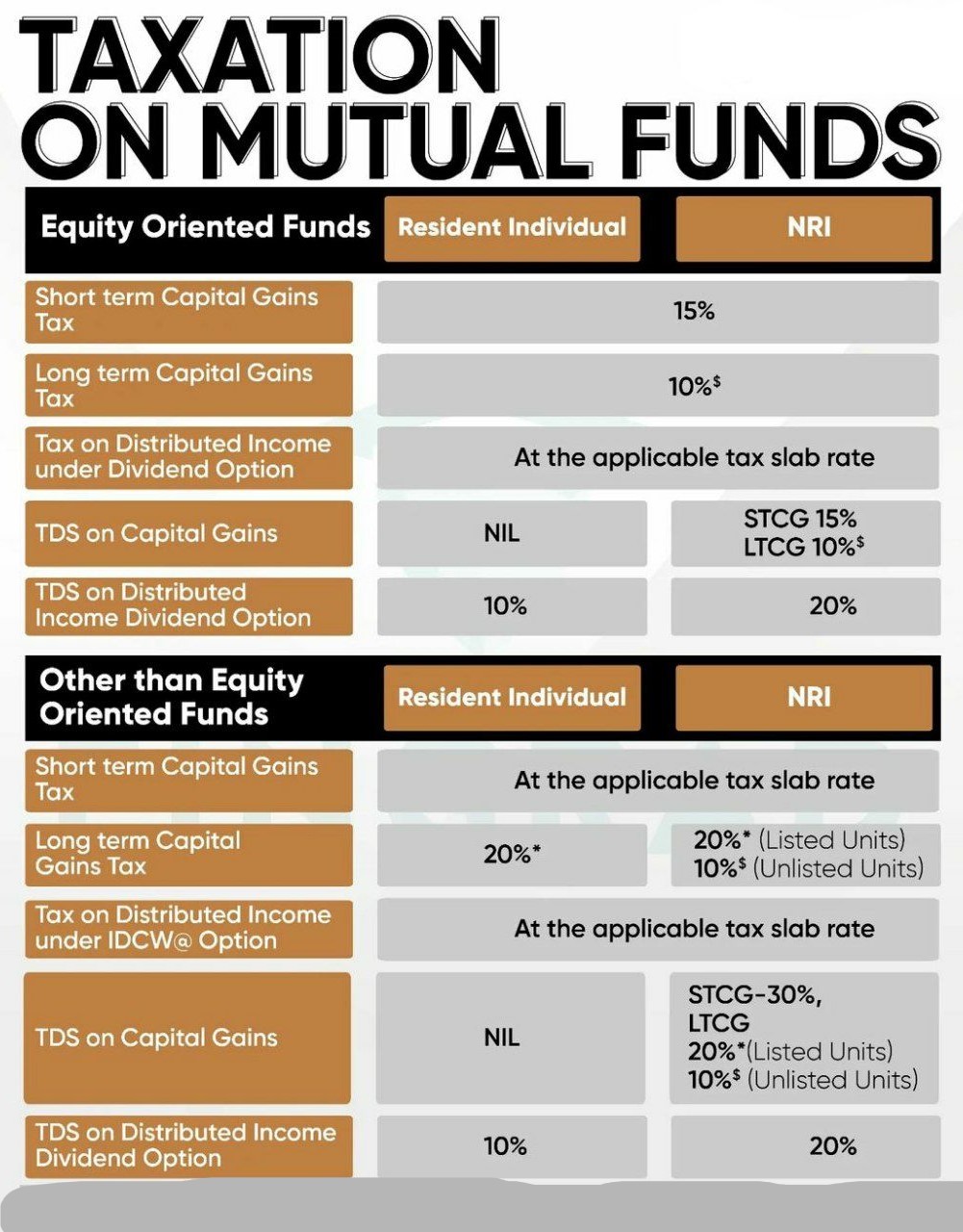

Taxation on Income from Equity and Debt Mutual Fund

Page Contents

Taxation on Income from Equity and Debt Mutual Fund Under section 10(35) of the Income Tax Act, 1961

1. Equity Mutual Fund

- The equity mutual fund is a kind of mutual fund scheme in which a substantial proportion of the assets under administration is primarily invested in stocks including the equity stock market.

- They come under the class of “Stock Mutual Funds” which is defined as funds with at least 65% of the portfolio is invested in equity and equity-related securities.

- Every mutual fund is known as equity mutual funds or stock mutual funds, including equity mutual funds, balanced funds, sectoral funds, large-cap funds, mid-cap funds, small-cap funds, etc.

A. Chargeability of DDT(Dividend Distribution Tax)

- In the hands of the investor, and distribution of income on equity mutual funds is totally tax-free. In addition, no dividend distribution tax is imposed on equity mutual funds, which means the house of the mutual fund is also not liable to deduct the dividend tax declared on an equity mutual fund scheme.

- Note: DDT is the abbreviation for ‘Dividend Distribution Tax’ which refers to the tax deducted or charged by the fund house (mutual fund company), on any divided declared and distributed to its investors.

B. Calculation of capital gains on Equity mutual Fund?

- Capital gains generated from the selling of equity mutual funds would only be liable to capital gains tax if the retention period has been longer than one year.

- Equity Mutual Funds are excluded from paying long-term capital gains tax, meaning you would not be allowed to pay any capital gains tax on those transactions if you sell your equity mutual fund after 1 year of holding.

- Under section 10(38) of the Income Tax Act, equity mutual funds are excluded from paying long-term capital gains tax, which ensures that if you sell your investment in equity mutual funds after 12 months of holding, you are not allowed to pay any capital gains tax on those transactions.

C. Calculation of Tax Liability of Equity Mutual funds

- Based on whether the gain on sale is known as short-term or long-term capital gains, equity mutual funds are subject to capital gains tax. Tax rates on capital gains are the same for both resident Indians and non-resident Indians.

- There is no dividend distribution tax on the payment of dividend income into equity mutual funds, unlike debt mutual funds.

| Type of Tax | Tax rate |

| Short Term Capital Gains Tax (under section 111A) | |

| Resident Indian | 15% |

| Non-Resident Indian | 15% |

| Long Term Capital Gains Tax ( under section 112 (A)] | |

| Resident Indian | 10% ( Capital gains exceeding ₹ 1 Lakh) |

| Non-Resident Indian | 10%( Capital gains exceeding ₹ 1 Lakh) |

| Dividend Distribution Tax | Nil (as per section 115R) |

2. Debt Mutual Fund

- The debt mutual fund is a kind of mutual fund scheme in which a substantial proportion of the assets under administration are invested mainly in fixed income instruments, including bonds and debentures.

- They come under the ‘Non-Equity Mutual Funds’ group, which is classified as funds with less than 65% of their portfolio invested in equity and equity instruments. All mutual funds, including debt mutual funds, gold funds, money market funds, balanced funds, etc. are Classified as non-equity mutual funds.

A. Chargeability of Dividend Distribution Tax

- For individuals and HUF investors, the allocation of income on debt mutual funds is subject to a dividend distribution tax at the rate of 28.33 percent (including surcharge and cessation). Asset management companies subtract DDT from the dividend in the debt mutual fund holder’s portfolio prior to crediting the dividend.

B. Calculation of capital gains on Equity mutual Fund?

- Capital gains generated from the selling of Debt mutual funds incur capital gains tax. Depending on the retention time, the sale may incur short-term capital gain tax or long-term capital gain tax.

Long-term capital gains-

- If, after 3 years of holding time, you sell your investment in a debt mutual fund, capital gains resulting from that sale are known as a long-term capital gain (LTCG) and will be charged at the tax rate on long-term capital gains.

- Long-term capital gains are eligible for an indexation advantage in which the cost of purchasing an asset over the retention period is adjusted for variations in the cost inflation index.

- In the event of an increase in the index, the purchase rate is changed upwards, thus decreasing the value of the capital gain and, thus, the tax on capital gains. The price indexes used for the adjustment are maintained and issued by the Department of Income Tax.

Short-term capital gains- If you sell your investment in less than 36 months (3 years) in a debt mutual fund, the capital gains resulting from the sale are known as a short-term capital gain (STCG) and are charged at the tax rate on short-term capital gains.

C. Calculation of Tax Liability on Debt mutual Fund?

For debt mutual funds, there are two types of taxes applied:

- capital gains tax Based on which the gain on sale is classified as short-term or long-term capital gains, For resident Indians and non-resident Indians, capital gains tax rates are different.

- Dividend Revenue or dividend tax reported on the debt investment mutual fund

| Type of Tax | Tax rate |

| Short Term Capital Gains Tax | |

| Resident Indian | As per an individual’s income tax bracket |

| Non-Resident Indian | As per an individual’s income tax bracket |

| Long Term Capital Gains Tax (under section 112) | |

| Resident Indian | 20% (with indexation benefit) |

| Non-Resident Indian | On listed funds- 20% (with indexation benefit) On unlisted funds- 10% (without indexation benefit) |

| Dividend Distribution Tax (DDT) | At the rate of 28.84% (including surcharge and cess) for individuals and HUF(under section 115R) |

Which is a better option: STOCK or MUTUAL FUNDS?

- Over 1 crore of new Demat accounts was opened in the previous year. Just 49 lakh demat accounts were opened in 2019 in order to bring that into perspective.

- There is no doubt that interest in equities has spiked with the financial markets back to all-time highs, whether it was the lockdown or the market rally, or low deposit rates.

- But should investors invest in shares for the first time by purchasing stocks directly, or should they opt for mutual funds? In this blog, we look at each of the positives and negative sides so that when you decide to park your hard-earned money in the stock market to reach your financial goals or want to build wealth for the long term, you can make an informed decision.

STOCKS:

- Stocks are financial instruments issued by companies that give part ownership of a company to investors. Investors stock their surplus mainly for capital appreciation, dividends, as well as voting rights, allowing them to be part of important business decisions. Stocks are also classified in common parlance as securities and as equities.

MUTUAL FUNDS:

- Mutual funds are financial vehicles in which, depending on the investment purpose of the fund, capital is mobilized from multiple investors and invested in various asset classes such as equity, debt, gold, etc

- While both of these options allow you to invest in equities, you should take the Mutual Fund route for more than a few reasons. Some basic reason is as follows:

Diversification of Portfolios

- Mutual Funds invest in a large stock universe that offers outstanding portfolio diversification and eliminates the risk of concentration. A decent number of the industry’s diversified funds have 50 or even more stocks in their respective portfolios.

- This diversification helps to reduce portfolio losses in the event that 1 or 2 stocks are harmed due to such negative events. The fact that only 10% of exposure to a single stock can be taken by equity funds also minimizes the risk factor in the investments

- The stock portfolio of an investor usually appears to be 10 to 15 stocks. This is similar to higher portfolio volatility, which would be measured as the market goes up and down.

- Today, you would need a huge amount of money if you want to get the same kind of diversification as a mutual fund. In addition, there are expenditures involved in purchasing and selling. For e.g., if you wish to buy 1 share of each of the constituents of NIFTY 50, you will need more than Rs. 1 lakh.

- The advantage of mutual funds is that an investor gets exposure to a large range of stocks through market capitalization and various sectors in his portfolio, even by investing a small sum of only Rs. 500 in a mutual fund.

Professional Management

- With a fund management team that does a lot of research on stocks, sectors, and the economy, mutual funds are professionally managed.

- This team spends a large amount of time reviewing the financial statements of the companies and meeting with the management of these companies until they decide on the universe of stocks, which helps them to get a holistic view of the stocks to be included in the portfolio.

- Most fund houses are also proficient in a robust risk management process that puts strict binding constraints on their portfolios, which in turn does not allow the fund management team to take undue risks.

- Investors would have to spend a significant amount of time researching stocks and various sectors to understand the headwinds and tailwinds in the underlying market.

- Investors dealing directly with stocks should also have a fair understanding of the macro-economic situation, giving them a clear outlook on which industries and stocks will be able to perform well in the future.

- This is an important exercise that investors need to do, as their portfolio of 10 to 15 stocks needs to be diversified according to their risk profile across market capitalization and sectors.

- In other terms, most of the aspects that the fund management team of fundamental analysts, technical analysts, economists, and risk modelers do must be done by the individual investor. That is definitely not the cup of tea of a beginner investor from a time & effort perspective.

Costs

- In terms of the cost-benefit, one of the economies of scale enjoyed by Mutual Funds is due to the large transaction volumes involved in the purchasing and sale of stocks.

- In addition, SEBI launched Direct Plans for the Mutual Fund Industry in 2013. In a direct plan arrangement, the fund houses subtract from the operating costs the fee-fees to marketers, resulting in a lower cost ratio for the investor.

- If you purchase stocks directly, you will have to pay charges such as brokerage, STT, SEBI turnover charges, GST, transaction fees, etc. But the good part is that these costs tend to be minimal over the long run unless you do frequent daily stock trading.

Variety of Options

- You have a wide range of options for pursuing your financial goals when it comes to Mutual Funds. Different funds, such as equity funds, debt funds, gold funds, foreign funds, etc., catering to various asset groups.

- There are also funds that fulfill particular purposes, such as retirement and plans for children. The other possible alternatives are active and passive funds. Depending upon their risk profile and time period, you will decide on the choices.

- So, if your risk profile is cautious, then you can choose from a range of small-exposure debt funds to equity-side large-cap funds. On the other side, you can get across the market capitalization curve and also have sector funds in your portfolio if you are an active investor.

- If you have a time horizon of 1 to 5 months, from a tenure perspective, then he can go in for liquid funds, while the short-term/corporate bond funds would be a good match for a 3-year time horizon.

- There is just 1 asset class as far as stock investment is concerned. Of course, there are over 5,000 companies to choose from within the stocks, but there are usually only 500 odd companies that are investable in the Indian stock exchanges.

- The wide range of options available in Mutual Funds offers you a lot of benefits that are not available when investing directly in stocks, such as particular categories or funds to accomplish targets, diversification, debt exposure, etc.

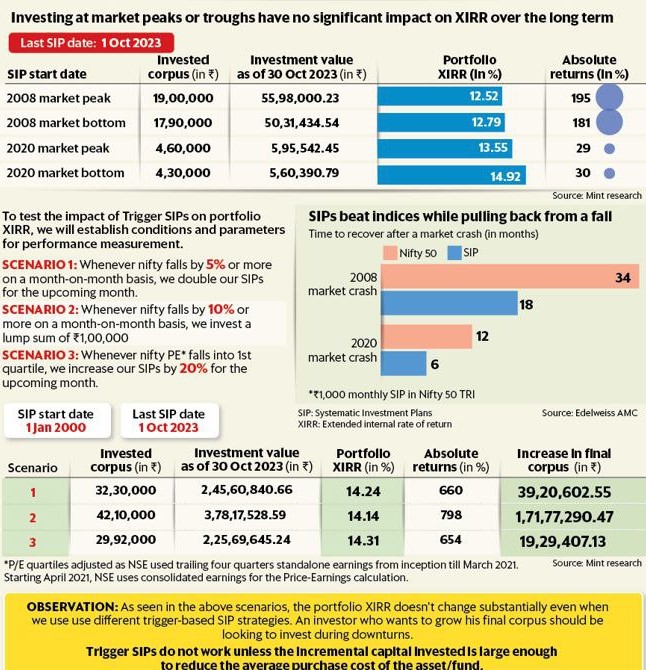

Disciplined Investing

- When it comes to exposure to the markets, mutual funds allow you to pursue a disciplined approach to investing. The most common way to invest in mutual funds is through Systematic Investment Plans (SIPS), as they allow you to make a daily investment of as little as Rs. 500 in mutual funds.

- Some brokerages have begun SIPs into inventories as far as stocks are concerned. The key thing to remember here, however, is that the correct stock selection should take place, and the volume of the SIP can vary according to the price of the stocks included in the portfolio.

Tax benefits

- While the taxation of equity mutual funds and shares is the same, section 80C enables investors to demand a deduction of up to Rs. 1.5 Lakh per year from the Equity Linked Savings Schemes (ELSS), a form of mutual fund scheme. For stocks, there is no such choice.

- The other tax benefit is that there is no tax to be charged by you when fund managers move across stocks, while in the case of direct investment in stocks, depending on your holding period, you will have to pay taxes once you leave a stock.

Variability in Returns

- The diversification of the portfolio of mutual funds not only helps to reduce risks but also makes it possible to receive stable returns over time.

- Stocks, on the other hand, have the potential to gain superlative returns. As mutual funds have caps on their holdings in each stock and are highly diversified, there would also be limited ability to earn high returns.

- This is why, for HNIs and ultra HNIs, stocks are the chosen vehicles. This approach to investment through stocks, however, may not be sufficient for new-to-invest users.

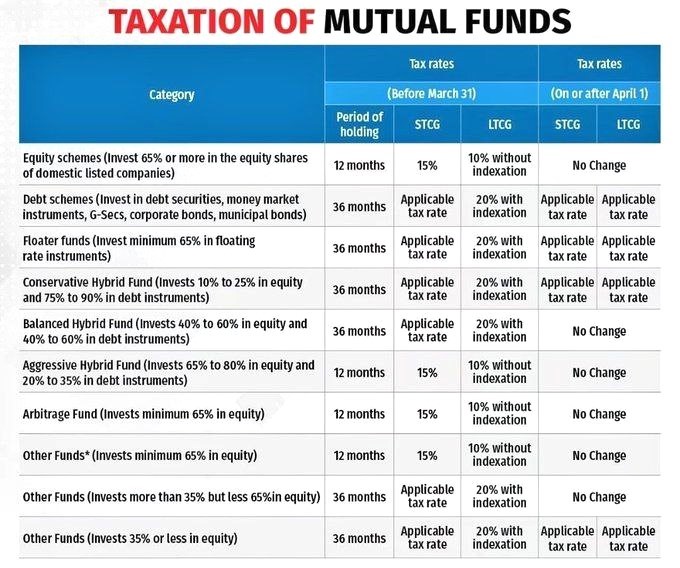

Recent update on 2023: Mutual funds income Taxation is analogous to income from non-mutual funds under the short-term/ long-term capital gains and dividends for non-corporates/corporations & non-resident Indians.

Taxation change in Investing in Mutual Funds

Biggest deterrent to investing is fear. Data can help mitigate the fear.

Conclusion:

- If you are a seasoned investor with the time and experience to look at company financial statements and have a research flair, then you should consider creating your own stock portfolio.

- There is a reasonable amount of uncertainty in the superlative returns associated with stock investments, which should be taken into consideration when dealing with them.”If you have trouble imagining a 20 percent loss in the stock markets, you should not be in stocks,” John Bogle, the founder of index funds, rightly said.

- Moreover, if you are fine with a team of experts managing your money whose aim is to give you consistent long-term returns, then mutual funds are the right choice for you.

- Mutual funds offer you a wide range of choices to choose from, which will help you achieve your goals with greater consistency in the time periods stated. Therefore, if you are a first-time investor who has not explored the waters in the capital market, then before trying your hand at stocks, start with mutual funds.

Popular blog:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

- Delisting regulation for Equity Shares

- Fema Compliance for FDI in Equity Share in India

For query or help, contact: singh@carajput.com or call at 9555555480