GST Amnesty Scheme may be announced in Budget 2023

Page Contents

Govt of India introducing new 1-time tax Amnesty scheme to decreased litigation which may be announced in Budget 2023

- New one Time Tax Amnesty/Dispute Resolution Scheme May Be announced In Budget 2023

- Central Board of Indirect Taxes & Customs, CBDT Studying Possible Contours Of Dispute Resolution Scheme or New Amnesty

- The Central Board of Indirect Taxes & Customs Collected 38,000 Cr Under 2019 Sabka Vishwas Legacy Dispute Resolution Scheme

- New 1-Time Tax Amnesty Scheme To Build On Success Of Similar Older Schemes

- Amnesty Scheme May Expedite 33,653 Customs Cases Worth 38,293 Cr Stuck In Litigation

- Central Board Direct Taxes & Customs Direct Taxes Collected 54,000 Cr Under Vivad Se Vishwas Scheme Of 2020

- New Dispute Resolution Scheme A Chance To Offload Burden Of Probable Future Liability

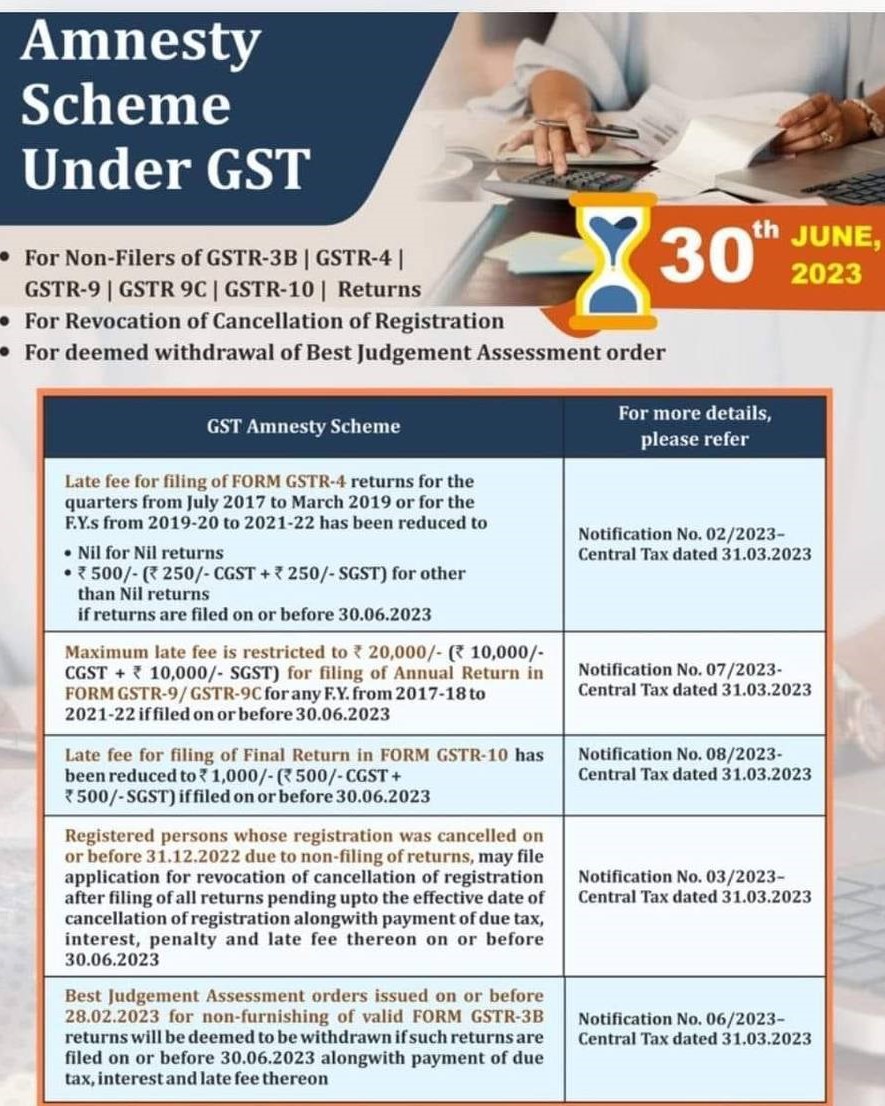

GST Amnesty Scheme 2023

- If you are a GST Registered Taxpayer and have made any defaults in relation to non-filing of returns under GSTR 4, GSTR 9, or GSTR 10 and default in Revocation of the canceled GST Registration do not worry as the GST Amnesty scheme is here. Register before 30.06.2023 to avail the benefit.

- The deadline to use this scheme is fast approaching, and this is the last chance to take advantage of this opportunity. I urge you to take immediate action and make the most of this scheme.

- GST Amnesty available to non-filers of Form GSTR-10 (Final Return) – Any GST Registered dealer who has not filed the Final GST Return in form GSTR-10 within Timeline date, for the period Financial Year 2017-18 to Financial Year 2021-22 then the late fee shall be restricted to INR 1k, In case such GSTR-10 is filed between 1.04.2023 to 30.06.2023.

Check out all main points of about GST Amnesty Scheme 2023

Question : Is there any amnesty scheme currently running, whereby we can pay reduced late filing fee on GSTR 3B

Ans : No waiver today, Amnesty scheme not applicable as of now. Legislature would not give relief

Our Indirect Taxation team of experts can help you to check your scheme eligibility and the benefit amount. Thank you for your time, and we look forward to hearing from you soon!

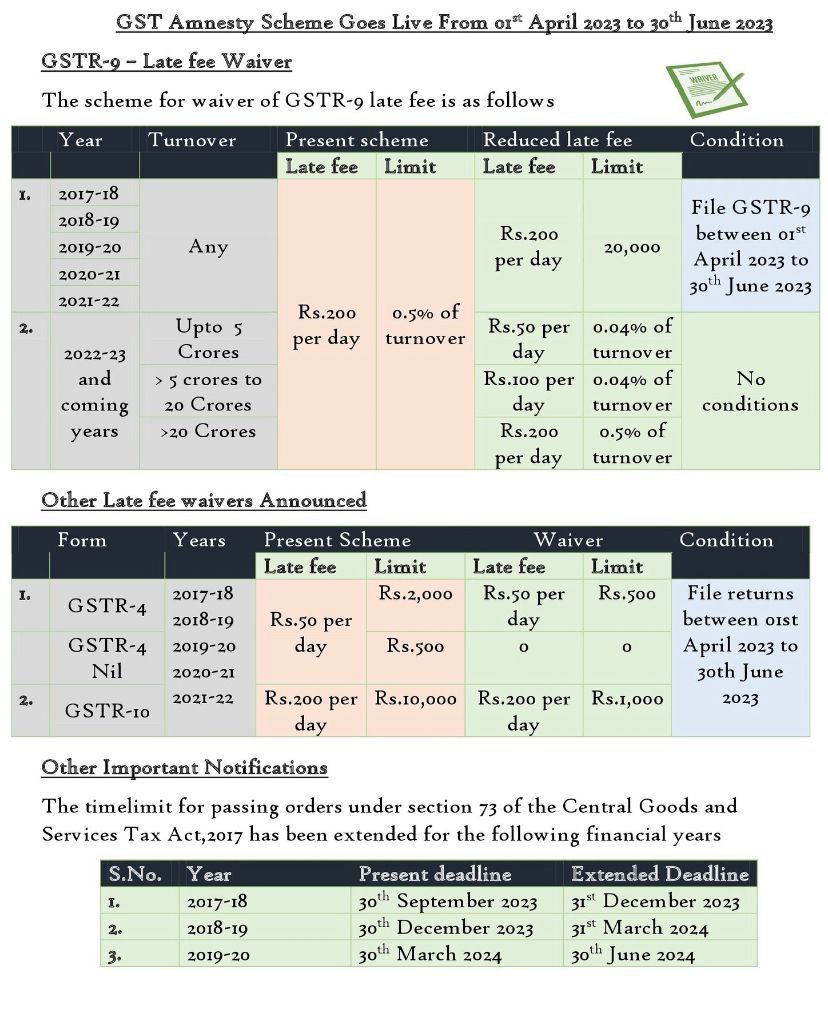

Latest Amnesty Scheme of Filling of GSTR-9 for the Financial Year 2017-2022]

Completed Details of GSTR-9 Late Fee.

- GST Registered persons having Aggregate Annual Turnover under GST upto 5CR – INR 25 + INR 25 per day max to 0.02% of Turnover.

- The GST Registered persons having Aggregate Annual Turnover under GST more than INR 5 Cr and upto 20CR – INR 50 + INR 50 per day max to 0.02% of Turnover.

- GST Registered persons fails to file GSTR-9 of Financial Year 2017-18 to Financial Year 2021-22 – Max. INR 10,000 subject to return furnish by 1stday of April, 2023 to the 30thday of June, 2023.

for more detail or Reference GST Notification No. 07/2023 – Central Tax dated 31.03.2023.