuals who have claimed housing allowance. Some individuals also receive heavy penalties as punishment. The action plan has started to be carried out by the income tax department in New Delhi. Throughout the previous income tax system, the Central Board of Direct Taxes provided a number of tax-saving options. In compliance with Income Tax Section 10(13A), the Income Tax Department provides tax benefits on housing expenses to members of the salaried class.

Renting a house is also a better alternative under this regime for tax savings. For this in February or March, you have to give your employer a receipt for the house rent. In addition, individuals who work also generate more paperwork.

Instead of asking the landlord for a receipt, it is most frequently observed that individuals fabricate fake house rent receipts on their own and give them to their employer. Taxpayers are now being requested to provide documents.

Income Tax Dept use specialised software to stop HRA kind of fraud

Tax Department use specialised software to stop this form of fraud. This specialised software makes it easy to spot false documents that taxpayers have filed. According to recent sources, the Income Tax Department is sending letters to these individuals. They must supply supporting paperwork for requests of tax exemptions. The department is thoroughly examining these records. The Income Tax Dept is taking strict action against falsified documents.

The Income tax dept is on the lookout for fake documents such as rent receipts, receipts for hiring people to do official duties, and receipts for interest paid on mortgages. These notices, which relate to the assessment year 2022–2023, are being sent in compliance with Section 133(6) of the IT Act. The assessing officer is authorised by law to request particular information regarding transactions made during a designated time period.

Simultaneously, the Income Tax Department has discovered another type of fraud, wherein homeowners are submitting house rent slips in order to claim tax exemptions. These people have been discovered by the Income Tax Department’s computer data check, and notices are now being prepared to be delivered to them.

According to the Central Board of Direct Taxes is a part of Department of Revenue in the Ministry of Finance. Making Action Plan, field officers are using technology to increase the revenue base.

The potential for large tax savings is the main defence for rent-related fraud. You would not be required to pay direct tax on the amount of Rs 2.40 lakh (Rs 20,000 per month) that you have placed your home for rent. Furthermore, if your company is providing you with a minimum dwelling rent allowance of Rs. 2.40 lakh.

FAQ on House Rent Allowance :

Question: What are the conditions and limit for HRA Exemptions under the head salary ?

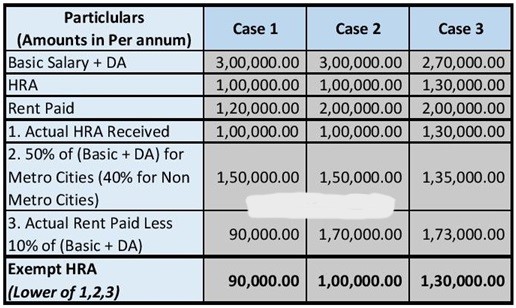

Ans : HRA Deduction available is the least of the following amounts:

- Actual House Rent Allowance received

- 50% of [basic salary + Dearness allowance] for those living in metro cities (Mumbai, Delhi, Kolkata or Chennai)

- 40% of [basic salary + Dearness allowance] for those living in non-metros

- Actual rent paid (-) 10% of basic salary + Dearness allowance

Example of House Rent Allowance

Question: if a person is paying home loan in one city and also paying rent in another city (his job location) can claim all these 3 deduction under income tax?

- Principal repayment under section 80C

- Interest paid under 24(b) and

- HRA under section 10(13A)

Ans: Yes taxpayer can do that But subject to fulfilling few conditions under section 80C ,interest paid under 24(b) and HRA u/s 10(13A).

Question: What is the punishment for creating a fake HRA claim ?

Ans: If an employee provides fake reimbursement bills to reduce their tax liabilities, that is considered income concealing. In this case, the income tax officer, or assessment officer, may open an investigation. The taxpayer then has to provide proof that the bills are legitimate.

If fraudulent bills are found, penalties will be imposed. Underreporting income is punishable by up to a 50% fine under Section 270A (1). A person who knowingly submits fake bills and gives misleading information about their income may face a fine of up to Rs 200.

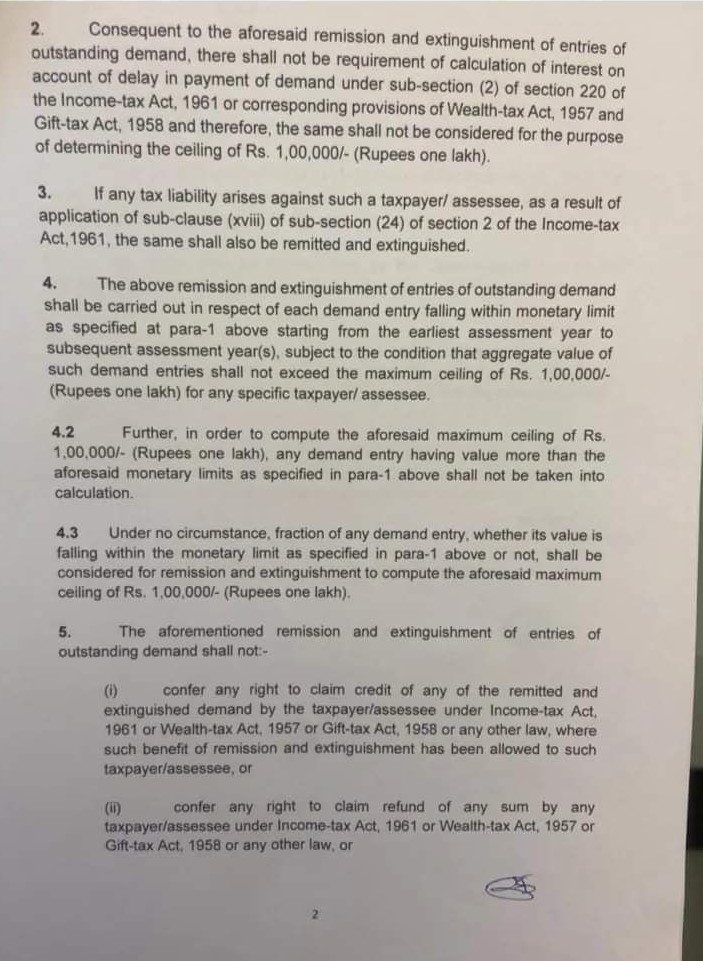

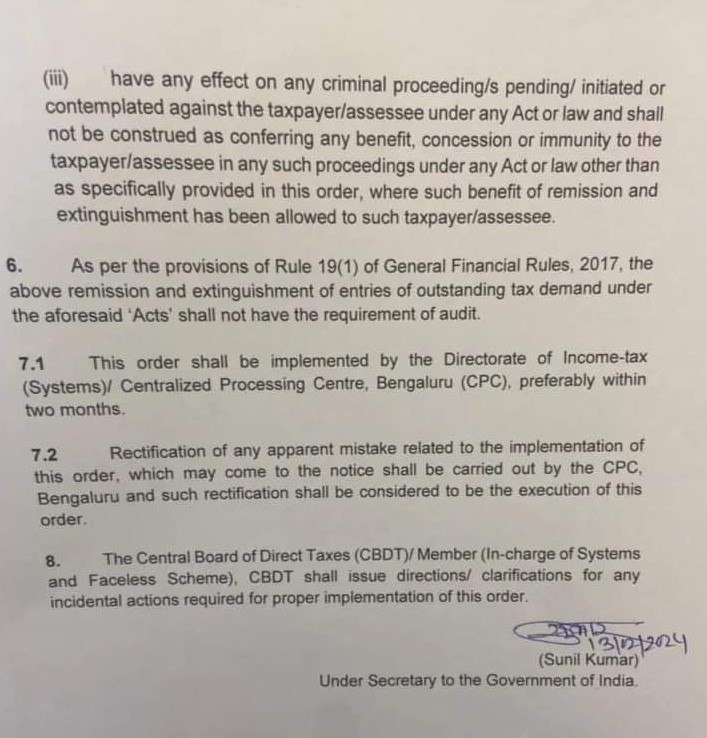

CBDT waive-off Income Tax Demands

More read for related blogs are:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

For query or help, contact: singh@carajput.com or call at 9555555480