Key updates on GST 2020

Page Contents

Key updates on GST- Compliance 2020

Background

Adhering to tax-related compliance introduced by the Indian government is obligatory for taxpayers in India. Failure to comply with the due dates for filing GST returns as well as the GST rules which result in the government imposing severe penalties on taxpayers in India.

The tax compliances have experienced a complete improvement in the last 6 months. Given the prevailing Coron-19 pandemics, the entire compliance schedule has been changed.

It is not only about income tax but also about GST. We’ve been reviewing income tax compliances over the past week and now we’re going to cover compliances that need to be completed by August 31 to escape fines and late fees.

Tax compliance was difficult, especially during the COVID period, when human health and safety were of primary importance. All the GST compliance requirements, the deadlines for which are August 31, 2020, are given below.

GST Milestones expiring 31 August 2020

Many deadlines for GST implementation expired on August 31, 2020. To prevent late payments and fines, it is important to recall those due dates and to file the returns. Let’s see which time-limit expires on August 31, 2020.

After taking into account the notifications the final deadlines will be as follows:

| 2 Yr from the prescribed date falls between | Final due date to submit a refund application |

| 1st January 2020 to 19th March 2020 | The respective day between 1st January 2020 to 19th March 2020 |

| 20th March 2020 to 31st March 2020 | 31st August 2020 |

Due to COVID 19 Situation and after Hon’ble FM Ms. Nirmala Sitharaman Ji “Corona is an act of God” and business loss now is the time to avoid late Fee, Interest, and Penalties.

·Refund Application FY 2017-18: Online thru Form GST RFD-01

·GSTR-4 (FY 2019-20): Filed by Composition Taxable Person (Notification No. 59/2020).

·GSTR-5: Filed by Non- Resident taxable person.

·ITC 04: ITC-04 is related to job worker and submitted by the principal every quarter. The last date of ITC 04 of the 4th quarter of 2019-20 and the first quarter of 2020-21 is 31st August 2020. (Notification No. 55/2020 dated 27.06.2020).

·As per Notification No. 55/2020 dated 27.06.2020, the due date for the month of March 2020 to July 2020 is extended to 31st August 2020 (Point No. 5 to 9).

·GSTR-5A: Filed by OIDAR service providers.

·GSTR-6: Filed by Input Service Distributors (ISD).

·GSTR-7: Filed by TDS deductor.

·GSTR-8: Filed by E-commerce Operator.

Letter of Undertaking (LUT) FY 2020-21: Notification No. 55/2020 Letter of Undertaking (LUT) is a document that exporters can file to export goods or services without having to pay taxes. Any registered individual will be able to supply LUT in GST RFD 11 type and export products without paying the integrated fee.

Other related GST compliances (except few provisions covered in the exclusion clause of N.N 55/2020-CT dated 27.06.2020) falls during the period 20.03.2020 to 30.08.2020 and which has not been made.

As per the latest notification released on December 26, 2019, provisional ITC has now been restricted to 10% instead of 20% of the eligible ITC (as per 2A). The new restriction has come into effect from January 1, 2020.

It is important to complete ITC matching in order to claim accurate provisional ITC before filing GSTR 3B. Should you happen to cross the limit, it will result in legal repercussions & heavy tax penalty (up to 24%)

How should you tackle this?

– Reconcile your GSTR 2A & Purchase register every month.

– Communicate the mismatches to your vendors.

– Claim only the matched transaction’s ITC in your 3B.

– Keep a proper track of ITC’s pertaining to Quarterly Filing vendors to claim later.

To help you with this complex & heavily manpower driven activity, Rajput Jain and associates have come up with an advanced reconciliation tool to keep you afloat of all the possible discrepancies & help you claim the right amount of ITC.

More updates:-Commerces Platform under GST

More updates:Composition levy scheme under GST

E-Invoicing: E-Invoicing is soon becoming necessary, We built a knowledge pool for fast integration. Details are an attached post :

Applicability of E-invoice Framework for GST

Complete coverage about online information Database access or retrieval(OIDAR)

Basic details of Invoice registration Portalirp on GST

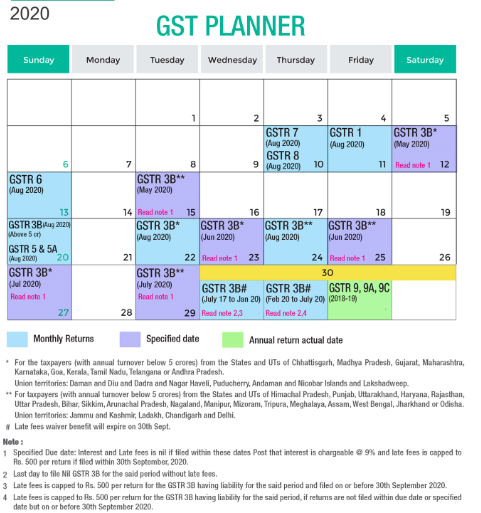

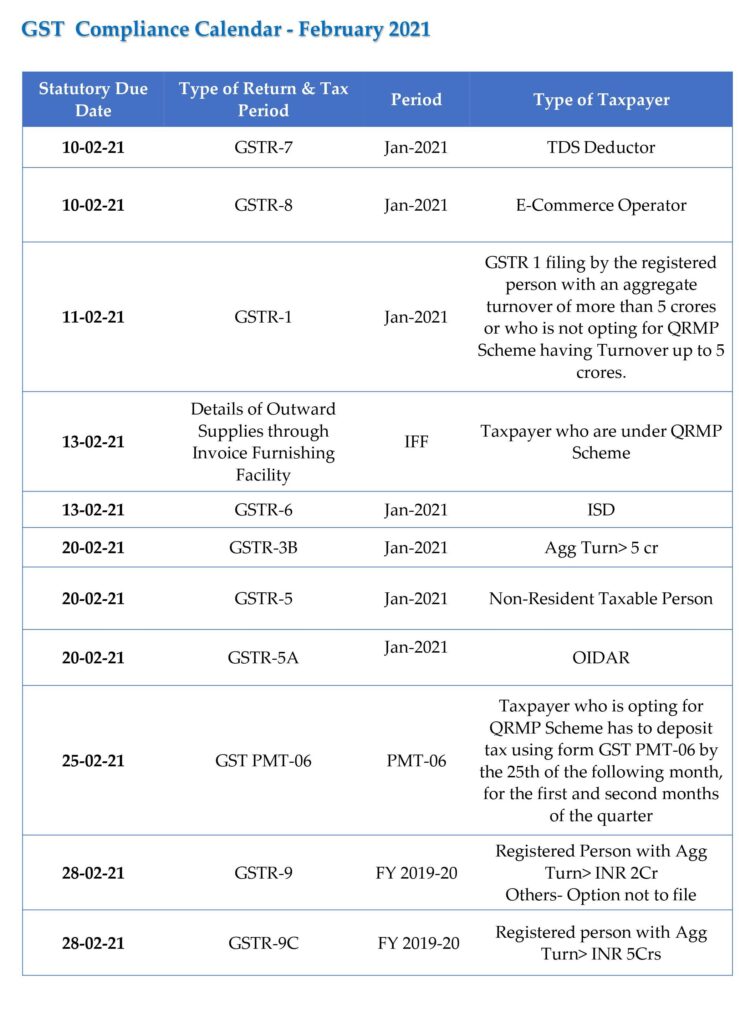

Moving to the September GST compliance timeline, here is a detailed description of our September compliance calendar:

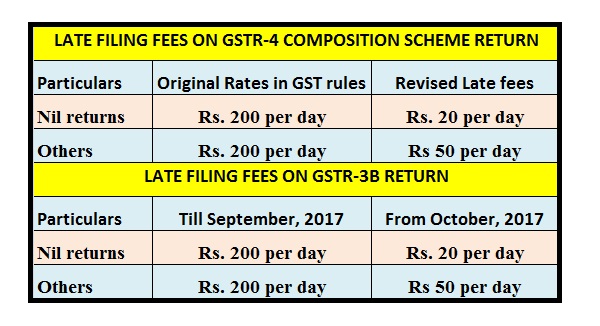

GST Returns Application late fee

The late fee according to the GST Act is Rs. 100 a day per statute. So it’s under CGST 100 and under SGST 100. Max is Rs. 200 / day. The maximum amount is Rs 5,000/-. No late fees are paid on IGST.

Submission of return is mandatory under GST. And if there is no trade, you will have to file a refund from Zero. You can not file a return until you register the return of the previous month/quarter.

Late filing of GST return would also have a cascading impact and will lead to heavy fines and penalties. The GSTR-1’s late filing fee is deposited in GSTR-3B ‘s liability ledger directly after such a delay.

Interest / Late Fee to be paid

The interest per annual is 18 percent. It must be based on the amount of outstanding tax owed by the taxpayer. It is to be calculated at the time of payment on the Net tax liability identified in the ledger. The time span is from the next day after filing due date to the final payment date.

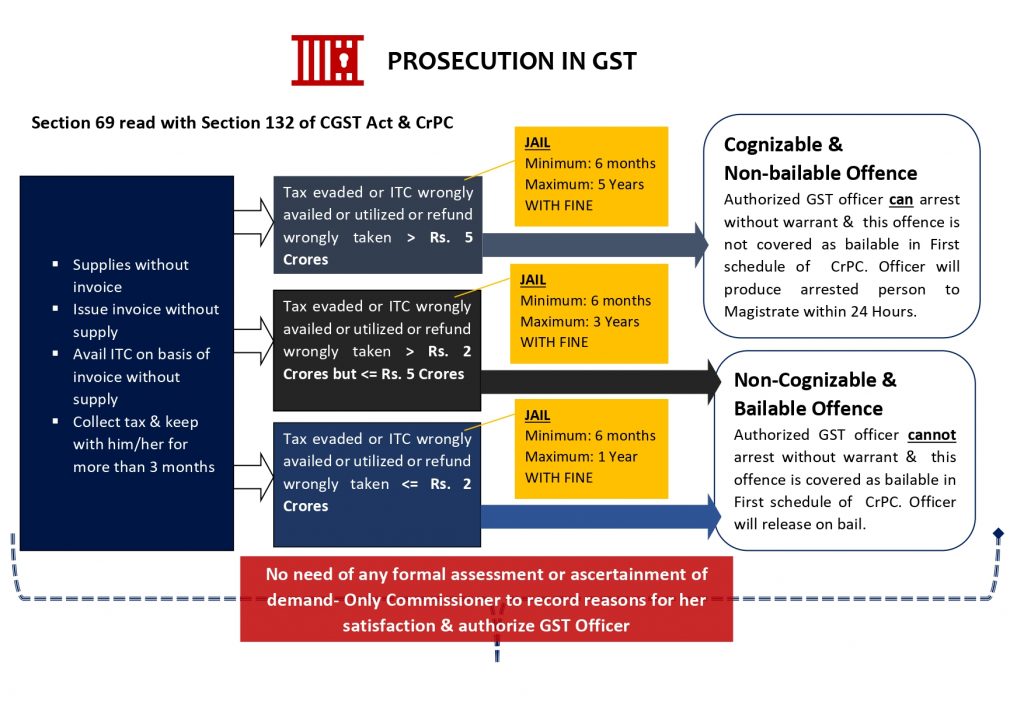

Prosecution in GST

Penal provisions of the Central Goods and Services Tax Act 2017 prevails over the Code of Criminal Procedure for GST frauds

The Honourable Bombay High Court, Tejas Pravin Dugad v. UOI dismissed the written petition filed by the Directors of M/s. Ganraj Ispat Private Limited challenging proceedings initiated by the Dept alleging fraudulent use of ITC on the basis of a counterfeit invoice held that the special provisions of the Central Goods and Services Tax Act, 2017 prevailed over the provisions of the CPC 1973 and it cannot be said that all the provisions of the CPC, 1973 [Order No. Criminal Writ Petition No. 1715 to 1718 of 2020, decided on 15 January 2021]

GST Audit Due date extended

Press Note regarding extension of due date for furnishing of Annual Returns GSTR-9 and GSTR-9C for the FY 2019-20 to March 31, 2021.

So here is the expectation that the compliances will be completed before all these extended due dates.

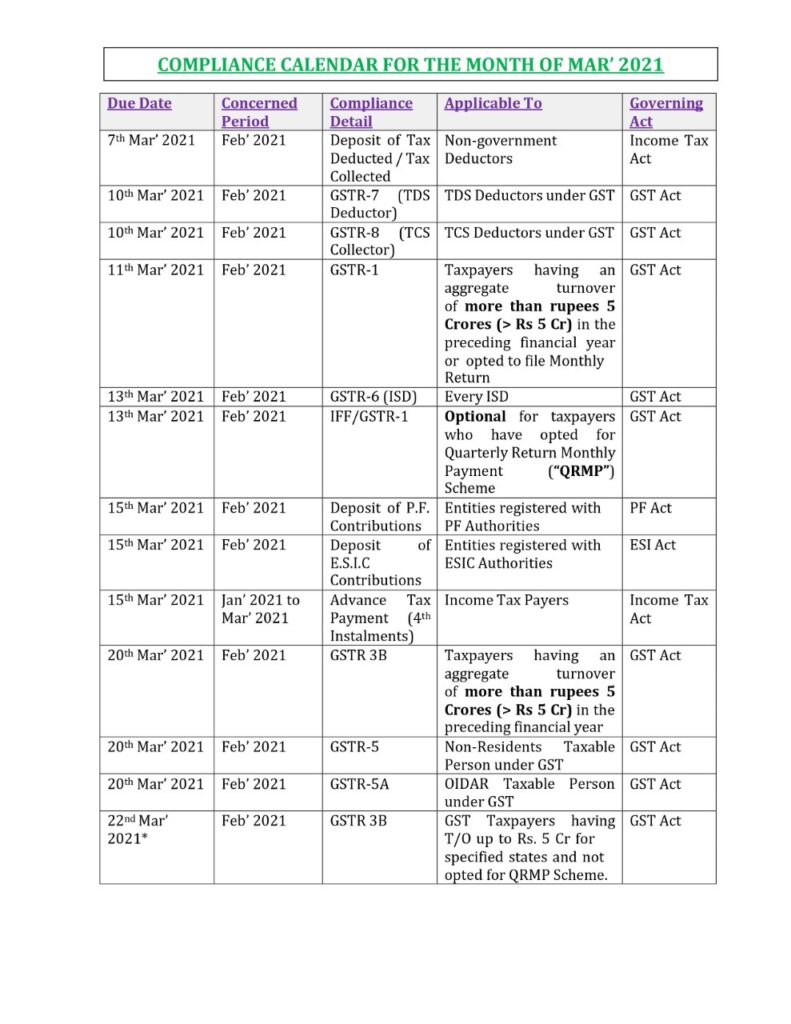

Compliance Calendar for March-2021.

Compliance Calendar for March-2021.

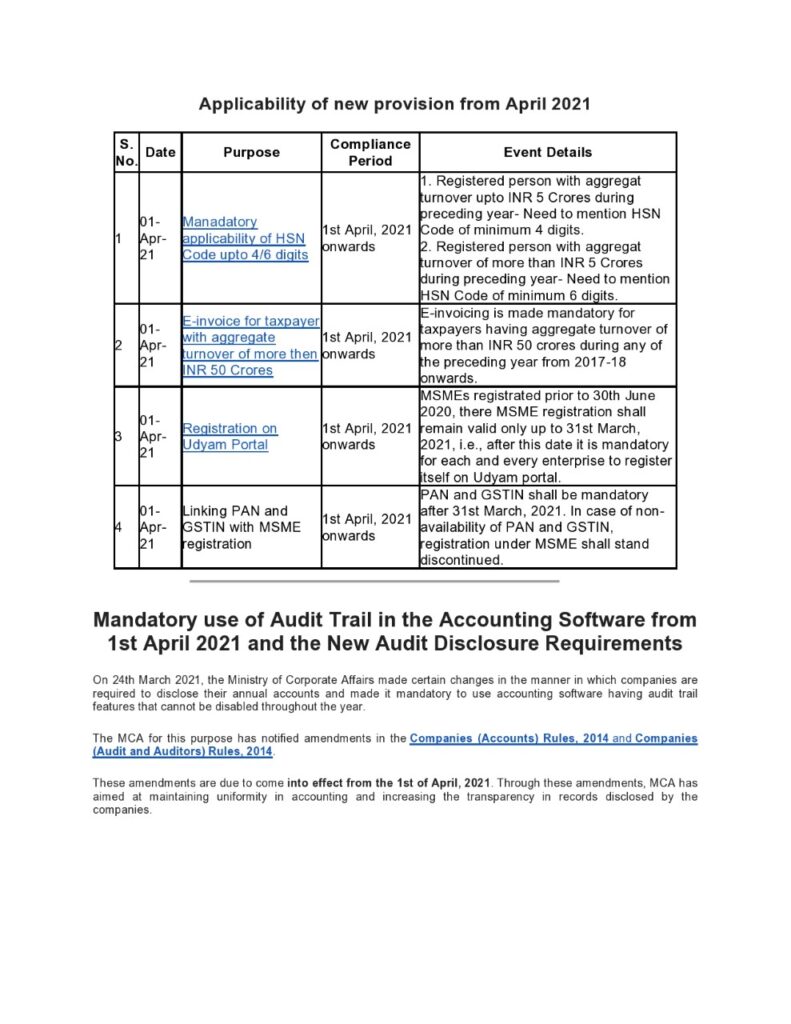

Applicability of new provision from April 2021

Statutory Compliance Calendar for August 2021 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| *Note 1: Not Opting for QRMP Scheme- Due Date for filling GOODS AND SERVICES TAXR – 3B with Annual Turnover up to 5 Crore in State 1 Group (Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu and Dadra & Nagar Haveli, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Lakshadweep, Puducherry, Andaman and Nicobar Islands, Chhattisgarh, Madhya Pradesh)

**Note 2: Not Opting for QRMP Scheme- Due Date for filling GOODS AND SERVICES TAXR – 3B with Annual Turnover up to 5 Crore in State 2 Group (Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Punjab, Uttarakhand, , Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Haryana, Rajasthan, Meghalaya, Assam, West Bengal, Himachal Pradesh, Uttar Pradesh, Bihar, Sikkim, Delhi). |