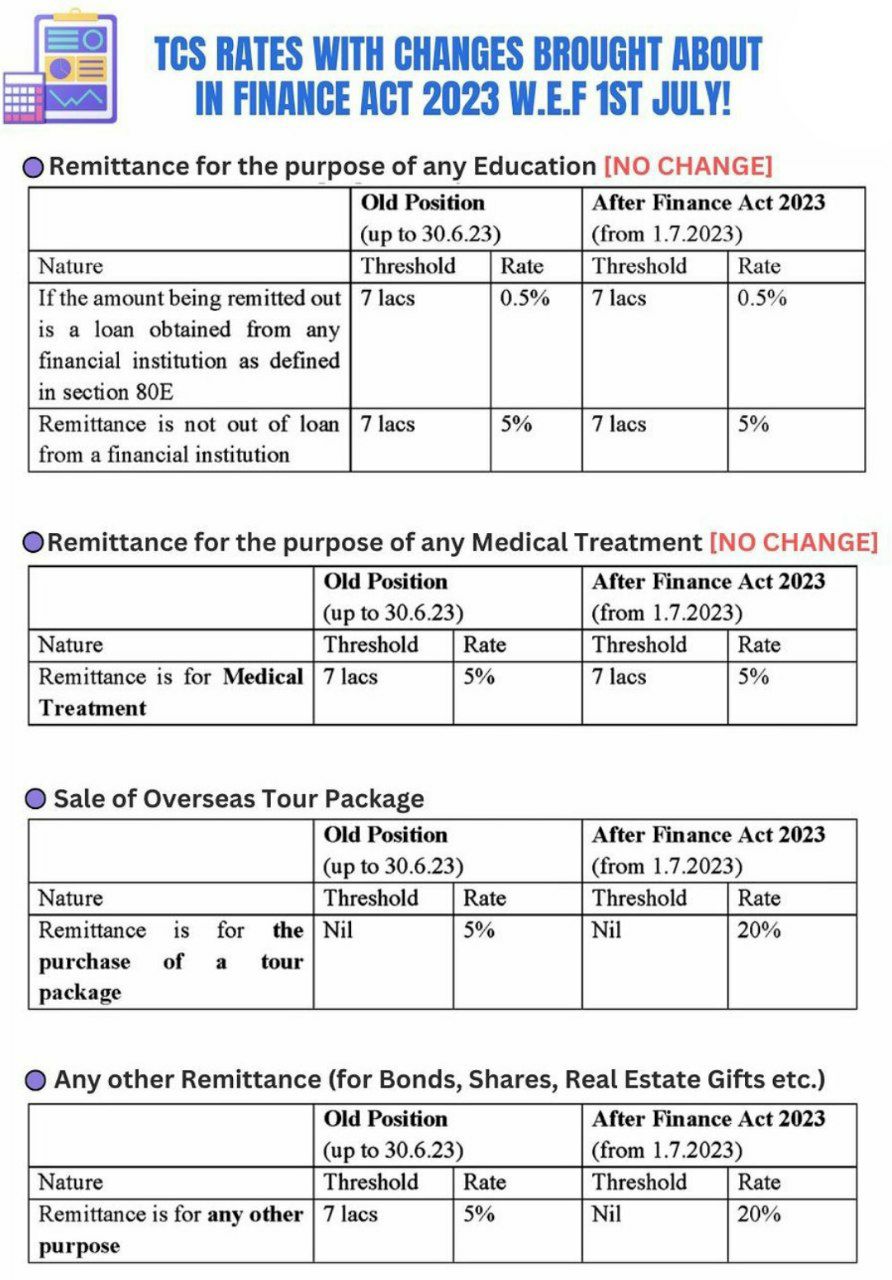

New TCS Rate Change w.f.t. 1 July 2023

Page Contents

New TCS Rate Change w.f.t. 1 July 2023

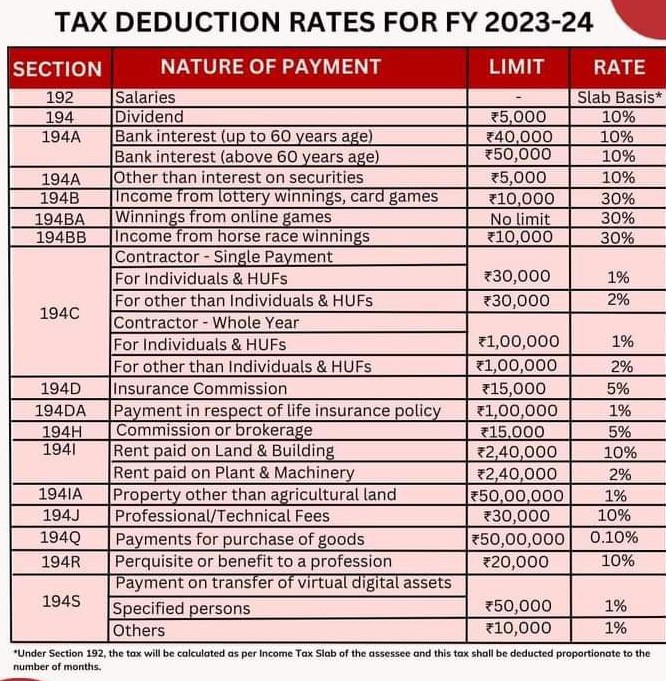

TDS Rate For The FY 2023-24

Overview of Tax Deducted at Source (TDS) Forms

TDS Certificate Form

| Sr. No | Form Number | Description |

| 1. | FORM- 16 | TDS Certificate of Salary |

| 2. | FORM- 16 A | TDS Certificate for Income other than Salary |

| 3. | FORM- 24Q | Quarterly statement of deduction of tax under sub-section(3) of section 200 of income tax act in respect of salary |

| 4. | FORM- 26Q | Quarterly statement of deduction of tax under sub-section(3) of section 200 of income tax act in respect of payments other than salary |

| 5. | FORM- 27Q | Quarterly statement of deduction of tax under sub-section(3) of section 200 of income tax act in respect of payments other than salary made to non-residents |

TDS Return Forms

| Sr. No | Form Name | Description |

| 1. | TDS Return Form 24Q | Statement for tax deducted at source from salaries |

| 2. | TDS Return Form 26Q | Statement for tax deducted at source on all payments other than salaries. |

| 3. | TDS Return Form 27Q | Statement for tax deduction on income received from interest, dividends, or any other sum payable to non residents. |

| 4. | TDS Return Form 27EQ | Statement of collection of tax at source. |

| 5. | TDS Return Form 27A | Form 27A is a control chart of quarterly TDS/TCS statements to be filed by deductors/collectors along with quarterly statements |

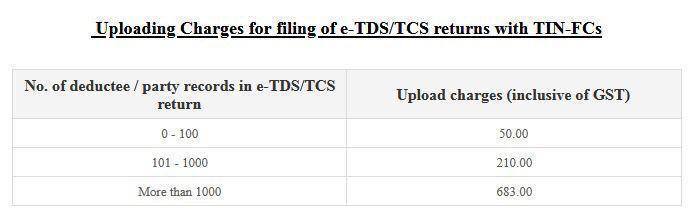

TIN Facilitation Center managed by NSDL used to charge the Fee for TDS and TDS return Filling:

TDS and TCS Punishment On Non compliance

You will have to pay a fine equal to the amount deducted/collected under the provisions of the Income Tax Act.

Prosecution (Sec 276B)

As per the prosecution (Sec 276B), if a person refuses to pay the payment to the Central Government, the TDS deducted by him under the provisions of Chapter XVII-B shall be entitled to obtain a strict penalty of at least three months, which may be expanded to seven years. The fine depends on the conditions or inquiry conducted by the appointed tax authority/assessment officer.

Penalty (Section 234E)

The deductee of the TDS shall be liable to pay a fine of INR 200/-per day before the full sum of the TDS is paid. However, the penalty shall not exceed the actual amount of the TDS.

Late Filing Fees :

For the delayed fee of TDS after deduction under Section 201(1A), you have to pay interest at a rate of 1.5 percent per month from the date of the deduction to the actual date of the deposit. It should also be remembered that interest is measured on a monthly basis rather than on a number of days. Half of a month will also be regarded as a whole month.

What is important to remember here is that

The estimation of interest on the balance of the TDS owed starts on the day from which the TDS was withheld rather than the day from which it was due.

PENALTIES (Section 271H)

Pursuant to this rule, the Assessing Officer may direct a person who has not filed a TDS payment on time with a minimum of INR 10,000, which may even be extended to INR 1,000,000.

No penalty will be levied for late payment of TDS / TCS returns:

If the following conditions are met, no penalty will be levied (under section 271H) for late payment of TDS / TCS returns:

-

- The tax deducted at the source must be paid to the credit of the government.

- No penalty will be levied if interest and late filing fees are paid to the Government’s credit.

- Before the one-year period expires, the TDS / TCS return has been filed from the due date.

TDS for the purchase of immovable property

-

- For the purchase of immovable property on which TDS applies, the return, together with the payment of TDS, must be made before the 30th of the following month. For example, TDS for property purchased in May must be deposited by 30 June.