MSME delay payment Provision u/s 43B(h): Deferred Deduction

Page Contents

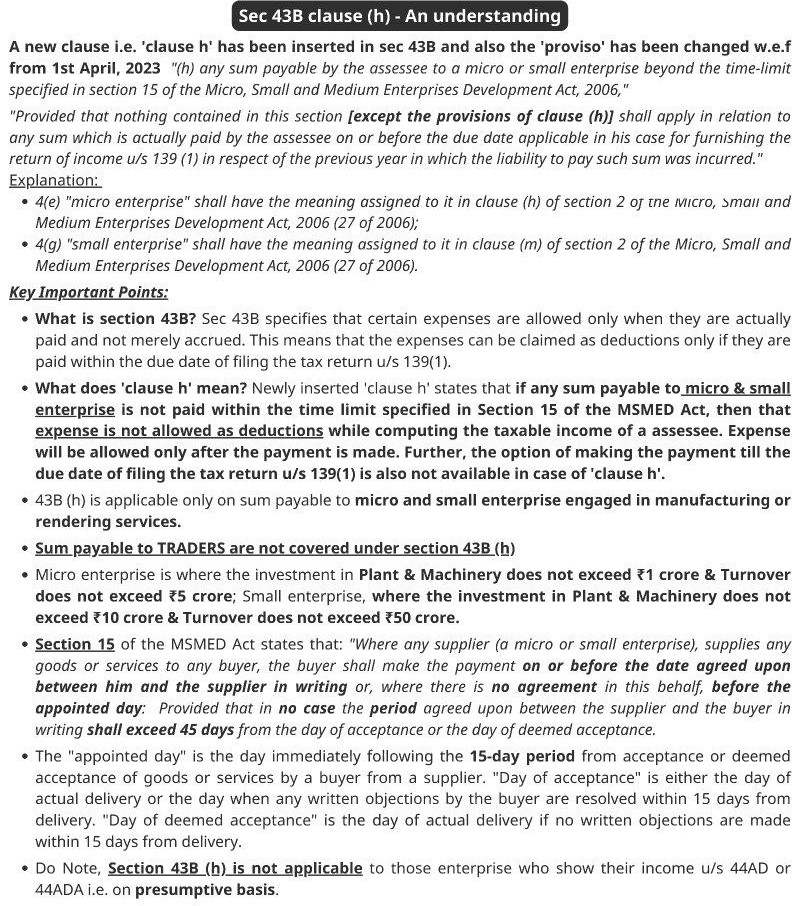

Legal Provision of Section 43B(h) of the Income Tax law.

What is come under the definition of Small Enterprises?

Business Enterprise which is completed all below conditions.

(a) Sale/ Turnover should not more than INR 50,00,00,000/-

(b) Investment is P&M Should not exceed INR 10,00,00,000/-

What is come under the definition of Micro Enterprises?

Business Enterprise which is completed all below conditions.

(a) Investment is P&M Should not more than INR 1,00,00,000/-

(b) Sale/ Turnover should not more than INR 5,00,00,000/-

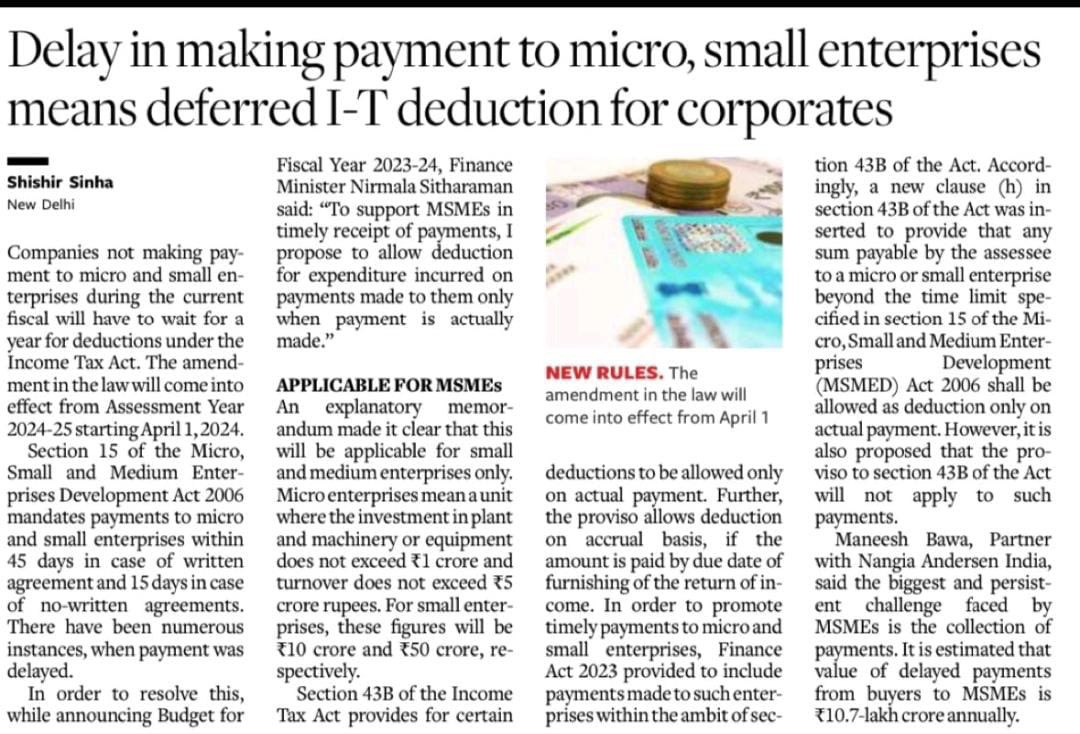

MSME units delay payment Legal provision under Section 43B(h):

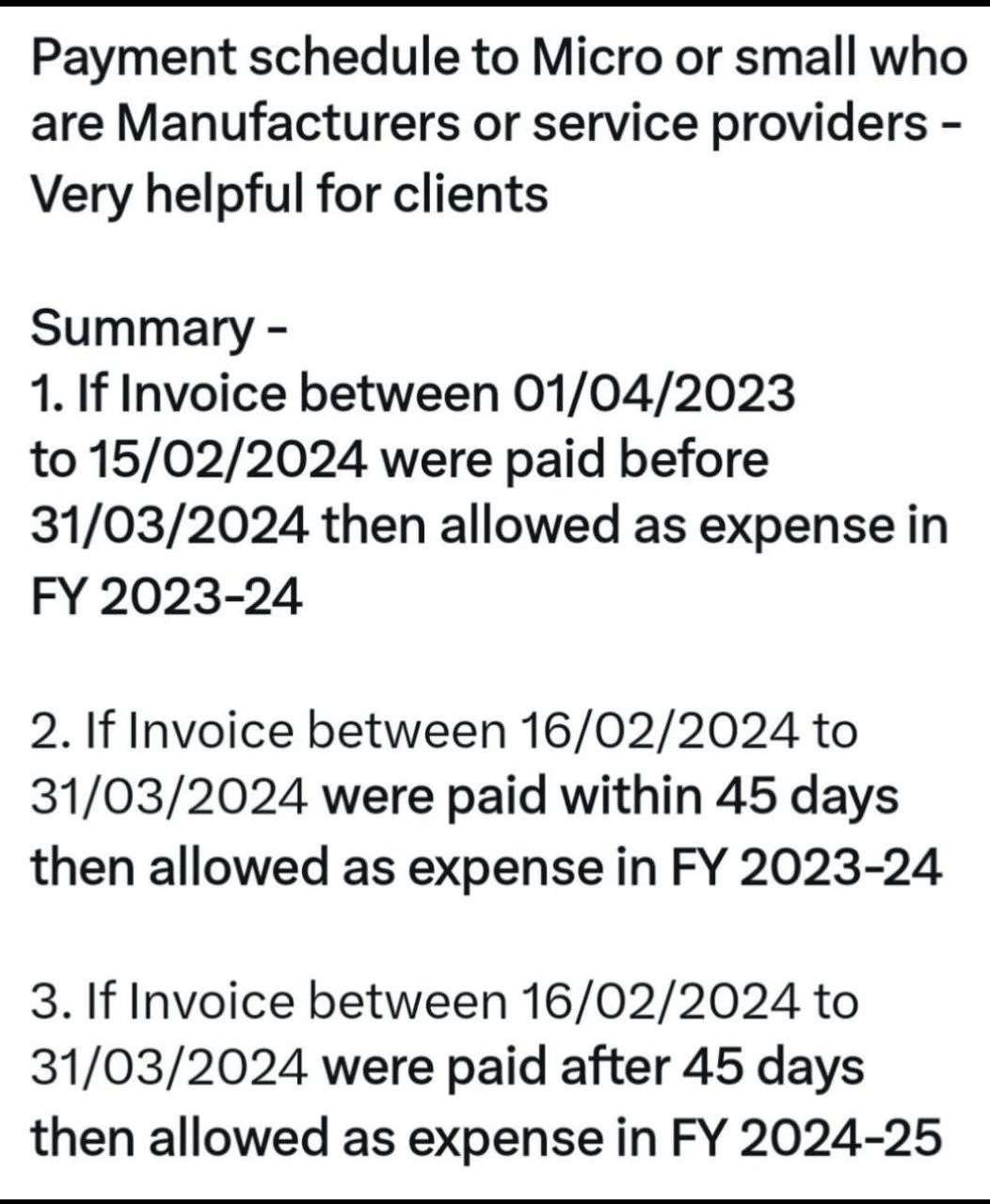

Income tax taxpayers have to take precautionary measures to avoid disallowance of expenditure which may be outstanding to Micro Small Enterprises/units as on 31-03-2024 representing expenditures of the FY 2023-24.

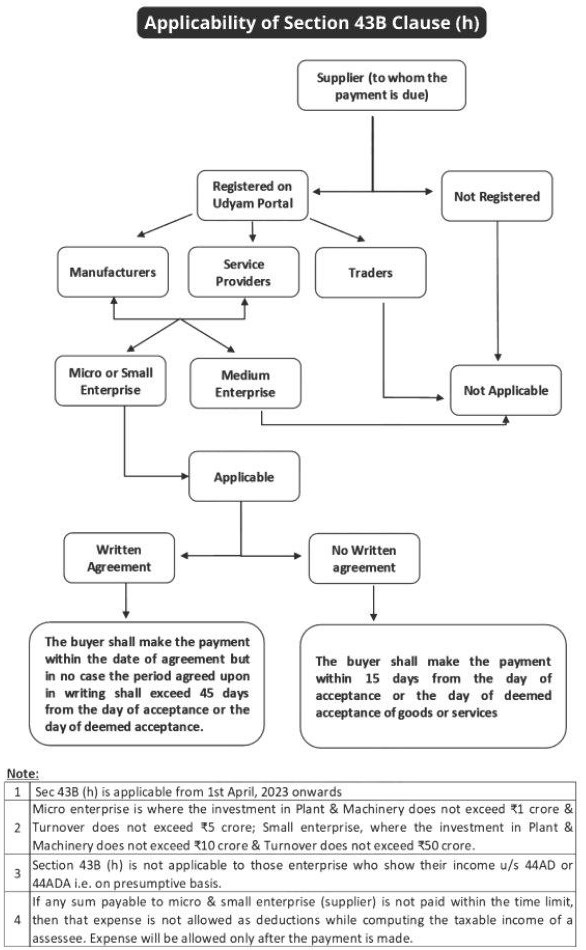

Analysis of the Legal Provision of Section 43B(h) Clause:

- Business Enterprise required to pay to small & micro Enterprise suppliers within Fifteen to Forty Five days as per sec 15 of the Micro, Small & Medium Enterprises Development Act, 2006

- The amount owed will be added to your taxable income if it is not paid within the specified time frame.

- Payments must be provided within Fifteen days if there are no written agreements.

- In the event of a legal written contract, outstanding payment must be made by the deadline specified. The agreements will last no more than Forty-Five days.

- Creditors को Time से Payment नहीं की तो Expense होगा Disallowed.

- Delay in Making Payment to Micro and Small Enterprises Means Deferred Deduction

Interest u/s 16 of the Micro, Small & Medium Enterprises Development Act, 2006

What are the consequences of not making the payment within prescribed time frame?

- If payments are not made within the allotted time, the amount will be added to the assesses’ taxable income, and they will be responsible for paying the applicable taxes. Where payments are made in PY, the taxpayer receives a deduction.

- If a Enterprises fails to pay Micro & Small Enterprises within the allotted time frame, it will be required to pay compound interest to the supplier on a monthly basis at a rate three times the bank interest as announced by the RBI.

Is it possible to deduct the interest deduction in Income Tax Computation?

According to Section 16, these interest costs qualify as penal interest. Accordingly, Interest costs incurred for late payments to Micro & Small Enterprises is not allowed u/s 37 of Income Tax Act,1961,

Key Note: Micro and Small Enterprises are covered under section 43N(h), So Legal Provision of Section 43B(h) shall not be applicable on Medium Enterprises.