All About on setting up a Branch Office in India

Page Contents

Set up branch office /representative office outside India

Indian dynamism, entrepreneurship, and enthusiasm is seeking new horizons across the world. Of course, anyone entering a far-off land must be sure of the laws, rules, and regulations of the host country.

Each country is different and keeping up with the laws of various countries can indeed be a challenge.

Reserve Bank of India

In India, the Reserve Bank of India is responsible for controlling and regulating investment in foreign entities by persons who are residents of India. someone could also be a citizen of India and a resident outside India.

A citizen who isn’t a resident of India won’t be governed by banking concerns of India regulations. An Indian resident is absolved to invest in foreign assets out of the income received when he/she was resident outside India.

So, if someone resident in India desires to enter into the overseas market, he can enter either by establishing a branch office or liaison office outside India or he can form an independent Company outside India.

The corporate formed outside India could also be within the variety of wholly-owned subsidiaries or venture companies.

It is important to notice that under section 2 of the FEMA Act, the intention to remain outside or inside India for an uncertain period is vital. this is often different from the provisions under section 6 of tax Act.

To be a resident under the revenue enhancement Act, a person needs to only stay in India for a specified number of days. So, a private is also a non-resident under the revenue enhancement Act during a year and should be resident as per the FEMA Act, during the identical year.

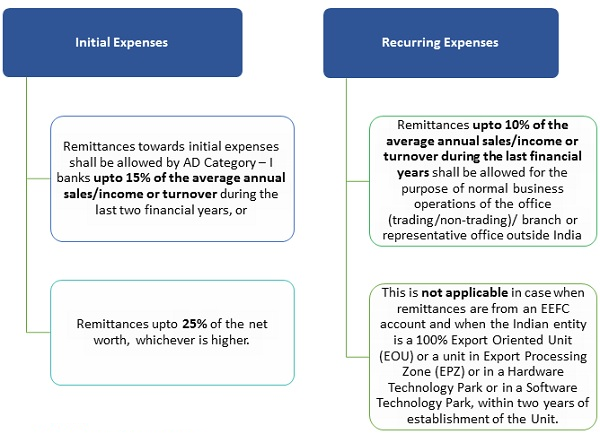

A person resident in India being a Firm or Company or Body Corporate registered in India is eligible to determine a branch outside India. General permission is out there for the opening of a checking account for the aim of meeting the Branch Expenses abroad subject to the following limits/conditions:

Acquisition of assets outside India

Branch/office/representative can acquire office equipment and other assets required for running their normal business operations. Funds required for this could be remitted by the Indian entity from India as an accounting transaction.

However, transfer or acquisition of immovable property outside India, apart from by way of lease not exceeding five years, by the overseas branch/ office/ representative are going to be subject to RBI regulations.

Notably, the above facility cannot be utilized by e-commerce companies who are, for instance, within the business of providing an e-commerce platform to foreign sellers and buyers and want to determine a group account during a foreign country without establishing a branch office or representative in this country.

Application to the ad banker

The Indian firm/companies should submit applications to their bankers (authorized dealers) in form OBR together with the particulars of their turnover duly certified by their auditors and also a declaration to the effect that they need not approach/would not approach the other authorized dealer for the power being applied for.

The appliance form OBR must be filled in with necessary details together with supporting documents. After which the exchange is released by the authorized dealer (bank).

A recurring (expenditure) remittance facilities are allowed initially for a period of two years only, after obtaining confirmation from the applicant that they need to complete all legal and other formalities in India and abroad in reference to the opening of trading/non-trading office or for posting a representative abroad.

Some of the main points to be provided within the application:

- Exporter’s Code Number allotted by Federal Reserve Bank.

- Nature of the applicant’s business in India.

- Particulars of foreign currency balances/securities, if any, held by the applicant.

- Present arrangements for applicant’s representation within the country/territory concerned if any. If there’s any agency arrangement, its full details include the quantity and date of Reserve Bank’s approval and commission paid during the past three years.

- Details in respect of realization of amount from export during the past two years.

- Commodity-wise/country-wise hack of exports realized within the last two years.

- Application is for appointing an agent (on fixed remuneration basis), or for opening a trading branch, or for a representative liaison office/non-trading branch.

- Place and country of posting of agent/representative office/branch.

- Territories/countries to be covered by the proposed agent/representative office/branch.

- Details of business which will be conducted abroad, through an agent/representative office/branch.

- Initial Establishment Expenses.

- Recurring expenses per month.

Off-site and on-site contracts

The overseas office/branch of software exporter company/firm may repatriate to India 100 percent of the contract value of every ‘off-site’ contract.

In the case of companies usurping ‘on site’ contracts, they ought to repatriate the profits of such ‘on site’ contracts after the completion of the said contracts.

An audited yearly statement showing receipts under ‘off-site’ and ‘on-site’ contracts undertaken by the overseas office, expenses, and repatriation thereon could also be sent to the AD Category – I banks.

Wholly Owned Subsidiaries make it possible for the parent company to manage and diversify. Generally, it is seen that the Wholly Owned Subsidiaries retains legal control over operations, products, and processes. a number of the samples of WOS include Reliance Industrial Investments and Holdings Limited owned by Reliance Group of Companies, Concorde Motors India Ltd, owned by TATA Motors.

Complete understanding of setting up a Branch Office in India

Complete understanding of Global Companies Preferences and Needs for open up operation setting up a Division or branch in India. a foreign company for setting up an office in India

- Branch office in India

- The liaison office in India or

- Setting up a Private limited company in India or

- Project office by a foreign company.

There are few requirements for a foreign corporation to open its branch in India. A subsidiary should be established for different reasons and the establishment of a head office in India’s requirements and needs.

The Reasons for set up Branch Office in India

For the following reasons, international firms, including US corporations, are allowed to set up branch offices in India:

- Import and Export of supply of goods

- Provision for Professional or advisory facilities

- Start the research work which includes what the parent company is already doing.

- for enlarge the Promoting technical or financial collaborations between Indian businesses and a foreign parent or group of companies worldwide.

- To provide the services to the parent company in India and to act as purchasing/selling representatives in India.

- for initiate information technology services, and software development in India.

- for the starting technological assistance to parent/group business provided goods.

- open up Shipping / Foreign Airline operation

- Global Banks opening

A Branch office is not allowed to conduct production operations of its own but is authorized to subcontract them to an Indian company. Branch offices founded with RBI approval may remit branch income outside India, net of relevant Indian taxes, and subject to RBI guidelines subjected to the condition of RBI grants permission to set up branch offices.

Specifications and conditions of an establishing Branch office in India

- The Indian branch office name will be the same as the parent business name.

- The Branch Office has no control, it is just an extension of an Existing company’s foreign world market.

- All branch office costs are borne by the Principal /head office because it has Indian activities revenue does not have revenue.

- Over the immediately intervening five years in the homeworld, the international parent corporation planning to open a branch office in India would have a successful track record.

- The company must have The Net Worth, i.e., amount of paid-up capital and free deposits, less intangible assets as specified in the latest Audited Balance Sheet or Financial Report accredited by a Certified Public Accountant or other Registered Financial Practitioner of that name shall not be less than or equivalent to USD 100,000.

A branch office is ideal for international firms looking to set up a temporary office in India and not involved or intending to make long-term plans for Indian operations; except for the above-listed finance, shipping and airlines, etc.

Necessary document required to establish a branch office in India

Presently, the application for the branch office and BRANCH office is sent through the AD according to the Reserve Bank of India’s conditions. The approved dealer implies obtaining banking licenses for a different entity.

To start a branch office in India the following filings are required:

- Certification of Incorporation – Translated & duly notarized and properly authenticated.

- The Latest audited Balance sheet and annual accounts of the parent company duly Translated notarized for the past 3 years and properly authenticated.

- The expected funding level for operations in India.

- Details Relating to address of the proposed local office, the number of persons likely to be employed, the number of Foreigners among such employees, and address of the head of the local office, if decided

- Details of Activity carried out in Home Country by the applicant organization in brief about the product and services of the company in Brief.

- Bankers Certificate

- Name, Address, email ID, and telephone number of the authorized person in Home

- Letter from the principal officer of the Parent company to RBI.

- Letter of authority from the parent company in favor of a Local Representative.

- A Letter of authority/ Resolution from the parent company for setting up BRANCH office in

- Comfort letter from the parent company intending to support the operation in India.

- Two copies of the English version of the Certificate of Incorporation, Memorandum & Articles of association (Charter Document) of the parent company duly attested by the Indian embassy or notary public in the country of registration.

- Details of Bankers of the Organization the Country of Origin along with the bank account number

- Commitment from the Organization to the effect that it will be open to report / opinion sought from its banker by the Government of India / Reserve Bank of India

- Form FNC 1 (Three copies)

- Latest Proof of identity of all the Directors – Properly Certified by Banker in Home Country and duly authenticated

- Latest Proof of address all of the Directors – Properly Certified by Banker in Home Country and duly authenticated

- Details of the Individuals / Company holding more than 10% of Equity

- Structure of the Organization and its Shareholding pattern

- Complete KYC of Shareholders holding more than 10% Equity in the Applicant Company Resolution for Opening up Bank Account with the Banker

- Duly Signed Bank Account Opening Form for Indian Bank

- Note: We can assist in getting all these documents, wherever required prepared and advice on the various issue relating to this. Please feel free for clarification, if any is required in this regard.

The RBI accepts the application for BRANCH office licenses but the Approved Dealers (AD) route the applications for the BRANCH office as per the recent changes. Despite that, the timeframe for creating the BRANCH office has significantly expanded. Even the paperwork needed for the same has significantly increased.

Know about- Foreign Company Open a Branch Office in India

Other criteria for Incorporation of Branch Office

That RBI-licensed branch office shall be licensed with the Ministry of Corporate Affairs, it is a branch office registration as a foreign business establishment in India. On such registration, the business registrar allocates a CIN i.e. Corporate Identification Code. The following forms must be filled out with the Companies Registrar:

- Form 44

- Charter, laws or document and articles of agreement or other act constituting or establishing the creation of a company(In the manner provided for in Rule 16, General Rules and Functions of the Companies (Central Government), 1956)

- Unless the records alluded to above are not in English instead of the original edition of the papers.

- Information Director(s)-Persons

- Information Director(s)-Public bodies

- Reserve Bank of India letter of approval

- Information Secretary(s)

- Resolution of control of attorney or board in lieu of designated representative(s)

Procedural criteria for post-incorporation

The below few more criteria for a branch office are also required after Incorporation:

- PAN of company.

- TAN (Tax-deductible Number) -Shop and Establishment certificate details

- certificate of GST Registering if Branch provides services in India or provide facilities in India

Annual Compliance practices a Branch Office needs

Every branch office is required each year to do the following activities:

- To be maintaining complete record Files

- To audited Financial Report

- To be Filling with RBI Annual Operation Certificate

- To be Completion of the regular report and balance sheet for the business registrar

- to timely inform about some shift in the world Business constitution of RBI & ROC

- to timely information about any change of Foreign Company Directors to RBI & ROC

- to timely information about all changes or shifts to RBI & ROC at the BRANCH office

- No additional place of business may be established until RBI intimation and approval.

Regarding company management standards in India see also Annual Corporate Filings in India.