Key note on 52nd Goods and Services Tax Council Meeting

Page Contents

SMT Nirmala Sitharaman Finance Minister Chairman of Goods and Services Tax Council has announced amendments to the Goods and Services Tax (Goods and Services Tax Appellate Tribunal) regulations. These changes include increasing the age limit for the President of Goods and Services Tax from 67 to 70 years, allowing members to serve until they reach the age of 67 instead of 65 as previously stipulated. Additionally, the minimum age requirement for both the members & President has been set at 50 years.

Key note on 52nd Goods and Services Tax Council Meeting

- GST Council say that Tax revisions for millet flour products:

(1). Food preparations made from millet flour, comprising at least 70 percentage of the composition by weight, will now be exempt from Goods and Services Tax when sold without branding. Goods And Services Tax rate on millet flour in powder form has been proposed as follows:

-

- Zero percentage if sold in other than pre-packaged and labeled form (containing at least 70% millets by weight)

- 5 percentage if sold in pre-packaged and labeled form. (containing at least 70% millets by weight)

(2). Goods and Services Tax on millet flour preparations has been reduced significantly from 18percentage to 5percentage for branded, pre-packaged, & labeled products. ,

3.The Central Government has delegated the authority to levy Goods and Services Tax on extra neutral alcohol to the states, allowing them to make decisions in this regard : Finance Minister.,

4.Foreign-owned coastal vessels engaged in coastal transportation within India are now exempt from the existing 5percentage Integrated Goods and Services Tax.

5.The Goods and Services Tax rate for Zari has been reduced from 18 percentage to 5percentage, and the Goods and Services Rate for molasses has been reduced from 28 percentage to 5 percentage.,

- The aforementioned idea should hasten the payment of cane debts due to sugarcane producers and boost mill liquidity. Additionally, because molasses is a component in the production of calf feed, the aforementioned rate drop will lower the overall cost of manufacturing it.

- In addition to the benefits mentioned above by the Council, the rate reduction on molasses will encourage the manufacture of bioethanol and its usage, with molasses serving as a key component.

Other Key Highlights of 52nd GST Council Meeting

6.The Goods and Services Tax on extra neutral alcohol for industrial use to be 18percentage,

7.There is No Goods And Services Tax applicable on corporate guarantees provided by directors of a company. However, in the case of corporate guarantees issued by holding companies, a Goods and Services Tax of 18 percentage will be levied on the total amount guaranteed by the parent company

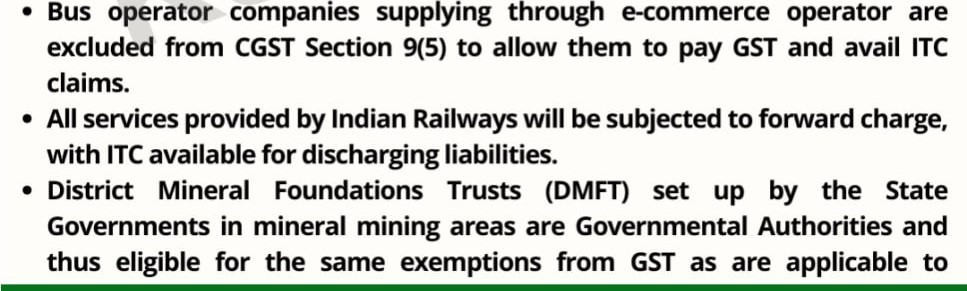

- the obligation to pay Goods And Services Tax on bus transport services obtained through ECOs was placed on the Electronic Commerce Operators as of January 1, 2022. (According to Section 9(5) of the CGST Act,) As a result, Electronic Commerce Operators won’t be required to pay Goods and Services Tax on services provided through e-commerce by such organised bus operators, as the Council has suggested excluding bus operators organised as businesses from the scope of the aforementioned regulations. These bus companies can now use their accumulated ITC to pay Goods And Services Tax on their purchases.

- Since the buses and batteries are so expensive, the organised bus operators, especially EV bus operators, were stuck with a significant ITC buildup when the Goods And Services Tax liability was transferred from such bus operators to Electronic Commerce Operators as of 01/01/2022. After this change, the aforementioned bus operators were unable to use the collected ITC because the majority of the tickets were purchased Via Electronic Commerce Operators.

- Therefore, industry organisations voiced their concerns, which the Council resolutely took up. It is now proposed that the anomaly be addressed by placing the responsibility back on the bus operators. These organised bus companies, especially EV bus companies, are quite relieved by this.

Provisional attachment in Goods and Services Tax Form GST DRC-22

- The order for provisional attachment in Goods and Services Tax Form GST DRC-22 shall not be valid after the lapse of one year from the date of the said order, according to a reasonable adjustment that the Council has recommended be made to Rule 159(2) of the Central Goods and Services Tax Rules, 2017.

- This is a very positive development for the sector, as taxpayers have been witnessing High Court rulings instructing the appropriate officers to release the temporarily attached properties after a year.

- This action will make it easier to release properties that are temporarily attached without requiring a separate, detailed written order from the Commissioner.