30% additional deduction on New Payroll expenses allowed

Page Contents

New Income Tax Scheme 30 percent additional deduction on New Payroll expenses for certain assesses: Section 80JJAA

- In order to encourage job generation in India, the Government enacted Section 80JJAA under Chapter VIA of the Income Tax Act, 1961 which provides for deductions for the employment of new workers.

- It shall refer to any assessee, who has company income & who is liable for audit pursuant to section 44AB of the Income Tax Act 1961.

- The rule is useful to newly formed start-ups and companies.

- Assessee will not be given a deduction if the business is established by changing the existing business or if the business is bought from another entity.

- The assessee will be excluded if he opts for a new tax regime or an existing tax regime of 115BAC from the previous year 2020-21.

How it is will get an extra 30% deduction from payroll payments for companies section 80JJAA?

- Here’s a peek at who will gain from Section 80JJAA under the current income tax regime:Only two types of deductions are available under the new tax regime for fiscal year 2020-21. The first concerns the employer’s contribution to the employee’s National Pension System (NPS) account and the second concerns Section 80 JJAA.

- Section 80JJAA shall extend from AY 2017-18. This provision provides for deductions for extra payroll expenses for new hires under Chapter VI-A of the Income Tax Act.

- The deduction may be reported by assesses who have started a new company, employed new staff and their tax records need to be audited.

Quantum of deductions under this Section 80JJAA

- The assessee shall earn a discount of 30 percent of the increased staff costs for three successive years from the year in which the assessee continues to incur additional staff costs.

- To order to assert the benefit, the assessee is required to file Form 10DA. Form 10DA is to be submitted by the Practicing Chartered Accountant on behalf of the assessee on the Income Tax e Filing Portal before or at the time of filing the income tax return.

What would you mean by extra personnel costs?

- Additional employee cost means total emolument/ salary/ wages paid or payable to additional employees during the previous year.

- In the case of new business additional employee cost shall be emolument paid or payable to employees employed during that period.

Section 80jjaa Condition

Conditions for alleging deduction under Section 80JJAA in the ITR

Assessee shall comply with the following requirements for demanding deductions under Section 80 of the JJAA:

- The assessee shall have profits from Company End and shall be required to have his / her account audited in compliance with Section 44AB along with the Chartered Accountants Report in income tax Form 10 DA.

- Assessee will be not built by breaking up or restoring an existing business.

- Company business should not be acquired via a transfer from any other person.

- The exclusion under Section 80JJAA must be stated in the income tax return.

Note:

- In the case of an existing commercial enterprise, no deduction shall be allowed unless there is a change in the number of employees.

- For example, the total number of employees as of 31/03/2019 was 100, and, in the previous year, 2019-20, 15 workers left the job and 15 new workers Attached there will be no deduction under this section.

- If 20 new workers have entered in the example specified, the deduction would be provided on the emolument charged to five employees.

- The salary is paid in cash, the assessee shall not be liable for the deduction under Section 80JJAA.

-

Additional staff do not include-

(a) The worker whose emolument/salary is more than Rs. 25.000 a month;

(b) An employee working for less than 240 days in the intervening year (in the case of the manufacture of garments or boots or leather goods working for less than 150 days in the PY)

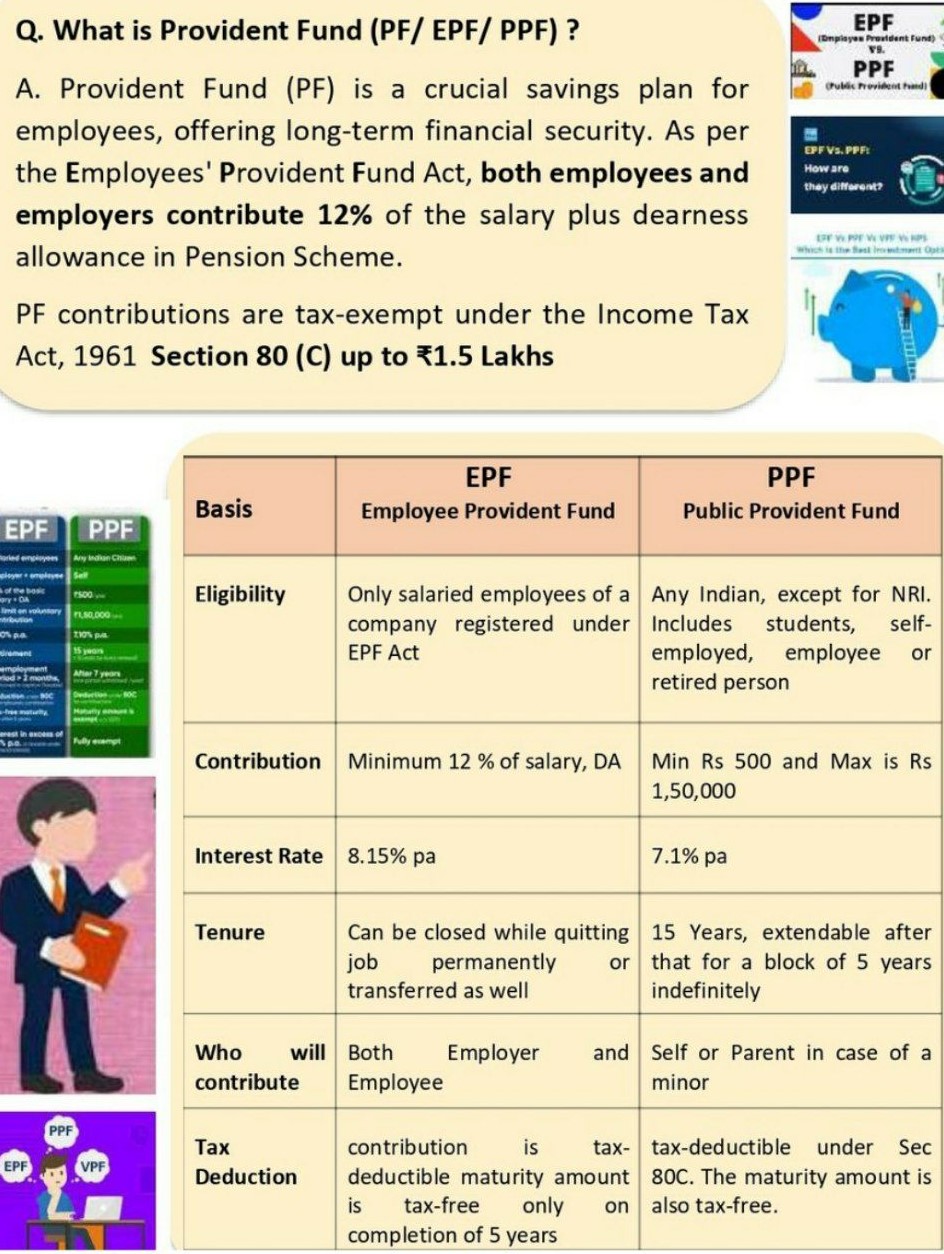

(c) Workers do not invest in the Approved Provident Fund;

(d) The Worker for whom the whole fee is paid by the government under the Workers pension scheme notified in compliance with the law of the employees’ provident fund & miscellaneous provision act, 1952.

(e) As provided for in the Financial Act 2018, if an employee is working for less than 240 days or 150 days in the preceding year in the case of the manufacture of garments or footwear or leather goods but is working for more than 240 days or 150 days in the subsequent year, he shall be considered to have been employed in the subsequent year.

Consequently, the contractor will be able to subtract 30 percent of the increased payroll expenses of those workers in the next year.

Popular blog:-