Compliances under one person company(OPC)

Page Contents

COMPLIANCES OF ONE PERSON COMPANY

It was recommended in 2005, by the committee headed by Dr. JJ Irani. A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to one person company.

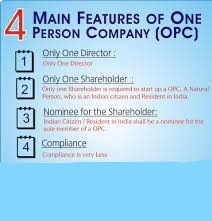

FEATURES OF COMPLIANCES OF ONE PERSON COMPANY

- All the provisions of the private company also apply to a one-person

- One person company can have only one person its

- company shall mention a nominee while submitting the documents at the time of incorporation.

- there is no perpetual succession of a one-person company

- one person company can have only director.

- There is no minimum paid-up share capital for one person company.

BENEFITS OF COMPLIANCES OF ONE PERSON COMPANY

POST INCORPORATION ANNUAL COMPLIANCES

-

CORPORATE STATIONERY OF ONE PERSON COMPANY

Name board – one person company shall affix the name of the company and address of its registered office outside every office or place in which it carries on business.

Rubber stamp– round rubber stamp and straight rubber stamp bearing the name of the company along with the designation of the authorized signatory can be purchased.

Letterhead– name and registered head of one person company must be printed on all letterhead, invoices, notices of the company.

- PAN OF ONE-PERSON COMPANY

After incorporation entity needs to obtain a pan card. pan can be applied online after incorporation to receive a pan allotment letter. The letter must be signed by one person company director, sealed with the company rubber stamp, and sent to the NSDL office. PAN card will be issued within 15 days after receiving of hard copy.

-

OPENING BANK ACCOUNT OF ONE PERSON COMPANY

As one person company is a corporate entity, no other tax registration and documents are required to open a bank account for a one-person company. as per reserve bank of India norms following documents are required-

- Self-attested copies of certificate of incorporation.

- Memorandum of association of the company

- Articles of association of the company

- Copy of pan letter

- Copy of telephone bill

- Identity proof of director

- Documents submitted for opening a bank account self-attested with the seal of the company.

- APPOINTMENT OF AUDITOR OF ONE PERSON COMPANY

All one-person companies are required to appoint their first auditor within 30 days of incorporation. The auditor must be appointed by the director of the one-person company for auditing financial statements.

- ALLOTMENT OF SECURITIES OF ONE PERSON COMPANY

Share certificates are required to be issued by the company which evidencing the ownership of the company. Every share certificate must be signed by the director or authorized person and have an impression of the common seal of the company.

Regular Compliances of One Person Company

- MEETING

In one person company has only one director its member are no need to conduct any meeting. Pass the resolution and entering the minute’s book is sufficient to satisfy the requirement.

- NOTICE OF INTEREST BY THE DIRECTOR

The Director of the company in the first board meeting disclose his interest in other entities in every financial year. FORM MGT – 1 is required to file for such disclosure. Director also discloses if there is any change in interest takes place.

-

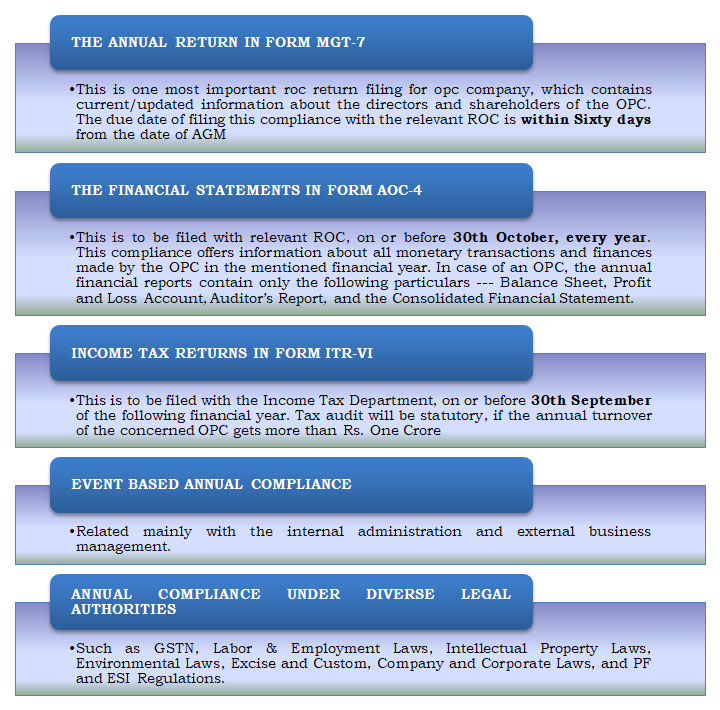

FINANCIAL STATEMENT

Following are the financial statement are required to file with the registrar of companies in FORM AOC – 4 within 180 days from the closure of financial year-

- Balance sheet of the company at the end of financial year.

- Profit and loss account

- Explanatory from forming part of the document.

financial statement of the company must be signed by one director.

- FILING OF ANNUAL RETURN

One person company shall prepare an annual return containing particulars at the end of the year and file with the registrar of companies in FORM MGT -7 before 30th September every year. The annual return should be signed by the company secretary of the company if there is no company secretary then by the director of the company.

-

FILING INCOME TAX RETURN

FORM ITR – 6 is to be filled with income tax department by one person company. due date of filing FORM ITR – 6 is 30th September of the assessment year. Tax audit is compulsory if turnover, total sales, gross receipt, exceeds 1 crore.

- PF & ESI REGISTRATION

If company employees more than 10 employees than one person company is compulsorily required to register under the ESI act, 1948. Similarly PF registration required for more than 20 employees.

- GST RETURN & RETURN FILLING

Business with turnover above the threshold limit Rs. 40 lakh (10 lakh as the case may be ) and the one dealing interstate are required to get compulsory registered under GST law. one person company are required to file GST return if they are registered under GST.

10 Reasons why start-ups should choose One Person Company (OPC) as their form of business

If you are a person having a business idea and thinking of starting a business, One Person Company is an ideal choice for you. Here are the 10 reasons why you should choose One Person Company (OPC) as your form of Business:

- A Separate Personality in the eyes of the law

The first and foremost reason is that a separate legal entity is created in the eyes of law, which is capable of doing almost everything a natural person can do.

- Easy Funding

An OPC can raise funds from others like venture capital, angel investors, financial institutions, etc., thus graduating itself to a private limited company.

- Additional risk, limited liability

The advantage of limited liability is certainly a desire of any start-up. It encourages you to take an additional risks with limited liability. (It means even if you fail, your liability will only be restricted to the value of your share capital, i.e. your personal assets are safe).

-

Minimum regulations

OPC need not bother too much about the compliances like other forms of companies. Therefore, entrepreneurs can concentrate on their core functional area.

- Benefits of being a Small Scale Industries (SSI)

An OPC can avail various benefits available to the SSI units. E.g. Loans at a lower rate of Interest, funding without any security from banks up to a certain limit, various benefits under Foreign Trade policy and many others as well. These benefits can really provide you early assistance, which is a boon for any business in the initial years.

- You are the Only Owner

You being the only owner give you full control over the entity. Further, faster decision-making will also help your business grow effectively.

- Your credit rating doesn’t matter

If OPC applies for the loan, then your credit rating is not relevant, rating of OPC is relevant. In other words, if you are having a bad credit rating, then also you can easily get funds, if the rating is OPC is as per norms.

- Benefits under Income Tax Law

Being registered as OPC, any remuneration paid to the director will be allowed as a deduction under income tax law, unlike proprietorship. Other benefits of presumptive taxation are also available subject to the income tax act.

- Receive interest on any late Payment

Since all start-ups are generally SSI’s, they are all covered under the Micro, Small and Medium Enterprises Development Act, 2006. If any buyer or service receiver pays you after a specified period then you are also entitled to the interest which is three times the bank rate.

- Increased Trust and prestige

Any business which runs in the form of a company always enjoys an increased trust and prestige than any other form of business.

“Existing proprietors can also convert themselves into the One Person Company (OPC) or any other company as per the requirements and can avail the above-mentioned benefits.”

- Start-Ups – Take Home 30% Extra!

The Twenty-First Century will belong to Knowledge! The statement is of course holds true when we look up at the big giants like Google, Microsoft etc. Also, when we look up at the start-ups across the world, the kind of innovation that they create is out of the world and with this, they earn a lot of dollars.

But, hold a second, how do feel if with all the hard work you did to earn hefty money and you get only seventy percent of that? Shocked? But that’s what happens in the real world. You do all the hard work and then maybe somebody impressed with your work may buy your start-up and pays you hefty dollars, however on that income you will have to pay tax @ 30% (assume tax rate is 30%), and at the end, you will be left only with 70%.

In other words, it means that if earn 100 Crores by selling your start-up, then you will get only 70 Crores net. Couldn’t we do anything? Is there any solution? Yes, there is!

With simple tax planning, we can avoid the tax liability and keep the 100% income with ourselves, and further to say it’s all legal!

This tax planning is, particularly for the Profession. The profession can be IT, Designing, Marketing or anything which require intellectual skills. Now let’s have a look at the tax planning!

Planning is very simple. While selling your start-up, you just have to remember that you are not selling any assets, company or anything you are selling your brand, your goodwill. When you give your transaction this kind of shape, then tax machinery will fail and you will benefit. Accordingly, no tax will be levied upon you and your whole income is tax-free, and remembers it’s your legal tax-free white income. You can do whatever you want to do with this income.

Also, remember that “money saved is money earned”

So, always think, plan and then execute before you commit to any big transaction because with simple planning you may save hefty money.

Popular Blogs:-

- Process of obtaining fresh DIN

- Are you a Director- then need to file E-KYC DIR-3 Form

- Last date of DIN KYC Has been extended

- Filing of Director KYC DIR-3

- significant-changes-introduced-in-foreign-director-investment-policy