What are the Parts of Form 26AS & its Structure?

Page Contents

What are details in the Form 26AS?

- Your Tax Credit Statement, also known as Form 26AS, is an important tax document. The days of manually downloading Form 26AS to file your IT returns are long gone.

- The Internal Revenue Service has been updating Form 26AS to include more and more information.

- The statement’s scope has now been broadened to include information about foreign transfers, mutual fund purchases and dividends, refund information, and so on.

- Form 26AS is a statement which shows the amount of TDS or TCS deducted from a taxpayer’s various sources of income.

- The dedicator subsequently deposits the tax deducted with the govt. It also includes information on the taxpayer’s advance tax, self-assessment tax, and high-value transactions.

- Form 26AS Includes info on TDS on your income by dedicators

- Regular assessment tax deposited by the income taxpayers PAN holders.

- Details of TCS.

- Advance tax paid by the Income taxpayer

- Self-assessment Income tax payments

- More additional informative details for example mutual fund purchase & receiving dividend income, interest on off-market transactions, income tax refunds, salary break up details, foreign remittances etc.

- Information of income tax refund received by you during FY.

- Information about high-value Transactions in respect of shares, mutual fund etc.

What are the Parts of Form 26AS & its Structure?

- In addition to the existing data contained in the form, the New Form 26AS, which goes into force on June 1, 2020, will include information on selected financial transactions, pending and completed assessment proceedings, tax demands, and refunds.

- Before New 26AS update, Scope of Form 26AS was expanded in Income tax Budget 2020. thereafter New Form 26AS was updated to include STF transactions, pending, tax demands and refunds and & completed assessment proceedings.

- Income tax Department has once again introduced an Annual Information Statement (AIS) to include new information such as overseas remittances, mutual fund purchases, interest on income tax refunds, off-market transactions, & dividend details, salary break-up details, and information from another person’s ITR.

- These records were previously obtained by the income tax department from licenced entities. For example, an authorised dealer (such as a bank) must file Form 15CC for every payment made to a non-resident, whereas transfer agents and depositories are already required to disclose off-market transactions ( gift transfers, legacy transfers, transfers between two Demat accounts, etc.).

- The salary breakdown is accessible in Form 16 based on information provided by employers on the TRACES site. The tax agency has access to information about some taxpayer transactions via other people’s ITRs. In their ITR, the seller of a property, for example, reports information about the buyers.

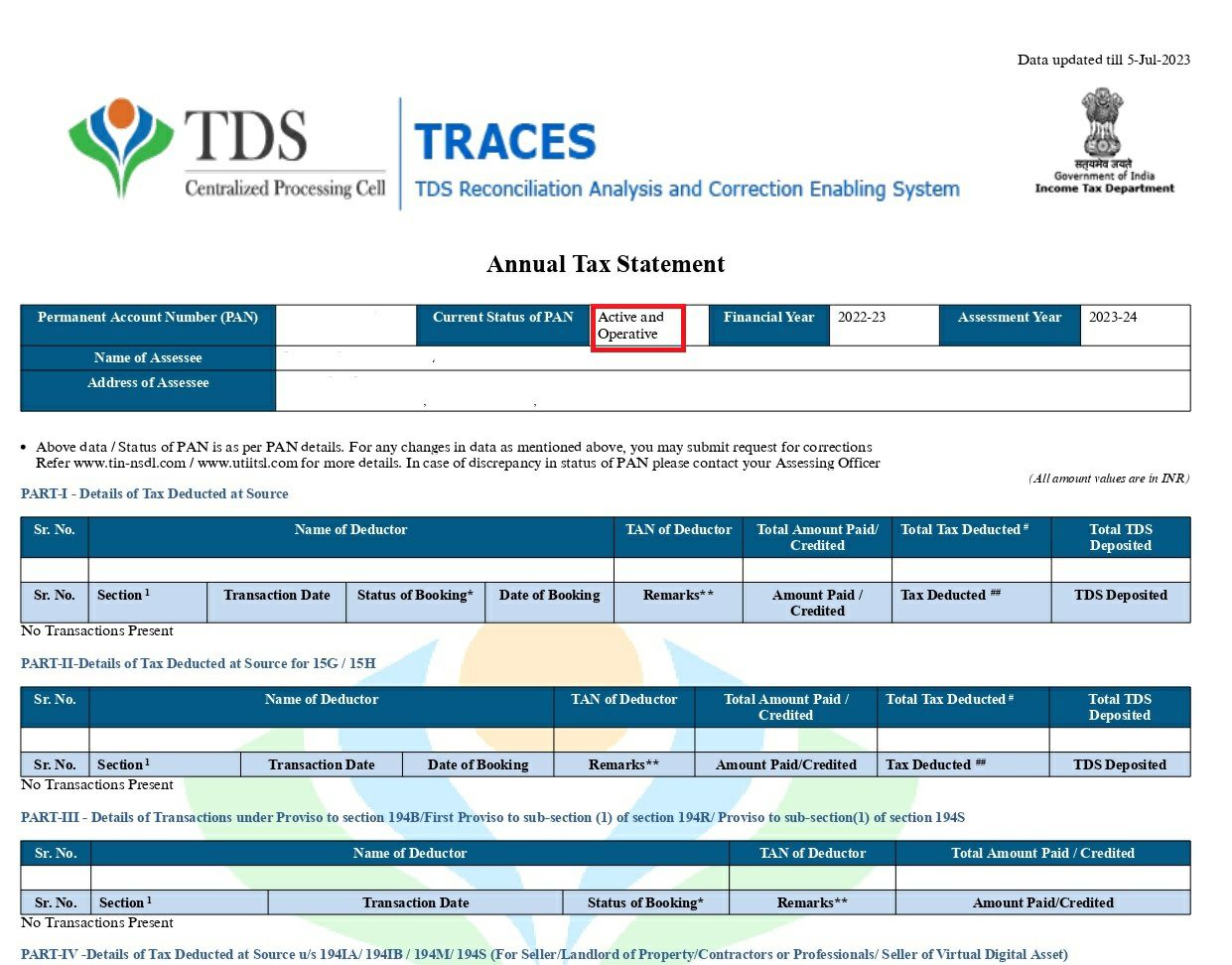

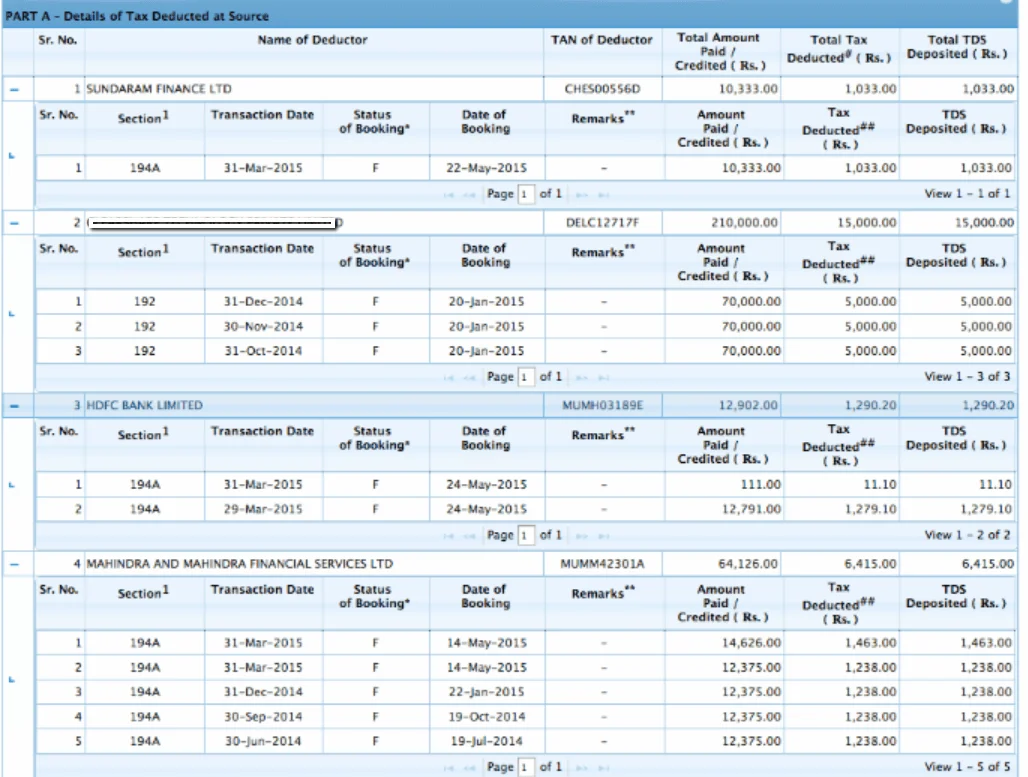

Part_A: Information of TDS- details on Taxes Deducted at the Source

-

-

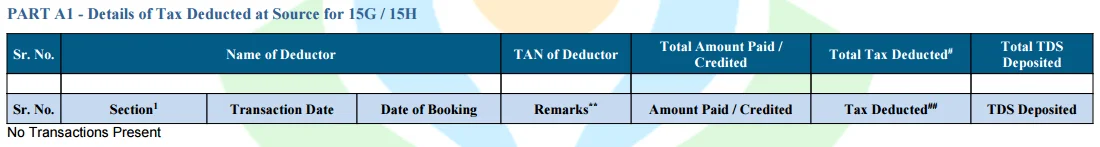

- Part_A1: Details of Tax Deducted at Source for Form 15G/Form 15H

-

-

-

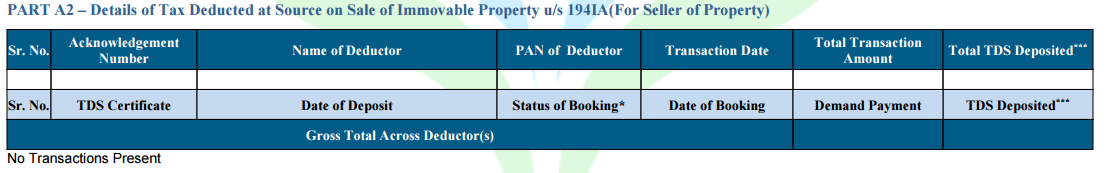

- Part_A2: Details of Tax Deducted at Source on sale of Immovable Property u/s194(IA) (For seller of Property)

-

TDS deducted on your salary, interest income, pension income, prize winnings, and other items are listed in Part A of Form 26AS. The deductor’s TAN, as well as the amount of TDS deducted and deposited, are also listed. On a quarterly basis, this data is published.

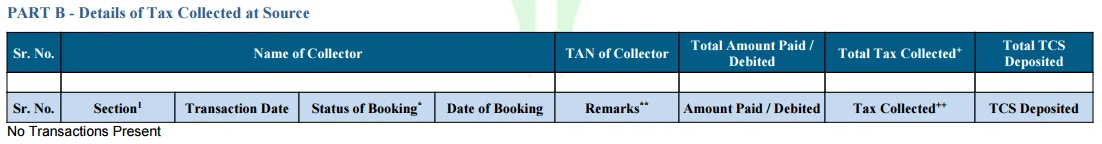

Part_B: Information of Tax Collected at Source

Part B contains information on the tax collected at source (TCS) by the goods vendor. If you are a seller and collect tax, you will have entries here.

Part_C: Information of Tax Paid (Other than Tax deduction at source or Tax Collected at Source )

That information will appear if you have deposited any taxes yourself. Here you will find information on advance tax as well as self-assessment tax. It also includes information about the challan used to deposit the tax.

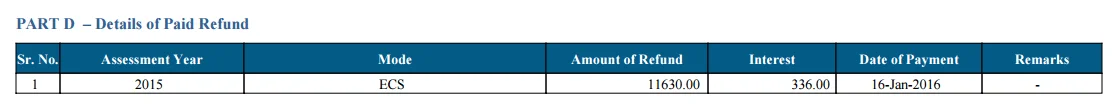

Part_D: Information of Paid income Tax Refund

This section will contain information on your refund, if any. The assessment year to which the refund applies, as well as the manner of payment, the amount paid and interest paid, and the payment date are all listed.

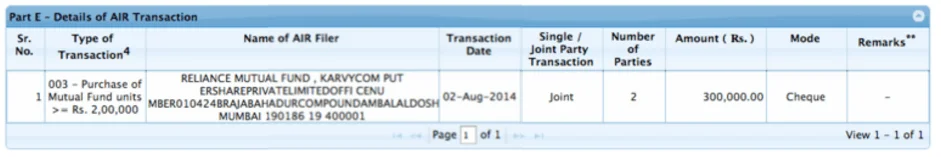

Part_E: Information of AIR Transaction

High-value transactions must be reported to the tax authorities by banks and other financial institutions. High-value mutual fund purchases, property acquisitions, and high-value corporate bond purchases are all reported here.

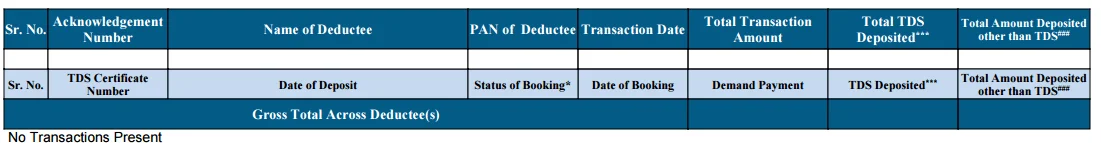

Part_F: Information of TDS on sale of immovable property u/s194IA (For Buyer of property)

Tax deduction at source must be deducted before making a payment to the seller if you have purchased a property. This section contains information on the Tax deduction at source you have deducted and deposited.

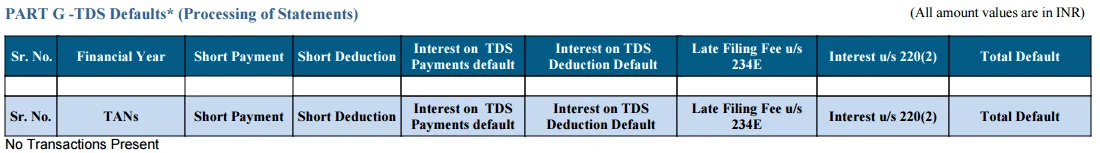

Part_G: Tax deduction at source Defaults* (processing of defaults)

Defaults relevant to statement processing are described below. They exclude any demands made by the assessing officer.

Update in Form 26AS

- In the section of current status of PAN in 26AS, those PANs that are linked to Aadhaar are shown as ‘Active & Operative.’

- From 1st July, PANs that are not linked with Aadhaar have become inoperative.