Basic Responsibilities & Liabilities of Forensic Auditor

Page Contents

Basic Responsibilities & Liabilities of Forensic Auditor

- Forensic auditor must also be familiar with legal concepts and procedures, including the ability to differentiate between substance and form when grappling with any issue

- Help formulate recovery of funds misused and deriving the end beneficiary of diversion

- Preparing financial evidence and analysis and presenting in court against criminal activity

- Assisting in securing documentation necessary to support or rebut a claim

- Reviewing the factual situation and providing suggestions on alternative course of action

To Do’s by the Forensic Auditor

- Forensic Auditor should Hint to be provided for further investigation in situation of limited evidence

- Match verbal indicators with physical behaviors during the Forensic Audit

- Forensic Audit Findings to be backed with evidences and supporting’s

- Disclaimers & Limitations to be disclosed with respect to the scope of work under Forensic Audit

- Forensic Auditor should Regular follow up for data via emails

- Reverifying all the data disclosed in the Audit reports, Stock Statements etc.

- Forensic Auditor should Maintaining proper records of collected of data from client and target.

- Developing a theory of the case during the Forensic Audit

- Forensic Auditor should Necessary written communication/ email with Borrower & client/target

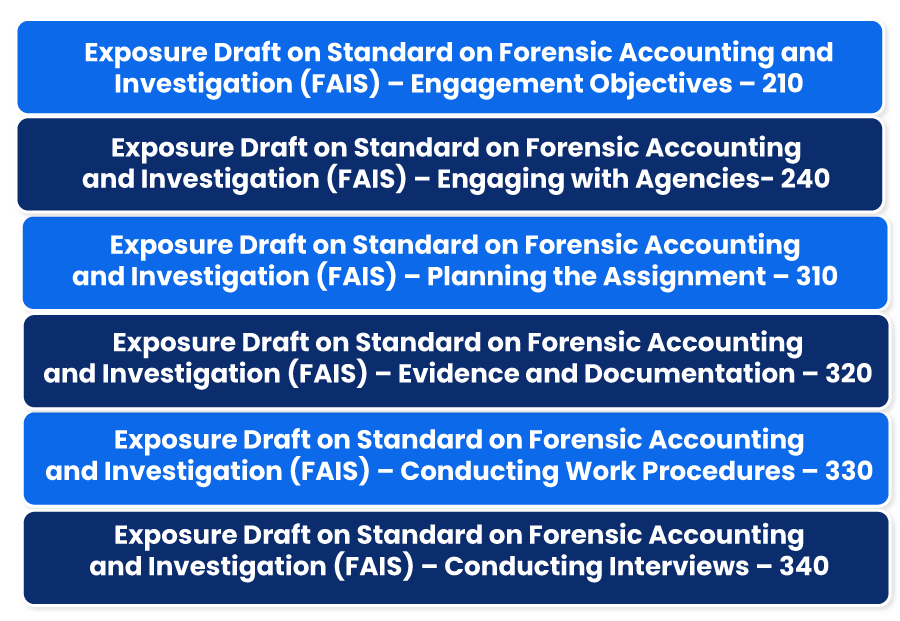

Forensic Auditing Standards issued By ICAI

The Institute of Chartered Accountants of India (ICAI) has released a set of forensic accounting and investigation standards in an effort to stop the growing problem of accounting, financial, and lending irregularities.

The auditor’s responsibilities in negotiating the details of the audit engagement with management are addressed under this Revised Standard on Auditing . The SA establishes the requirements for an forensic accounting and investigation audit, the terms of an audit engagement and amendments therein, and separates the management and auditors’ responsibilities, among many other issues.

For details about the : You may refer link – ICAI Forensic Accounting Investigation Standards

What at to Don’ts by the Forensic Auditor

- Incomplete/partial disclosures of limitations, clause and Disclaimers

- Forensic Auditor Don’t make assumptions

- Delay in submitting reports

- Forensic Auditor Should not be judgmental

- Collecting data illegally or without authorization

- Relying on data/information from unknown sources

- Submitting report without annexures

- Forensic Auditor Using of target’s computers to work

- No direct dependence on other work/report of Professionals

- Direct working on the original data

- Not maintaining confidentiality of the Forensic Audit

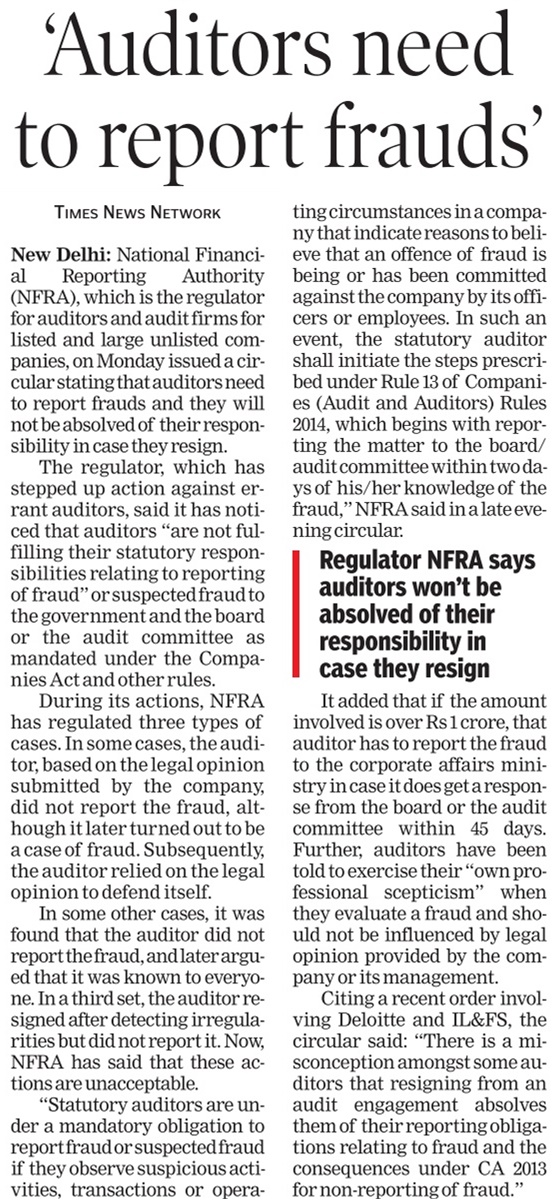

Guidelines on Forensic Audit issued by Authorities i.e RBI

| Declaring company as fraud with reference to circular: Criteria/ under which class is specified – RISERVE BANK OF INDIA Master Circular on Frauds Classification and Reporting 1 July 2015 | A Declaring company as wilful defaulter with reference to circular: Criteria/ under which class is specified] – RISERVE BANK OF INDIA Master Circular on Wilful Defaulter 1 July 2015 |

| The Classifying the transaction resulting into fraud- RISERVE BANK OF INDIA Circular on Framework for dealing with loan frauds (Early Warning Signs) 7 May 2015 | Concluding the report pertaining to Fraud/ No Fraud- IBA Circular on Forensic Audit Report 11 June 2019 |

| Classifying the account due to non -cooperation- RISERVE BANK OF INDIA Circular on Non Cooperative Borrowers 22 December 2014 | |

Master Directions on Frauds – Classification & Reporting by banks & select Financial Institutions

Master Circular No. RBI/DBS/2016-17/28 DBS.CO.CFMC.BC.No.1/23.04.001/2016-17 dated 1st July

2016

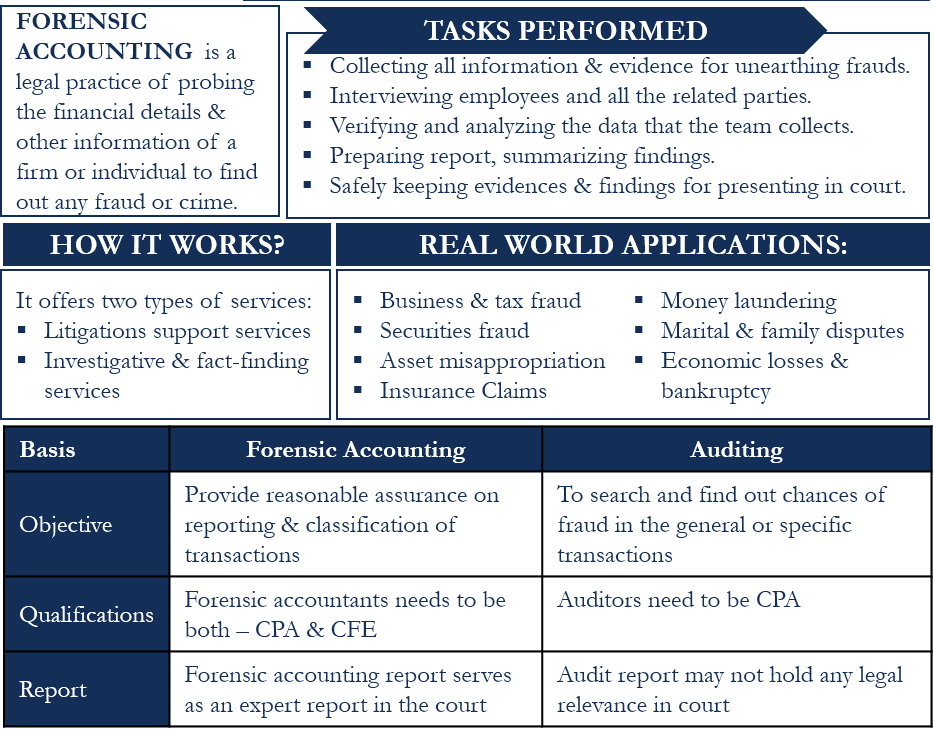

Accounting and forensic auditing play a significant role in locating instances of fraud and corruption due to their distinct qualities as one of the particular professions in accounting. To combat the spread of corruption, several nations are now heavily implementing accounting and forensic audits. Businesses can greatly benefit from forensic audits and accounting implementation.

Forensic Audit Services & Application

With the worldwide increase in financial crimes, forensic auditing has become more crucial to ensure the financial growth of organisations and the economy. Some of the most popular areas to investigate in a forensic audit include the following:

- Extortion

- Corruption Incidents

- Possibility for conflict of interest

- Deceptive Financial Statements

- Misuse of assets

Our investigation uncovered irregularities in the concession’s awarding, but it did not turn up any proof that the syndicate of lenders’ equity or finances were used to pay bribes or participate in other illegal activity. Rajput Jain & Associates forensic audit Services provide one-stop support for all compliance related support services,

- Rajput Jain & Associates also forensic audit investigated thoroughly the company’s continuing operations (revenue and expenses) and made recommendations for improvements that the management of the company may make to the monthly and annual reporting to the syndicate. We are happy to assist you in following types of forensic Audit Like Regulatory Audit, Proprietary Audit, Investigative Audit, Data & Financial Audit, Transaction Audit, Miscellaneous Audit

- Our strength lies in bringing together team of highly qualified, skilled and motivated professionals who are encouraged to lead, innovate and excel. Rajput Jain & Associates are a team of professionals CA’s, CMA’s, FAFD, IT Expert and Industry Expert with combined experience of 50+ man-years.