PM Modi speech on Taxation: Seamless, painless

Page Contents

Key highlights of PM Modi’s speech on Transparent Taxation: Seamless, painless, Faceless Assessment

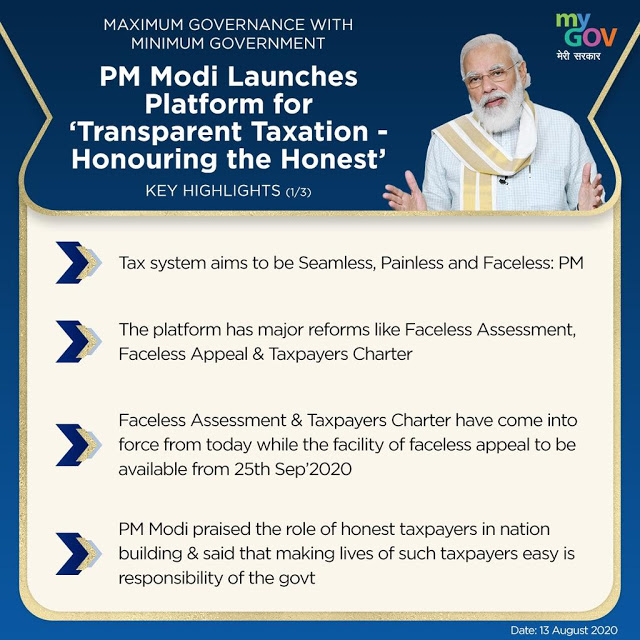

On 13 August PM Modi will launch the platform ‘Transparent Taxation – Honoring the Honest’, The upcoming platform would help CBDT’s reform agenda to make the tax filing process clearer and simpler, the Ministry of Finance said.

The CBDT has taken a number of steps in recent years to boost transparency and introduced direct tax reforms: PMO.

In the run-up to Independence Day, in a bid to honor honest taxpayers, Prime Minister Narendra Modi is preparing to launch the Transparent Taxation Honest Platform, a move that will enhance attempts to reform and streamline our taxation system.

The system that will be launched today is expected to continue the journey of direct tax reforms that have been undertaken over the last six years.

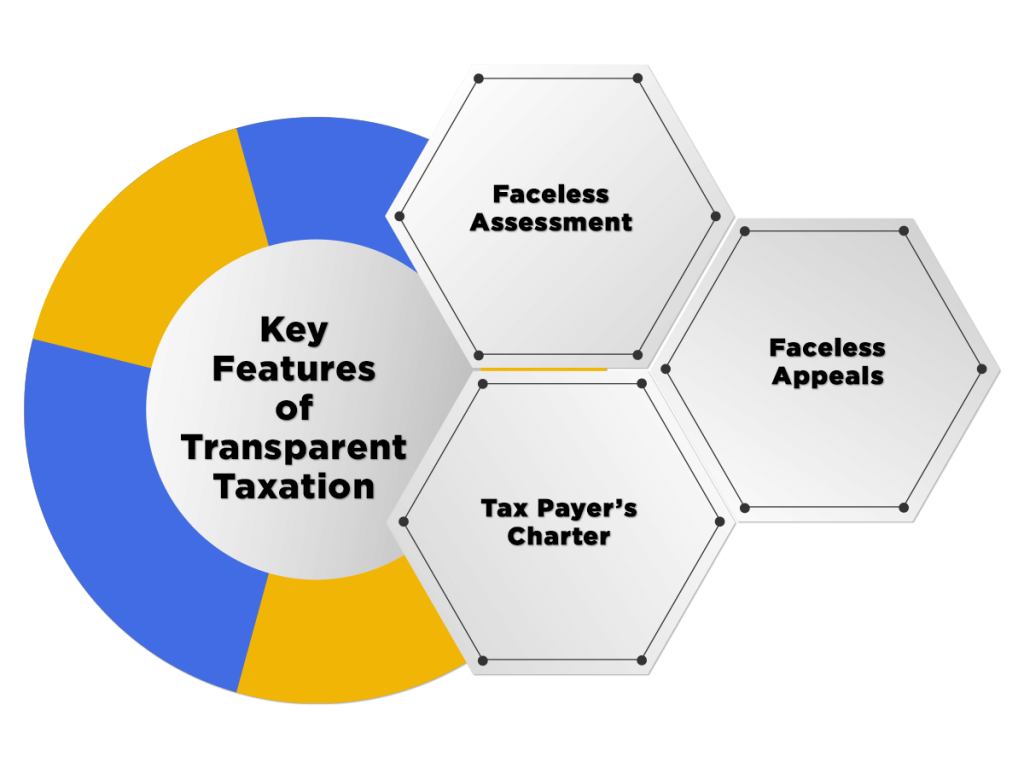

Key highlights of PM Modi’s speech on Tax Reforms are as under:

- Faceless Income Tax Scrutiny – The income tax assessment is now entirely faceless. No local officer shall be engaged in the proceedings. Such a process shall be confidential to the taxpayer as well as to the tax officer.

- Now, a smooth, faceless, and tireless process.

- Faceless Income Tax Appeal

- No issue with the transfer of income tax officers

- Out of 130 Crores, only 1.5 Crores Indian pays income tax. Therefore, they should come forward to pay their taxes properly.

- In the last 6 years, about 1500 laws have been abolished by the Modi administration. In India, for ease of business.

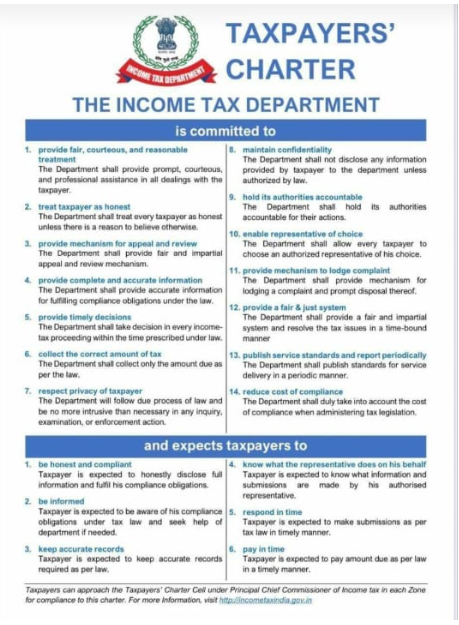

- Incorporated the Taxpayer Charter, which set out the dedication of the Income Tax Department and the perceptions of the Taxpayers.

- The main purpose is to make every rule-of-law, policy-driven, and public-friendly. This is the use of the new governance model and the country is getting results.

- Taxpayers charter is also a major step forward on the nation’s development journey.

- India is among the lowest corporate tax nations, says PM Modi.

- There is a very small percentage of the total population of taxpayers in the country. He said that.

- The goal is to make the tax system seamless, painless, and faceless.

- The statement posted on Wednesday stated that tax reforms would involve increasing accountability in official communications through the recently launched Document Identification Number (DIN) in which each departmental communication would carry a unique document identification number generated by a computer.

Income Tax

The IT Department also outlined the Direct Tax “Vivad Vishwas Act, 2020,” under which declarations for settlement of disputes are currently being filed, in order to provide for the resolution of pending tax disputes.

The monetary requirements for filing departmental appeals in multiple appellate courts have been increased to efficiently raise taxpayer lawsuits and litigation.

Several measures were taken to promote digital transactions as well as electronic payment methods.

The IT dept is determined to take measures forward and has also made efforts to ease adherence for taxpayers during the COVID period by trying to extend statutory timeliness for filing returns as well as releasing refunds promptly to increase liquidity in the hands of taxpayers.

The Prime Minister’s forthcoming announcement of the “Transparent Taxation-Honoring the Honest” initiative would begin the path of direct tax reforms.

we hope, this will improve the quality of assessments, even if there would be more litigation at ITAT/HC/ SC level due to the difference of opinion of Tax Payers and the Income Tax Department.

Popular blog:-