How to Process of Linking Aadhaar to UAN

Page Contents

www.carajput.com; UAN & Aadhar

How to Process of Linking Aadhaar to Universal Account Number

Link Aadhaar to UAN and get a claim for EPF in 5 days

The government has come up with a new initiative to reduce the time required in claim settlement and ease the process of withdrawal from the EPF account. Employees can link their Aadhaar to UAN (Universal Account Number) and process their EPF claims for as little as 5 days. The procedure usually took months to process earlier, and the employee had to get the employer’s attestation done.

After new rules are implemented, employees can fill in the “Composite Claims Form” to do away with both the employer’s attestation process. It has greatly reduced the time it took for PF cases to be settled.

But the requests can only be processed when the applicant satisfies those conditions within the given time limit. Those are the appropriate conditions:

- You should file one claim online at https:/unified portal-mem.epfindia.gov.in/member interface/

- For PF settlements only those employees who have UAN can apply.

- To complete the KYC (Know Your Customer) process, employees must update and get their Aadhaar and bank details approved on the portal.

- The current employer must check that the employee has submitted an e-KYC.

Type Composite Claims

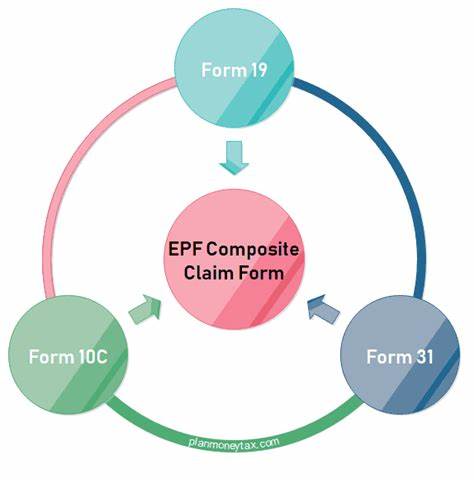

- The Composite Claim Form (CCF) is linked to Aadhaar and can, therefore, be used for the advantage of EPF Form 19, Form 10C, and Form 31 (PF part-removal).

- As a result, the worker would have to fill out only one application for final PF settlement and partial withdrawal to satisfy educational, medical, housing, and many other requirements. 2 benefits of CCF will be below mention:

- (i) Certification of the Employer would not be necessary for the resolution of cases.

- (ii) No written documentation shall be submitted to the EPFO(Employee Provident Fund Organization) for the purpose of requesting the fractional withdrawal.

What is the Claim Process in EPFO

The following process for claiming PF settlement would need to be followed:

- Login to the Member area of the EPFO website at https:/unified portal-mem.epfindia.gov.in / user interface/

- Click the category titled “KYC” under the “Manage” option.

- insert your Aadhaar and bank details in the provided space, and click the submit button.

- The Employer will have to approve the details of the data.

- The application can be made online within the two-month shift of the job.

- An OTP is sent for authentication to the registered mobile number.

- Once the employee has entered the OTP and sent the form, his application is approved and the withdrawal process starts.

For a more clear understanding of UAN and KYC.

Popular blog:-