Capital gain tax exemption if invest in residential property

Page Contents

Exemption of Capital gains – in case of investment in residential house

Section 54F of the Income-tax Act, 1961 – Exemption of Capital gains – in case of investment in residential house

[2015]56 taxman .com 163-HIGH COURT OF KARNATAKA-Commissioner of Income-tax, Bangalore v. K Ramachandra Rao

FACTS:

The assessee sold certain land to a trust for consideration of Rs.2.87 crore.

In the returns filed under section 153A, the assessee computed Long Term Capital Gains of Rs.2.87 crore before claiming exemption under sections 54B and 54F.

During assessment proceedings, the assessing authority disallowed the assessee’s claim for exemption under section 54F.

On appeal, the Commissioner (Appeals) held that the assessee’s investment in construction subsequent to the date of sale and investment in the eligible project even after the project of the house is started beyond one year will be eligible for exemption under section 54F.

However, the investment made prior to more than one year before the date of transfer was not eligible for exemption. Accordingly, he granted an exemption.

On revenue’s appeal, the Tribunal affirmed the said order. On further appeal to High Court:

Issues to be decided

Whether the assessee was entitled to the benefit conferred under section 54F when the sale consideration was utilized for the construction of a residential house on a site that was owned by him within one year from the date of transfer?

When the assessee had invested the entire sale consideration in the construction of a residential house within three years from the date of transfer, could he be denied exemption under section 54F on the ground that he did not deposit the said amount in the capital gains account scheme before the due date prescribed under section 139(1)?

HELD

Section 54(F) deals with capital gains on the transfer of certain capital assets not to be charged in case of investment in a house.

In Section 54F(1) provides, in the case of an assessee being an individual or a Hindu undivided family, the capital gain arises from the transfer of any long term capital asset, not being a residential house and the assessee within a period of one year before or two years after the date on which the transfer took place, purchased or has within a period of three years after that date constructed a residential house, the capital gain shall be dealt with in accordance with the said provision which is stated under section 54F(4).

Section 54F(4) stipulates if the amount of net consideration which is not appropriated by the assessee towards the purchase of the new asset made within one year before the date on which transfer of the original asset took place or which is not utilized by him for the purchase or construction of the new asset before the date of furnishing the return of income under section 139 shall be deposited by him before furnishing such return in any case not later than the due date applicable in the case of the assessee for furnishing the return of income under section 139(1) in an account in any such bank or institution as specified and utilized in accordance with any scheme which the Central Government may, by notification in the official gazette framed in this behalf.

A section 54F(4) is attracted only to a case where the sale consideration is not utilized either for purchase or for construction of a residential house. It has no application to a case where the assessee invests the sale consideration derived from the transfer either in purchasing the property or constructing the residential house within the period stipulated in Section 54F(1).

The proviso to section 54F puts an embargo on the application of section 54F to cases that are mentioned in the said proviso. That is to be eligible for the benefit under section 54F(1) the assessee should not be owning more than one residential house other than the new asset acquired or he should not purchase any residential house other than the new asset within a period of one year after the date of transfer of a residential asset or constructs any residential house other than the new asset within a period of three years after the date of transfer of the residential asset.

In the entire scheme, there is no prohibition for the assessee putting up construction out of sale construction received by such transfer of a site which is owned by him as is clear from the language used.

It is open for the assessee to put up a residential construction or to purchase a residential house. It is not the requirement of law that he should purchase a residential site and then put-up construction.

Therefore, in the instant case admittedly the assessee has purchased a vacant site on 31-3-2001. He sold the original asset on 27-8-2003 on which date he already owned a site.

In fact even before the sale of the original asset he had started construction on such site by availing loan from the bank. In terms of section 54F(1) all investments made in the construction of the residential house of the said site within a period of one year prior to 27-8-2003 would be eligible for exemption under section 54F(1).

Similarly, all investments in the said construction after 27-8-2003 within a period of three years therefrom are also eligible for exemption.

Therefore, the argument that such investment in putting up a residential construction cannot be made on a site owned by him to be eligible for the exemption is without any substance.

Both the appellate authorities have rightly extended the benefit to the assessee and there is no error committed by them which calls for interference.

As is clear from section 54F(4) in the event of the assessee not investing the capital gains either in purchasing the residential house or in constructing a residential house within the period stipulated in section 54F(1)

if the assessee wants the benefit of section 54F, then he should deposit the said capital gains in an account that is duly notified by the Central Government.

In other words, if he wants to claim exemption from payment of income tax by retaining the cash, then the said amount is to be invested in the said account.

If the intention is not to retain cash but to invest in construction or any purchase of the property and if such investment is made within the period stipulated therein, then section 54F(4) is not at all attracted.

Therefore the contention that the assessee has not deposited the amount in the Bank account as stipulated and therefore, he is not entitled to the benefit even though he has invested the money in construction is also not correct.

For the aforesaid reasons, both the substantial questions of law are answered in favor of the assessee and against the revenue. Therefore, all four appeals are dismissed.

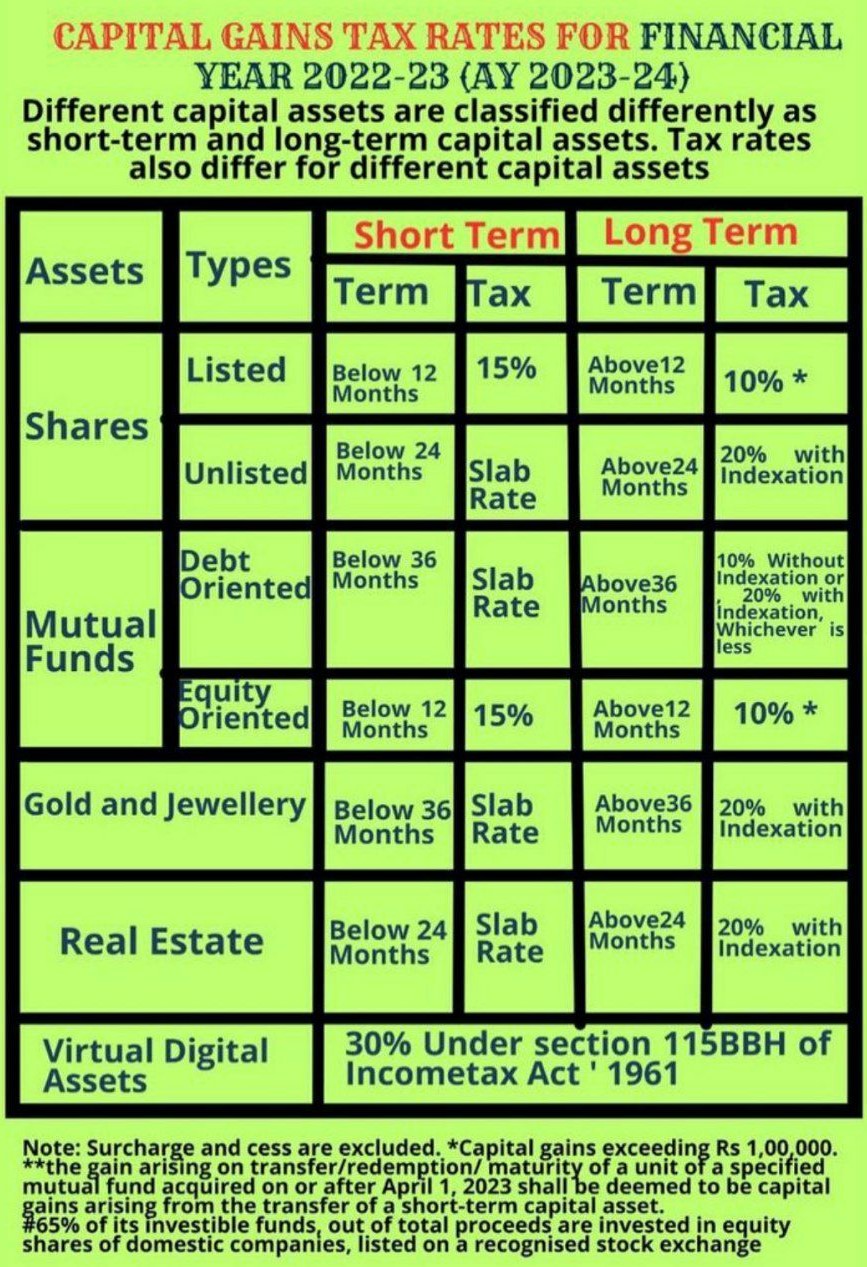

Summary of Capital Gain

Also read: Popular blog:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

For query or help, contact: singh@carajput.com or call at 9555555480